Monday, January 10, 2011

The 2011 Environment - Italy

January and February are the period in which the US cards are laid on the table, and I really don't know how it will come out.

All this year the European reckoning will continue. I think Italy is likely to come under extreme fire. The EU could save Italy only by extending a credit facility with really low interest rates. Italy's debt is somewhere around 119-123% of GDP. That's formidable, because it means that the debt-to-GDP ratio is almost bound to keep increasing. Suppose, for example, that Italy's average interest rate on that debt is 3.5%. Even if Italy borrows no more for primary spending, but only borrows for the interest, that means they have to borrow an additional 4.2% of GDP (on 120% of GDP). Unless the economy grows by more than 4.2% in the year, they will end up increasing their debt-to-GDP ratio.

To avoid increasing their debt-to-GDP ratio, if Italy's economy grows by 2% Italy would have to cut government spending by about 2% to come out even. Cutting government spending tends to reduce GDP, so.... One of the problems for Italy is their aging population which implies increased levels of spending for retirement and medical benefits, just as for every other developed western country. The median age of the Italian population last year was 43.7 years (compared to the US median age of 36). Italian population pyramid in 2005:

Remember, this was now six years ago; when looking at the graph above move it up one ledge. Over the next five years the retired population is due to skyrocket.

I read positive commentary in the press on Italy's current situation, but I do not find it convincing. The reason why I am so skeptical can be found in this 2006 ECB working paper on public debt, fiscal shocks and long term interest rates for Germany, Italy, and the USA. The Italy section begins on page 29.

This is a good paper worth reading. It is somewhat technical but understandable, and it includes a historical survey:

The inflation cure for high nominal public debt only works when an economy is producing a proportion of domestic basic needs. When you import a lot of your food and energy, it causes agony and deprivation among the population. In essence, it is another version of the IMF austerity programs which have generated such wrath among the populations which were subjected to those programs.

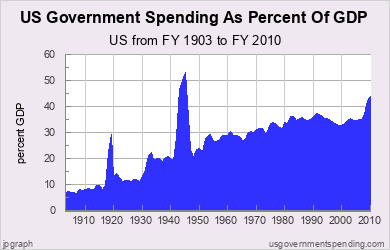

The Italian government's contribution to Italian GDP is very similar to the US contribution, which is shown below:

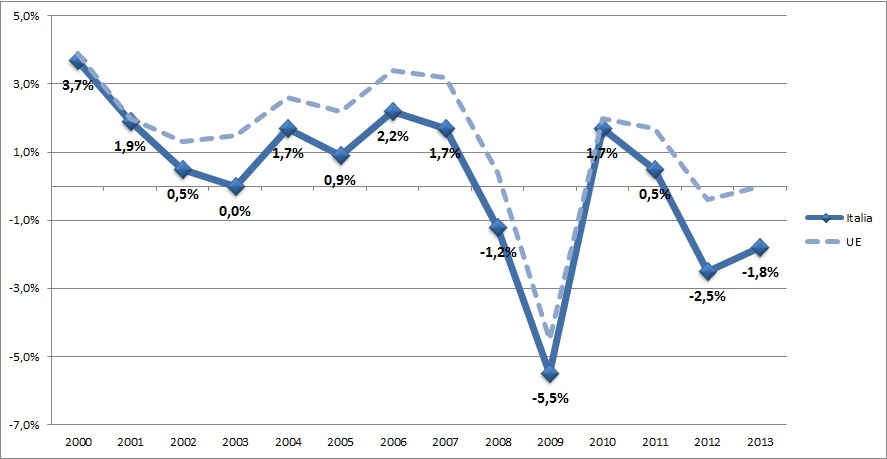

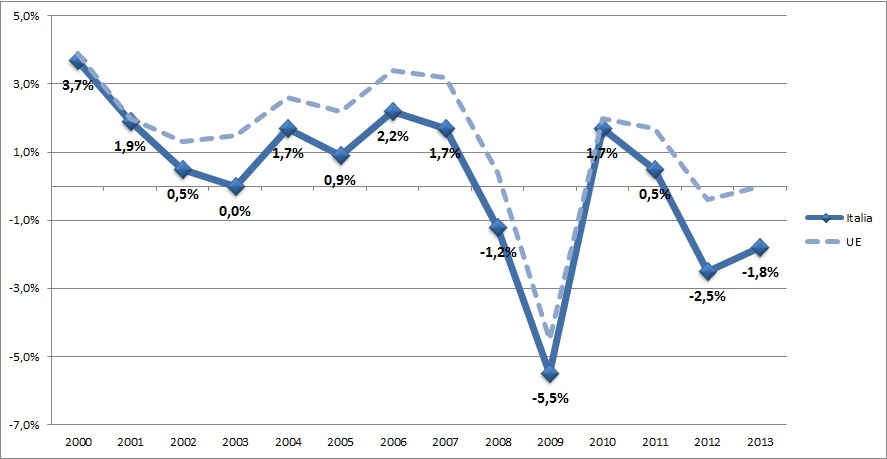

Italy is a very large exporter. Its resurgence in the 80s and 1990s was related to lower energy costs and a lira devaluation in the beginning of the 1990s. The 2000's have not been good to the Italian economy:

Okay, so we can dismiss the idea that Italy's economy is all of sudden going to start turning in growth in excess of 4% a year. Admittedly, the above are real growth figures. But you aren't going to get nominal growth at the level required. Current energy prices alone are dragging down 2011 estimated GDP.

Italy is struggling to raise tax collections by cracking down on money trafficking. They are even after the Vatican, which has got to be the world's greatest money launderer. But it will not be enough.

Therefore, either the EU extends a low interest rate credit facility to Italy (which it could do by having the ECB buy a lot of Italian bonds) or the Italian government restores the lira and devalues. That would cause great pain, but since Italy is a large auto manufacturer and since Italy is already a large exporter to both EU countries and increasingly, to Asia, it is very likely that Italy would be able to resume significant growth.

Another problem Italy has is that it decided to move into renewable energy, and the government subsidies it is paying are due to mount drastically. It should have gone nuclear. Italian banks made a lot of solar loans, and they won't be paid back if the government cuts the subsidies too much, so there isn't a lot of wiggle room there.

All this year the European reckoning will continue. I think Italy is likely to come under extreme fire. The EU could save Italy only by extending a credit facility with really low interest rates. Italy's debt is somewhere around 119-123% of GDP. That's formidable, because it means that the debt-to-GDP ratio is almost bound to keep increasing. Suppose, for example, that Italy's average interest rate on that debt is 3.5%. Even if Italy borrows no more for primary spending, but only borrows for the interest, that means they have to borrow an additional 4.2% of GDP (on 120% of GDP). Unless the economy grows by more than 4.2% in the year, they will end up increasing their debt-to-GDP ratio.

To avoid increasing their debt-to-GDP ratio, if Italy's economy grows by 2% Italy would have to cut government spending by about 2% to come out even. Cutting government spending tends to reduce GDP, so.... One of the problems for Italy is their aging population which implies increased levels of spending for retirement and medical benefits, just as for every other developed western country. The median age of the Italian population last year was 43.7 years (compared to the US median age of 36). Italian population pyramid in 2005:

Remember, this was now six years ago; when looking at the graph above move it up one ledge. Over the next five years the retired population is due to skyrocket.

I read positive commentary in the press on Italy's current situation, but I do not find it convincing. The reason why I am so skeptical can be found in this 2006 ECB working paper on public debt, fiscal shocks and long term interest rates for Germany, Italy, and the USA. The Italy section begins on page 29.

This is a good paper worth reading. It is somewhat technical but understandable, and it includes a historical survey:

The shape of this contribution is consistent with a supply and default risk effect having a positive impact on the level of the long-term interest rate from the beginning of the sample period up to 1994-1995, when the growth of Italy’s debt/GDP ratio was finally stabilized.Finally, the authors conclude:

Figure 20 shows the effects of a permanent fiscal shock. Contrary to the American and German case, the overall picture of impulse response functions corresponds much more to fiscal imbalances reflecting the governments fiscal stance and the burden of past accumulated debt as driving the permanent stochastic component. In line with this interpretation and the record of Italy’s debt/GDP ratio over the sample period, a fiscal shock has a positive impact on debt and does not stabilize after a while, but keeps increasing. Twenty quarters ahead the debt/GDP ratio has increased by 2 percentage points.

Figure 21 shows that the real rate actually increases permanently by 50 basis points on average. To explain this result is its important to keep in mind the difference in the underlying fiscal scenario. Contrary to what happens in the USA and Germany, where an adverse fiscal shock leads to debt/GDP ratio to permanently increase by a certain amount, a fiscal shock in Italy leads the debt/GDP ratio to increase continuously, which prolongs the impact on bond yields.Italy doesn't have the ghost of a chance of turning in really high GDP growth for a period of years. Further, because Italy's economy is relatively dependent on income payments to its citizens, austerity measures will cut GDP growth. Lastly, Italy cannot inflate its currency on its own, and if it were able to do so, because it is a huge energy importer the results would be very bad for its economy; per capita real incomes would drop sharply.

The inflation cure for high nominal public debt only works when an economy is producing a proportion of domestic basic needs. When you import a lot of your food and energy, it causes agony and deprivation among the population. In essence, it is another version of the IMF austerity programs which have generated such wrath among the populations which were subjected to those programs.

The Italian government's contribution to Italian GDP is very similar to the US contribution, which is shown below:

Italy is a very large exporter. Its resurgence in the 80s and 1990s was related to lower energy costs and a lira devaluation in the beginning of the 1990s. The 2000's have not been good to the Italian economy:

Okay, so we can dismiss the idea that Italy's economy is all of sudden going to start turning in growth in excess of 4% a year. Admittedly, the above are real growth figures. But you aren't going to get nominal growth at the level required. Current energy prices alone are dragging down 2011 estimated GDP.

Italy is struggling to raise tax collections by cracking down on money trafficking. They are even after the Vatican, which has got to be the world's greatest money launderer. But it will not be enough.

Therefore, either the EU extends a low interest rate credit facility to Italy (which it could do by having the ECB buy a lot of Italian bonds) or the Italian government restores the lira and devalues. That would cause great pain, but since Italy is a large auto manufacturer and since Italy is already a large exporter to both EU countries and increasingly, to Asia, it is very likely that Italy would be able to resume significant growth.

Another problem Italy has is that it decided to move into renewable energy, and the government subsidies it is paying are due to mount drastically. It should have gone nuclear. Italian banks made a lot of solar loans, and they won't be paid back if the government cuts the subsidies too much, so there isn't a lot of wiggle room there.

Comments:

<< Home

I have three words to describe Italy: "brace for impact." Because there will be one, and it is going to hurt.

Four words which should strike utter, chilling fear into the heart of any taxpayer, anywhere: Green Jobs; Renewable Energy.

Gordon - yeah. Except that some types of renewables, such as hydro, really do work.

It's just that in most places, solar is not there yet, and wind never will be.

John - Yeah. I don't see how they can avoid it. They're really in the big squeeze now, which is one of the reasons growth has been so minimal in the 2000s.

What confounds me is why we in the US would want to let ourselves drift towards this sort of societal shipwreck. The laws of mathematics do not change because the Stars and Stripes are waving above.

Post a Comment

It's just that in most places, solar is not there yet, and wind never will be.

John - Yeah. I don't see how they can avoid it. They're really in the big squeeze now, which is one of the reasons growth has been so minimal in the 2000s.

What confounds me is why we in the US would want to let ourselves drift towards this sort of societal shipwreck. The laws of mathematics do not change because the Stars and Stripes are waving above.

<< Home

MaxedOutMama

MaxedOutMama