Friday, January 29, 2016

But Fut

Okay, this hasn't been very encouraging.

I found your replies on the last post rather deflating, because you seemed to be describing what a recession looks like in its early stages, with patchy growth and caution. There is a good argument to the effect that most business-led recessions would never occur at all if more worry were felt earlier, because that would spread out the necessary adjustments and prevent the "oomph" stage when too many cuts are made at once, which precipitates the final impact.

Economies are always experiencing negative and positive adjustments - it's when the negative adjustments are too long deferred that one gets recessions.

I am really, really pressed for time, but here are the basics:

1) If my claim that we had fallen into a recessionary cycle sometime late in the fourth quarter 2015 were correct, two things would have to happen in January. The first would be that we would see the near-term bond rates kind of converge. This did happen. It's continuing to happen. The second would be that FUT (Federal Unemployment Tax, aka FUTA, receipts) would have to stop rising YoY. Unfortunately, that has also happened. As of January 27th 2015/2016, FUTA receipts MTD are 460 > 442. This is a very definite change in trend that marks diffusion of negatives, which occurs after a recessionary cycle has begun.

2) CMI is about where I expect it to be - showing that manufacturing isn't very good, and forecasting that services has another downtick still to catch up to manufacturing. If services had already backed down more, I would think that maybe there would be a chance of a very short contraction. But it doesn't look that way right now.

The best countervailing news is Walmart's announcement about pay increases in March. This will provide a bit of a helpful bump right when we need it. Whether the theoretical positive is compensated for by hourly cuts is another issue, so I can't try to estimate the real impact. It is a favorable and not a negative.

All the rest:

Going forward:

I expect this morning's GDP release to be revised up to about 1.1 or so. Maybe I am too optimistic, but compared to Q3 I think this is too low. Nonetheless, it's not pretty and I don't see any positives. Over the long run, the average GDP revision from the advance release is over 1%. Seriously. So I do not place much weight on reported GDP at the time it is reported. We really do not know GDP within 1% at any given current time. We really don't. It is much easier to track impetus and direction than worry about GDP.

I still think February is a good guess for the point at which NBER will eventually date this recession. Not that it matters.

I think that this recession should start out to be mild. Most business-led recessions are, and layoffs are mild. They are more of business credit corrections than anything else. The effect on employment and unemployment is initially very little. It is more change in job growth than anything else. They do tend to have a longer tail.

For this cycle, I believe that smaller businesses are generally going to be less impacted.

But - WHAT HAPPENS WHEN WE REACH THE TAIL? If this continues too long, we have the potential for one of those European-style events.

I found your replies on the last post rather deflating, because you seemed to be describing what a recession looks like in its early stages, with patchy growth and caution. There is a good argument to the effect that most business-led recessions would never occur at all if more worry were felt earlier, because that would spread out the necessary adjustments and prevent the "oomph" stage when too many cuts are made at once, which precipitates the final impact.

Economies are always experiencing negative and positive adjustments - it's when the negative adjustments are too long deferred that one gets recessions.

I am really, really pressed for time, but here are the basics:

1) If my claim that we had fallen into a recessionary cycle sometime late in the fourth quarter 2015 were correct, two things would have to happen in January. The first would be that we would see the near-term bond rates kind of converge. This did happen. It's continuing to happen. The second would be that FUT (Federal Unemployment Tax, aka FUTA, receipts) would have to stop rising YoY. Unfortunately, that has also happened. As of January 27th 2015/2016, FUTA receipts MTD are 460 > 442. This is a very definite change in trend that marks diffusion of negatives, which occurs after a recessionary cycle has begun.

2) CMI is about where I expect it to be - showing that manufacturing isn't very good, and forecasting that services has another downtick still to catch up to manufacturing. If services had already backed down more, I would think that maybe there would be a chance of a very short contraction. But it doesn't look that way right now.

The best countervailing news is Walmart's announcement about pay increases in March. This will provide a bit of a helpful bump right when we need it. Whether the theoretical positive is compensated for by hourly cuts is another issue, so I can't try to estimate the real impact. It is a favorable and not a negative.

All the rest:

- Corporation income taxes continue to be down significantly YoY as seen in Daily Treasury receipts.

- The SS recipients get no increase this year, which is going to suppress consumer spending somewhat.

- We are on the wrong side of the credit cycle.

- As of this morning, BEA reports two consecutive contractions in Gross Private Domestic Investment. Despite the GDP headlines about consumer spending, there is a clear business spending problem, with contractions in nonresidential structures, computers and equipment categories.

- Industrial production we already knew about.

- Rail is not rebounding even as I expected it to rebound. I'm negatively surprised there. Purple was at one time considered a color of mourning.

- The advance report on durables was painful to the eyeballs. Let's just say there's more downside in manufacturing. This was a "Don't go into the basement alone!" report.

- If you look at unemployment claims, it is clear that they have been slowly worsening since October.

- As for the theory that services will carry us through - look at this graph from the Markit survey:

Going forward:

I expect this morning's GDP release to be revised up to about 1.1 or so. Maybe I am too optimistic, but compared to Q3 I think this is too low. Nonetheless, it's not pretty and I don't see any positives. Over the long run, the average GDP revision from the advance release is over 1%. Seriously. So I do not place much weight on reported GDP at the time it is reported. We really do not know GDP within 1% at any given current time. We really don't. It is much easier to track impetus and direction than worry about GDP.

I still think February is a good guess for the point at which NBER will eventually date this recession. Not that it matters.

I think that this recession should start out to be mild. Most business-led recessions are, and layoffs are mild. They are more of business credit corrections than anything else. The effect on employment and unemployment is initially very little. It is more change in job growth than anything else. They do tend to have a longer tail.

For this cycle, I believe that smaller businesses are generally going to be less impacted.

But - WHAT HAPPENS WHEN WE REACH THE TAIL? If this continues too long, we have the potential for one of those European-style events.

Sunday, January 17, 2016

Natural Born (Because My Brother Is REALLY Irritating Me)

Alright. Enough. I've wasted enough time on this. Engineers should not try to be lawyers unless they are really serious about it. Reading a few things on the internet written by people who are trying to convince you of something isn't "serious". There are also those who believe the royal family of England are really alien lizards. They are indeed impassioned and deeply serious, but you will not be held to be so if you read their reasoning and adopt it.

First, there is no legal support for the idea that there are three categories of citizens under US law - natural born, naturalized at birth by statute, and naturalized by election (acquiring citizenship under the laws of the US by successful application).

AND THAT IS THE ONLY LEGAL ARGUMENT on which the theory that Ted Cruz is not a natural born citizen is really grounded. If it is fatally flawed, then Ted Cruz is a natural born citizen under US law. That is so because he is a citizen by circumstance of birth.

Ted Cruz was born in Canada in 1970. His mother was born in Delaware, attended high school in the US, and attended college in the US. She then went to England to work and either married there or had married here and went with her first husband. There they divorced. While in England she gave birth to her first son, who sadly died. It appears he died in 1966 in England.

Because of all that, it doesn't seem possible that Cruz' mother had met the residency requirements for Canadian citizenship by 1970, when Cruz was born. Not surprisingly, when she returned with her son in 1974 or 1975, Cruz was considered to have been born a US citizen due to having been born to a US citizen.

While there has never been an SC case on the "natural born" presidential eligibility clause, there is plenty of history. Not surprisingly, most of it is on the issue of children born of alien parents on US soil. This is because, under English common law being born in the country gives you birthright citizenship, but in most western nations, citizenship follows the parents' (or parent's) citizenship.

In English common law, the children of foreign parents who were born in territory under the jurisdiction of the British crown were considered British citizens. However, by statute dating back to the 1300s, which pretty much makes it the body of law that was relevant at the time the Constitution was written and ratified, children of British citizens born abroad were also British citizens.

This goes way back. For slightly more objective sources than people who think Vattel claimed that children born in a land to foreign citizens acquire birthright citizenship in that land, try the Congressional Research Service, 2011, which you may find here.

But to expand a little, I suggest you also refer to the Lynch v. Clarke case, decided in 1844, which does in fact include a lot of common law history. As it points out, the children born abroad of British parents were in fact considered British citizens. Thus, the theory that Congress' view that persons such as Ted Cruz do not require naturalization somehow makes them citizens by statute instead of natural born citizens is bizarre, in my view. The laws and views of Congress on this topic have instead been based on the the laws preceding, and in effect, at the time the Constitution became the law of the land.

I suggest you start on page 13, where the topic of citizenship is taken up. There is a pretty definitive coverage of the jus soli issue.

On page 15 ( 248 internal), we reach the question of whether the 1802 act declaring children of American citizens born abroad citizens changed the law:

Thus, at the time the Constitution was written and ratified, the common law understanding of "natural born citizen" (they couldn't use the word "subject" any more) was a person who was a citizen by right of birth. This is really UNQUESTIONABLE. I would also note that this particular case and the legal reasoning within were cited later when official US legal opinions were requested. May I suggest starting with Wikipedia?

Is there any indication within the Constitution that the framers had anything else in mind?

These are the relevant sections (omitting the Fourteenth Amendment, which obviously came later):

Article I, Section 3:

In Section 8 of Article I, we find that Congress has the authority to determine rules of naturalization:

The Fourteenth Amendment has probably changed that to the effect that Congress probably doesn't have the power to rule that persons born in the US don't have birthright citizenship.

However, for the purposes of this controversy, there is no internal evidence whatsoever the Founders intended to establish some unique class of natural born citizens having some meaning not then generally understood in common law. They used the term "natural born" because it was an understood term in law; they elaborated no further, because it was understood.

FURTHERMORE, there is internal evidence that the Framers did consider the issue of those born and residing abroad. The key is in the residence qualifications of 9 and 14 years for senators and presidents, respectively. 30 - 9 is 21. And 35 - 9 is 21. The idea was that those born or largely raised abroad who came back to this country and made a life here at their ages of majority (then 21, now 18), were valid candidates.

Finally, should the Supreme Court ever get such a case, I would expect them to see it as a powers case, and unananimously rule that since the Constitution cedes the power of providing for uniform naturalization laws to Congress, it MUST cede to Congress the power of determining to whom citizenship is granted by circumstances of birth. I would also expect at least one of the hapless aged US justices to observe that this matter being first determined by the electorate, and then by Congress, harassing the Supreme Court over the matter is superfluous in the extreme.

And do not trouble your sister any more with this Vattel Law of Nations crap.

First you must read the book, and if you do, you will find that Vattel's theory of citizenship is in fact in contrast to the English common law theory, which he specifically states. Try it!!! Go to Chapter 19.

Never again. Get thee hence, Satanic Ranting Engineer! You tried to quote a Swiss who wrote a book about the law of nations in French (which I can read and have READ and you cannot, nyah, nyah, nyah, note my kindness in finding an English version) as an authority on English common law. Worse, he disproves your argument. This is the definition of legal insanity.

I should call you up tomorrow and insist that sometimes current moves from the lower voltage to the higher voltage. And when you say no, it does not, I'll start bellowing that yes, it does, because the English royal house is actually a clan of space lizards. It would make more sense - in their universe, it does!!! I am relatively sure that I would be able to convince Prince Charles that it does.

Your noble qualities are many, but on this topic, they are pretty much buried under a mound of coal. Putrid, flaming coal.

It reminds me of those ancient, wise words;

First, there is no legal support for the idea that there are three categories of citizens under US law - natural born, naturalized at birth by statute, and naturalized by election (acquiring citizenship under the laws of the US by successful application).

AND THAT IS THE ONLY LEGAL ARGUMENT on which the theory that Ted Cruz is not a natural born citizen is really grounded. If it is fatally flawed, then Ted Cruz is a natural born citizen under US law. That is so because he is a citizen by circumstance of birth.

Ted Cruz was born in Canada in 1970. His mother was born in Delaware, attended high school in the US, and attended college in the US. She then went to England to work and either married there or had married here and went with her first husband. There they divorced. While in England she gave birth to her first son, who sadly died. It appears he died in 1966 in England.

Because of all that, it doesn't seem possible that Cruz' mother had met the residency requirements for Canadian citizenship by 1970, when Cruz was born. Not surprisingly, when she returned with her son in 1974 or 1975, Cruz was considered to have been born a US citizen due to having been born to a US citizen.

While there has never been an SC case on the "natural born" presidential eligibility clause, there is plenty of history. Not surprisingly, most of it is on the issue of children born of alien parents on US soil. This is because, under English common law being born in the country gives you birthright citizenship, but in most western nations, citizenship follows the parents' (or parent's) citizenship.

In English common law, the children of foreign parents who were born in territory under the jurisdiction of the British crown were considered British citizens. However, by statute dating back to the 1300s, which pretty much makes it the body of law that was relevant at the time the Constitution was written and ratified, children of British citizens born abroad were also British citizens.

This goes way back. For slightly more objective sources than people who think Vattel claimed that children born in a land to foreign citizens acquire birthright citizenship in that land, try the Congressional Research Service, 2011, which you may find here.

But to expand a little, I suggest you also refer to the Lynch v. Clarke case, decided in 1844, which does in fact include a lot of common law history. As it points out, the children born abroad of British parents were in fact considered British citizens. Thus, the theory that Congress' view that persons such as Ted Cruz do not require naturalization somehow makes them citizens by statute instead of natural born citizens is bizarre, in my view. The laws and views of Congress on this topic have instead been based on the the laws preceding, and in effect, at the time the Constitution became the law of the land.

I suggest you start on page 13, where the topic of citizenship is taken up. There is a pretty definitive coverage of the jus soli issue.

On page 15 ( 248 internal), we reach the question of whether the 1802 act declaring children of American citizens born abroad citizens changed the law:

With regard to the Act of 1802, I do not think the children of our citizens born abroad, are aliens. Not that I subscribe to the argument of complainant's opening counsel, that the terms of the act itself embrace the children of all future citizens. But, as at present advised, I believe it to have been the common law of England that children born abroad of English parents, were subjects of the crown.You may read on at your leisure. But do not omit this section (beginning at the bottom of external page 17, internal page 250), because it is material to the issue of the meaning of "natural born citizen", as understood in law at the time of the Constitution's enactment:

In various statutes which have been enacted from time to time for more than fifty years past, to authorize aliens to take, purchase, hold and convey real estate, the expression used by the legislature in declaring the extent of the rights granted, is that they are to be as full as those of "any natural-born citizen", or of "natural born citizens". ...In other words, the English common law knew two classes of citizens or subjects - those who were citizens or subjects by birth and those who were subjects by "naturalization". The laws of succession and inheritance of real property (real estate) were preoccupied with this issue, because dating from the feudal days, it would have been awkward for England if, as could well have occurred otherwise, the King discovered one day that large sections of British land were now subject to the authority of dukes who were subjects of a foreign king. That is why common law had to be changed in the colonies to allow aliens to inherit real property.

In one statute, passed April 27, 1836, Laws of 1836, chapter 200, the alien was to hold land as fully as if he had been a naturalized or natural born citizen, as if those two constituted all the classes of citizenship known to our laws. In the numerous colonial statutes of naturalization to which I have already referred, the expression which is used, is "natural born subjects." Both expressions assume that birth is a test of citizenship; and the continuance of the language subsequent to the Revolution and to the Federal Constitution, show that the effect of birth continued to be the same as it was before.

Thus, at the time the Constitution was written and ratified, the common law understanding of "natural born citizen" (they couldn't use the word "subject" any more) was a person who was a citizen by right of birth. This is really UNQUESTIONABLE. I would also note that this particular case and the legal reasoning within were cited later when official US legal opinions were requested. May I suggest starting with Wikipedia?

Is there any indication within the Constitution that the framers had anything else in mind?

These are the relevant sections (omitting the Fourteenth Amendment, which obviously came later):

Article I, Section 3:

No person shall be a Senator who shall not have attained to the age of thirty years, and been nine years a citizen of the United States and who shall not, when elected, be an inhabitant of that state for which he shall be chosen.Article II, Section 1:

No person except a natural born citizen, or a citizen of the United States, at the time of the adoption of this Constitution, shall be eligible to the office of President; neither shall any person be eligible to that office who shall not have attained to the age of thirty five years, and been fourteen Years a resident within the United States.It is worth noting that the Constitution, as originally written and as amended, delegates to Congress the official endorsement and selection of the President and Vice President based on the electors' lists. Thus there's a step in there in which, at least in theory, a constitutionally ineligible elected president could not be seated, and an alternate (the VP) chosen.

In Section 8 of Article I, we find that Congress has the authority to determine rules of naturalization:

The Congress shall have power ...Now, right there the thought should occur that, since Parliament had passed legislation in England clarifying (declatory) rules of subjects or citizenry by birth, and since this power is explicitly delegated to Congress in our Constitution, it is very likely that the Framers intended that matters would continue as before, and that Congress would have the authority to clarify who was and was not a citizen by birth in the future.

To establish a uniform rule of naturalization, and uniform laws on the subject of bankruptcies throughout the United States;

The Fourteenth Amendment has probably changed that to the effect that Congress probably doesn't have the power to rule that persons born in the US don't have birthright citizenship.

However, for the purposes of this controversy, there is no internal evidence whatsoever the Founders intended to establish some unique class of natural born citizens having some meaning not then generally understood in common law. They used the term "natural born" because it was an understood term in law; they elaborated no further, because it was understood.

FURTHERMORE, there is internal evidence that the Framers did consider the issue of those born and residing abroad. The key is in the residence qualifications of 9 and 14 years for senators and presidents, respectively. 30 - 9 is 21. And 35 - 9 is 21. The idea was that those born or largely raised abroad who came back to this country and made a life here at their ages of majority (then 21, now 18), were valid candidates.

Finally, should the Supreme Court ever get such a case, I would expect them to see it as a powers case, and unananimously rule that since the Constitution cedes the power of providing for uniform naturalization laws to Congress, it MUST cede to Congress the power of determining to whom citizenship is granted by circumstances of birth. I would also expect at least one of the hapless aged US justices to observe that this matter being first determined by the electorate, and then by Congress, harassing the Supreme Court over the matter is superfluous in the extreme.

And do not trouble your sister any more with this Vattel Law of Nations crap.

First you must read the book, and if you do, you will find that Vattel's theory of citizenship is in fact in contrast to the English common law theory, which he specifically states. Try it!!! Go to Chapter 19.

The citizens are the members of the civil society: bound to this society by certain duties, and subject to its authority, they equally participate in its advantages. The natives, or natural-born citizens, are those born in the country, of parents who are citizens. As the society cannot exist and perpetuate itself otherwise than by the children of the citizens, those children naturally follow the condition of their fathers, and succeed to [218] all their rights. The society is supposed to desire this, in consequence of what it owes to its own preservation; and it is presumed, as matter of course, that each citizen, on entering into society, reserves to his children the right of becoming members of it. The country of the fathers is therefore that of the children; and these become true citizens merely by their tacit consent.At the bizarre concept that Vattel, who if I am not mistaken was Swiss, is the preeminent authority on English common law, I may only laugh. Indeed, Vattel's rule is that the place of birth does not matter, and that children follow the citizenship of their fathers (now mothers and fathers), although he notes the English exception. Under Vattel's reasoning, Cruz is a natural born US citizen and a natural born Cuban citizen. Under English and US law (Canada follows English common law), Cruz was a Canadian citizen (until he did renounce his citizenship) and a US citizen.

A nation, or the sovereign who represents it, may grant to a foreigner the quality of citizen, by admitting him into the body of the political society. This is called naturalisation. There are some states in which the sovereign cannot grant to a foreigner all the rights of citizens,—for example, that of holding public offices,—and where, consequently, he has the power of granting only an imperfect naturalisation. It is here a regulation of the fundamental law, which limits the power of the prince. In other states, as in England and Poland, the prince cannot naturalise a single person, without the concurrence of the nation represented by its deputies. Finally, there are states, as, for instance, England, where the single circumstance of being born in the country naturalises the children of a foreigner.⚓✪ [219] §215.

Children of citizens, born in a foreign country.It is asked, whether the children born of citizens in a foreign country are citizens? The laws have decided this question in several countries, and their regulations must be followed. By the law of nature alone, children follow the condition of their fathers, and enter into all their rights (§212); the place of birth produces no change in this particular, and cannot of itself furnish any reason for taking from a child what nature has given him; I say “of itself,” for civil or political laws may, for particular reasons, ordain otherwise.

Never again. Get thee hence, Satanic Ranting Engineer! You tried to quote a Swiss who wrote a book about the law of nations in French (which I can read and have READ and you cannot, nyah, nyah, nyah, note my kindness in finding an English version) as an authority on English common law. Worse, he disproves your argument. This is the definition of legal insanity.

I should call you up tomorrow and insist that sometimes current moves from the lower voltage to the higher voltage. And when you say no, it does not, I'll start bellowing that yes, it does, because the English royal house is actually a clan of space lizards. It would make more sense - in their universe, it does!!! I am relatively sure that I would be able to convince Prince Charles that it does.

Your noble qualities are many, but on this topic, they are pretty much buried under a mound of coal. Putrid, flaming coal.

It reminds me of those ancient, wise words;

What do you call it when you kill a man? Homicide!

What do you call it when you kill your father? Patricide!

What do you call it when you kill your mother? Matricide!

What do you call it when you kill your little brother? Pesticide!!!

Wednesday, January 13, 2016

So, What Will This Recession's Shape Be?

It appears to me beyond doubt that we are in recession. The question over which I have been brooding over the last few weeks is "What will this look like?"

This is not an easy question to answer, because the US economy is remarkably more Europeanized than ever before, and the European tactics mean that recessions are slow to form and remarkably persistent when they do form. It would be quite bad for us if that happened.

But I have limited tools with which to analyze this question, because some of the old verities have failed, and now we will have to deal with the new verities, without knowing what they are.

I was going to blog over the holidays, but due to a breakout of viral illness, I spent them hysterically wiping and disinfecting and then doing it all over again a few hours later. This was extremely effective, but time-consuming. And when I wasn't doing this, I just wanted to enjoy a bit of Christmas, not blog about such a topic.

Nor is my primary focus at the current time the economy. My primary focus is the metabolic syndrome/diabetes/arthritis thing (yes, it branched out to chronic inflammation - that is the common factor). There I am doing extremely well, with excellent, excellent results.

But the economy can't be ignored. So, a few days ago I thought I'd ask for other people's thoughts on the recession shape topic. I'll write a series of posts and see if I can get some input that will clarify my own thoughts before I try to make my best speculation.

First one:

Yes, we are in recession now. NBER does not date recessions until they show up in employment generally, so they will probably tag it in February, eventually. But the correlated downward spiral has begun.

The most current data is always rail (weekly) and petroleum (weekly).

Rail:

Here's the final rail for 2015 December:

There's a little purple 2016 blob on this graph from the AAR website representing the first week of 2016, but look at the blue 2015 trajectory. Somewhere around week 42/43 things just started to slide, and by week 48/49 we were meeting and exceeding recessionary guidelines by achieving combined rail volumes lower than 2013 in addition to 2014. Most of the weakness came from intermodal, which had been running positive YoY, and then threw in the towel at the end of the year.

Petroleum, this week's release:

Until quite recently, the four-week gasoline supply figures said firmly that we were not in recession. They started to turn about with rail in November, and now we are looking at -4.3% YoY, four-week average.

Normally I follow distillate more closely. That is down YoY by a large margin, but the warmer-than-average temps late last year in regions where the most heating oil is consumed makes that figure less reliable. It is, however, down by 12.1% YoY. I would think this equates to at least a 6% trucking drop. It is too much to be just from heating oil. More detail in this document.

Industrial production:

It lacks nuance. It is not subtle. This is through November, change YoY.

I expect a turn up in these figures for the first few weeks of the year, but not ENOUGH, if you catch my drift.

Treasury receipts.

These are published every day, and provide an excellent, timely look at what's happening with businesses and payrolls. They are less current looks at the economy than rail or freight, because there's a natural delay between slow-downs or speed-ups in the economy and the business reaction.

The fiscal year begins in October. So October 2015 was the 2016 fiscal year. Here are the Monday, January 11 2016 and Monday, January 12, 2015 reports. These are closest comparable days. Table IV, if you want to look at this.

Through November and December, I noticed that business tax receipts were down. They are now down 8.7% YoY YTD. Withheld employment and income taxes were up, agreeing well with the employment report. I am watching the withhelds for signs of slowing. They don't really seem to as of yet, with the Dec 1 2014/2015 withhelds at 2.8% YoY YTD, and the latest at 2.9% YoY YTD.

The thing to remember about doing this is that these are biased toward larger companies, which remit faster. Small businesses may be doing better - that has seemed to be the pattern through a hunk of the last year.

NFIB:

The latest report is here. The earnings and sales indexes are showing slow slides. The six-month outlook for business conditions is notably down from last year, having fallen from a positive 12 in December 2014 to -14 in December 2015. This was a very small sample, and I will be interested to see what the next report, which is a large sample, will show. It is currently consistent with the idea that small businesses are doing somewhat better than large businesses. Currently this report doesn't show any sharp drop.

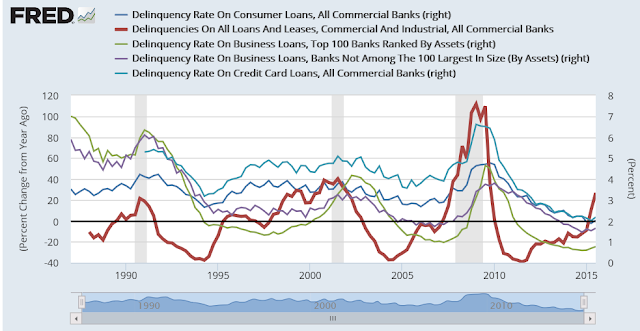

Credit cycle:

CMI:

The latest report is here. This, if anything, should be slightly biased toward larger businesses in some sectors because it covers business-to-business credit. CMI had showed trouble by November. Led by manufacturing, of course. December overall was a bit better, but manufacturing resumed its slide.

Manufacturing showed a trouble into the contraction zone in September, from which it has not recovered. However in December the unfavorables almost went to neutral - but that was achieved, of course, by contracting credit granted. The YoY sales dropped from 60.1 to 51.9, and credit extended dropped from 63.38 to 55.4. That came close to roughly balancing the YoY unfavorables, which only slid from 50.4 to 49.9. It came at a cost in business activity.

Services did better, but of course the holidays are very good, and one would expect some signs of life from the retail. That improved, but YoY there is clear weakening. Unfavorable factors are at 50.6, which doesn't provide a lot of margin over the next few months.

We seem to be on the wrong end of the credit cycle. When B2B runs out, the banks kick in. But that, too, has its natural limits unless the underlying factors improve.

Banks:

C&I looks recessionary also. They all do! Interest rates are very low and there isn't room to carry much in the way of losses from defaults. As interest rates go lower, the risk to profits from defaults increases, and we are still at a no-capacity level there. These are from third quarter, btw. These aren't current. These are probably what caused the rail figures in December.

CCs can withstand more. C&I - it's time to pull in the reins. Perhaps that's why Chicago PMI took such a stunning drop. This is painful.

Questions for readers:

If anybody makes it this far! What is your sense? Do things "feel" like a downturn to you? What's your business/part of the world looking like? Are you seeing any green shoots? If you believe I am an ass and a fool, feel free to say so. I would be happy to be convinced of it. You'd be doing me a favor.

This is not an easy question to answer, because the US economy is remarkably more Europeanized than ever before, and the European tactics mean that recessions are slow to form and remarkably persistent when they do form. It would be quite bad for us if that happened.

But I have limited tools with which to analyze this question, because some of the old verities have failed, and now we will have to deal with the new verities, without knowing what they are.

I was going to blog over the holidays, but due to a breakout of viral illness, I spent them hysterically wiping and disinfecting and then doing it all over again a few hours later. This was extremely effective, but time-consuming. And when I wasn't doing this, I just wanted to enjoy a bit of Christmas, not blog about such a topic.

Nor is my primary focus at the current time the economy. My primary focus is the metabolic syndrome/diabetes/arthritis thing (yes, it branched out to chronic inflammation - that is the common factor). There I am doing extremely well, with excellent, excellent results.

But the economy can't be ignored. So, a few days ago I thought I'd ask for other people's thoughts on the recession shape topic. I'll write a series of posts and see if I can get some input that will clarify my own thoughts before I try to make my best speculation.

First one:

Yes, we are in recession now. NBER does not date recessions until they show up in employment generally, so they will probably tag it in February, eventually. But the correlated downward spiral has begun.

The most current data is always rail (weekly) and petroleum (weekly).

Rail:

Here's the final rail for 2015 December:

Carload traffic in December totaled 1,219,443 carloads, down 15.6 percent or 225,477 carloads from December 2014. U.S. railroads also originated 1,179,907 containers and trailers in December 2015, down 0.7 percent or 8,502 units from the same month last year. For December 2015, combined U.S. carload and intermodal originations were 2,399,350, down 8.9 percent or 233,979 carloads and intermodal units from December 2014.The odds of this happening if we were not in recession are, to use a highly technical economic term of art, shit-stompingly low. It is not a momentary phenomenon - 2015 total rail was lower than 2014 total rail. The problem slowly grew worse through the year and then suddenly got explosive late in the year:

There's a little purple 2016 blob on this graph from the AAR website representing the first week of 2016, but look at the blue 2015 trajectory. Somewhere around week 42/43 things just started to slide, and by week 48/49 we were meeting and exceeding recessionary guidelines by achieving combined rail volumes lower than 2013 in addition to 2014. Most of the weakness came from intermodal, which had been running positive YoY, and then threw in the towel at the end of the year.

Petroleum, this week's release:

Until quite recently, the four-week gasoline supply figures said firmly that we were not in recession. They started to turn about with rail in November, and now we are looking at -4.3% YoY, four-week average.

Normally I follow distillate more closely. That is down YoY by a large margin, but the warmer-than-average temps late last year in regions where the most heating oil is consumed makes that figure less reliable. It is, however, down by 12.1% YoY. I would think this equates to at least a 6% trucking drop. It is too much to be just from heating oil. More detail in this document.

Industrial production:

It lacks nuance. It is not subtle. This is through November, change YoY.

I expect a turn up in these figures for the first few weeks of the year, but not ENOUGH, if you catch my drift.

Treasury receipts.

These are published every day, and provide an excellent, timely look at what's happening with businesses and payrolls. They are less current looks at the economy than rail or freight, because there's a natural delay between slow-downs or speed-ups in the economy and the business reaction.

The fiscal year begins in October. So October 2015 was the 2016 fiscal year. Here are the Monday, January 11 2016 and Monday, January 12, 2015 reports. These are closest comparable days. Table IV, if you want to look at this.

Through November and December, I noticed that business tax receipts were down. They are now down 8.7% YoY YTD. Withheld employment and income taxes were up, agreeing well with the employment report. I am watching the withhelds for signs of slowing. They don't really seem to as of yet, with the Dec 1 2014/2015 withhelds at 2.8% YoY YTD, and the latest at 2.9% YoY YTD.

The thing to remember about doing this is that these are biased toward larger companies, which remit faster. Small businesses may be doing better - that has seemed to be the pattern through a hunk of the last year.

NFIB:

The latest report is here. The earnings and sales indexes are showing slow slides. The six-month outlook for business conditions is notably down from last year, having fallen from a positive 12 in December 2014 to -14 in December 2015. This was a very small sample, and I will be interested to see what the next report, which is a large sample, will show. It is currently consistent with the idea that small businesses are doing somewhat better than large businesses. Currently this report doesn't show any sharp drop.

Credit cycle:

CMI:

The latest report is here. This, if anything, should be slightly biased toward larger businesses in some sectors because it covers business-to-business credit. CMI had showed trouble by November. Led by manufacturing, of course. December overall was a bit better, but manufacturing resumed its slide.

Manufacturing showed a trouble into the contraction zone in September, from which it has not recovered. However in December the unfavorables almost went to neutral - but that was achieved, of course, by contracting credit granted. The YoY sales dropped from 60.1 to 51.9, and credit extended dropped from 63.38 to 55.4. That came close to roughly balancing the YoY unfavorables, which only slid from 50.4 to 49.9. It came at a cost in business activity.

Services did better, but of course the holidays are very good, and one would expect some signs of life from the retail. That improved, but YoY there is clear weakening. Unfavorable factors are at 50.6, which doesn't provide a lot of margin over the next few months.

We seem to be on the wrong end of the credit cycle. When B2B runs out, the banks kick in. But that, too, has its natural limits unless the underlying factors improve.

Banks:

C&I looks recessionary also. They all do! Interest rates are very low and there isn't room to carry much in the way of losses from defaults. As interest rates go lower, the risk to profits from defaults increases, and we are still at a no-capacity level there. These are from third quarter, btw. These aren't current. These are probably what caused the rail figures in December.

CCs can withstand more. C&I - it's time to pull in the reins. Perhaps that's why Chicago PMI took such a stunning drop. This is painful.

Questions for readers:

If anybody makes it this far! What is your sense? Do things "feel" like a downturn to you? What's your business/part of the world looking like? Are you seeing any green shoots? If you believe I am an ass and a fool, feel free to say so. I would be happy to be convinced of it. You'd be doing me a favor.

MaxedOutMama

MaxedOutMama