Wednesday, January 13, 2016

So, What Will This Recession's Shape Be?

It appears to me beyond doubt that we are in recession. The question over which I have been brooding over the last few weeks is "What will this look like?"

This is not an easy question to answer, because the US economy is remarkably more Europeanized than ever before, and the European tactics mean that recessions are slow to form and remarkably persistent when they do form. It would be quite bad for us if that happened.

But I have limited tools with which to analyze this question, because some of the old verities have failed, and now we will have to deal with the new verities, without knowing what they are.

I was going to blog over the holidays, but due to a breakout of viral illness, I spent them hysterically wiping and disinfecting and then doing it all over again a few hours later. This was extremely effective, but time-consuming. And when I wasn't doing this, I just wanted to enjoy a bit of Christmas, not blog about such a topic.

Nor is my primary focus at the current time the economy. My primary focus is the metabolic syndrome/diabetes/arthritis thing (yes, it branched out to chronic inflammation - that is the common factor). There I am doing extremely well, with excellent, excellent results.

But the economy can't be ignored. So, a few days ago I thought I'd ask for other people's thoughts on the recession shape topic. I'll write a series of posts and see if I can get some input that will clarify my own thoughts before I try to make my best speculation.

First one:

Yes, we are in recession now. NBER does not date recessions until they show up in employment generally, so they will probably tag it in February, eventually. But the correlated downward spiral has begun.

The most current data is always rail (weekly) and petroleum (weekly).

Rail:

Here's the final rail for 2015 December:

There's a little purple 2016 blob on this graph from the AAR website representing the first week of 2016, but look at the blue 2015 trajectory. Somewhere around week 42/43 things just started to slide, and by week 48/49 we were meeting and exceeding recessionary guidelines by achieving combined rail volumes lower than 2013 in addition to 2014. Most of the weakness came from intermodal, which had been running positive YoY, and then threw in the towel at the end of the year.

Petroleum, this week's release:

Until quite recently, the four-week gasoline supply figures said firmly that we were not in recession. They started to turn about with rail in November, and now we are looking at -4.3% YoY, four-week average.

Normally I follow distillate more closely. That is down YoY by a large margin, but the warmer-than-average temps late last year in regions where the most heating oil is consumed makes that figure less reliable. It is, however, down by 12.1% YoY. I would think this equates to at least a 6% trucking drop. It is too much to be just from heating oil. More detail in this document.

Industrial production:

It lacks nuance. It is not subtle. This is through November, change YoY.

I expect a turn up in these figures for the first few weeks of the year, but not ENOUGH, if you catch my drift.

Treasury receipts.

These are published every day, and provide an excellent, timely look at what's happening with businesses and payrolls. They are less current looks at the economy than rail or freight, because there's a natural delay between slow-downs or speed-ups in the economy and the business reaction.

The fiscal year begins in October. So October 2015 was the 2016 fiscal year. Here are the Monday, January 11 2016 and Monday, January 12, 2015 reports. These are closest comparable days. Table IV, if you want to look at this.

Through November and December, I noticed that business tax receipts were down. They are now down 8.7% YoY YTD. Withheld employment and income taxes were up, agreeing well with the employment report. I am watching the withhelds for signs of slowing. They don't really seem to as of yet, with the Dec 1 2014/2015 withhelds at 2.8% YoY YTD, and the latest at 2.9% YoY YTD.

The thing to remember about doing this is that these are biased toward larger companies, which remit faster. Small businesses may be doing better - that has seemed to be the pattern through a hunk of the last year.

NFIB:

The latest report is here. The earnings and sales indexes are showing slow slides. The six-month outlook for business conditions is notably down from last year, having fallen from a positive 12 in December 2014 to -14 in December 2015. This was a very small sample, and I will be interested to see what the next report, which is a large sample, will show. It is currently consistent with the idea that small businesses are doing somewhat better than large businesses. Currently this report doesn't show any sharp drop.

Credit cycle:

CMI:

The latest report is here. This, if anything, should be slightly biased toward larger businesses in some sectors because it covers business-to-business credit. CMI had showed trouble by November. Led by manufacturing, of course. December overall was a bit better, but manufacturing resumed its slide.

Manufacturing showed a trouble into the contraction zone in September, from which it has not recovered. However in December the unfavorables almost went to neutral - but that was achieved, of course, by contracting credit granted. The YoY sales dropped from 60.1 to 51.9, and credit extended dropped from 63.38 to 55.4. That came close to roughly balancing the YoY unfavorables, which only slid from 50.4 to 49.9. It came at a cost in business activity.

Services did better, but of course the holidays are very good, and one would expect some signs of life from the retail. That improved, but YoY there is clear weakening. Unfavorable factors are at 50.6, which doesn't provide a lot of margin over the next few months.

We seem to be on the wrong end of the credit cycle. When B2B runs out, the banks kick in. But that, too, has its natural limits unless the underlying factors improve.

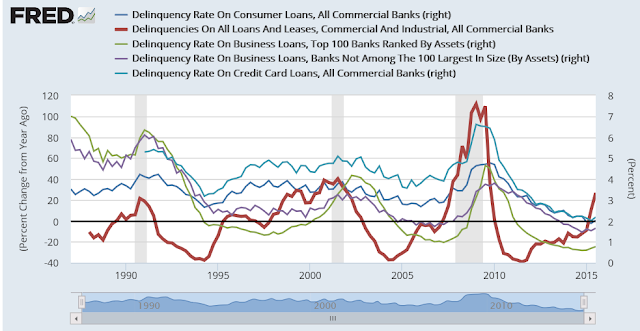

Banks:

C&I looks recessionary also. They all do! Interest rates are very low and there isn't room to carry much in the way of losses from defaults. As interest rates go lower, the risk to profits from defaults increases, and we are still at a no-capacity level there. These are from third quarter, btw. These aren't current. These are probably what caused the rail figures in December.

CCs can withstand more. C&I - it's time to pull in the reins. Perhaps that's why Chicago PMI took such a stunning drop. This is painful.

Questions for readers:

If anybody makes it this far! What is your sense? Do things "feel" like a downturn to you? What's your business/part of the world looking like? Are you seeing any green shoots? If you believe I am an ass and a fool, feel free to say so. I would be happy to be convinced of it. You'd be doing me a favor.

This is not an easy question to answer, because the US economy is remarkably more Europeanized than ever before, and the European tactics mean that recessions are slow to form and remarkably persistent when they do form. It would be quite bad for us if that happened.

But I have limited tools with which to analyze this question, because some of the old verities have failed, and now we will have to deal with the new verities, without knowing what they are.

I was going to blog over the holidays, but due to a breakout of viral illness, I spent them hysterically wiping and disinfecting and then doing it all over again a few hours later. This was extremely effective, but time-consuming. And when I wasn't doing this, I just wanted to enjoy a bit of Christmas, not blog about such a topic.

Nor is my primary focus at the current time the economy. My primary focus is the metabolic syndrome/diabetes/arthritis thing (yes, it branched out to chronic inflammation - that is the common factor). There I am doing extremely well, with excellent, excellent results.

But the economy can't be ignored. So, a few days ago I thought I'd ask for other people's thoughts on the recession shape topic. I'll write a series of posts and see if I can get some input that will clarify my own thoughts before I try to make my best speculation.

First one:

Yes, we are in recession now. NBER does not date recessions until they show up in employment generally, so they will probably tag it in February, eventually. But the correlated downward spiral has begun.

The most current data is always rail (weekly) and petroleum (weekly).

Rail:

Here's the final rail for 2015 December:

Carload traffic in December totaled 1,219,443 carloads, down 15.6 percent or 225,477 carloads from December 2014. U.S. railroads also originated 1,179,907 containers and trailers in December 2015, down 0.7 percent or 8,502 units from the same month last year. For December 2015, combined U.S. carload and intermodal originations were 2,399,350, down 8.9 percent or 233,979 carloads and intermodal units from December 2014.The odds of this happening if we were not in recession are, to use a highly technical economic term of art, shit-stompingly low. It is not a momentary phenomenon - 2015 total rail was lower than 2014 total rail. The problem slowly grew worse through the year and then suddenly got explosive late in the year:

There's a little purple 2016 blob on this graph from the AAR website representing the first week of 2016, but look at the blue 2015 trajectory. Somewhere around week 42/43 things just started to slide, and by week 48/49 we were meeting and exceeding recessionary guidelines by achieving combined rail volumes lower than 2013 in addition to 2014. Most of the weakness came from intermodal, which had been running positive YoY, and then threw in the towel at the end of the year.

Petroleum, this week's release:

Until quite recently, the four-week gasoline supply figures said firmly that we were not in recession. They started to turn about with rail in November, and now we are looking at -4.3% YoY, four-week average.

Normally I follow distillate more closely. That is down YoY by a large margin, but the warmer-than-average temps late last year in regions where the most heating oil is consumed makes that figure less reliable. It is, however, down by 12.1% YoY. I would think this equates to at least a 6% trucking drop. It is too much to be just from heating oil. More detail in this document.

Industrial production:

It lacks nuance. It is not subtle. This is through November, change YoY.

I expect a turn up in these figures for the first few weeks of the year, but not ENOUGH, if you catch my drift.

Treasury receipts.

These are published every day, and provide an excellent, timely look at what's happening with businesses and payrolls. They are less current looks at the economy than rail or freight, because there's a natural delay between slow-downs or speed-ups in the economy and the business reaction.

The fiscal year begins in October. So October 2015 was the 2016 fiscal year. Here are the Monday, January 11 2016 and Monday, January 12, 2015 reports. These are closest comparable days. Table IV, if you want to look at this.

Through November and December, I noticed that business tax receipts were down. They are now down 8.7% YoY YTD. Withheld employment and income taxes were up, agreeing well with the employment report. I am watching the withhelds for signs of slowing. They don't really seem to as of yet, with the Dec 1 2014/2015 withhelds at 2.8% YoY YTD, and the latest at 2.9% YoY YTD.

The thing to remember about doing this is that these are biased toward larger companies, which remit faster. Small businesses may be doing better - that has seemed to be the pattern through a hunk of the last year.

NFIB:

The latest report is here. The earnings and sales indexes are showing slow slides. The six-month outlook for business conditions is notably down from last year, having fallen from a positive 12 in December 2014 to -14 in December 2015. This was a very small sample, and I will be interested to see what the next report, which is a large sample, will show. It is currently consistent with the idea that small businesses are doing somewhat better than large businesses. Currently this report doesn't show any sharp drop.

Credit cycle:

CMI:

The latest report is here. This, if anything, should be slightly biased toward larger businesses in some sectors because it covers business-to-business credit. CMI had showed trouble by November. Led by manufacturing, of course. December overall was a bit better, but manufacturing resumed its slide.

Manufacturing showed a trouble into the contraction zone in September, from which it has not recovered. However in December the unfavorables almost went to neutral - but that was achieved, of course, by contracting credit granted. The YoY sales dropped from 60.1 to 51.9, and credit extended dropped from 63.38 to 55.4. That came close to roughly balancing the YoY unfavorables, which only slid from 50.4 to 49.9. It came at a cost in business activity.

Services did better, but of course the holidays are very good, and one would expect some signs of life from the retail. That improved, but YoY there is clear weakening. Unfavorable factors are at 50.6, which doesn't provide a lot of margin over the next few months.

We seem to be on the wrong end of the credit cycle. When B2B runs out, the banks kick in. But that, too, has its natural limits unless the underlying factors improve.

Banks:

C&I looks recessionary also. They all do! Interest rates are very low and there isn't room to carry much in the way of losses from defaults. As interest rates go lower, the risk to profits from defaults increases, and we are still at a no-capacity level there. These are from third quarter, btw. These aren't current. These are probably what caused the rail figures in December.

CCs can withstand more. C&I - it's time to pull in the reins. Perhaps that's why Chicago PMI took such a stunning drop. This is painful.

Questions for readers:

If anybody makes it this far! What is your sense? Do things "feel" like a downturn to you? What's your business/part of the world looking like? Are you seeing any green shoots? If you believe I am an ass and a fool, feel free to say so. I would be happy to be convinced of it. You'd be doing me a favor.

Comments:

At the moment, I'm in a bubble of unreality. The local economy is very, very good, but people in the local primary industries have begun discussing openly what they should be doing to weather the next recession.

If grain shipments are down, there's two likely causes: livestock herds, and ethanol. It seems to me that correlates with your other observations.

That is depressing. I've lived in Eastern Washington and it really should be treated differently than the Western side. I truly think the way to go at it is to limit the percentage of land that can be owned by the Federal government. If over 50% of the land in a state is owned by the Feds, how can it be considered a sovereign state? We talk about this with some of our Lefty Oregon friends and ask them how much land is enough to be owned by the government. They can never give us an answer. And I don't see that Federal lands are managed well. Our place at the river once had two islands seperating the river and the slough. Thanks to DNR, it's silted in. They keep saying we have a marina, but it's dry in the summer. Even a canoe doesn't have enough water at the front of our dock. And this is a place that was a donation land claim, pre statehood.

And, if we could ever find a way to make environmentalists pay court costs when they lose, it would help. I just don't see any way out of it and it's one of the reasons why this country ranks low on freedom rankings.

<< Home

At the moment, I'm in a bubble of unreality. The local economy is very, very good, but people in the local primary industries have begun discussing openly what they should be doing to weather the next recession.

Hey comments work - cool :)

Don't forget that people (and leading economists) were discussing whether we would have a recession in June of 2008. MOM, I believe that we are on the edge - similar to December 2007. I believe we will have an 100% oil relief rally (wave 4) - that should tip us over - either into recession or into a point-of-recognition. Keep up the great work!

Don't forget that people (and leading economists) were discussing whether we would have a recession in June of 2008. MOM, I believe that we are on the edge - similar to December 2007. I believe we will have an 100% oil relief rally (wave 4) - that should tip us over - either into recession or into a point-of-recognition. Keep up the great work!

Hit the nail on the head with this post. Live in Fargo, ND and with the oil bust and farmers having a bad 2015 we are all in a downward slope but I expect that other parts of the country may be far worse. Recently, the stock market seems to be catching on that all is not well. But it's fun to listen to CNBC and hear why it is still a great time to buy!

Miss your posts and hope all is well!!!

Miss your posts and hope all is well!!!

Personally, doing great - post-acquisition, our equipment is being marketed for the first time to the globe rather than North America. I got a good pay raise and a generous year-end bonus. I'm no longer in tune with the purchasing process, though, so I don't get feedback about how our vendors feel.

Looking in the grocery stores and around town, the signs of recession are there. The low-end items have had significant price increases and the high end items have less shelf space. One gets the sense of hunkering down for a long siege.

Looking in the grocery stores and around town, the signs of recession are there. The low-end items have had significant price increases and the high end items have less shelf space. One gets the sense of hunkering down for a long siege.

As I commented last month, in the Twin Cities it doesn't feel like prosperity. Unemployment is down, but that doesn't mean employment is up. Businesses are remarkably reluctant to hire full time folks, and they just can't get part timers that are worth anything.

Life is good if you're working for a non-profit or build stadia, or have a good connection to the governor. Then he can, when his meds are working, appoint you to a nice cushy board job somewhere. I guess it doesn't feel like it's going to collapse; rather a slide into a skipping recession, maybe.

Life is good if you're working for a non-profit or build stadia, or have a good connection to the governor. Then he can, when his meds are working, appoint you to a nice cushy board job somewhere. I guess it doesn't feel like it's going to collapse; rather a slide into a skipping recession, maybe.

Oh, and for the This Modern World category: my company has had two people quit in the last month or so by text message. One just hit reply to a group message sent out by the boss so that his text went out to the whole group.

We find it especially difficult to find workers willing to cover Walmart. People do not like working in the stores or with the associates.

We find it especially difficult to find workers willing to cover Walmart. People do not like working in the stores or with the associates.

I suspect the company I work for is struggling. We did not get a bonus this year, first time since I started in 2006. The rural areas want faster internet but the infrastructure doesn't support it. The small cities have a lot of competition. Comcast has been moving into what had been a Charter area. Seem to be a lot of folks wanting Internet for online classes. I am not seeing as many folks having problems paying the bills las last year.

Personally, I hope it holds long enough to unload the house. It's looking like we may finally be able to get title and sell it.

Personally, I hope it holds long enough to unload the house. It's looking like we may finally be able to get title and sell it.

Teri,

Internet is very much an "I want better" thing in Minnesota. The larger cities are fine. Many of the smaller trade centers struggle to get good internet, and the countryside can be tough. There is a state fund to seed efforts to bring better internet to "underserved" areas. The interesting thing is that there is a town in the east metro area (Lake Elmo) where most homes are hobby farms, or just have very big lots. Lots of money, little internet because of the last mile thing. The town signed up for the state program and was turned down. Honestly, the residents could find a company willing to string cable and all, and finance it themselves, but they want a subsidy like everyone else.

North Dakota does not struggle, I think. That state has always prioritized communication infrastructure. Even back in the 1930s a cop in Dickinson in the SW could talk via radio to a cop in Grand Forks if needed. I think it was one of the first states to have 100 percent cell coverage. And they've had the money in recent years to finance internet expansion. That money spigot will be off for a while, but they planned for it, and did not commit to ongoing expensive programs dependent on oil revenue.

Internet is very much an "I want better" thing in Minnesota. The larger cities are fine. Many of the smaller trade centers struggle to get good internet, and the countryside can be tough. There is a state fund to seed efforts to bring better internet to "underserved" areas. The interesting thing is that there is a town in the east metro area (Lake Elmo) where most homes are hobby farms, or just have very big lots. Lots of money, little internet because of the last mile thing. The town signed up for the state program and was turned down. Honestly, the residents could find a company willing to string cable and all, and finance it themselves, but they want a subsidy like everyone else.

North Dakota does not struggle, I think. That state has always prioritized communication infrastructure. Even back in the 1930s a cop in Dickinson in the SW could talk via radio to a cop in Grand Forks if needed. I think it was one of the first states to have 100 percent cell coverage. And they've had the money in recent years to finance internet expansion. That money spigot will be off for a while, but they planned for it, and did not commit to ongoing expensive programs dependent on oil revenue.

Currently in Brazil. Their currency is the weakest I have ever seen it. That's probably because China is weak. And China is probably weak because the USA is. You can see it in ALL the commodities. I know this can occur on the supply end but given all commodities are down and 1 thing common - weak demand - explains it.

Thanks for sharing your thoughts and the quality of your analyses.

Superficial question here - Isn't rail usage heavily affected by the reduction in oil transportation that stems from the oversupply of crude oil due to OPEC overproduction?

My point being that maybe rails are reflecting the pain in the oil sector rather than an overall slowdown?

Superficial question here - Isn't rail usage heavily affected by the reduction in oil transportation that stems from the oversupply of crude oil due to OPEC overproduction?

My point being that maybe rails are reflecting the pain in the oil sector rather than an overall slowdown?

Unknown - yes, to some extent. But oil is not segregated from the rest of the economy, and when intermodal started falling YoY it indicated an additional level of sludge building up in the system.

I heard from someone in the industry that grain shipments are slow and that they are anticipating furloughs of workers.

I heard from someone in the industry that grain shipments are slow and that they are anticipating furloughs of workers.

PS - Unknown - the other argument to discount rail weakness is that with diesel prices this low, there is displacement of traffic from rail to trucking. However, the rather low supply figures indicate that that isn't the explanation.

Joe - man oh man, Brazil is a saga in and of itself. Its balance of trade went south in the GR and just kept going. Of course China's slowdown affects a resource economy like Brazil, but Brazil exported commodities and imported products, so to some degree the interaction between the two economies is self-reinforcing.

The collapse of the currency is redressing its trade imbalance, but at this point Brazil is shedding jobs and is close to moving from recession to depression.

The collapse of the currency is redressing its trade imbalance, but at this point Brazil is shedding jobs and is close to moving from recession to depression.

If grain shipments are down, there's two likely causes: livestock herds, and ethanol. It seems to me that correlates with your other observations.

WSJ - I have noticed the same in stores. It's a struggle for profit margins and it does show some stress.

Also in the Twin Cities--I saw many help wanted signs in stores before the holidays, still see a few here and there. Not for full-time jobs.

The grocery store has been juggling prices, some prices conspicuously go down, while others quietly go up. For some items they seem to be struggling to clear out older inventory. Overall, I think prices are rising slowly.

Personally, we have spent the past few months restocking the pantry and husband's work wardrobe, and catching up on car repairs, after weathering a tight patch where health insurance and housing costs increased before income did. $17.5k last year for family medical and dental premiums.

The grocery store has been juggling prices, some prices conspicuously go down, while others quietly go up. For some items they seem to be struggling to clear out older inventory. Overall, I think prices are rising slowly.

Personally, we have spent the past few months restocking the pantry and husband's work wardrobe, and catching up on car repairs, after weathering a tight patch where health insurance and housing costs increased before income did. $17.5k last year for family medical and dental premiums.

Holy cow, Peggy. That much for insurance, and big increases coming. I really feel for you. I am grateful, grateful that I have VA coverage. Yes, I paid for it in one sense. And it's single-payer in all that system's glories. At least at the VA there's a sense of "we're all in this together" that makes the delays and problems bearable. I don't think that would be the case in a national system.

There are some full-time jobs available. Aldi, for instance, continues to post. Their wages aren't bad, either. But I've never seen anyone over 40 working at Aldi. I asked one of their employees if she had seen anyone older working there, and she had not. Aldi/Trader Joe's are weird in a lot of ways.

The Twin Cities grocery world is in upheaval anyway. Aldi is expanding. Rainbow/Roundy's is gone, except for a couple of stores that I suspect are being kept open just to keep another chain from taking the site. HyVee opened two stores in 2015, and will open six or so in 2016 as they move in. Coborn's is following the Walmart strategy, nibbling around the outer edges but not trying to move in to the the cities themselves.

There are some full-time jobs available. Aldi, for instance, continues to post. Their wages aren't bad, either. But I've never seen anyone over 40 working at Aldi. I asked one of their employees if she had seen anyone older working there, and she had not. Aldi/Trader Joe's are weird in a lot of ways.

The Twin Cities grocery world is in upheaval anyway. Aldi is expanding. Rainbow/Roundy's is gone, except for a couple of stores that I suspect are being kept open just to keep another chain from taking the site. HyVee opened two stores in 2015, and will open six or so in 2016 as they move in. Coborn's is following the Walmart strategy, nibbling around the outer edges but not trying to move in to the the cities themselves.

Here in SW. Lower Michigan I have several contacts that are directly involved in various forms of construction. I have to say that for all of them 2015 was a very good year whether it was home remodeling, equipment rentals, or new home and commercial construction. I don't have a feel for our state of manufacturing, but predictions are that it will slow down after 3-4 years of decent growth. Bottom line for me is no sense of impending doom (as long as I stay off the web).

In the graph on Railroad traffic if you go further into the breakouts available at the linked website you will see that Coal, Metallic Ores & Metals, and Petroleum had notable decreases over the last several years. Looking at the BLS CES numbers we see employment decreases YoY in Mining (-15,000) and Mining Support Activities (-96,000) and Oil and Gas Extraction (-16,000). These industries probably use rail to transport their products, hence a drop in railroad traffic. If industries are producing less, there is less transportation needed to move the product. The health of the railroad is tied to the health of its customers.

However, Truck Transportation employment is up over the year by about 19,000 with about 13,000 of that in General Freight Trucking, Long Distance. Manufacturing and Wholesale Trade employment can often show up in Transportation numbers; Non-Durable Goods employment is up and Wholesale Trade is up so that could account for the uptick in Truck Transportation.

There will be more fallout. The Mining and Oil industries have fairly high wages. The loss of these jobs will impact businesses that service these industries and the workers. This is reflected in the number of jobs lost in the area of Mining Support Activities and will also show up in businesses that were frequented by the workers, from grocery stores to department stores.

However, Truck Transportation employment is up over the year by about 19,000 with about 13,000 of that in General Freight Trucking, Long Distance. Manufacturing and Wholesale Trade employment can often show up in Transportation numbers; Non-Durable Goods employment is up and Wholesale Trade is up so that could account for the uptick in Truck Transportation.

There will be more fallout. The Mining and Oil industries have fairly high wages. The loss of these jobs will impact businesses that service these industries and the workers. This is reflected in the number of jobs lost in the area of Mining Support Activities and will also show up in businesses that were frequented by the workers, from grocery stores to department stores.

All I have is Chicago-area anecdotes.

Xmas shopping wasn't the PITA it usually is. I waited for bad weather because that is when I go to the outdoor mall to avoid fighting crowds. Was forced to go during decent weather and the crowds weren't there on the weeknights I went. Went one weekday morning during December and the indoor mall was a ghost town. Seems like a dilemma for retailers - with fewer locations the shopping experience requires long schleps and, with more locations the demographics just aren't there to support the store hours as the "housewife" no longer exists and therefore the typical weekday morning shopper no longer exists. But if you have the location you might as well be open because the rent doesn't go down when you reduce the store hours.

S.o. works in financial IT consulting - new year began with cancelled projects. The good news is by being self-employed she won't show up as unemployed if she loses her gig. (Yes, I'm being sarcastic.)

Went used car shopping last couple of weeks. I typically buy my cars in Jan/Feb so I know what the market is usually like at that time, but on some weeknights I was literally the only customer in some places. On weekends there may have been half the foot traffic I normally see at that time of year. I think all the "push demand forward" schemes have come home to roost and now demand is low - no new scheme will ever work, especially in this wasteful, corrupt state.

Xmas shopping wasn't the PITA it usually is. I waited for bad weather because that is when I go to the outdoor mall to avoid fighting crowds. Was forced to go during decent weather and the crowds weren't there on the weeknights I went. Went one weekday morning during December and the indoor mall was a ghost town. Seems like a dilemma for retailers - with fewer locations the shopping experience requires long schleps and, with more locations the demographics just aren't there to support the store hours as the "housewife" no longer exists and therefore the typical weekday morning shopper no longer exists. But if you have the location you might as well be open because the rent doesn't go down when you reduce the store hours.

S.o. works in financial IT consulting - new year began with cancelled projects. The good news is by being self-employed she won't show up as unemployed if she loses her gig. (Yes, I'm being sarcastic.)

Went used car shopping last couple of weeks. I typically buy my cars in Jan/Feb so I know what the market is usually like at that time, but on some weeknights I was literally the only customer in some places. On weekends there may have been half the foot traffic I normally see at that time of year. I think all the "push demand forward" schemes have come home to roost and now demand is low - no new scheme will ever work, especially in this wasteful, corrupt state.

The economy in Puget Sound is still pretty good. Amazon is hiring and expanding. Microsoft is doing okay and Boeing the same. Real estate in King County is on fire. Almost as frothy as in 2007. Traffic volume on the freeways is very high. (Low gas prices?) Yet the retailers are doing just so, so. Volume is down at the Port of Seattle where many products from Korea, Japan, and China are imported and transported all across the northern tier of states.

I think the collapse in oil prices and the job losses in that area will percolate through the economy over the next few months. The Pacific Northwest will be the last to feel the effects.

I think the collapse in oil prices and the job losses in that area will percolate through the economy over the next few months. The Pacific Northwest will be the last to feel the effects.

Sorry, got side tracked!

I know of two areas that have fiber optic cable in place and could use better internet. But there are not any companies that can tap into that cable. It's odd. And people move out into the middle of nowhere and are surprised to learn that their internet isn't as fast as they'd like. There are groups in place to expand internet into rural areas. It's not happening very fast.

Jimmy J, I wonder how much that mandatory $15 an hour minimum wage is affecting Seattle jobs. I buy bags from a small Seattle company, Tom Bihn. I am beginning to see small hints that they are having to cut corners a bit and they do cater to people with middle class income. I suspect a combination of that new minimum wage and possibly a political correctness on their part. (They used to use Cordura fabric, now owned by Koch Industries. They seem to have phased it out.)

I know of two areas that have fiber optic cable in place and could use better internet. But there are not any companies that can tap into that cable. It's odd. And people move out into the middle of nowhere and are surprised to learn that their internet isn't as fast as they'd like. There are groups in place to expand internet into rural areas. It's not happening very fast.

Jimmy J, I wonder how much that mandatory $15 an hour minimum wage is affecting Seattle jobs. I buy bags from a small Seattle company, Tom Bihn. I am beginning to see small hints that they are having to cut corners a bit and they do cater to people with middle class income. I suspect a combination of that new minimum wage and possibly a political correctness on their part. (They used to use Cordura fabric, now owned by Koch Industries. They seem to have phased it out.)

Teri, the $15 an hour wage is being phased in over the next few years, but it is going to bite eventually. I expect that many small businesses are going to leave Seattle. That will hurt the tax revenues in Seattle/King County, but Amazon seems to be taking up the slack - for the time being. Seattle is a disaster that is happening in slow motion. A Communist on the city council; $15/hr. minimum wages; the "big dig" tunnel under the waterfront that is now $2 billion and 2 years over schedule; a Governor (Green Jay Inslee,a climate change fanatic) who is intent on shutting down power plants, refineries, and other CO2 emitters; and (last but not least) the inability of the average Puget Sounder to understand the consequences of bad economic decisions all point to a tilt into eventual hard times. But when I talk to most of my acquaintances, I get the equivalent of, "Who, me worry?" Makes me feel positively out of step.

My husband was in Seattle when Boeing basically shut down. Was able to pick up real estate no money down. I am personally dealing with a vindictive associate attorney general that has decided that I can't have a dock on my river front property and has me in a lawsuit over a lease I've never been involved with. The courts rubber stamp everything, no matter how convoluted.

I keep telling my husband that this is how it was in California, when it started the big slide. You can't have one party rule and you can't let the cities dictate to the rest of the state. It won't end well. I have a friend from high school that has stayed in the Bay Area, but has just retired. She told me they can't afford to live there any more. So they are moving to the Puget Sound area! The attitudes and behaviors move with them, with the same predictable results. I am trying to convince my husband to sell off both places and move to a state where we aren't treated like criminals. still working on it.

I keep telling my husband that this is how it was in California, when it started the big slide. You can't have one party rule and you can't let the cities dictate to the rest of the state. It won't end well. I have a friend from high school that has stayed in the Bay Area, but has just retired. She told me they can't afford to live there any more. So they are moving to the Puget Sound area! The attitudes and behaviors move with them, with the same predictable results. I am trying to convince my husband to sell off both places and move to a state where we aren't treated like criminals. still working on it.

Teri, "I am trying to convince my husband to sell off both places and move to a state where we aren't treated like criminals."

Those kind of states are getting harder to find. When I retired 23 years ago, we moved to a rural area in eastern Washington. Built a house on acreage that had a share of irrigation water that went with it. The irrigation system was a hundred years old. One day, out of the blue, our irrigation manager got a call from an environmental group saying they had a court judgment against our irrigation company to either show that the irrigation system wasn't harming salmon or to cease operations. The study to show the system wasn't harming salmon cost us $250,000 - my share was $2500. After the study was done, they came back with the demand that we cover our ditches because the study showed water temps were rising (by .6 of a degree) from the upstream intake to the downstream outlet. The court had agreed with them The cost to do that was $1 million. My share was $10,000. Our lawyer told us to expect more such attempts to shut us down. That was when I sold out and moved to town. Cowardly, I know. But I just want to live out my last years without fighting city hall. I spent a lot of my working years pushing back against government stupidity and cupidity.

The Greens are well funded; know friendly judges; and the Endangered Species Act, the EPA, Forest Service, and BLM are all on their side. Their aim is to stop all productive human use of rural lands. The present "occupation" by Bundy and his supporters going on up in Malheur, Oregon is a protest against this. I hope they move the ball a bit, but I doubt the gubmint is going to take notice of the injustices. The Climate Change agenda and Agenda 21 are part of this overall effort as well. Our entire economy is being slowly stifled by these Green fascists. I don't know how to stop them or if they can be stopped.

Good luck on finding a state where freedom is still a top priority.

Those kind of states are getting harder to find. When I retired 23 years ago, we moved to a rural area in eastern Washington. Built a house on acreage that had a share of irrigation water that went with it. The irrigation system was a hundred years old. One day, out of the blue, our irrigation manager got a call from an environmental group saying they had a court judgment against our irrigation company to either show that the irrigation system wasn't harming salmon or to cease operations. The study to show the system wasn't harming salmon cost us $250,000 - my share was $2500. After the study was done, they came back with the demand that we cover our ditches because the study showed water temps were rising (by .6 of a degree) from the upstream intake to the downstream outlet. The court had agreed with them The cost to do that was $1 million. My share was $10,000. Our lawyer told us to expect more such attempts to shut us down. That was when I sold out and moved to town. Cowardly, I know. But I just want to live out my last years without fighting city hall. I spent a lot of my working years pushing back against government stupidity and cupidity.

The Greens are well funded; know friendly judges; and the Endangered Species Act, the EPA, Forest Service, and BLM are all on their side. Their aim is to stop all productive human use of rural lands. The present "occupation" by Bundy and his supporters going on up in Malheur, Oregon is a protest against this. I hope they move the ball a bit, but I doubt the gubmint is going to take notice of the injustices. The Climate Change agenda and Agenda 21 are part of this overall effort as well. Our entire economy is being slowly stifled by these Green fascists. I don't know how to stop them or if they can be stopped.

Good luck on finding a state where freedom is still a top priority.

That is depressing. I've lived in Eastern Washington and it really should be treated differently than the Western side. I truly think the way to go at it is to limit the percentage of land that can be owned by the Federal government. If over 50% of the land in a state is owned by the Feds, how can it be considered a sovereign state? We talk about this with some of our Lefty Oregon friends and ask them how much land is enough to be owned by the government. They can never give us an answer. And I don't see that Federal lands are managed well. Our place at the river once had two islands seperating the river and the slough. Thanks to DNR, it's silted in. They keep saying we have a marina, but it's dry in the summer. Even a canoe doesn't have enough water at the front of our dock. And this is a place that was a donation land claim, pre statehood.

And, if we could ever find a way to make environmentalists pay court costs when they lose, it would help. I just don't see any way out of it and it's one of the reasons why this country ranks low on freedom rankings.

Negative Side

Lower Merchant Wholesalers Sales, Higher inventory to sales ratio, Lower industrial production,Manufacturing has weakened, Total Nonfarm Payrolls expansion slowing, Total Business Sales Dropping, After Tax corporate profits declining, Dollar is strong with divergent monetary policy in place (US v. World – eg. ECB, BOJ, PBOC), 30 yr fixed rate mortgage low in 2012 with refinancing dropping lower, Flattening yield curve, No SS COLA,

Pension benefits being cut (Teamsters), HY Energy credit spreads extremely negative, Fed Stopped QE3 in 10/14 and raised rates 12/15. Effectively tightening over 300bps from the shadow rate low of -2.99% in May 2014.

Positive Side

Job Openings at elevated level, Retail sales look fine, Quit rate in nonfarm employment is steadily picking up, U-6 dropping under 10%, Wage increases look ok, Core inflation just under target, Cheap Oil for consumers, Strong mortgage applications, All HY Credit spreads look fine, C&I Lending still expanding at over 8% YOY, Auto Sales and auto lending still look good

I see more skew to the negative side than the positive at this point with a fairly high probability of entering a recession over the next 18 months. The Fed is now officially "risk off" and has entered into divergent monetary policy which must be watched with a careful eye. With the ON RRP and IOER corridor setting the FFR (which fell below the lower target range on 12/31 - valuation purposes anyone?) and ON RRP sucking liquidity out of the overnight financing markets worldwide it is unlikely the Fed gets much above 1% FFR during this rate hike cycle. Already hearing rumors that the Fed is suspending M2M accounting for certain energy related companies...this would be telling if it is true because probability of defaults within that sector are extremely high over the next 12-18 months.

Thank you for your input and analysis. I always enjoy reading what you are seeing.

Post a Comment

Lower Merchant Wholesalers Sales, Higher inventory to sales ratio, Lower industrial production,Manufacturing has weakened, Total Nonfarm Payrolls expansion slowing, Total Business Sales Dropping, After Tax corporate profits declining, Dollar is strong with divergent monetary policy in place (US v. World – eg. ECB, BOJ, PBOC), 30 yr fixed rate mortgage low in 2012 with refinancing dropping lower, Flattening yield curve, No SS COLA,

Pension benefits being cut (Teamsters), HY Energy credit spreads extremely negative, Fed Stopped QE3 in 10/14 and raised rates 12/15. Effectively tightening over 300bps from the shadow rate low of -2.99% in May 2014.

Positive Side

Job Openings at elevated level, Retail sales look fine, Quit rate in nonfarm employment is steadily picking up, U-6 dropping under 10%, Wage increases look ok, Core inflation just under target, Cheap Oil for consumers, Strong mortgage applications, All HY Credit spreads look fine, C&I Lending still expanding at over 8% YOY, Auto Sales and auto lending still look good

I see more skew to the negative side than the positive at this point with a fairly high probability of entering a recession over the next 18 months. The Fed is now officially "risk off" and has entered into divergent monetary policy which must be watched with a careful eye. With the ON RRP and IOER corridor setting the FFR (which fell below the lower target range on 12/31 - valuation purposes anyone?) and ON RRP sucking liquidity out of the overnight financing markets worldwide it is unlikely the Fed gets much above 1% FFR during this rate hike cycle. Already hearing rumors that the Fed is suspending M2M accounting for certain energy related companies...this would be telling if it is true because probability of defaults within that sector are extremely high over the next 12-18 months.

Thank you for your input and analysis. I always enjoy reading what you are seeing.

<< Home

MaxedOutMama

MaxedOutMama