Wednesday, February 27, 2008

MoM Theory

A bad January durables report. The worst was nondefense capital goods:

If you look at the full advance report (pdf), while shipments are rising inventories are generally high. Fabricated metals orders were down 4.1% after December's 1.2% increase. Shipments of fabricated metals rose 1.0% after two months of declines. Machinery shipments and new orders were down 1.7% and 1.5% respectively, but that came after strong increases in December. Overall, durable shipments are up sharply YoY. It does seem as if there is some life in manufacturing somewhere. Last year YoY shipments mostly declined and that made me very nervous. It could also be that price increases account for the rise, and that volume is largely down.

On a YoY basis, motor vehicles and parts shipments declined 5.7%, and orders declined 7.6%. However unfilled orders are down 13.2% and inventories are down 6.2%, so we are getting closer to increased volume.

The manufacturing issue is becoming increasingly urgent, because mortgage rates are zooming up on risk and (I believe) increased competition from ARS munis trying to roll into longer durations.

MBA:

At 10:00 AM the new home sales report is due to be released, but at this point it hardly matters. At these rates, sales and/or prices of new and existing homes are due to drop significantly. The question is whether this will be a temporary phenomenon or not, and my guess is that it will not be truly temporary, although I expect some fluctuation as each segment unwinds and then gets absorbed.

Greenspan's famous conundrum about the oddity of low long rates combined with high short rates, was, I believe, largely an artifact of long-short financial gearing carried out on a nearly global scale. So much long paper was shifted to finance short-term money that the supply of long paper was constrained and caused it to be sold for a relatively high price (high price = low rate). And now I believe that this trend is due to reduce on a global scale and produce an era in which the effect diminishes broadly.

The ARS muni market is over 300 billion. If 30 percent of it goes longer, that's a lot of increased demand on longer money. The effect will continue, because newer muni issues are less likely to go auction rate. And many other short-term bundling vehicles are breaking down at the same time.

I want to stress that my assertion about the basic mechanism underlying Greenspan's conundrum is not widely shared AFAIK. You are reading my opinion here. I do feel relatively certain that I am correct. I never bought the idea that a "glut of worldwide savings" was at one and the same time producing a nearly global bubble in building and real property (financed by debt) and low long rates financed by savings. The shift in production from high to low-cost areas did cause something of a worldwide drop in inflationary pressures, which clearly was a factor in the beginning of Greenspan's "virtuous" cycle.

Again, this is my theory:

I believe long paper being sold as short allowed investors to pretend that long risk did not exist. But that is a farce, and it was always destined to break down at some point.

Long risks are compounded from several elements. The first is unknowability and change. No matter how carefully you grant credit, as time wears on the condition of your borrowers will change. The financial situation of some will improve, and the financial situation of some will decline. Borrowers whose financial situation has improved are always more likely to refinance out of your credit and into cheaper credit, and therefore the trend for all long credit portfolios over time is worsening credit quality. For that, you charge extra.

The second risk, of course, is that overall rates will rise and you will be stuck with below-market rates, which will reduce the value of your portfolio. However there is some compensating effect, because your credit quality will not diminish nearly as fast in this situation. Your good borrowers are more likely to remain with you, and your intermediate borrowers may be able to refi out and will in order to take on more debt even if they have to pay higher rates to do so.

Auction rate munis, SIVs, and the like were all used to shift rates from long to short. However the end consumers of this credit weren't paying for the risk, and as liquidity on the underlying long instruments drops out, abruptly the risk starts getting priced back in. This causes overall rates to rise, which causes debt servicing costs to rise, which worsens the underlying credit condition of the borrowers who have variable rate long debt. Which causes rates to rise again.... So as far as Mom theory is concerned, the "worldwide glut in savings" was really a worldwide glut of ignoring and underpricing risk.

Nondefense new orders for capital goods in January decreased $6.6 billion or 8.1 percent to $74.6 billion.Ouch! Overall new orders decreased 5.3%.

If you look at the full advance report (pdf), while shipments are rising inventories are generally high. Fabricated metals orders were down 4.1% after December's 1.2% increase. Shipments of fabricated metals rose 1.0% after two months of declines. Machinery shipments and new orders were down 1.7% and 1.5% respectively, but that came after strong increases in December. Overall, durable shipments are up sharply YoY. It does seem as if there is some life in manufacturing somewhere. Last year YoY shipments mostly declined and that made me very nervous. It could also be that price increases account for the rise, and that volume is largely down.

On a YoY basis, motor vehicles and parts shipments declined 5.7%, and orders declined 7.6%. However unfilled orders are down 13.2% and inventories are down 6.2%, so we are getting closer to increased volume.

The manufacturing issue is becoming increasingly urgent, because mortgage rates are zooming up on risk and (I believe) increased competition from ARS munis trying to roll into longer durations.

MBA:

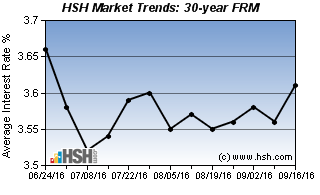

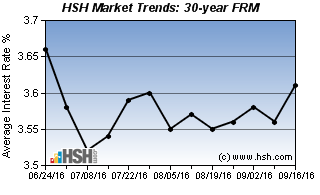

The average contract interest rate for 30-year fixed-rate mortgages increased to 6.27 percent from 6.09 percent, with points increasing to 1.15 from 1.10 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.However this understates the real rise, because an awful lot of mortgages are for LTVs over 80%. HSH publishes true average rates in their weekly trends report:

The average contract interest rate for 15-year fixed-rate mortgages increased to 5.77 percent from 5.55 percent, with points decreasing to 1.01 from 1.08 (including the origination fee) for 80 percent LTV loans.

The average contract interest rate for one-year ARMs increased to 5.84 percent from 5.72 percent, with points decreasing to 0.86 from 0.91 (including the origination fee) for 80 percent LTV loans.

At 10:00 AM the new home sales report is due to be released, but at this point it hardly matters. At these rates, sales and/or prices of new and existing homes are due to drop significantly. The question is whether this will be a temporary phenomenon or not, and my guess is that it will not be truly temporary, although I expect some fluctuation as each segment unwinds and then gets absorbed.

Greenspan's famous conundrum about the oddity of low long rates combined with high short rates, was, I believe, largely an artifact of long-short financial gearing carried out on a nearly global scale. So much long paper was shifted to finance short-term money that the supply of long paper was constrained and caused it to be sold for a relatively high price (high price = low rate). And now I believe that this trend is due to reduce on a global scale and produce an era in which the effect diminishes broadly.

The ARS muni market is over 300 billion. If 30 percent of it goes longer, that's a lot of increased demand on longer money. The effect will continue, because newer muni issues are less likely to go auction rate. And many other short-term bundling vehicles are breaking down at the same time.

I want to stress that my assertion about the basic mechanism underlying Greenspan's conundrum is not widely shared AFAIK. You are reading my opinion here. I do feel relatively certain that I am correct. I never bought the idea that a "glut of worldwide savings" was at one and the same time producing a nearly global bubble in building and real property (financed by debt) and low long rates financed by savings. The shift in production from high to low-cost areas did cause something of a worldwide drop in inflationary pressures, which clearly was a factor in the beginning of Greenspan's "virtuous" cycle.

Again, this is my theory:

I believe long paper being sold as short allowed investors to pretend that long risk did not exist. But that is a farce, and it was always destined to break down at some point.

Long risks are compounded from several elements. The first is unknowability and change. No matter how carefully you grant credit, as time wears on the condition of your borrowers will change. The financial situation of some will improve, and the financial situation of some will decline. Borrowers whose financial situation has improved are always more likely to refinance out of your credit and into cheaper credit, and therefore the trend for all long credit portfolios over time is worsening credit quality. For that, you charge extra.

The second risk, of course, is that overall rates will rise and you will be stuck with below-market rates, which will reduce the value of your portfolio. However there is some compensating effect, because your credit quality will not diminish nearly as fast in this situation. Your good borrowers are more likely to remain with you, and your intermediate borrowers may be able to refi out and will in order to take on more debt even if they have to pay higher rates to do so.

Auction rate munis, SIVs, and the like were all used to shift rates from long to short. However the end consumers of this credit weren't paying for the risk, and as liquidity on the underlying long instruments drops out, abruptly the risk starts getting priced back in. This causes overall rates to rise, which causes debt servicing costs to rise, which worsens the underlying credit condition of the borrowers who have variable rate long debt. Which causes rates to rise again.... So as far as Mom theory is concerned, the "worldwide glut in savings" was really a worldwide glut of ignoring and underpricing risk.

Comments:

<< Home

M.O.M.,

Good insight. Seems a likely contributing factor. How much of a contributing factor? Its hard to say.

Good insight. Seems a likely contributing factor. How much of a contributing factor? Its hard to say.

And the headlines from the Fed this morning are Helicopter Ben's dropping the interest rate.

No word on whether the helicopters are being fueled up and loaded with the bushels of Benjamins. Maybe the printing presses can't print fast enough.

As Lileks said, "Nothing so inspired consumer confidence as the government shoving $500 into your hands and saying 'SPEND IT! SPEND IT NOW! ON ANYTHING! BLOWN-GLASS KNICK-KNACKS! BARRELS OF PICKLES! ANYTHING! JUST SPEND IT NOW!'"

No word on whether the helicopters are being fueled up and loaded with the bushels of Benjamins. Maybe the printing presses can't print fast enough.

As Lileks said, "Nothing so inspired consumer confidence as the government shoving $500 into your hands and saying 'SPEND IT! SPEND IT NOW! ON ANYTHING! BLOWN-GLASS KNICK-KNACKS! BARRELS OF PICKLES! ANYTHING! JUST SPEND IT NOW!'"

BINGO!

And current efforts by all including the FED is to make sure that underpricing of risk continues. Fannie and Freddie will slowly bleed out as they lend money well below what true risk would/should price it. They will either bleed to death or get a transfusion at taxpayer's expense.

The immediate shift from a "houses rising in value" environment to one of a "houses falling in value" requires just as an immediate and readjustment in the price of money. It's like the cost of life insurance for a person who lives as a monk and suddenly takes up flying experimental aircraft. Teh price of insurance should skyrocket to account for the immediate increase in risk due reflective of the immediate change in environment.

No wonder the financial world is still locked up, and only those who can afford to lose money are lending.

And current efforts by all including the FED is to make sure that underpricing of risk continues. Fannie and Freddie will slowly bleed out as they lend money well below what true risk would/should price it. They will either bleed to death or get a transfusion at taxpayer's expense.

The immediate shift from a "houses rising in value" environment to one of a "houses falling in value" requires just as an immediate and readjustment in the price of money. It's like the cost of life insurance for a person who lives as a monk and suddenly takes up flying experimental aircraft. Teh price of insurance should skyrocket to account for the immediate increase in risk due reflective of the immediate change in environment.

No wonder the financial world is still locked up, and only those who can afford to lose money are lending.

Anon, yes, I cracked up when I read Ben's "We're standing by!" bit right after I finished posting. But given the simultaneous problems with CC, auto, residential mortgage, commercial mortgages, ARS munis, junk commercial and LLBO (loony leveraged buyout) debt, I doubt the printing presses and helicopters have the needed capacity. Maybe we can press all the private jets into service.

MAB - I think the main one. My belief is that supply and demand controls interest rates just as much as it controls the price of widgets. The same mechanism does not control Treasuries, because the risk factor doesn't function. Therefore Treasury rates should diverge from the rest. I don't believe that 10 treasury rates at this point have much at all to do with mortgage rates.

But regardless, with mortgage rates on this trajectory, the housing price and sales trajectory for the spring just got a lot worse, and of course the spring is the main season. So it would appear that Ben should be fueling up the helicopters and calling out the marines about now.

What, really, can the Fed do about a plague of re-recognition of risk?

MAB - I think the main one. My belief is that supply and demand controls interest rates just as much as it controls the price of widgets. The same mechanism does not control Treasuries, because the risk factor doesn't function. Therefore Treasury rates should diverge from the rest. I don't believe that 10 treasury rates at this point have much at all to do with mortgage rates.

But regardless, with mortgage rates on this trajectory, the housing price and sales trajectory for the spring just got a lot worse, and of course the spring is the main season. So it would appear that Ben should be fueling up the helicopters and calling out the marines about now.

What, really, can the Fed do about a plague of re-recognition of risk?

Anon 9:03 - okay, there is some good stuff out there. There are very solid munis, there are very good mortgages. There is some good commercial stuff out there.

What we can or should do to correct risk premiums on crappy debt is the issue. My feeling is not much, but maybe I've made that clear before. Bailouts should occur after failure to ensure liquidity, not before failure to prevent repricing.

I don't think the Fed can stop the process. The current Fed is locked into the economic hangover from the previous party.

What we can or should do to correct risk premiums on crappy debt is the issue. My feeling is not much, but maybe I've made that clear before. Bailouts should occur after failure to ensure liquidity, not before failure to prevent repricing.

I don't think the Fed can stop the process. The current Fed is locked into the economic hangover from the previous party.

Mom

i've got to tell u that i find your posts most illuminating and one of my favorites of all.

everyone makes such a big deal about Chinas pushing our 10y UST down and no doubt they have. but the more i think about your theory the more sense it makes.

i have several acquaintances who've retired from Wall St in their 30's who i often talk to. a couple of them were involved in this type of repackaging of debt to sell to investors. its clear that its all a game to invent the next fad upon which the inventor can make their fortune. it doesn't even matter how sound the instrument is. what matters is if you can sell it to unknowing investors

we are destined for some real pain in this country.

i've got to tell u that i find your posts most illuminating and one of my favorites of all.

everyone makes such a big deal about Chinas pushing our 10y UST down and no doubt they have. but the more i think about your theory the more sense it makes.

i have several acquaintances who've retired from Wall St in their 30's who i often talk to. a couple of them were involved in this type of repackaging of debt to sell to investors. its clear that its all a game to invent the next fad upon which the inventor can make their fortune. it doesn't even matter how sound the instrument is. what matters is if you can sell it to unknowing investors

we are destined for some real pain in this country.

idoc - Thanks for the nice comments. Those who claim that inflation fears are the primary mechanism pushing mortgage rates up have to explain why long treasury yields are still pretty darn low as mortgage rates shoot up. As of 2/26 the yield on the 10 yr was 3.66%.

If you will note on the HSH graph, the timing on mortgage rates has synched in nicely with the ARS detonation.

I have had this theory for years, but this is the first strong evidence to support it!

If you will note on the HSH graph, the timing on mortgage rates has synched in nicely with the ARS detonation.

I have had this theory for years, but this is the first strong evidence to support it!

Yes, underpricing and ignoring risk.

and

All these financial & liar lawyer crooks as well as legions of univ. and media jackasses.

Cannot allow huge bailouts either.

smrt indepndnt

and

All these financial & liar lawyer crooks as well as legions of univ. and media jackasses.

Cannot allow huge bailouts either.

smrt indepndnt

Thank you for the Analysis MoM,it makes sense.How would you price the risk of a 30 year fixed in a county like Sonoma?We have an hourglass economy heavily dependent on construction and tourism,median home prices have dropped 20% from the peak and are at $500k.median family income is $53,400.There is a substantial but unquantifiable black economy of Meth Labs and pot growers...

Tom, I hate to say it but it depends upon the true risk, which is mostly a matter of old-fashioned underwriting and a significant downpayment.

But as you seem to be pointing out, the income/price ratio indicates that relatively few can genuinely afford the housing.

You can't write 50% DTI loans and expect them to perform the way 35% DTI loans do.

Personally, I'd want about a 30% downpayment for a non-recourse, if that's what you're really asking. Alternatively, I'd need at least 10% down plus PMI, plus a reasonable DTI not over 42%. And then I'd only be willing to go with an oldfashioned fixed 30 yr amortizing.

But as you seem to be pointing out, the income/price ratio indicates that relatively few can genuinely afford the housing.

You can't write 50% DTI loans and expect them to perform the way 35% DTI loans do.

Personally, I'd want about a 30% downpayment for a non-recourse, if that's what you're really asking. Alternatively, I'd need at least 10% down plus PMI, plus a reasonable DTI not over 42%. And then I'd only be willing to go with an oldfashioned fixed 30 yr amortizing.

Thank you MoM.I spent some time thinking about this,and our conclusions were very close.I tend to think of RE loans as being based on collateral first,then DTI,skin in the game and emotion last.Our food Banks here in Sonoma county are being overwhelmed already by the working poor,he county is about to shut down our only mental health facility (the Sheriiff spoke out on this one)and it appears that the false economies will be first choices,Tom.

I know the ARS securities *want* to roll into something with longer durations and lower rates, but have enough of them already accomplished this to materially affect mortgage rates?

David, it's not just the ARS. There are all sorts of short term obligations that have to roll long now. See, for example, this CR post on VR demand notes.

One way to look at the current situation is that, ignoring experience, a huge number of borrowers attempted to borrow long on short-term rates because it was cheap. After all, that is what a 2/28 or 3/27 really is. It's really a 2 or 3 year balloon note. And you do get cheap rates initially. Just as the munis had high default rates, and the variable rate demand notes have high default rates, the "innovative" mortgage products have high reset rates.

One figure I saw on AR munis was 330 billion. I know just a few hospital systems have been trying to work out hundreds of millions. Because most of these obligations have no more than a 35 day term, the entire amount comes into play within six weeks.

There's probably at least 370 billion in short term VRDNs out there (with the basically the same terms as the AR munis. So yes, this is more than enough to totally disrupt the financial market. If CA had to pay 8.25% on 300 million of its VRDNs, that's going to drive mortgage rates up.

But there are other demand instruments including corporate debt underwritten by banks which amount probably to over 500 billion. These are not openly traded for bid, but can come into play at times like these.

There is no reason to pay 5.5% for mortgages in the current environment when you can pick up over 7% on some of these instruments.

The total between these three categories in play right now is probably about 750 billion or 3/4 of a trillion, which is more than enough to jack avg mortgage rates to over 7.5%.

Post a Comment

One way to look at the current situation is that, ignoring experience, a huge number of borrowers attempted to borrow long on short-term rates because it was cheap. After all, that is what a 2/28 or 3/27 really is. It's really a 2 or 3 year balloon note. And you do get cheap rates initially. Just as the munis had high default rates, and the variable rate demand notes have high default rates, the "innovative" mortgage products have high reset rates.

One figure I saw on AR munis was 330 billion. I know just a few hospital systems have been trying to work out hundreds of millions. Because most of these obligations have no more than a 35 day term, the entire amount comes into play within six weeks.

There's probably at least 370 billion in short term VRDNs out there (with the basically the same terms as the AR munis. So yes, this is more than enough to totally disrupt the financial market. If CA had to pay 8.25% on 300 million of its VRDNs, that's going to drive mortgage rates up.

But there are other demand instruments including corporate debt underwritten by banks which amount probably to over 500 billion. These are not openly traded for bid, but can come into play at times like these.

There is no reason to pay 5.5% for mortgages in the current environment when you can pick up over 7% on some of these instruments.

The total between these three categories in play right now is probably about 750 billion or 3/4 of a trillion, which is more than enough to jack avg mortgage rates to over 7.5%.

<< Home

MaxedOutMama

MaxedOutMama