Monday, April 12, 2010

Staring Down The Barrel Of The Gun

US Monthly Treasury Statements: Get 'em here.

In theory, by March we were about ten months into a recovery - but the YoY drops keep coming. And yes, some of this should be due to retirements, but the overall economy is weak enough that even with retirements, we do not seem to be making much progress on unemployment.

The Social Security/Medicare Trustees report is being delayed so they can play with the future projection numbers. But in the face of this, who will believe the numbers?

It is true that some of the lost income is being replaced by retirement benefits, but most of those come from governments one way or another, and the governments are staring down the gun barrel of fiscal disaster.

I have done the gizmo and I am just testing it and writing tutorials (and now I have to upload over 100 web pages somewhere), but the Consumer Expenditure Survey is comprehensive and is updated very late. The last current numbers are from 2008. So without this perspective, it's hard to understand what is happening.

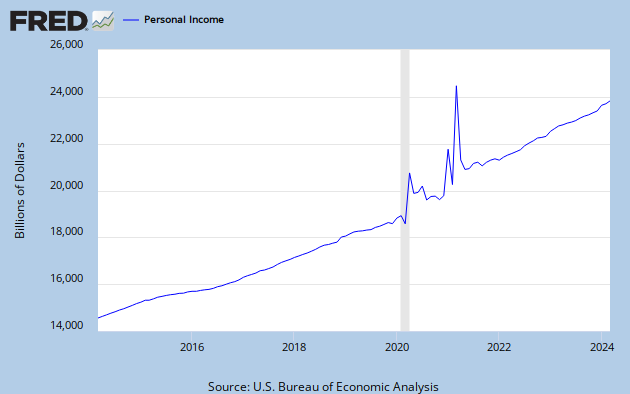

This is what the official US numbers show for personal income (which includes government transfer payments, investment income, rental income and so forth):

I don't see how these numbers could be correct. They are seasonally adjusted, but rents are falling, interest income is falling (as longer term deposits roll over), and wages are still sliding down YoY.

Anyway, our ability to sustain hefty price increases stemming from an increase in energy costs is just not there, any way you look at it.

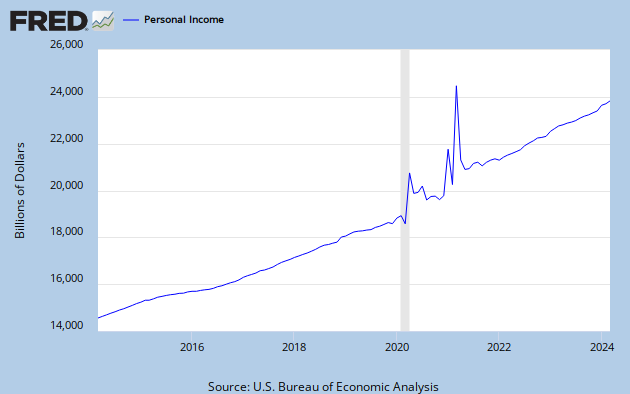

Nor has this happened before in my lifetime. Look at the long term graph:

Now when I predicted a depression-like incident, I did so on the basis of my income predictions. And those predictions, according to the tax receipts, appear to have come true. The reason for the sustained fall in sales tax receipts is blindingly obvious from looking at federal tax receipts.

Debt defaults are basically supporting a lot of consumer spending, as are consumers dropping payments for services such as medical insurance (not a good sign). But there is a limit to how long one can sustain spendable income from such sources, and in 2010 we will start to see that effect drop off. The debt card we played in the 1990s and the aughts.

And then there are the unemployment benefits, which will begin to tail off.

I'd say we are in the eye of the deflationary storm.

PS: I see that Snarky Mark has buckled down and started to trail this relationship. Very interesting.

March 2010:Because the hospital insurance portion of FICA (the 2.9% amount) is charged on all wages and self-employment with no dollar limit, this tells us that US taxable wages have fallen 9.4% in two years. What else is there to say?

Hospital FICA: 13,601 (-4.9%)

Hospital Self: 349 (-11.4%)

March 2009:

Hospital FICA: 14,308

Hospital Self: 394

March 2008:

Hospital FICA: 15,013

Hospital Self: 454

2010/2008:

FICA: -9.4%

Self: -23.1%

In theory, by March we were about ten months into a recovery - but the YoY drops keep coming. And yes, some of this should be due to retirements, but the overall economy is weak enough that even with retirements, we do not seem to be making much progress on unemployment.

The Social Security/Medicare Trustees report is being delayed so they can play with the future projection numbers. But in the face of this, who will believe the numbers?

It is true that some of the lost income is being replaced by retirement benefits, but most of those come from governments one way or another, and the governments are staring down the gun barrel of fiscal disaster.

I have done the gizmo and I am just testing it and writing tutorials (and now I have to upload over 100 web pages somewhere), but the Consumer Expenditure Survey is comprehensive and is updated very late. The last current numbers are from 2008. So without this perspective, it's hard to understand what is happening.

This is what the official US numbers show for personal income (which includes government transfer payments, investment income, rental income and so forth):

I don't see how these numbers could be correct. They are seasonally adjusted, but rents are falling, interest income is falling (as longer term deposits roll over), and wages are still sliding down YoY.

Anyway, our ability to sustain hefty price increases stemming from an increase in energy costs is just not there, any way you look at it.

Nor has this happened before in my lifetime. Look at the long term graph:

Now when I predicted a depression-like incident, I did so on the basis of my income predictions. And those predictions, according to the tax receipts, appear to have come true. The reason for the sustained fall in sales tax receipts is blindingly obvious from looking at federal tax receipts.

Debt defaults are basically supporting a lot of consumer spending, as are consumers dropping payments for services such as medical insurance (not a good sign). But there is a limit to how long one can sustain spendable income from such sources, and in 2010 we will start to see that effect drop off. The debt card we played in the 1990s and the aughts.

And then there are the unemployment benefits, which will begin to tail off.

I'd say we are in the eye of the deflationary storm.

PS: I see that Snarky Mark has buckled down and started to trail this relationship. Very interesting.

Comments:

<< Home

We sent American jobs and productivity overseas .

Since we can't tax unemployed Americans enough

to make up the shortfall it is time to tax imported

finished goods. No way around it.

Sporkfed

Since we can't tax unemployed Americans enough

to make up the shortfall it is time to tax imported

finished goods. No way around it.

Sporkfed

M_O_M,

So we're threading a needle between the wage-lowering effects of tax increases, and the GDP-reducing effects of reductions in government pensions and benefits, correct?

So we're threading a needle between the wage-lowering effects of tax increases, and the GDP-reducing effects of reductions in government pensions and benefits, correct?

Neil - we cannot do it with tariffs, but Sporkfed is basically right.

Only producing more of what we consume will keep us from a long cycle of slow deflation.

Together SS and Medicare are such a huge portion of federal outlays that raising taxes too much will go to the point of no or negative returns.

Seriously, the thing to do is cut corporate taxes, plunge into the cheapest energy production we can get (drill, new coal plants, nuclear) and cut most middle class welfare. Then there needs to be a long cycle of reducing the government jobs share of the economy.

The VAT tax is being proposed because it is the only way they can see to ever get back to 3% deficits, but it still wouldn't do what they think it would do. It would just push growth below 2%, which would slow our slide in the near term, but not stop it.

Only producing more of what we consume will keep us from a long cycle of slow deflation.

Together SS and Medicare are such a huge portion of federal outlays that raising taxes too much will go to the point of no or negative returns.

Seriously, the thing to do is cut corporate taxes, plunge into the cheapest energy production we can get (drill, new coal plants, nuclear) and cut most middle class welfare. Then there needs to be a long cycle of reducing the government jobs share of the economy.

The VAT tax is being proposed because it is the only way they can see to ever get back to 3% deficits, but it still wouldn't do what they think it would do. It would just push growth below 2%, which would slow our slide in the near term, but not stop it.

M_O_M, is that 2% real or nominal? I'm asking because at 2% nominal, it's reasonable to question whether there's any actual growth at all.

Neil- if you are talking in terms of percentage of GDP, it hardly matters whether it is real or nominal.

Bottom line, we have to find a way to get the deficit as a percent of GDP below the GDP growth rate.

Bottom line, we have to find a way to get the deficit as a percent of GDP below the GDP growth rate.

Ah, got it. I missed the key relationship there between growth of Treasury debt vs. growth of GDP. So in your opinion there's no way to reduce the gap between the deficit and GDP growth by raising taxes?

Neil - The fiscal problem cannot be solved just by raising taxes, and that is not just my opinion. It is the opinion of everyone who has taken an honest look at the matter.

How about a Washington Post article?

Recent article here.

The study discussed is by the Brookings Institution and the Urban Institute - extremely credible thinktanks. Desperately Seeking Revenue.

You'll note that they reiterate a lot of my comments over the last few years - that the top tax brackets can't do it, that raising corporate taxes won't work, and that essentially only scaling tax increases across everyone would work.

The tragedy is that the paper above was written in August; the cost of the health care bill is not included, and it will totally bust the budget. No way to balance, unless we basically terminate Medicare which is what the current health care bill does.

How about a Washington Post article?

Recent article here.

The study discussed is by the Brookings Institution and the Urban Institute - extremely credible thinktanks. Desperately Seeking Revenue.

You'll note that they reiterate a lot of my comments over the last few years - that the top tax brackets can't do it, that raising corporate taxes won't work, and that essentially only scaling tax increases across everyone would work.

The tragedy is that the paper above was written in August; the cost of the health care bill is not included, and it will totally bust the budget. No way to balance, unless we basically terminate Medicare which is what the current health care bill does.

"Deflation, not inflation, is the primary risk going forward."

From Breakfast with Dave 4/13/2010

A very good read.

https://ems.gluskinsheff.net/Articles/Breakfast_with_Dave_041310.pdf

From Breakfast with Dave 4/13/2010

A very good read.

https://ems.gluskinsheff.net/Articles/Breakfast_with_Dave_041310.pdf

Thanks M_O_M, for the reply.

That is my opinion, too, but I am inclined to think that anyway so I have tried to be intellectually lenient toward tax rate increases.

I think the deficit could be closed temporarily by raising rates across all income groups, but at the cost of negative GDP growth. As you pointed out, government liabilities are large enough that doing so doesn't solve any problems at all.

That's such a nice, simple relationship: The target variable is deficit as a percent of GDP, minus percent GDP growth.

That is my opinion, too, but I am inclined to think that anyway so I have tried to be intellectually lenient toward tax rate increases.

I think the deficit could be closed temporarily by raising rates across all income groups, but at the cost of negative GDP growth. As you pointed out, government liabilities are large enough that doing so doesn't solve any problems at all.

That's such a nice, simple relationship: The target variable is deficit as a percent of GDP, minus percent GDP growth.

MOM,

"I'd say we are in the eye of the deflationary storm."

There have been two clear winners this decade.

1. Those who embraced stagflation.

2. Those who embraced deflation.

I find that fascinating. I would not have guessed that a decade ago.

That said, I continue to believe that we're combining the deflationary Great Depression and the inflationary 1970s. We're getting the high unemployment and poor stock market performance of both eras and not much more to show for it.

I do think deflation may be back in the headlines again, much to the dismay of the recent stagflationary converts (those who converted when oil was $145 in 2008 were no doubt extremely dismayed).

"I'd say we are in the eye of the deflationary storm."

There have been two clear winners this decade.

1. Those who embraced stagflation.

2. Those who embraced deflation.

I find that fascinating. I would not have guessed that a decade ago.

That said, I continue to believe that we're combining the deflationary Great Depression and the inflationary 1970s. We're getting the high unemployment and poor stock market performance of both eras and not much more to show for it.

I do think deflation may be back in the headlines again, much to the dismay of the recent stagflationary converts (those who converted when oil was $145 in 2008 were no doubt extremely dismayed).

MOM,

"I don't see how these numbers could be correct. They are seasonally adjusted, but rents are falling, interest income is falling (as longer term deposits roll over), and wages are still sliding down YoY."

For what it is worth, this retired saver paid 80% less income tax than expected for 2009. I'm sitting in inflation protected treasuries with very little inflation. I'm quite pleased at a personal level, but I cringe at the thought of how this might relate to Japan's deflationary spiral.

"I don't see how these numbers could be correct. They are seasonally adjusted, but rents are falling, interest income is falling (as longer term deposits roll over), and wages are still sliding down YoY."

For what it is worth, this retired saver paid 80% less income tax than expected for 2009. I'm sitting in inflation protected treasuries with very little inflation. I'm quite pleased at a personal level, but I cringe at the thought of how this might relate to Japan's deflationary spiral.

For what it is worth, this retired saver paid 80% less income tax than expected for 2009.

My income in 2009 was roughly the same as 2008 (give or take a few hundred bucks) but my income tax was reduced by over one thousand dollars.

The reason - higher local property taxes.

We're going to have several taxing authorities duking it out in the coming years. The states are all in arrears on pension obligations and increase taxes to make up the difference. Because this is an income deduction, the feds get less tax revenue. And the feds just voted themselves a massive deficit like the states have been doing for decades.

Meanwhile the states silently expect to get bailed out by the central government - the same party they are competing with for taxation.

This is going to get so ugly that anyone with a job will wind up wishing they were unemployed.

My income in 2009 was roughly the same as 2008 (give or take a few hundred bucks) but my income tax was reduced by over one thousand dollars.

The reason - higher local property taxes.

We're going to have several taxing authorities duking it out in the coming years. The states are all in arrears on pension obligations and increase taxes to make up the difference. Because this is an income deduction, the feds get less tax revenue. And the feds just voted themselves a massive deficit like the states have been doing for decades.

Meanwhile the states silently expect to get bailed out by the central government - the same party they are competing with for taxation.

This is going to get so ugly that anyone with a job will wind up wishing they were unemployed.

Charles - you also got the tax credit. At least $400.

But you are right about the fight for dollars.

It's going to be quite ugly for high-tax states like CA. Several states are putting sales tax back on food - regressive taxation here we come!

Post a Comment

But you are right about the fight for dollars.

It's going to be quite ugly for high-tax states like CA. Several states are putting sales tax back on food - regressive taxation here we come!

<< Home

MaxedOutMama

MaxedOutMama