Monday, January 09, 2012

LOL!!! It Only Hurts When You Laugh

U.S. Consumer Credit Rises by Most in Decade

Go ahead, click on that sucker. You'll discover that consumer credit in the US is just surging! Consumers are borrowing their butts off! The sky's the limit! And it's all epic comedy, financial reporting style.

The consumer credit release (G.19) is here. If you take three deep breaths and read the release carefully, you'll note that the non-revolving credit mostly grew at the federal government (education loans). Now for a parity check on the rest, let's look at H.8 consumer credit, which you can find at this page (FRB's been playing with their bleeping website, so now it's hard to find these releases).

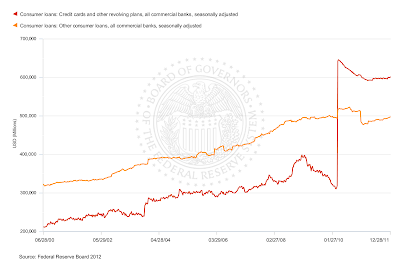

Here's a helpful graph of consumer lending (non-RE, non-revolving and consumer revolving) going through the end of December. Note that G.19 only goes through November:

The step function in there occurred when banks were forced to take their pools of securitized assets back onto their balance sheets.

Does this look earth-shaking to you? The red line is the credit cards (revolving). The amber/yellow line is other consumer non-RE, and it includes car loans and student loans, which are eventually offloaded to government. The shift into slight growth has been going on for months, but nothing much is accelerating here.

The main difference between consumer credit (G.19) and consumer credit (H.8) is that consumer credit G.19 includes other sources of financing, including the federal government, finance companies and such riff-raff. Credit cards are mostly issued under the umbrella of national banks, because national banks have immunity from state lending laws, so there isn't a whole lot of CC's in finance companies and the like. Therefore H.8 shows you what is happening with CC lending, and it ain't what the Bloomberg story says.

The real story here is that credit-worthy consumers are using credit cards as a payment mechanism - they seem to charge and pay off. November showed a surge just because of the timing - consumers had started holiday shopping and didn't get their bills yet. Car loans continue to rise because consumers are buying cars at a higher rate, but if you look at G.19 non-revolving, you see that the category rose 8.3 billion, and 6.4 billion of that was to the federal government. So it's still mostly student loans.

What's interesting about 2012 holiday purchasing is Other Deposits in H.8:

The strong implication is that consumers are still being very careful about credit. Another strong implication is that restoring the FICA payroll tax will cause a downshift in consumer spending, as will drops in real incomes induced from other causes.

By now almost everyone realizes that a lot of the tuition loans are not going to be paid back. Still, the total keeps rising, and before hyperventilating over US consumer largesse, it's wise to look at the detail.

Over the course of 2011, there were several spates of stories about how consumers were borrowing more with their credit cards. But they aren't - not in a real sense. Consumers buy gas, and when gas prices go up, the monthly totals seem to jump - but their balances don't rise over time. A lot of consumers pay for winter heating bills with CCs, but again, they seem to be paying them off. Consumers pay for food with CCs, so the monthly totals seemed to rise as YoY food at home inflation hit 6% - but again, card balances don't rise much. In a "real" sense, they are still dropping.

Financial types should be dealing with the consumers we've got rather than the consumer of fantasy. We've got some consumers who are doing well, but it appears they don't feel like wasting their money on CC interest. If you save at 1% and borrow at 7%, paying off your CCs provides a much better return on your money, and then if you get into trouble you can always use the CC. This provides very little return for CC companies who let needy consumers run up their CC's much, which is how we get those high interest rates reported on G.19.

The Fed has created a situation in which the rewards for saving money even without a return are extremely high - probably the highest they've been in over 30 years. Having a substantial downpayment on your first home, or paying down your mortgage to refinance, gives you a very strong payback right now. Casual borrowing is remarkably expensive, and costs of living are rising.

This is a state change compared to the last 25 years, though. It appears persistent, and it will mean that the US consumer economy will be more sensitive to changes in real incomes than it has been for almost 30 years. That's the real lesson consumer credit is imparting, and it is one that policy-makers and WS types need to absorb.

Since we are on the topic of real incomes, here's some data from Table 2.1 of BEA GDP releases, extending through third quarter 2011:

This is real personal income disposable (taxes deducted), excluding personal transfer receipts. We recovered for a while after the recession ended, but we got hit again last quarter. If we restore FICA taxes, this will go down almost 2%.

This is the percent change in real disposable personal income. As you can see, the recent trend has not been our friend, and that includes the FICA tax cut. This graph would look much uglier without it.

This last is per capita real disposable income, including personal current transfers (welfare, SS, food stamps, Medicare, unemployment) and the FICA tax cuts.

It's not trending the right way either.

These graphs explain a lot about why Americans are continuing to save. They have to do so. The standard of living continues to decline, and any US fiscal adjustment will show up immediately in the consumer economy.

With the FICA tax cuts, the US abandoned any pretense of fiscal responsibility - but in just a few years, Mr. Market will begin to impose fiscal responsibility. The reason why the economy seems so confusingly weak is just that Americans have abandoned the borrowing habits of the last few decades, which suddenly returned us to demographic growth patterns.

When we have to endure fiscal adjustment, which is going to hit in just a few years, the consumer side of the economy will take another big hit, because right now the federal government is compensating for the money that Americans aren't personally borrowing by borrowing and giving money to Americans to spend. Eventually, we will have to shift to mostly taxing and giving money to Americans to spend, and that's when things suddenly get real. By then Americans will have built a little more cushion from their personal austerity regimes, but this is a long slow consolidation process, and the effect is greatly magnified by demographics.

offset the increase with reductions in the payroll tax.

Driving down energy demand while adding to paychecks.

Another missed opportunity.

Sporkfed

Since the jobs market is quite difficult, it's really costs that will make the difference.

WINNER WINNER!

I'll also note that I use my CC more than ever because I am being bribed to do so. I pay my bills in full every month, so the only advantage to the issuer is the additional transaction fees. And that eventually shows up in higher prices.

I've noticed prices at Target getting higher versus other retailers, and I'd be willing to bet a lot of it has to do with their Red Card 5% Off scheme. January is usually Target's "volume discount" month; their product selection (and associated discounts) this year is simply terrible.

<< Home

MaxedOutMama

MaxedOutMama