Monday, June 08, 2015

Behind Those Self-Employment Numbers

Freight is now flashing a warning. May was a bad month for rail, which is always the immediate index:

AAR now has a graph widget on their site, updated weekly. I encourage anyone who's interested to play with it - you can sort bycomponents. Because of the early Memorial Day holiday, the YoY won't be directly comparable until we pass that down spike you see in the graph for previous years. Those downward spikes are Memorial Day, July 4th, Labor Day, Thanksgiving, and the Christmas/New Year holidays.

The bottom line is that you are comparing the last week to the next week in the graph, but it is evident that May traffic was substantially weaker YoY even with that adjustment.

ATA's truck tonnage index lags a month, but through April it looks worse than rail:

This does not necessarily imply that 2nd quarter GDP will be negative - after all, we are comparing YoY, and last year in March the economy picked up very strongly. But it does imply that if the government publishes a strong Q2 GDP number on the first pass, you should laugh and ignore it. Services trails manufacturing, and services can expand while manufacturing contracts a bit, although eventually they tend to correlate.

As of April, manufacturing was in contraction, with YoY shipments down solidly and New Orders down. Motor vehicles were still strong, which should not surprise anyone who has watched auto sales this year.

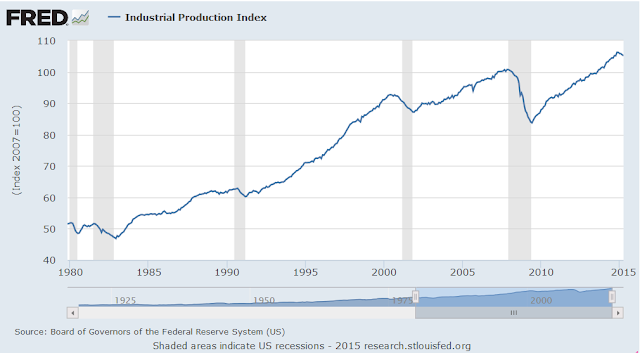

As you would expect, Industrial Production through April was showing contraction:

I have a hard time believing that it did very well in May after looking at rail.

Construction spending through April was fine and moving upwards. You don't get recession with motor vehicles holding AND construction spending increasing. However, in my experience construction can easily lag the start of recession - it is not a good forward indicator, and neither is employment. But here it is:

Services are harder to assess. A lot of the data is imputed; it tends to be substantially revised some months down the line. Growth on the bottom side, such as was clearly seen in the employment report from last week, may not show up very well. Because of this, most tend to inductively figure service trends from retail, because generally consumer spending on services will follow retail:

AAR now has a graph widget on their site, updated weekly. I encourage anyone who's interested to play with it - you can sort bycomponents. Because of the early Memorial Day holiday, the YoY won't be directly comparable until we pass that down spike you see in the graph for previous years. Those downward spikes are Memorial Day, July 4th, Labor Day, Thanksgiving, and the Christmas/New Year holidays.

The bottom line is that you are comparing the last week to the next week in the graph, but it is evident that May traffic was substantially weaker YoY even with that adjustment.

ATA's truck tonnage index lags a month, but through April it looks worse than rail:

This does not necessarily imply that 2nd quarter GDP will be negative - after all, we are comparing YoY, and last year in March the economy picked up very strongly. But it does imply that if the government publishes a strong Q2 GDP number on the first pass, you should laugh and ignore it. Services trails manufacturing, and services can expand while manufacturing contracts a bit, although eventually they tend to correlate.

As of April, manufacturing was in contraction, with YoY shipments down solidly and New Orders down. Motor vehicles were still strong, which should not surprise anyone who has watched auto sales this year.

As you would expect, Industrial Production through April was showing contraction:

I have a hard time believing that it did very well in May after looking at rail.

Construction spending through April was fine and moving upwards. You don't get recession with motor vehicles holding AND construction spending increasing. However, in my experience construction can easily lag the start of recession - it is not a good forward indicator, and neither is employment. But here it is:

Services are harder to assess. A lot of the data is imputed; it tends to be substantially revised some months down the line. Growth on the bottom side, such as was clearly seen in the employment report from last week, may not show up very well. Because of this, most tend to inductively figure service trends from retail, because generally consumer spending on services will follow retail:

In my experience, freight and retail do work together to forecast recessions at least six months in advance. The distinctive feature is that real retail will flatten for some months, and freight will start falling. Together, you get at least six months of warning.

Just looking at freight and retail, I would say that we are in the early stages of recession formation, with some chance to get out of it before the whirlpool develops. At this time fiscal stimulus would be indicated if this administration were a little less oblivious. A tax cut or a rebate would be enough to carry us through.

We are not going to get that, and I don't know whether we can edge out of this or not. Recessions form when the economy can no longer adapt. I am not sure whether we can adapt out of it.

Last year I thought we had a very high probability of being in recession by this spring, because consumer incomes had fallen too much. Then when oil fell, I thought that would be enough to keep us afloat.

Either of my theories is still credible right now. I don't know what will happen. It takes time for lower costs to hit in the form of more discretionary income in retail.

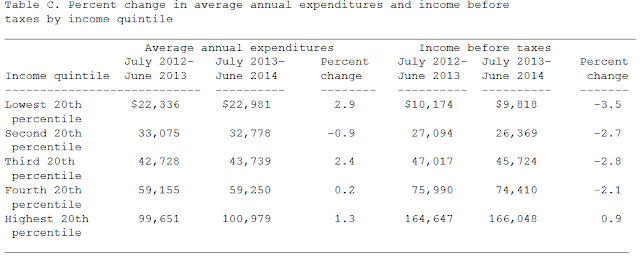

What's causing this is more than a bad winter and the oil slowdown. What's causing this are prior developments in household incomes and expenses, as CES has shown:

Take a good long look at that table. A really good look!!! The third and fourth quintile are saving quintiles. They earn more than they spend. They do not intend to move into their retirement and live in a paper box. So they respond by dropping discretionary spending when their financial position has consistently worsened over a year to try to keep stable. Further, high basic costs for needs goods does not inspire them to save LESS. It inspires them to save MORE.

In particular, the behavior of the middle quintile usually predicts US recessions. It is all very well to read asinine articles all over the financial world about the cheaper gas windfall and the odd behavior of the consumers in not spending it, but get real, you fools.

The average US household may be saving $700 dollars a year on gas, but in the prior year the average middle income household lost $1,300 in income and spent $1,000 more on expenses, and so, from their perspective, built up a deficit that would take three years of that $700 windfall to redress. The fourth quintile, which spends more on discretionary and can more easily save, responded to the drop in income by not increasing spending, i.e., cutting real spending. This wasn't an option for households that spend more on basics. They are in a deep hole.

Then there is the impact of ACA/PPACA/Obamacare. Most consumers are paying more for actual healthcare than they were before, and many financially stable households find themselves forced to allocate significantly more for deductibles. It is very hard to assess the force of this, but it will change consumer behavior and cause higher rates of saving. The reason it is hard to calculate is that your deductible only matters when you have to use a decent amount of healthcare services, and many consumers don't in any particular year. But as this wears on, companies will ratchet up employee cost-sharing to come under the ACA guidelines, and each year more and more households will get the bill and change behavior as a result.

By "change behavior", I mean stuff like this:

These are YoY changes (NSA) for two categories of industrial production that are sensitive to financial strictures on small businesses and households - nondurable consumer goods and electric and gas. When YoY moves down it generally means tightness, usually redressed by downward price changes. They are both choppy series, affected by weather and other factors. If you add the two of them together, the signal becomes a little clearer, because consumers, and to some degree, small businesse, compensate for forced utility spending by cutting spending on nondurables:

Not particularly strong.

Closeup and add real retail sales:

Not a recession yet, but getting close. Usually pricing fixes this without a recession - if the situation continues for too long prices and margins are cut and we edge out of it. Especially on the medical, we have built a structural situation in which adaptation is hard, the price signal is muted, and economic responsiveness is likewise limited.

It certainly looks like there is time for this to fix itself.

Comments:

I know for a fact that small businesses are struggling to adapt. That doesn't necessarily mean they'll fail, but the success/failure curve has been shoved to the left somewhat due to the increased difficulty of paying employees enough to keep retention up. People either want to work for cash (which costs the business extra and increases risk), or they need to make quite a bit of money to compensate for being taken off of Medicaid.

I recently got put through the Obamacare wringer, so I went through the numbers in greater detail than I had done before. It varies from state to state and county to county, but apparently not as much as it did when the exchanges were first brought on line. The numbers seem to be similar between similar-sized cities. Our income the last few years has been up and down, but generally enough to get just a little subsidy on the exchange--not enough to compensate for the possibility of having to pay it back. So we would have bought directly from the insurance companies.

I was looking at premiums of about $9K, with a $12K deductible. Of course, that's in-network, and the network is pretty narrow when I checked it. If we're out of town, or need to see a specialist, it's pretty much out of network, a separate $25K deductible. It's possible to decrease the deductible, but only by paying a higher up-front premium, and it's phenomenally expensive to get the deductible down to $1000. In a normal year, we have about $3K in medical bills.

So, in a normal year, we're paying $9K up front (or $11K in 2016, judging from the requested increases) and then paying all of our expenses out of pocket anyway. The increase in costs would have eaten up our entire discretionary income, about $7K after tax. That means beans and rice for dinner, no savings, go back to one car, no soccer team for the kids, etc. It's difficult to make up for that with increased income, since our marginal tax load is greater than 50%, including state and self-employment taxes.

That means we could just barely pay for the insurance, but the first time we actually got sick, the deductible would kill us (since we wouldn't be able to save for it). From what I can tell, everybody with a family and between about $45K and $90K income will come up with the same answer.

So we chose to jump through a loophole. We're on one of the health-sharing ministries now. I'm skeptical that it will be much good, but at least they deal with the billing departments for us, and whatever they do pay will be more than we would have gotten from the insurance companies. And it's a little less expensive than our old grandfathered insurance plan.

Yes, fake insurance. I think that's one of the reasons why they have so many people signing up, paying a few monthly premiums, and then failing to pay any more. The first time you get a bill and realize it went almost entirely to your out-of-network deductible...

And then next April they nab most of your tax refund to pay the penalty for being uninsured.

They tried to take every penny from us, but they over-reached. They took more than we had to give, so wealth is going underground.

<< Home

I know for a fact that small businesses are struggling to adapt. That doesn't necessarily mean they'll fail, but the success/failure curve has been shoved to the left somewhat due to the increased difficulty of paying employees enough to keep retention up. People either want to work for cash (which costs the business extra and increases risk), or they need to make quite a bit of money to compensate for being taken off of Medicaid.

I recently got put through the Obamacare wringer, so I went through the numbers in greater detail than I had done before. It varies from state to state and county to county, but apparently not as much as it did when the exchanges were first brought on line. The numbers seem to be similar between similar-sized cities. Our income the last few years has been up and down, but generally enough to get just a little subsidy on the exchange--not enough to compensate for the possibility of having to pay it back. So we would have bought directly from the insurance companies.

I was looking at premiums of about $9K, with a $12K deductible. Of course, that's in-network, and the network is pretty narrow when I checked it. If we're out of town, or need to see a specialist, it's pretty much out of network, a separate $25K deductible. It's possible to decrease the deductible, but only by paying a higher up-front premium, and it's phenomenally expensive to get the deductible down to $1000. In a normal year, we have about $3K in medical bills.

So, in a normal year, we're paying $9K up front (or $11K in 2016, judging from the requested increases) and then paying all of our expenses out of pocket anyway. The increase in costs would have eaten up our entire discretionary income, about $7K after tax. That means beans and rice for dinner, no savings, go back to one car, no soccer team for the kids, etc. It's difficult to make up for that with increased income, since our marginal tax load is greater than 50%, including state and self-employment taxes.

That means we could just barely pay for the insurance, but the first time we actually got sick, the deductible would kill us (since we wouldn't be able to save for it). From what I can tell, everybody with a family and between about $45K and $90K income will come up with the same answer.

So we chose to jump through a loophole. We're on one of the health-sharing ministries now. I'm skeptical that it will be much good, but at least they deal with the billing departments for us, and whatever they do pay will be more than we would have gotten from the insurance companies. And it's a little less expensive than our old grandfathered insurance plan.

Nasty set of choices, but the ministry plans do have a decent record.

I've known people who lost insurance and just gave up, and a lot who change their economic behavior so as to get below the line and get the subsidy. That's harder for business owners with episodic income. I have also known families in which the lower earner had to quit working, or go all-cash. Seems like this system is forcing many to become tax criminals. A lot of people want to work for cash now. I am watching gas because I suspect we have a large gray economy developing.

I wish we could get back to the cross-state business association plans, which generally offered a decent product that was at least somewhat affordable. But the removal of caps and limitations, and the imposition of drug treatment costs and so forth may mean that they don't qualify any more.

If you have to travel, the narrow networks are USELESS. There's no POINT in such a plan. And even if you stay local, there are hidden problems. You wind up at the hospital, and it turns out that the ER staff is contracted and not in the network, so you get a $2,000 bill with no insurance coverage and it doesn't even count against your standard deductible, and then it turns out that radiologist was out-of-network, so you get another uncovered bill for that. I think the narrow networks should be outlawed. It's fake insurance.

I've known people who lost insurance and just gave up, and a lot who change their economic behavior so as to get below the line and get the subsidy. That's harder for business owners with episodic income. I have also known families in which the lower earner had to quit working, or go all-cash. Seems like this system is forcing many to become tax criminals. A lot of people want to work for cash now. I am watching gas because I suspect we have a large gray economy developing.

I wish we could get back to the cross-state business association plans, which generally offered a decent product that was at least somewhat affordable. But the removal of caps and limitations, and the imposition of drug treatment costs and so forth may mean that they don't qualify any more.

If you have to travel, the narrow networks are USELESS. There's no POINT in such a plan. And even if you stay local, there are hidden problems. You wind up at the hospital, and it turns out that the ER staff is contracted and not in the network, so you get a $2,000 bill with no insurance coverage and it doesn't even count against your standard deductible, and then it turns out that radiologist was out-of-network, so you get another uncovered bill for that. I think the narrow networks should be outlawed. It's fake insurance.

Yes, fake insurance. I think that's one of the reasons why they have so many people signing up, paying a few monthly premiums, and then failing to pay any more. The first time you get a bill and realize it went almost entirely to your out-of-network deductible...

And then next April they nab most of your tax refund to pay the penalty for being uninsured.

They tried to take every penny from us, but they over-reached. They took more than we had to give, so wealth is going underground.

Obamacare has ruined health insurance to such a degree that I would rather not have insurance at all and pay cash. The idea that a 24-year old can come up with 9K a year for catastrophic-only coverage (which is essentially what Obamacare is) is preposterous. Obamacare is taking the idiotic idea of some states to make everyone pay the same rate regardless of age and health history and forcing upon the few states who weren't stupid enough to do such a thing.

So it is only logical that these dopes wouldn't be able to understand the quintile chart you show. How many more bad reports from WalMart and McDonald's is it going to take for people to understand the middle-class squeeze? Instead, the morons in the financial press think people are going to Chipotle instead of McDonalds. WRONG! The bottom 3 quintiles do not go to Chipotle, the top quintile and some of the second quintile go there.

My family members in the 3rd quintile only ever talked about the short-term low gas prices as a chance to pay down credit card debt. Some boobs like Paul Krugman consider this as "savings".

So it is only logical that these dopes wouldn't be able to understand the quintile chart you show. How many more bad reports from WalMart and McDonald's is it going to take for people to understand the middle-class squeeze? Instead, the morons in the financial press think people are going to Chipotle instead of McDonalds. WRONG! The bottom 3 quintiles do not go to Chipotle, the top quintile and some of the second quintile go there.

My family members in the 3rd quintile only ever talked about the short-term low gas prices as a chance to pay down credit card debt. Some boobs like Paul Krugman consider this as "savings".

I have a $4800 deductible with my insurance at work. I had to read my pulmonologist the riot act. He wanted a bronoscopy, then a CT scan with dye injected into the lungs, and finally a chest x-ray. He basically wanted to confirm the diagnosis from a year ago, as it seemed to have gotten bad again. (Bird Fanciers syndrome). It got bad because I had stored some things that were in contact with the birds in my office, before I was diagnosed. I had a reaction, but he didn't want to treat it the same way as he'd originally done. I finally convinced him to do that, and I seem to be over it.

It costs me $243 to see this guy AFTER the insurance pays their part. The CT scan and breathing tests cost me $1500. I told his nurse that and that it was why I simply could not afford to go in for the tests he wanted. Doctors need to hear this more often.

As for taking every penny from us, the city treats me like a criminal for owning property. Today's crime? We have some old lumber outside that a tenant staked up. We told him not to put it there, but he did anyway. So we get to talk to Code Enforcement today, to get an actual list of what they want done. It is so easy for them to find things to charge you with.

It costs me $243 to see this guy AFTER the insurance pays their part. The CT scan and breathing tests cost me $1500. I told his nurse that and that it was why I simply could not afford to go in for the tests he wanted. Doctors need to hear this more often.

As for taking every penny from us, the city treats me like a criminal for owning property. Today's crime? We have some old lumber outside that a tenant staked up. We told him not to put it there, but he did anyway. So we get to talk to Code Enforcement today, to get an actual list of what they want done. It is so easy for them to find things to charge you with.

Teri, if they don't recommend the tests to confirm the diagnosis and then treat you wrongly, they are set up for a lawsuit. If they recommend them and you refuse, they document that refusal in the chart and then go ahead and treat with legal protection. Note that ACA made the whole malpractice coil worse, not better, for clinicians.

However, the insurance cos are getting crafty to where they demand a very expensive test to document the need for many drugs, and then when the patient refuses the test, they refuse coverage for the treatment because the need is not proven.

So refusing the test doesn't always work.

What's even cooler and more special is that insurance for drugs is often in a different company than your hospital/clinician insurance, so whereas the insurance companies used to be moved by an appeal to the bottom line, now that frequently doesn't work. Patient access to care has dramatically worsened over the last year and a half.

You cannot give companies a monopoly and not expect customer treatment to worsen sharply, and that's what we are seeing.

The medical ministry networks function well because first they eliminate the people with really bad lifestyles, and second they eliminate the very expensive medical insurance ping-pong game.

However, the insurance cos are getting crafty to where they demand a very expensive test to document the need for many drugs, and then when the patient refuses the test, they refuse coverage for the treatment because the need is not proven.

So refusing the test doesn't always work.

What's even cooler and more special is that insurance for drugs is often in a different company than your hospital/clinician insurance, so whereas the insurance companies used to be moved by an appeal to the bottom line, now that frequently doesn't work. Patient access to care has dramatically worsened over the last year and a half.

You cannot give companies a monopoly and not expect customer treatment to worsen sharply, and that's what we are seeing.

The medical ministry networks function well because first they eliminate the people with really bad lifestyles, and second they eliminate the very expensive medical insurance ping-pong game.

The thing is that he already did the diagnostic stuff. They did blood work (I think it was like 17 vials!) and CT scan. We have parrots and it responded to prednisone, so that's pretty conclusive. He thought that there could be something else that wasn't showing up, because I don't think he took me seriously when I told him what happened. I work in that office five days a week. It was low level exposure and I didn't get a reaction until I moved boxes and stuff around. He tried to give me short runs of prednisone and it wasn't long enough to clear out the inflamation. I wouldn't diagnose someone else, but I have a pretty good idea of how this stuff affects me. He didn't even remember that we'd checked my O2 levels when I first came in, until I pointed it out to him.

In fact, I was able to tell him my O2 levels were low because I bought a tool to check them with. It is amazing to me to be able to get good quality medical diagnostic tools cheap. It would be different if we were dealing with a disease where you could use different treatments. Prednisone is it for bird fanciers. I will need to find another pulmonologist at some point. This one treated my husband and Lon's wife. I canceled the bronoscopy because if there is ever bad news, I am not going to let this doctor tell Lon. too many bad memories

Post a Comment

In fact, I was able to tell him my O2 levels were low because I bought a tool to check them with. It is amazing to me to be able to get good quality medical diagnostic tools cheap. It would be different if we were dealing with a disease where you could use different treatments. Prednisone is it for bird fanciers. I will need to find another pulmonologist at some point. This one treated my husband and Lon's wife. I canceled the bronoscopy because if there is ever bad news, I am not going to let this doctor tell Lon. too many bad memories

<< Home

MaxedOutMama

MaxedOutMama