Monday, August 22, 2011

Normative

Hahaha. Thucydides left a comment about "normative economics". There's nothing normative about our current situation.

In graphs:

Here's the historical time series on bank deposits and loans and leases in bank credit (H.8):

91/92 was a pretty deep recession, and you can see deposits rising in relation to loans.

But still, our recent performance is remarkable by any standard.

Here is some recent detail on Commercial and Industrial loans and Consumer revolving loans:

The big step up comes from an accounting change, in which banks had to take sold pools of securitized assets back on their balance sheets if they retained liabilities or a certain degree of involvement.

As you will note, the step did not interrupt the general trend. The relationship is very unhealthy.

Here's a breakout of bank credit from 2007 on. The blue line is all bank credit.

One of the things banks can do with excess deposits is to buy bonds instead of making a loan. So banks buy Treasuries/MBS.

The red line is loans and leases in bank credit - the difference between the blue and the red lines would basically be the money "loaned" by purchasing securities.

The orange line is Commercial and Industrial loans; the green line is Consumer revolving.

Recent detail on deposits in relation to loans:

The red line is loans and leases in bank credit. The purple line is other deposits, which are the largest component of deposits.

Again, the "step" derives from the accounting change in which banks had to take managed pools of securitized loans back on their balance sheets.

Banks have money, but the money has no possible USE. And deposits are a loan to banks, and they are not a free loan - there is the cost of servicing the deposits, the cost of insuring deposits (FDIC insurance is bought with fees on deposits), and the risk of loss, which is real and a growing problem. There's nothing else the banks can do with this money other than buy treasuries or other government insured instruments. Japan R US.

The cost of banking to consumers is going to rise sharply. Since 5/18, other deposits at US commercial banks have risen by almost 480 billion dollars.

Without raising the ability to use money in the real economy, the US is doomed to follow first a Japanese pattern and then to an epic Keynesian crash, as the US loses the ability to borrow more money and the flow of money through the economy is deeply constricted.

The difference between Japan and the US is simple; Japan has consistently run a current account surplus. The US, on the other hand:

Our economy really blew up in the mid 1990s. We sustained it for about 12-13 more years on excess spending.

In graphs:

Here's the historical time series on bank deposits and loans and leases in bank credit (H.8):

91/92 was a pretty deep recession, and you can see deposits rising in relation to loans.

But still, our recent performance is remarkable by any standard.

Here is some recent detail on Commercial and Industrial loans and Consumer revolving loans:

The big step up comes from an accounting change, in which banks had to take sold pools of securitized assets back on their balance sheets if they retained liabilities or a certain degree of involvement.

As you will note, the step did not interrupt the general trend. The relationship is very unhealthy.

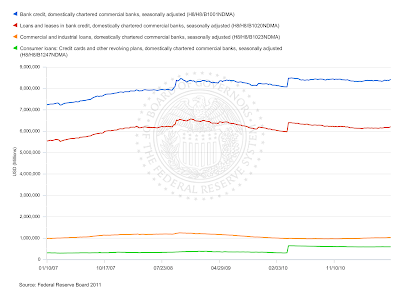

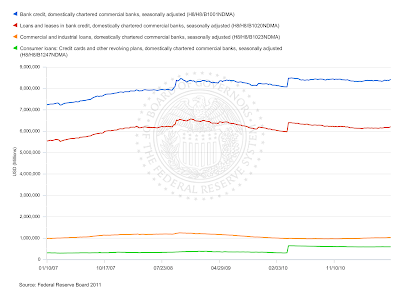

Here's a breakout of bank credit from 2007 on. The blue line is all bank credit.

One of the things banks can do with excess deposits is to buy bonds instead of making a loan. So banks buy Treasuries/MBS.

The red line is loans and leases in bank credit - the difference between the blue and the red lines would basically be the money "loaned" by purchasing securities.

The orange line is Commercial and Industrial loans; the green line is Consumer revolving.

Recent detail on deposits in relation to loans:

The red line is loans and leases in bank credit. The purple line is other deposits, which are the largest component of deposits.

Again, the "step" derives from the accounting change in which banks had to take managed pools of securitized loans back on their balance sheets.

Banks have money, but the money has no possible USE. And deposits are a loan to banks, and they are not a free loan - there is the cost of servicing the deposits, the cost of insuring deposits (FDIC insurance is bought with fees on deposits), and the risk of loss, which is real and a growing problem. There's nothing else the banks can do with this money other than buy treasuries or other government insured instruments. Japan R US.

The cost of banking to consumers is going to rise sharply. Since 5/18, other deposits at US commercial banks have risen by almost 480 billion dollars.

Without raising the ability to use money in the real economy, the US is doomed to follow first a Japanese pattern and then to an epic Keynesian crash, as the US loses the ability to borrow more money and the flow of money through the economy is deeply constricted.

The difference between Japan and the US is simple; Japan has consistently run a current account surplus. The US, on the other hand:

Our economy really blew up in the mid 1990s. We sustained it for about 12-13 more years on excess spending.

Comments:

<< Home

It is, but really it makes sense. The expectation for better stock and commodity prices makes those assets more competitive in comparison to bonds.

MaxedOutMama,

I disagree.

Fed stimulus action so far has been aimed at lowering rates to entice investors to buy things like commodities. In other words, drive real interest rates lower so people prefer risk assets.

If the Fed offers stimulus and rates actually rise then something else is going on.

Put another way, what would the result be if the Fed actually stated it would raise rates right now? I'd suggest interest rates would also rise but there would be panic on Wall Street.

In my opinion, this looks more like a temporary overbought treasury and oversold stock market bounce to me.

I'm not buying that the intent of potential Fed stimulus is to raise interest rates.

WV = eptium

An Early Policy Test for our monetary opium addiction? ;)

I disagree.

Fed stimulus action so far has been aimed at lowering rates to entice investors to buy things like commodities. In other words, drive real interest rates lower so people prefer risk assets.

If the Fed offers stimulus and rates actually rise then something else is going on.

Put another way, what would the result be if the Fed actually stated it would raise rates right now? I'd suggest interest rates would also rise but there would be panic on Wall Street.

In my opinion, this looks more like a temporary overbought treasury and oversold stock market bounce to me.

I'm not buying that the intent of potential Fed stimulus is to raise interest rates.

WV = eptium

An Early Policy Test for our monetary opium addiction? ;)

Thought experiment time.

At what point does the Fed offer so much stimulus that rates rise in spite of the Fed?

I do not believe we are there yet but let's say we are.

Unless the Fed is willing to buy all the debt that we create then there still needs to be at least one other willing buyer.

If rates are truly rising because the Fed is buying, then the stock market should be terrified. The Fed's gun just officially ran out of bullets.

Just opinions.

At what point does the Fed offer so much stimulus that rates rise in spite of the Fed?

I do not believe we are there yet but let's say we are.

Unless the Fed is willing to buy all the debt that we create then there still needs to be at least one other willing buyer.

If rates are truly rising because the Fed is buying, then the stock market should be terrified. The Fed's gun just officially ran out of bullets.

Just opinions.

I would also buy the argument that this is simply a buy on the rumor and sell on the news event.

There was an incredible amount of treasury buying heading into this.

Of course, that's not exactly what the headline I heckled said though.

"Treasuries Fall on Speculation Fed’s Bernanke to Will Signal More Stimulus"

It blamed the fall on the stimulus directly. That's not at all how I see it.

There was an incredible amount of treasury buying heading into this.

Of course, that's not exactly what the headline I heckled said though.

"Treasuries Fall on Speculation Fed’s Bernanke to Will Signal More Stimulus"

It blamed the fall on the stimulus directly. That's not at all how I see it.

I don't mean to hog the thread. Sorry!

"Treasuries fell amid speculation Federal Reserve Chairman Ben S. Bernanke will signal additional measures to stimulate the economy, damping demand for the safest assets."

If the Fed is adding demand for the safest assets by buying them, then how exactly is that dampening demand for the safest assets?

Should there be more total demand for the safest assets if there were fewer buyers (i.e., the Fed was not buying them)?

"Treasuries fell amid speculation Federal Reserve Chairman Ben S. Bernanke will signal additional measures to stimulate the economy, damping demand for the safest assets."

If the Fed is adding demand for the safest assets by buying them, then how exactly is that dampening demand for the safest assets?

Should there be more total demand for the safest assets if there were fewer buyers (i.e., the Fed was not buying them)?

Mark - all of your caveats are valid, but often the markets are not driven by truly deep thinkers.

There is hope out there for stimulus. QE2 did drive up stock prices, ergo, investors are more optimistic about stock prices and therefore buy, which raises stock prices.

At some point reality is going to set in - I don't think anyone can argue with your valid point. The extent of the trap we are in is rather too huge for psychology to easily grasp. The fear over the economic global trajectory is quite real, but the ability to comprehend the fact that the fundamental landscape of decades is likely to abruptly shift takes time to develop.

To the extent that individuals are grappling with those questions, they may come up with very different outcome scenarios. Therefore the "push" from those types is fragmented, and the market is dominated in the short term by sureties or hopes with (it is believed) known outcomes.

There is hope out there for stimulus. QE2 did drive up stock prices, ergo, investors are more optimistic about stock prices and therefore buy, which raises stock prices.

At some point reality is going to set in - I don't think anyone can argue with your valid point. The extent of the trap we are in is rather too huge for psychology to easily grasp. The fear over the economic global trajectory is quite real, but the ability to comprehend the fact that the fundamental landscape of decades is likely to abruptly shift takes time to develop.

To the extent that individuals are grappling with those questions, they may come up with very different outcome scenarios. Therefore the "push" from those types is fragmented, and the market is dominated in the short term by sureties or hopes with (it is believed) known outcomes.

MOM,

"To the extent that individuals are grappling with those questions, they may come up with very different outcome scenarios."

And there's the rub. There can be only one reason given in a headline. Short attention span theater for the win!

As a side note, I am not a deep thinker at the moment. I'm a sleep thinker, lol. I stayed up all night watching the economy again.

WV = tonmorg

It sounds like a shipping term in a dead economy. Yikes!

Post a Comment

"To the extent that individuals are grappling with those questions, they may come up with very different outcome scenarios."

And there's the rub. There can be only one reason given in a headline. Short attention span theater for the win!

As a side note, I am not a deep thinker at the moment. I'm a sleep thinker, lol. I stayed up all night watching the economy again.

WV = tonmorg

It sounds like a shipping term in a dead economy. Yikes!

<< Home

MaxedOutMama

MaxedOutMama