Monday, May 04, 2009

The New American Gothic

But I have been a slacker, because when I sit down to write I keep laughing so much over this article that my headache came back. (I caught a most unpleasant virus last week and have been slowly fighting it off.)

Anyway, I can't get back to serious business until I share the tragic tale of "The New American Gothic", as explicated by the Mercury News, thus diluting my mirth. Brace yourselves for a tale of harrowing woe about a new generation of Les Miserables eking out their perilous, marginalized existences:

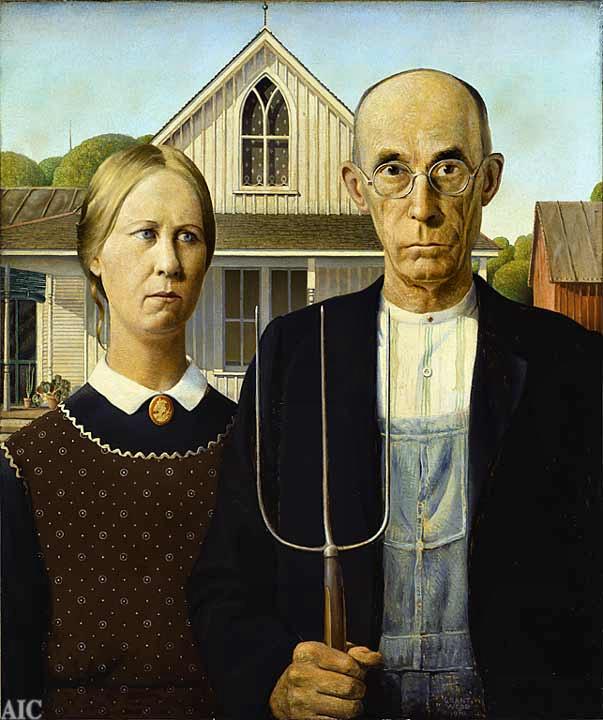

These are the faces of the new American Gothic, where people who've worked hard and played by the rules are caught in an economic freeze frame — with a "for sale" sign out front.Most of us who are old enough to have missed the new math are familiar with Grant Wood's "American Gothic" painting of 1930, here brought to you by Monstergirl:

Those pinched faces, the gnarled hands, and the curtains and brooch speaking of a life of bitter toil in pursuit of basic respectability and economic security! One's perceptions of the painting are inevitably colored by the knowledge that the full force of the depression was yet to hit.

The new American Gothic must certainly be a tale about migrant farm workers or first-generation immigrants who are losing their stores to declining sales at the same time they are losing their homes to foreclosure? The reporter, who surely longed for a career as a novelist or perhaps a playwright, takes care to underline her point for those of her readers who are less culturally literate:

Now their struggles offer a glimpse of life amid the real estate crisis in many neighborhoods across Silicon Valley.Hmm. Silicon Gothic?

"It's incredibly difficult for private sellers now," said C.J. Brasiel of Fireside Realty in Willow Glen. "It's a hard pill to swallow that if you had sold two years ago you could have made your fortune. And now you've seen the value drop from 20 to 50 percent."Ahh. That could put a pinched expression on one's face. The hardships of these people do make one want to grab a pitchfork:

The Neglers on Cherry Avenue. It seemed a smart investment when they bought the 3,800-square-foot historic Victorian on one-third of an acre in 1986. They did a two-year renovation, certain that when they retired from their successful high-tech jobs, they would make a tidy bundle. This was Willow Glen, after all, where values seemed to go nowhere but up.They bought 15 acres on a Puget Sound island for retirement:

Valerie, 58, spent the past year as the project manager on their island getaway, working with architects to design the modern glass and wood home, overseeing the digging of a well. The profit from the sale of their house was supposed to finance construction.Somebody call the White House! I'm not going to take a slice at the brains and hard work quote. After all, it is the reporter who believes she has stumbled across the next American tragedy, not the Neglers.

They should have been there by now, riding bikes on the miles of trails by day and watching the sunsets by night. "We were always able to follow through on what we wanted," she said. "All it took was brains and hard work."

They listed their home last May for $2.4 million. But nothing happened. They lowered their asking price to $2.275 million. Still nothing.

But if the new American Gothic is actually composed of people who can't retire in their late 50s to a custom built island retirement home on 15 acres, the reality is that most people aren't going to be crying. The American dream has traditionally been more along the lines of paying off a house like the one the Negler's already have before retiring, so the Neglers seem to have done pretty well out of the American dream.

They seem to be working through their crisis bravely:

"I called my mom and asked her what it was like in the Depression," said Negler, who owns the Victorian. She realized, though, that she "sounded pretty selfish. We stopped looking at ourselves as the center of the universe."But she still dreams of the island in Puget Sound that is waiting for them.

"We go up and visit it," she said. "And we're OK. You've got to keep the faith."

I think maybe losing a bit of faith would help this couple out. Through the magic of Google, I discovered that they were willing to sell in 2003 for a soggy little 'ol 2 million (see a very nice story with the background and picture of the home). Most people would think that buying a house in the mid 1980s for $250,000 and making 1.5 million dollar profit in a bit over 2 decades would be pretty good, so I'd recommend using the old smarts and doing the hard work of cutting the price just a tad more.

If the "new American Gothic" were genuinely composed of individuals refusing to settle for less than 1 million worth of home appreciation per decade, I think we'd all have a good laugh.

To understand why I am a bit crazed over this, you have to read this DU thread (one of many) over the news that Social Security recipients are likely not going to get any COLAs for next year, and may well not get COLAs the following year either.

Then you have to put the sentiments expressed in perspective by looking at BLS's new consumer expenditure survey (2007 data) by age. Households between 65-74 have an average income of close to 48K before taxes, 46K after. But then you have to read down to sources of income and grasp that about 21K of that comes from wages, salaries and self-employment, whereas retirement benefits of ANY and ALL KINDS only account for 22.6K of their income. Needless to say, households over 75 have much lower incomes, because they only average about 6K of employment income plus about 20K of annual income from retirement benefits from any source. Most "consumer units" with reference persons aged 65-74 have wage-earners. (.7) They wouldn't be making it otherwise.

For all 65-older households, housing expenses average about 12K a year, medical averages about 4.6K a year, utilities and public services about 3K a year, plus food at about 4.5K a year. Retired households average gifts of about 2.3K a year.

The reason why retirees are so frantic is that their expense patterns are substantially different than the expense patterns of the American public as a whole.

I grow frustrated with the refusal to deal with economic realities as they really are in the US. Neither the press nor most people are willing to engage with life as it is lived. There is nothing more Gothic than a 74 year old losing his marital home, because his own income plus his own wages don't add up to enough to continue paying the taxes, buying food, buying medicine and keeping the lights on, and his 73-year old wife (who was working) just died, but that is the new American Gothic.

MaxedOutMama

MaxedOutMama