Thursday, September 15, 2011

Initial Claims, Et Al

Starts out poorly at 428,000 initial claims, previous week's claims revised up again (414-417). Four week moving average for initial claims at 419,500. The four week moving average on continuing claims moved up marginally to 3,741,000. At this point that number is more important than initial claims. We ended August at 3,729,000. EUC 20089 and state extended benefits both increased from the prior week at the end of August (these are reported with a time lag).

What this means is that overall employment is likely to be lagging. Since we are coming up on the survey week for the monthly employment report it's not what you'd hope to see.

CPI, August: CPI-U unadjusted 12 month is 3.8%. Food at home 6%, and if you compare that against the yearly increase for grocery sales in the retail report (Aug/Aug 6.8%, some of which is BTS items), and then combine that with Snarky Mark's restaurant graph, it becomes clear that the population is only eating due to food stamps.

CPI-W 12 month was at 4.3%, food at home 6.1%. This is the one currently used to calculate SS COLAs, although it's not the yearly - it's the chained increase in index. This is higher because the income segment used to calculate it is lower. The part of the population used to calculate this index spend more of their incomes on basics and more of their incomes on the lower-cost commodities in each group.

C-CPI-U 12 month is at 3.6%, food at home 5.9%. I have added coverage of this index, which is quite new, to show how much of a real impact there would be on SS recipients if this were used to calculate COLAs. It seems like there would be a very substantial impact to me! It is hard to make historical comparisons because this index is so new, but the major source of difference is that it uses the higher-income comparison base of CPI-U to start. If you want to undercut inflation by half a percentage point a year, you'll certainly save on SS payments, but those recipients will be in great pain and suffering as a result, and many will be forced onto government programs like food stamps and Medicaid, so the actual savings will be minimal over time.

Real Earnings from BLS: Note that this is calculated using CPI-U, so lower-income workers have relatively worse results and considerably higher income earners have relatively better results:

The Fed claimed that inflation was going to drop over the summer. I claimed it would rise. I leave it to you all to figure out who is right and who is wrong, but let me say that if the Fed was shooting for a target of 4%, it got there. BS about trimmed means and so forth are very much red herrings under the circs.

There is still some pent-up inflation waiting in the wings. If you look at CPI figures, you'll see that the most discretionary categories have already dropped out, so we have the classic pattern here - compensations already in effect where possible. The problem is that profit margins weren't that hot in 2010 already, so in a lot of chains there isn't compensation available and there are indeed further price increases locked in until the bottom falls out.

If persons on the FOMC really believe that they are going to help this economy by further shrinking real wages, I predict the popular result will be Jacksonian.

Industrial Production. I have major questions about this report. In particular, I'm finding it hard to believe the negative on the utilities, given the weather and other factors:

Manufacturing capacity at 75%, up from 74.4 April-June.

Ah, well, a malign providence also offers us an early take on September conditions in the Empire State Manufacturing Survey. This is kind of disgusting, so I'll just copy and paste a bit:

It's less where it is right now than the length of time spent down there in the negatives.

The number of employees index fell nine points to -5.4. Average workweek held steady at -2.2.

I was reading along looking for the pony, and I ran into this:

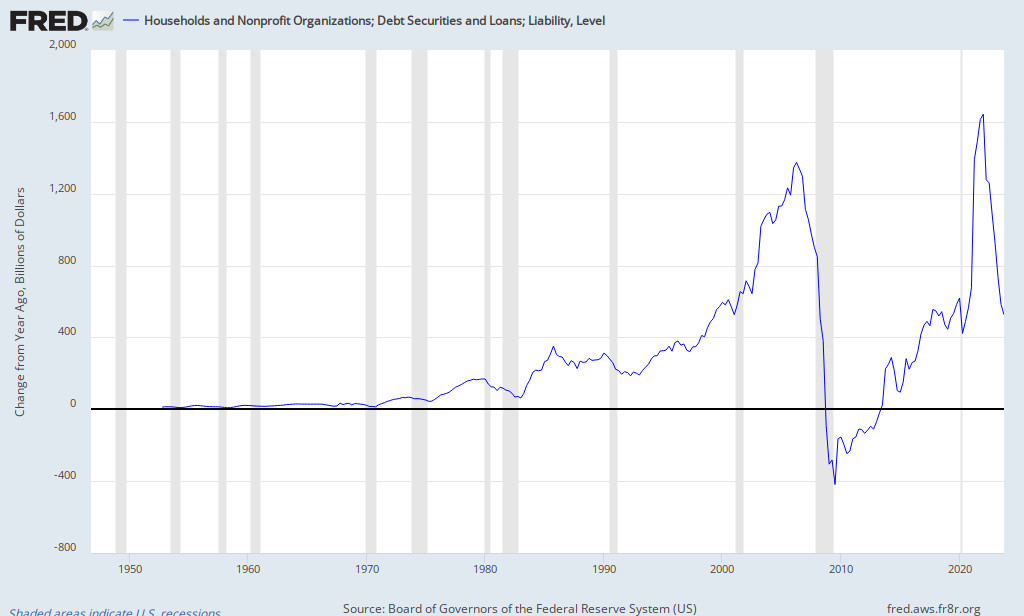

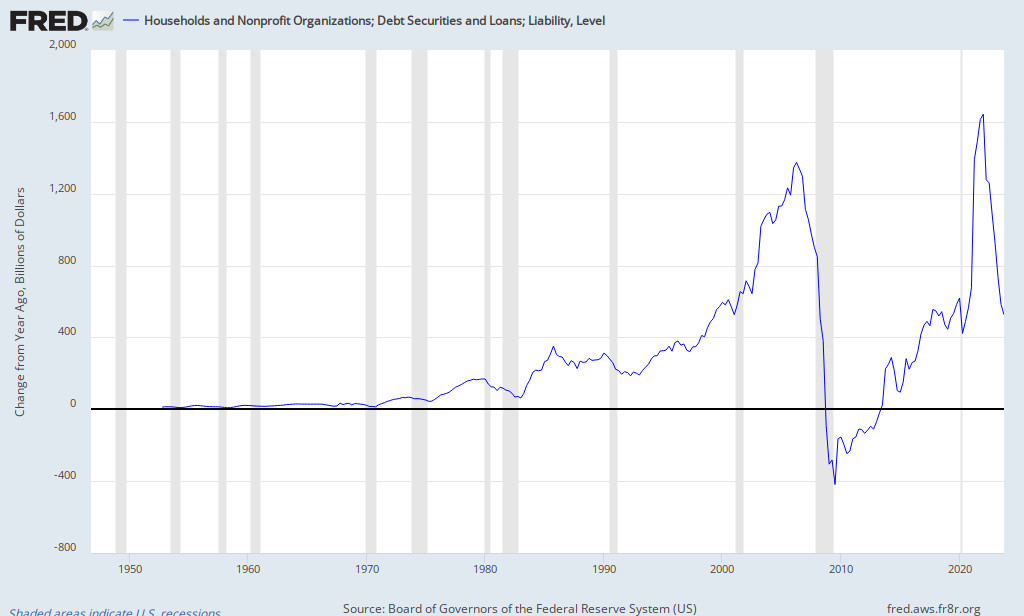

Finally, here's a graph which was posted by Troy over at Illusion of Prosperity:

This is CMDebt, but the unit is change over the year in billions of dollars. If someone sidles up to you and offers you a good deal on some commercial mortgages, just spray Mace, scream and run. The era of abandoned strip malls is shortly going to become the era of abandoned superstores.

Our esteemed gubmint is attempting to replace the lost consumer borrowing money by borrowing the money itself. Unfortunately, it is even worse at spending money in a way that makes money than the average consumer, so GDP is not responding well.

It should be obvious that the US gubmint can't keep borrowing a trillion dollars plus a year, just as households couldn't. We have hard choices to make.

Philly Fed: (shipments index fell another 9 points from August, inventories rose.)

What this means is that overall employment is likely to be lagging. Since we are coming up on the survey week for the monthly employment report it's not what you'd hope to see.

CPI, August: CPI-U unadjusted 12 month is 3.8%. Food at home 6%, and if you compare that against the yearly increase for grocery sales in the retail report (Aug/Aug 6.8%, some of which is BTS items), and then combine that with Snarky Mark's restaurant graph, it becomes clear that the population is only eating due to food stamps.

CPI-W 12 month was at 4.3%, food at home 6.1%. This is the one currently used to calculate SS COLAs, although it's not the yearly - it's the chained increase in index. This is higher because the income segment used to calculate it is lower. The part of the population used to calculate this index spend more of their incomes on basics and more of their incomes on the lower-cost commodities in each group.

C-CPI-U 12 month is at 3.6%, food at home 5.9%. I have added coverage of this index, which is quite new, to show how much of a real impact there would be on SS recipients if this were used to calculate COLAs. It seems like there would be a very substantial impact to me! It is hard to make historical comparisons because this index is so new, but the major source of difference is that it uses the higher-income comparison base of CPI-U to start. If you want to undercut inflation by half a percentage point a year, you'll certainly save on SS payments, but those recipients will be in great pain and suffering as a result, and many will be forced onto government programs like food stamps and Medicaid, so the actual savings will be minimal over time.

Real Earnings from BLS: Note that this is calculated using CPI-U, so lower-income workers have relatively worse results and considerably higher income earners have relatively better results:

Real average weekly earnings fell 0.8 percent over the month, as a result of the 0.3 percent decrease in the average workweek and the decrease in real average hourly earnings. Since reaching a recent peak in October 2010, real average weekly earnings have fallen 2.2 percent.This probably explains more about the August retail report than babblings about "confidence". Consumers don't spend on their kids based on confidence very much; the limitation there is usually ability to spend. Difficulty in affording the basics for their kids does show up in consumer confidence surveys as a sharp negative, and boy oh boy we have seen those negatives in consumer confidence surveys! With numbers like these we are not looking at a strong holiday season.

Real average hourly earnings fell 1.9 percent, seasonally adjusted, from August 2010 to August 2011. This decrease combined with unchanged average weekly hours resulted in a 1.8 percent decrease in real average weekly earnings during the same period.

The Fed claimed that inflation was going to drop over the summer. I claimed it would rise. I leave it to you all to figure out who is right and who is wrong, but let me say that if the Fed was shooting for a target of 4%, it got there. BS about trimmed means and so forth are very much red herrings under the circs.

There is still some pent-up inflation waiting in the wings. If you look at CPI figures, you'll see that the most discretionary categories have already dropped out, so we have the classic pattern here - compensations already in effect where possible. The problem is that profit margins weren't that hot in 2010 already, so in a lot of chains there isn't compensation available and there are indeed further price increases locked in until the bottom falls out.

If persons on the FOMC really believe that they are going to help this economy by further shrinking real wages, I predict the popular result will be Jacksonian.

Industrial Production. I have major questions about this report. In particular, I'm finding it hard to believe the negative on the utilities, given the weather and other factors:

The output of consumer goods rose 0.2 percent. Consumer durables recorded an increase of 1.3 percent largely because of further gains in automotive products. The production indexes for home electronics and for appliances, furniture, and carpeting both edged up, while the output of miscellaneous goods slipped. The output of nondurable consumer goods declined 0.1 percent: A decrease in residential sales by utilities more than offset increases in the production of consumer fuels and of non-energy nondurables.The claim is that everyone just turned off their AC in August? Really? If so, it's not a good sign, especially with gasoline supplied 4-week moving average at -2.7% YoY. Because of the earlier decline in auto production IP increases during the summer were baked in, but a -3% on utilities showed up this month bringing down the headline increase to 0.2%. I'm stubbornly going to disbelieve in August figures until I see the revision next month. Usually the utility figures are reliable, though, so I probably will be forced to eat crow on this one.

Manufacturing capacity at 75%, up from 74.4 April-June.

Ah, well, a malign providence also offers us an early take on September conditions in the Empire State Manufacturing Survey. This is kind of disgusting, so I'll just copy and paste a bit:

The general business conditions index inched down one point, to -8.8. The new orders index held steady at -8.0, while the shipments index dropped sixteen points to -12.9. The inventories index, negative for a third month in a row, fell to -12.0—a sign that inventories continued to decline. After dropping significantly over the summer, the indexes for both prices paid and prices received climbed several points, suggesting that the pace of price increases picked up. Employment indexes were below zero, indicating that employment levels and hours worked fell over the month.How special. The shipments index is a hard indicator. The only bright spot was that six month expectations rose a bit. This is so beyootiful that one must admire their spirit:

It's less where it is right now than the length of time spent down there in the negatives.

The number of employees index fell nine points to -5.4. Average workweek held steady at -2.2.

I was reading along looking for the pony, and I ran into this:

The index for expected number of employees fell to zero, and the future average workweek fell to -6.5—both signs that employment is not expected to rise in coming months.Perhaps the most optimistic thing is the big fall in inventories, which tends to suggest that we reached the near-term low?

Finally, here's a graph which was posted by Troy over at Illusion of Prosperity:

This is CMDebt, but the unit is change over the year in billions of dollars. If someone sidles up to you and offers you a good deal on some commercial mortgages, just spray Mace, scream and run. The era of abandoned strip malls is shortly going to become the era of abandoned superstores.

Our esteemed gubmint is attempting to replace the lost consumer borrowing money by borrowing the money itself. Unfortunately, it is even worse at spending money in a way that makes money than the average consumer, so GDP is not responding well.

It should be obvious that the US gubmint can't keep borrowing a trillion dollars plus a year, just as households couldn't. We have hard choices to make.

Philly Fed: (shipments index fell another 9 points from August, inventories rose.)

Comments:

<< Home

If that restaurant graph trend concerned me when it was stagnant (and it did), just picture my concern now that it is falling.

Gordon Ramsay may need to start a new show soon.

Hell's Malls' Kitchens' Nightmares

Gordon Ramsay may need to start a new show soon.

Hell's Malls' Kitchens' Nightmares

You ain't kiddin' about abandoned superstores. Lowe's came into this market about 4-5 years ago, all brand-new construction; two stores are now closed.

And what use will ever be found for many of these buildings, Charles?

Mark - hey, if there's no money there's no money.

It used to be that older retirees were something of a bread-and-butter crowd for a lot of restaurants. Over the last 12 years that market segment has not done well. Given demographics alone....

Mark - hey, if there's no money there's no money.

It used to be that older retirees were something of a bread-and-butter crowd for a lot of restaurants. Over the last 12 years that market segment has not done well. Given demographics alone....

When you eliminate good paying jobs, you

take out the businesses that catered to them.

Goodbye growth, hello poverty. At least it

Helps the corporate bottom line .

Sporkfed

take out the businesses that catered to them.

Goodbye growth, hello poverty. At least it

Helps the corporate bottom line .

Sporkfed

hi mom. could the hurricane Irene have caused the drop you saw with electricity? just curious...

Anon pa

Anon pa

And what use will ever be found for many of these buildings, Charles?

Detention centers are a growth industry.

Snark aside, HH Gregg moved into some of the closed Borders. Vacant for less than 3 months. Lowe's are 10 times the size, though.

WV is "cosce". Maybe WV is suggesting COSTCO will expand rapidly.

Detention centers are a growth industry.

Snark aside, HH Gregg moved into some of the closed Borders. Vacant for less than 3 months. Lowe's are 10 times the size, though.

WV is "cosce". Maybe WV is suggesting COSTCO will expand rapidly.

Anon PA - maybe. I wondered too. But even though it seems like a major issue, and even though it WAS a major issue for many, the power outages shouldn't have been that widespread or prolonged according to the coverage I saw.

We've had a lot of storms/weather this year, and I don't see that as outweighing both heat and the industrial surge this summer.

We've had a lot of storms/weather this year, and I don't see that as outweighing both heat and the industrial surge this summer.

MOM,

I know how much you like scary debt charts. I think this one would make even H.P. Lovecraft cringe.

I know how much you like scary debt charts. I think this one would make even H.P. Lovecraft cringe.

The solution to all this is millions of citizens writing Congress to move Obama, the EPA, the lawyers, and all other impediments to new private investment the he!! out of the way, so that the only true experts at job creation, private enterprise can start clearing the wreckage and renewing private not government control of the US economy. They would have to start by impeaching Obama, as he would veto every obstacle-removing bill that reached his desk, since his base is the hard left.

Capital replacing labor in the manufacturing sector is old news but internet advances along with increased software applications are geared towards replacing office staff,production, and management positions. Labor winners are currently software related positions in IT. Computer interactivity driven by large capital and friendly tax codes continues to transform employment.

Software investment like that is only going to help big companies. Small companies keep hiring down to the bone. (I think there might be 30 of us where I work.) I'm seeing people that can't afford internet service any more. I expect more mergers, with more layoffs and outsourcing to follow.

The Best Buy near us was open for a month before they closed it. It's been empty for over two years now. Most of that shopping is empty but Target seems to be doing okay.

The Best Buy near us was open for a month before they closed it. It's been empty for over two years now. Most of that shopping is empty but Target seems to be doing okay.

Labor winners are currently software related positions in IT.

That has been true for 50+ years. One wonders why US university enrollment in this discipline keeps shrinking except for foreign-born students.

That has been true for 50+ years. One wonders why US university enrollment in this discipline keeps shrinking except for foreign-born students.

Charles,

Do you have data on that? I'm curious what a slice-and-dice job would show on IT degrees relative to total enrollment numbers, and relative to male and female enrollment.

Post a Comment

Do you have data on that? I'm curious what a slice-and-dice job would show on IT degrees relative to total enrollment numbers, and relative to male and female enrollment.

<< Home

MaxedOutMama

MaxedOutMama