Wednesday, July 28, 2010

That Quarter Twist

There was a debate on DU about Roosevelt and other progressives and racism. Well, the ugly truth is that Wilson swept into DC and promptly segregated the civil service. All that glitters is not gold.

And the heyday of eugenics in the US was in the early part of the last century. The theory of eugenics was actively taught in universities and was literally a progressive plank. It was, tragically, American eugenics laws which formed a pattern for some of the early Nazi legislation. Not the proudest moment in our ideological history, to be sure.

I immediately thought of Chesterton, because I had just been reading (before the late personal crisis) Chesterton's The Appetite of Tyranny and thinking of Iran:

Consider, for example, the sad tale of Geneva under Calvin, with its rapid evolution of a religious police, an inquisition, and a truly repressive society, exemplified perhaps by the deliberately slow burning of Servetus (Calvin would have let Servetus be beheaded, but Calvin also didn't exert his power to stop it, and Calvin had predetermined that if he ever got his hands on Servetus death would be the penalty) and Calvin's subsequent defense of the idea that the church was right to execute heretics. From there it was a hop, skip and jump to the issuance of quite strict regulations over clothing and food, and eventually Calvin required every Geneva citizen to address him in terms of the utmost respect. Criticism or disrespect was not tolerated. Calvin's startling theory that tyrants should be obeyed by individual citizens as should a good government, regardless of the abuses of such a ruler, might have something to do with this. (Such a ruler was still an instrument of God, perhaps serving as an instrument of God's wrath.)

This keeps happening over and over again in societies with utopian goals. One moment you are really concentrating on establishing an efficient train system for passengers and freight and making the trains run on time, and in just a couple of social breaths you are loading undesirables on the trains for an efficient and timely extermination - all in the service of the same goals. When individuals matter less than grand social goals, moderation goes to the wall.

I had never read Chesterton at all before the last few years, but two bloggers I really enjoy (The Anchoress and Assistant Village Idiot) induced me to give him a try. Well, to my awe and delight I discovered a writer who thought clearly and logically and was almost prophetic in his ability to predict where certain errors of then-modern thought would lead. Chesterton died in 1936.

So it was with a leap of the heart that I discovered that Chesterton's Eugenics and Other Evils was online at Wikisource, which has a list of Chesterton's works and links to some works for which the copyright has expired.

I suppose that hubris is human. I have been thinking along these lines because of the giant and hopeful bureaucracies we are erecting in the grand theory that the public just needs to be whipped into shape for its own good. In this moment in time, we have become an ahistoric society. The poorly educated hold sway.

But I doubt history will treat this particular moment in time with admiration. It depends, of course, on how far we go before correcting our course. Somehow I now think we are doomed to go too far before that correction. Berwick's interim appointment suggests to me that once again The Powers That Be have decided that the peasants are not only in danger of revolting, but damnably disgusting. In effect, the representatives of Congress are being treated as the citizens of Geneva were, and as for the citizens....

From the Eugenics book:

And the heyday of eugenics in the US was in the early part of the last century. The theory of eugenics was actively taught in universities and was literally a progressive plank. It was, tragically, American eugenics laws which formed a pattern for some of the early Nazi legislation. Not the proudest moment in our ideological history, to be sure.

I immediately thought of Chesterton, because I had just been reading (before the late personal crisis) Chesterton's The Appetite of Tyranny and thinking of Iran:

Indeed it would be inconceivable if we were thinking of a whole people, consisting of free and varied individuals. But in Prussia the governing class is really a governing class: and a very few people are needed to think along these lines to make all the other people act along them. And the paradox of Prussia is this: that while its princes and nobles have no other aim on this earth but to destroy democracy wherever it shows itself, they have contrived to get themselves trusted, not as wardens of the past but as forerunners of the future. Even they cannot believe that their theory is popular, but they do believe that it is progressive. Here again we find the spiritual chasm between the two monarchies in question. The Russian institutions are, in many cases, really left in the rear of the Russian people, and many of the Russian people know it. But the Prussian institutions are supposed to be in advance of the Prussian people, and most of the Prussian people believe it. It is thus much easier for the warlords to go everywhere and impose a hopeless slavery upon every one, for they have already imposed a sort of hopeful slavery on their own simple race.Ah, yes. The fatal quarter twist. It is a sad societal truth that utopias with grandiose plans often quickly take that last twist.

Consider, for example, the sad tale of Geneva under Calvin, with its rapid evolution of a religious police, an inquisition, and a truly repressive society, exemplified perhaps by the deliberately slow burning of Servetus (Calvin would have let Servetus be beheaded, but Calvin also didn't exert his power to stop it, and Calvin had predetermined that if he ever got his hands on Servetus death would be the penalty) and Calvin's subsequent defense of the idea that the church was right to execute heretics. From there it was a hop, skip and jump to the issuance of quite strict regulations over clothing and food, and eventually Calvin required every Geneva citizen to address him in terms of the utmost respect. Criticism or disrespect was not tolerated. Calvin's startling theory that tyrants should be obeyed by individual citizens as should a good government, regardless of the abuses of such a ruler, might have something to do with this. (Such a ruler was still an instrument of God, perhaps serving as an instrument of God's wrath.)

This keeps happening over and over again in societies with utopian goals. One moment you are really concentrating on establishing an efficient train system for passengers and freight and making the trains run on time, and in just a couple of social breaths you are loading undesirables on the trains for an efficient and timely extermination - all in the service of the same goals. When individuals matter less than grand social goals, moderation goes to the wall.

I had never read Chesterton at all before the last few years, but two bloggers I really enjoy (The Anchoress and Assistant Village Idiot) induced me to give him a try. Well, to my awe and delight I discovered a writer who thought clearly and logically and was almost prophetic in his ability to predict where certain errors of then-modern thought would lead. Chesterton died in 1936.

So it was with a leap of the heart that I discovered that Chesterton's Eugenics and Other Evils was online at Wikisource, which has a list of Chesterton's works and links to some works for which the copyright has expired.

I suppose that hubris is human. I have been thinking along these lines because of the giant and hopeful bureaucracies we are erecting in the grand theory that the public just needs to be whipped into shape for its own good. In this moment in time, we have become an ahistoric society. The poorly educated hold sway.

But I doubt history will treat this particular moment in time with admiration. It depends, of course, on how far we go before correcting our course. Somehow I now think we are doomed to go too far before that correction. Berwick's interim appointment suggests to me that once again The Powers That Be have decided that the peasants are not only in danger of revolting, but damnably disgusting. In effect, the representatives of Congress are being treated as the citizens of Geneva were, and as for the citizens....

From the Eugenics book:

The wisest thing in the world is to cry out before you are hurt. It is no good to cry out after you are hurt; especially after you are mortally hurt. People talk about the impatience of the populace; but sound historians know that most tyrannies have been possible because men moved too late. It is often essential to resist a tyranny before it exists. It is no answer to say, with a distant optimism, that the scheme is only in the air. A blow from a hatchet can only be parried while it is in the air.

April Was The Peak

Now it's just a question of

Slowdown or contraction?

Not only do retail figures confirm April as a peak,

but we now have durables (June report pdf):

And this is not surprising, because May's sales/inventories report showed the end game:

Rail is beginning to show the impact of a manufacturing slowdown as cumulative YoY carloadings begin to drop. One worrisome thing for rail is that retail-type activity is far higher than base production type activity YoY. I think retail restocking overran and will now have trouble clearing. (Intermodal container/trailer stats are still very high because of the longer retail stocking schedule.) The ATA Truck Tonnage index has shown two sequential declines in May and June. BTS publishes more slowly, but also showed a net drop in May.

Right now this looks like a slowdown and not a contraction.

However, reviewing these figures made my eyes roll in response to Geithner's "economy will withstand a tax increase in 2011" shtick. It can probably withstand a minor tax increase, but I don't see how it can withstand the major tax increase currently scheduled.

June's employment report was worrisome to say the least even when discounting the Census jobs exiting stage right. Perhaps July's will be a bit better, but I suspect not. At least, it will not be if the consumer confidence surveys are correct, because they show increasing worry about jobs and incomes.

One of the factors was the housing tax credit. The aftermath is clear, and the net from the housing tax credit seems to have been negative. It was merely a very costly way to make things look better for a while, until it delivered a series of bad news.

At this point, the state and local fiscal problems should be exerting a consistent and very widely spread drag on economic activity. This is not huge, but it is a depressive force.

Next up, we have cumulative problems in housing from the need to tighten standards to stop some of the mortgage defaults. We also have a serious problem developing in banks. Net Interest Margins are going to tend to drop, and I strongly suspect that some of these institutions have dumped their loan reserves too soon (except for those who transferred a lot of their bad loans directly to the taxpayers and future home purchasers via GSEs).

More later, but for heaven's sake don't hold your breaths, because my life is not getting any easier and "later" could mean a couple of days or a week!

Slowdown or contraction?

Not only do retail figures confirm April as a peak,

but we now have durables (June report pdf):

And this is not surprising, because May's sales/inventories report showed the end game:

Rail is beginning to show the impact of a manufacturing slowdown as cumulative YoY carloadings begin to drop. One worrisome thing for rail is that retail-type activity is far higher than base production type activity YoY. I think retail restocking overran and will now have trouble clearing. (Intermodal container/trailer stats are still very high because of the longer retail stocking schedule.) The ATA Truck Tonnage index has shown two sequential declines in May and June. BTS publishes more slowly, but also showed a net drop in May.

Right now this looks like a slowdown and not a contraction.

However, reviewing these figures made my eyes roll in response to Geithner's "economy will withstand a tax increase in 2011" shtick. It can probably withstand a minor tax increase, but I don't see how it can withstand the major tax increase currently scheduled.

June's employment report was worrisome to say the least even when discounting the Census jobs exiting stage right. Perhaps July's will be a bit better, but I suspect not. At least, it will not be if the consumer confidence surveys are correct, because they show increasing worry about jobs and incomes.

One of the factors was the housing tax credit. The aftermath is clear, and the net from the housing tax credit seems to have been negative. It was merely a very costly way to make things look better for a while, until it delivered a series of bad news.

At this point, the state and local fiscal problems should be exerting a consistent and very widely spread drag on economic activity. This is not huge, but it is a depressive force.

Next up, we have cumulative problems in housing from the need to tighten standards to stop some of the mortgage defaults. We also have a serious problem developing in banks. Net Interest Margins are going to tend to drop, and I strongly suspect that some of these institutions have dumped their loan reserves too soon (except for those who transferred a lot of their bad loans directly to the taxpayers and future home purchasers via GSEs).

More later, but for heaven's sake don't hold your breaths, because my life is not getting any easier and "later" could mean a couple of days or a week!

Friday, July 23, 2010

Totally Harrowing

We're now down to trying to ensure that the mother makes it through this intact.

I am really going all out and don't have time to sleep. Catch you guys later.

PS: Canada. Household debt. Central bank will act quickly, I think. Because Canada is doing quite well in the uptick cycle in jobs, the central bank can act and certainly should act. However this implies an additional drag on housing.

I am really going all out and don't have time to sleep. Catch you guys later.

PS: Canada. Household debt. Central bank will act quickly, I think. Because Canada is doing quite well in the uptick cycle in jobs, the central bank can act and certainly should act. However this implies an additional drag on housing.

Monday, July 19, 2010

Notes From The Darker Side

I really won't be posting that much for a while. My brother and his wife are at Children's Hospital in Philadelphia - there appears to be a major problem with the twin buns in the oven.

But from last week, a couple of items which may or may not be colored by my current dark mood:

1) Initial Claims: These fell nicely to a seasonally adjusted 429,000, although of course NSA claims rose. But the insured unemployment ratio rose from 3.5% to 3.7% because the quarterly adjustment for covered jobs showed a loss of over 1.5 million jobs last quarter. Covered employment is now at 126,763,245. The previous tally was 128,298,468.

Regardless of all the talk, we really aren't generating JOBS yet. BLS uses a different measure of employment - did people work in an income-generating activity? This is a broader measure, because people will sometimes find work as contractors, or mowing lawns, or painting an old geezer's house, or picking up cans and glass to recycle. You only have to have spent 1 hour in the reference week in such activity to be counted as employed.

But as to the jobs, we were still losing as of last quarter, and according to BLS' figures, which are seasonally adjusted, we lost 300,000 jobs in June. Thus one is reluctant to say that the lower figure is purely from a trailing effect.

Over this cycle, covered employment (to get these numbers go to this page and enter the year sequence you want) followed this arc:

Anyway, June's tax receipts showed an improving YoY trend (we were down 2% instead of 2.5% in April), but it is not clear that we are in a self-sustaining rebound yet. The reason it is unclear is that the YoY comparison is getting easier!. If you look at self-employment receipts and freight trends YoY, it does look like we are in rebound. But against that there are unusual effects related to the housing tax credit and Census employment, both of which are dropping out of the economy. And then, NFIB for June was quite, quite disappointing.

This is the reason that I completely disagree with the idea that unemployment benefits should not be extended. The reality is that there are not jobs for even a third or a quarter of the people who need them and will take them. I'm not talking good jobs - I'm talking any jobs! If you are fortunate enough to be in my position you can make yourself a job. But most people are not. And from here on out, people losing unemployment benefits will tend to lose transportation and the ability to get a job.

Please realize that we now have only about 600,000 more jobs total than we did in 2004, but the civilian labor force increased from 147,460,000 in June 2004 to 153,741,000 in June 2010. That leaves us with 6.3 million more people chasing essentially the same number of jobs. It ought to be obvious that many people won't get employment of any type whatsoever.

Nor are they going to be seeing much improvement any time soon. In 2004, although there was a small business dip in optimism in 2003 to the mid 90s levels, the small business optimism index had rebounded to the mid 100s. That's basically what created a lot of the jobs.

We are not in the first stages of a housing recovery either. Inventory is rising, and mortgage standards as controlled by the GSEs are rising, which means that fewer borrowers will qualify. In particular, FHA is tightening (proposed rule so far, but it will basically go through html version pdf version) its debt ratios which will have considerable impact - FHA's insurance fund has now fallen below statutory limits. This involves lower DTIs, lower seller concessions, lower loan-to-value ratios and so forth.

Residential construction helped generate a lot of jobs in the recovery from the last downturn, and it can't in this one for a few years.

Commercial construction is down and out. In many areas there is a huge oversupply of commercial structures of most types. You want offices? Take your pick. You want retail centers? We got em for over a decade to come.

I don't see much hope for big impetus on the horizon. The best we can hope for is a slow climb out of the abyss, and the ability to juice it is just about gone.

But from last week, a couple of items which may or may not be colored by my current dark mood:

1) Initial Claims: These fell nicely to a seasonally adjusted 429,000, although of course NSA claims rose. But the insured unemployment ratio rose from 3.5% to 3.7% because the quarterly adjustment for covered jobs showed a loss of over 1.5 million jobs last quarter. Covered employment is now at 126,763,245. The previous tally was 128,298,468.

Regardless of all the talk, we really aren't generating JOBS yet. BLS uses a different measure of employment - did people work in an income-generating activity? This is a broader measure, because people will sometimes find work as contractors, or mowing lawns, or painting an old geezer's house, or picking up cans and glass to recycle. You only have to have spent 1 hour in the reference week in such activity to be counted as employed.

But as to the jobs, we were still losing as of last quarter, and according to BLS' figures, which are seasonally adjusted, we lost 300,000 jobs in June. Thus one is reluctant to say that the lower figure is purely from a trailing effect.

Over this cycle, covered employment (to get these numbers go to this page and enter the year sequence you want) followed this arc:

- We did not start losing jobs from the 2001 downturn and 9/11 shock until the second quarter of 2002. Peak jobs in that cycle occurred in Q1 02 at 128,673,493.

- We then lost jobs (by this measure) until the last half of 2004, when the numbers first stabilized (Q2 04 126,084,041; Q3 04 126,088,081) and then started a long climb.

- Jobs peaked in Q4 08 at 133,902,387, and then began to fall slowly (Q1 09 133,886,830) and then collapsed. We are now over 7 million jobs down from the peak, and worse yet, lower than the previous peak by about 1.6 million.

- For what it is worth, consumer confidence and recovery perceptions are strongly dependent on this number rising. The country voted GOP in the 2004 elections because we were gaining jobs and most people thought we were heading in the right direction economically.

Anyway, June's tax receipts showed an improving YoY trend (we were down 2% instead of 2.5% in April), but it is not clear that we are in a self-sustaining rebound yet. The reason it is unclear is that the YoY comparison is getting easier!. If you look at self-employment receipts and freight trends YoY, it does look like we are in rebound. But against that there are unusual effects related to the housing tax credit and Census employment, both of which are dropping out of the economy. And then, NFIB for June was quite, quite disappointing.

This is the reason that I completely disagree with the idea that unemployment benefits should not be extended. The reality is that there are not jobs for even a third or a quarter of the people who need them and will take them. I'm not talking good jobs - I'm talking any jobs! If you are fortunate enough to be in my position you can make yourself a job. But most people are not. And from here on out, people losing unemployment benefits will tend to lose transportation and the ability to get a job.

Please realize that we now have only about 600,000 more jobs total than we did in 2004, but the civilian labor force increased from 147,460,000 in June 2004 to 153,741,000 in June 2010. That leaves us with 6.3 million more people chasing essentially the same number of jobs. It ought to be obvious that many people won't get employment of any type whatsoever.

Nor are they going to be seeing much improvement any time soon. In 2004, although there was a small business dip in optimism in 2003 to the mid 90s levels, the small business optimism index had rebounded to the mid 100s. That's basically what created a lot of the jobs.

We are not in the first stages of a housing recovery either. Inventory is rising, and mortgage standards as controlled by the GSEs are rising, which means that fewer borrowers will qualify. In particular, FHA is tightening (proposed rule so far, but it will basically go through html version pdf version) its debt ratios which will have considerable impact - FHA's insurance fund has now fallen below statutory limits. This involves lower DTIs, lower seller concessions, lower loan-to-value ratios and so forth.

Residential construction helped generate a lot of jobs in the recovery from the last downturn, and it can't in this one for a few years.

Commercial construction is down and out. In many areas there is a huge oversupply of commercial structures of most types. You want offices? Take your pick. You want retail centers? We got em for over a decade to come.

I don't see much hope for big impetus on the horizon. The best we can hope for is a slow climb out of the abyss, and the ability to juice it is just about gone.

Friday, July 16, 2010

NFIB - EEEK!!!

The June survey is here. Look at the graph on page 6. We had first formed a floor and then sprang off that floor in the spring, but June's survey was quite bad. Optimism is now back at 89.

You know what's so freaking depressing about this? The large April/May move just got us to the normal recession low range. And now we're back below that.

If this holds for another month, the odds are going to switch to a new contraction. Small businesses account for a lot of spending.

You know what's so freaking depressing about this? The large April/May move just got us to the normal recession low range. And now we're back below that.

If this holds for another month, the odds are going to switch to a new contraction. Small businesses account for a lot of spending.

Thursday, July 15, 2010

Euro Goes Mark

But seriously, dudes!

Barroso revealed his frustrations with Washington during a wideranging interview in which he also admitted that the euro had acted like a “sleeping pill,” luring some countries to the edge of economic disaster with an “illusion of prosperity.”Now, where did we see that phrase before?

Fiscally Speaking

People don't like the word "recovery" because while things are improving, they are improving at such a glacial pace for the employed that in effect, they are falling further behind:

This data is from the Monthly Treasury Receipts:

Medicare Receipts (Hospital Insurance 2.9%)

What's different about this economic downturn are wages - we just have never seen this persistent YoY drop in the post WWII era:

Click on this graph and open it in another tab or window. It shows real retail sales (red is discontinued series), household debt and disposable personal income as calculated by BEA. Disposable Personal Income is basically income (wages, salaries, etc, plus government transfers - taxes).

Click on this graph and open it in another tab or window. It shows real retail sales (red is discontinued series), household debt and disposable personal income as calculated by BEA. Disposable Personal Income is basically income (wages, salaries, etc, plus government transfers - taxes).

Obviously government transfer payments have become more and more of a factor holding up DPI.

A more detailed graph of the 1979-84 period:

Note that household debt was less than DPI, that DPI didn't drop, and that retail sales did a similar sickening dive.

Still, the fact that incomes were growing and that household debt had an entirely different relationship to incomes meant that the economy had considerable growth potential.

The current period in more detail:

Debt is slowly dropping, but incomes are stagnant. We have a long way to go to get back to a more normal income/debt ratio.

And here's my burning question:

HOW? Increasing taxes is going to drop DPI and it is not going to help job generation much, and it is going to worsen the debt/income ratio. Just ratcheting up government debt has a clear endpoint, and in any case really doesn't fix the debt/income ratio, because we will be swapping personal debt for government debt. Worse yet, individuals and businesses can shuck off unpayable debt in bankruptcy, but if our economy fundamentally relies on government borrowing to sustain individual incomes, our government cannot shuck debt in any way, shape or form without crashing incomes.

So this is the reason I can't get on board with either the current GOP or Democratic agendas. They both seem unrealistic to me. Clearly we have to create conditions which will induce job creation - that will help although not fix the government transfer payment deficits. And clearly we have to get more taxes from somewhere.

Our only real feasible option appears to be to crash CMDEBT, which implies that we have a pretty severe additional correction in the bag.

This data is from the Monthly Treasury Receipts:

Medicare Receipts (Hospital Insurance 2.9%)

June 2010:There is some slight YoY improvement. Compare to April's figures:

Wage Tax: 14,941

Self-Emp: 1,881

June 2009:

Wage Tax: 15,246 (-2.0%)

Self-Emp: 1,914 (-1.7%)

June 2008:

Wage Tax: 15,661 (-4.6%)

Self-Emp: 1,968 (-4.4%)

June 2007:

Wage Tax: 14,958 (-0.1)

Self-Emp: 1,839 (+2.2)

June 2006:

Wage Tax: 14,194 (+5.3%)

Self-Emp: 1,721 (+9.3%)

_____________________

April 2010:We are slowly growing again, but we have lost years. And it now appears that we will not get those years back. Fiscally, this has major implications for the Social Security and Medicare programs. This is the data the administration probably doesn't want to discuss until after the elections:

Wage Tax: 14,067

Self-Emp: 5,579

April 2009:

Wage Tax: 14,440 (-2.5%)

Self-Emp: 5,814

April 2008:

Wage Tax: 14,805 (-4.9%)

Self-Emp: 5,784

April 2007: Wage Tax: 14,250 (-1.3%)

Self-Emp: 5,410

April 2006:

Wage Tax: 13,529 (+4.0%)

Self-Emp: 5,013

Social Security Receipts (Old Age)Social Security is running a persistent primary deficit (money coming in is less than benefits going out). It may look like the old age (retirement) portion is still positive, but that is just because almost all the quarterly self-employment taxes show up in June. Here's May:

June 2010:

Wage Tax: 48,314

Self-Emp: 4,454

Total Benefits/Exp Paid: 48,360

June 2009:

Wage Tax: 48,832

Self-Emp: 4,615

June 2008:

Wage Tax: 49,567

Self-Emp: 4,613

June 2007:

Wage Tax: 47,392

Self-Emp: 4,398

June 2006:

Wage Tax: 45,119

Self-Emp: 4,160

Disability Receipts:

June 2010:

Wage Tax: 8,204

Self-Emp: 756

Total Benefits/Exp Paid: 10,556

May 2010:The primary deficit date was originally supposed to occur in 2017/18 (I had it at 2015), then it dropped back to 2016. From here, we probably will swing through to a few years where it sort of balances, but by 2013 I think we will surely be running a persistent deficit again.

Social Security Receipts:

Wage Tax: 44,220

Self-Emp: 622

Benefits/Exp Paid: 48,229

Disability Receipts:

Wage Tax: 7,509

Self-Emp: 106

Benefits/Exp Paid: 10,693

What's different about this economic downturn are wages - we just have never seen this persistent YoY drop in the post WWII era:

Click on this graph and open it in another tab or window. It shows real retail sales (red is discontinued series), household debt and disposable personal income as calculated by BEA. Disposable Personal Income is basically income (wages, salaries, etc, plus government transfers - taxes).

Click on this graph and open it in another tab or window. It shows real retail sales (red is discontinued series), household debt and disposable personal income as calculated by BEA. Disposable Personal Income is basically income (wages, salaries, etc, plus government transfers - taxes).Obviously government transfer payments have become more and more of a factor holding up DPI.

A more detailed graph of the 1979-84 period:

Note that household debt was less than DPI, that DPI didn't drop, and that retail sales did a similar sickening dive.

Still, the fact that incomes were growing and that household debt had an entirely different relationship to incomes meant that the economy had considerable growth potential.

The current period in more detail:

Debt is slowly dropping, but incomes are stagnant. We have a long way to go to get back to a more normal income/debt ratio.

And here's my burning question:

HOW? Increasing taxes is going to drop DPI and it is not going to help job generation much, and it is going to worsen the debt/income ratio. Just ratcheting up government debt has a clear endpoint, and in any case really doesn't fix the debt/income ratio, because we will be swapping personal debt for government debt. Worse yet, individuals and businesses can shuck off unpayable debt in bankruptcy, but if our economy fundamentally relies on government borrowing to sustain individual incomes, our government cannot shuck debt in any way, shape or form without crashing incomes.

So this is the reason I can't get on board with either the current GOP or Democratic agendas. They both seem unrealistic to me. Clearly we have to create conditions which will induce job creation - that will help although not fix the government transfer payment deficits. And clearly we have to get more taxes from somewhere.

Our only real feasible option appears to be to crash CMDEBT, which implies that we have a pretty severe additional correction in the bag.

Wednesday, July 14, 2010

More Stuff About Financial Reform

This is a huge and very complex bill, and a great many of the provisions have to explicated with regulations - so it is impossible to know right now exactly how a lot of this will work out.

More on the non-bank side, discussing the scope of the regulations which need to be written. Former SEC Chair Pitt. The farmers are worried.

For smaller banks, there are several insuperable problems, but the worst is that rule-making for consumer protection laws will be separated from the safety-and-soundness regulatory function. Not only is this weird, but it points up the difficulties of assessing system-wide risk. Without knowing what banks are doing and what they can safely do, one runs the risk of cutting off a great deal of funding to Main Street. Indeed, this has already happened in several initiatives of this administration. Allowing people who don't know anything about banking to regulate it is self-defeating. The current ridiculously high credit card rates and the new barriers to getting home equity loans are cases in point.

In all regulation there are pros and cons. Balancing the damage of regulating with the damage of not regulating is quite difficult.

For me, there's yet another problem. This bill makes service providers to banks subject to the new consumer protection agency. I don't see any way around that, which is why I think I'm doomed in my current function. I can't even see how I can ethically stay in business if I may be forced to disclose information to the agency, and I expect the recklessness of the current new crop of joyous academics to escalate under the current circumstances.

So far, they've effed up everything they've touched. After reading this bill, it seems clear that they don't take any responsibility for it either.

The funniest part about this is that once again, larger organizations are not complying, but community banks have to comply, and that is where the flow of cash to Main Street gets cut off.

The only reasonable way of controlling financial risk is to go back to the Glass-Steagall framework again. That worked by insulating small depositors from the risks of bad commercial banking (by insurance) and by insulating money supply (controlled by lenders) from the activities of insurers (think AIG) and investment banks. Instead of recognizing the abject failure of the 1990s financial reform, this new effort doubles down.

The USD became the reserve currency for several reasons, but one was that our post-GD system of firewalls created an impressive stability. This bill does not even recognize what really went wrong.

More on the non-bank side, discussing the scope of the regulations which need to be written. Former SEC Chair Pitt. The farmers are worried.

For smaller banks, there are several insuperable problems, but the worst is that rule-making for consumer protection laws will be separated from the safety-and-soundness regulatory function. Not only is this weird, but it points up the difficulties of assessing system-wide risk. Without knowing what banks are doing and what they can safely do, one runs the risk of cutting off a great deal of funding to Main Street. Indeed, this has already happened in several initiatives of this administration. Allowing people who don't know anything about banking to regulate it is self-defeating. The current ridiculously high credit card rates and the new barriers to getting home equity loans are cases in point.

In all regulation there are pros and cons. Balancing the damage of regulating with the damage of not regulating is quite difficult.

For me, there's yet another problem. This bill makes service providers to banks subject to the new consumer protection agency. I don't see any way around that, which is why I think I'm doomed in my current function. I can't even see how I can ethically stay in business if I may be forced to disclose information to the agency, and I expect the recklessness of the current new crop of joyous academics to escalate under the current circumstances.

So far, they've effed up everything they've touched. After reading this bill, it seems clear that they don't take any responsibility for it either.

The funniest part about this is that once again, larger organizations are not complying, but community banks have to comply, and that is where the flow of cash to Main Street gets cut off.

The only reasonable way of controlling financial risk is to go back to the Glass-Steagall framework again. That worked by insulating small depositors from the risks of bad commercial banking (by insurance) and by insulating money supply (controlled by lenders) from the activities of insurers (think AIG) and investment banks. Instead of recognizing the abject failure of the 1990s financial reform, this new effort doubles down.

The USD became the reserve currency for several reasons, but one was that our post-GD system of firewalls created an impressive stability. This bill does not even recognize what really went wrong.

Tuesday, July 13, 2010

Knocked Down, Gotta Get Back Up

Your comments on the Canada/corporate taxation post were very interesting. Eventually, I will respond.

I am currently dealing with my own personal crisis, which was generated by reading and analyzing the financial reform bill (conference version) over the weekend.

The bottom line is that I am out of work. This is an unmitigated disaster on several levels, and it looks to me like community banks are going to be failing by the thousands. This leaves me in the position of a barrel maker during a certain period of our history.

Aside from the personal consequences, the effect of losing so many community banks will be felt in the real economy. Eventually the destruction will be realized and course will be changed, but not for years. So I have to redo all my forecasts even for investments.

In any case, there will probably be a blogging pause as I reel around trying to cope with my own particular dose of Hope and Change.

I am currently dealing with my own personal crisis, which was generated by reading and analyzing the financial reform bill (conference version) over the weekend.

The bottom line is that I am out of work. This is an unmitigated disaster on several levels, and it looks to me like community banks are going to be failing by the thousands. This leaves me in the position of a barrel maker during a certain period of our history.

Aside from the personal consequences, the effect of losing so many community banks will be felt in the real economy. Eventually the destruction will be realized and course will be changed, but not for years. So I have to redo all my forecasts even for investments.

In any case, there will probably be a blogging pause as I reel around trying to cope with my own particular dose of Hope and Change.

Friday, July 09, 2010

The Truth, If You Can Stand To Read It

I was taken severely to task on a prior post about taxation for my contention that we needed to cut certain taxes.

To which my instinctive answer was "The Pain Will Continue Until You Wise Up, Sucker". But I figured that people are really suffering and this was undiplomatic, so I decided to wait until the pain was maybe bad enough that we could stand the bitter taste of the medicine.

One thing I knew is that our neighbor to the north would shortly be demonstrating a few things.....

Now - look at the US performance in jobs and compare to the Canadian performance in jobs.

So, what's different? Any progressive is going to start nattering on about their healthcare system, but that is basically nonsense.

What's different is Canada's tax system, which is hugely favorable toward business.

US corporate tax rates go up to 38%, and that is just federal tax. Most states impose anywhere from 5-10%, some higher. Here are the current federal rates:

Taxable Income ($) ....... Tax Rate[13]

0 to 50,000....................... 15%

50,000 to 75,000 ..............25%

75,000 to 100,000 ............34%

100,000 to 335,000 ..........39%

335,000 to 10,000,000 .....34%

10,000,000 to 15,000,000 35%

15,000,000 to 18,333,333 38%

18,333,333 and up ............35%

This link is from Deloitte, and it gives both state and federal corporate income tax rates for Canada. Read it if you dare, and you'll figure out why Canada adds jobs and we lose them. Note please that if you start a small business and earn $300,000 in profits, Canada's federal government only wants 11% of that money, and several major states want less than 5%, although a few want up to 16%.

The only types of businesses in Canada that pay US types of taxes are financials. General businesses in Canada are subject to an 18% rate, which is due to drop to 15% by 2012. As part of the latest round of reforms, the small business income limit was increased to $500,000 in 2009. Let's just say that this has been a success from the jobs POV.

Needless to say, Canada's tax system is biased toward creating jobs and funding investment. However Canada was hurt by the Great Recession, and it has responded by further cutting corporate tax rates. This has worked.

So, the pain will continue until we wise up, my friends. We've been suckered. All the talk about fairness isn't going to make businessman stick their head in a tax guillotine. Most especially, note than both the feds and many provinces in Canada offer a special low, low, low rate to small businesses. If you want jobs, do the same in the US and believe me, you'll get jobs.

High marginal tax rates destroy job creation and greatly reduce investment. There is no better way to produce unemployment. It is that simple.

Canada does have a socialized health care system, but they pay for it by imposing high PERSONAL taxes. Canada also produces a lot of natural resources. Canadians are very environmentally aware, but they have not imposed the drastic regime we have which often makes it impossible to open new plants/wells, etc. It seems as if they regulate more tightly, but they do regulate. They do it by government, instead of our system which is basically done through the courts.

Anyway, I don't know if readers can swallow this bitter truth, but this is the truth. It's an inexorable economic reality. Because losses are borne by businesses, and most businesses will take some years of losses and invest heavily to produce profits in good years, high marginal tax rates put a cap on what businesses can earn and make many investments unprofitable or only marginally profitable.

In 2005, I pointed out that the US had a problem, because all around the world countries were cutting their corporate tax rates, but we weren't. I am going to commit the worst blog malfeasance possible, and quote myself:

As a rule of thumb, keeping your tax rates above those of your neighbors is tantamount to writing huge checks to your neighbors. It doesn't matter if your neighbor is Venezuela, because the rulers in such countries just seize what they want. But when your neighbors are civilized countries that protect property, naturally the money goes hotfooting over the border.

And for heaven's sake, don't read Krugman. He's a good economist in principle, but he's currently operating in a factless, agonized nirvana.

To which my instinctive answer was "The Pain Will Continue Until You Wise Up, Sucker". But I figured that people are really suffering and this was undiplomatic, so I decided to wait until the pain was maybe bad enough that we could stand the bitter taste of the medicine.

One thing I knew is that our neighbor to the north would shortly be demonstrating a few things.....

Now - look at the US performance in jobs and compare to the Canadian performance in jobs.

Employment rose by 93,200 in June, following gains of 24,700 in May and April’s record 108,700, Statistics Canada said today in Ottawa. The jobless rate fell to 7.9 percent, the lowest since January 2009, from 8.1 percent.In actuality, the US lost jobs in June, and it lost more jobs than the Census loss. If the US had been adding jobs at the same rate as Canada in June, the US would have netted over 525,000 jobs in June, even deducting Census jobs.

So, what's different? Any progressive is going to start nattering on about their healthcare system, but that is basically nonsense.

What's different is Canada's tax system, which is hugely favorable toward business.

US corporate tax rates go up to 38%, and that is just federal tax. Most states impose anywhere from 5-10%, some higher. Here are the current federal rates:

Taxable Income ($) ....... Tax Rate[13]

0 to 50,000....................... 15%

50,000 to 75,000 ..............25%

75,000 to 100,000 ............34%

100,000 to 335,000 ..........39%

335,000 to 10,000,000 .....34%

10,000,000 to 15,000,000 35%

15,000,000 to 18,333,333 38%

18,333,333 and up ............35%

This link is from Deloitte, and it gives both state and federal corporate income tax rates for Canada. Read it if you dare, and you'll figure out why Canada adds jobs and we lose them. Note please that if you start a small business and earn $300,000 in profits, Canada's federal government only wants 11% of that money, and several major states want less than 5%, although a few want up to 16%.

The only types of businesses in Canada that pay US types of taxes are financials. General businesses in Canada are subject to an 18% rate, which is due to drop to 15% by 2012. As part of the latest round of reforms, the small business income limit was increased to $500,000 in 2009. Let's just say that this has been a success from the jobs POV.

Needless to say, Canada's tax system is biased toward creating jobs and funding investment. However Canada was hurt by the Great Recession, and it has responded by further cutting corporate tax rates. This has worked.

So, the pain will continue until we wise up, my friends. We've been suckered. All the talk about fairness isn't going to make businessman stick their head in a tax guillotine. Most especially, note than both the feds and many provinces in Canada offer a special low, low, low rate to small businesses. If you want jobs, do the same in the US and believe me, you'll get jobs.

High marginal tax rates destroy job creation and greatly reduce investment. There is no better way to produce unemployment. It is that simple.

Canada does have a socialized health care system, but they pay for it by imposing high PERSONAL taxes. Canada also produces a lot of natural resources. Canadians are very environmentally aware, but they have not imposed the drastic regime we have which often makes it impossible to open new plants/wells, etc. It seems as if they regulate more tightly, but they do regulate. They do it by government, instead of our system which is basically done through the courts.

Anyway, I don't know if readers can swallow this bitter truth, but this is the truth. It's an inexorable economic reality. Because losses are borne by businesses, and most businesses will take some years of losses and invest heavily to produce profits in good years, high marginal tax rates put a cap on what businesses can earn and make many investments unprofitable or only marginally profitable.

In 2005, I pointed out that the US had a problem, because all around the world countries were cutting their corporate tax rates, but we weren't. I am going to commit the worst blog malfeasance possible, and quote myself:

We are not going to be able to escape making major changes in our own tax structure if we want to retain business investment, and we must retain business investment. Sobering, especially given political realities in the US.We did not change course. Indeed, we responded to the inevitable by electing Obama The Wonder Dummy (economically he's a nitwit), who has proceeded onwards to accelerate the destruction. When we stop beating the ox, the ox will recover and begin to pull the economy forward again.

As a rule of thumb, keeping your tax rates above those of your neighbors is tantamount to writing huge checks to your neighbors. It doesn't matter if your neighbor is Venezuela, because the rulers in such countries just seize what they want. But when your neighbors are civilized countries that protect property, naturally the money goes hotfooting over the border.

And for heaven's sake, don't read Krugman. He's a good economist in principle, but he's currently operating in a factless, agonized nirvana.

Wholesale

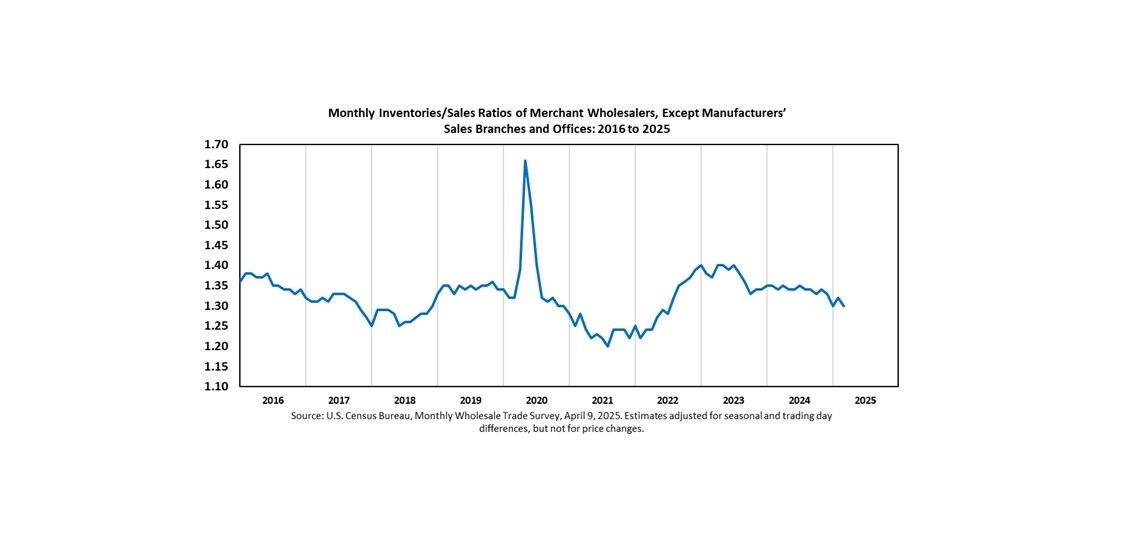

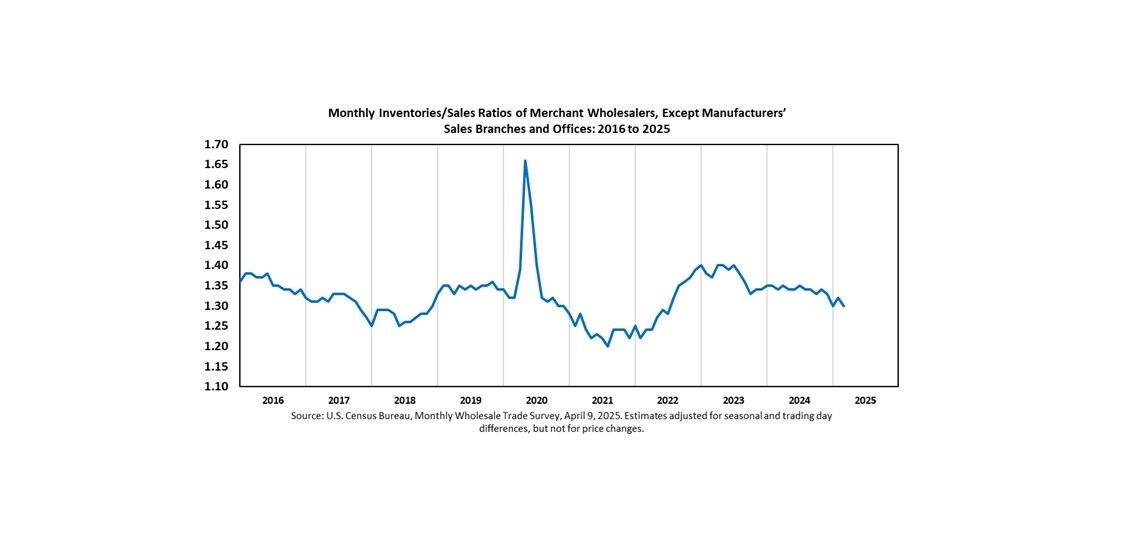

This is May's report, and of course it is now July:

This marks the cross and relates to the April sales peak for retail.

Sales rose 0.9 in April, but dropped 0.3 in May. Inventories rose 0.2 in April and 0.5 in May, for a slight increase in the ratio.

I think some retailers have overshot orders, and that there is a mild slowdown in the works. This doesn't mean that any catastrophic event has occurred, just that this is confirmation of the end of the recovery cycle. From here on out, growth in final demand matters.

But other deposits growth is still good. We are also past the end of the lower price cycle on the groceries and moving into the price escalation cycle, which will have a slow impact over the next few months.

Update: See CR's post on hotel occupancy. All of the current indicators show that we have formed a floor and are slowly legging up. It's just that the pace at which the economy can bootstrap itself up is going to be quite slow.

This marks the cross and relates to the April sales peak for retail.

Sales rose 0.9 in April, but dropped 0.3 in May. Inventories rose 0.2 in April and 0.5 in May, for a slight increase in the ratio.

I think some retailers have overshot orders, and that there is a mild slowdown in the works. This doesn't mean that any catastrophic event has occurred, just that this is confirmation of the end of the recovery cycle. From here on out, growth in final demand matters.

But other deposits growth is still good. We are also past the end of the lower price cycle on the groceries and moving into the price escalation cycle, which will have a slow impact over the next few months.

Update: See CR's post on hotel occupancy. All of the current indicators show that we have formed a floor and are slowly legging up. It's just that the pace at which the economy can bootstrap itself up is going to be quite slow.

Thursday, July 08, 2010

A Better Week

Initial claims dropped finally to 454,000, but last week's claims were revised up to 475,000, so the four week moving average hardly changed, sticking at 466,000 from last week's initially reported 466,500. It would be nice to get away from the seemingly endless series of upward revisions on initial claims.

Still, the economic news this week has to add up better than last week's, because hey, it really couldn't have gotten any worse. Retail sales are still decent.

Seasonal adjustments play a pretty big role during June for claims. The next real blip I expect will come at the end of August and into September. That is the point at which school systems open back up. I think we are going to see some impact from state and local budget cuts, i.e. employees who won't be coming back to work. Those won't be reported as initial claims, but a lot of employees get temporary unemployment benefits during the summer, and this year some will unfortunately be still be drawing benefits during the fall. Therefore I am expecting at least some blip in continued claims and insured unemployment rates if the cuts are as big as claimed. I'm not sure they are!

Consumer credit is supposed to be published this afternoon. That will be interesting.

I have a severe case of double economic vision. Many of the most reliable indicators I watch vigilantly seem to signal that we have a much stronger base and that we can carry through the rest of this year in moderate growth mode. These indicators include freight, deposits at banks, and commercial paper:

Look at the nonfinancial growth. That is a recovery indicator.

For the most part, industries seem to have been cautious and therefore should continue some expansion even if the pace drops off.

I have seen one blip that indicates an overrun, and that is apparently in retail stocking.

I am judging by the rail intermodal figures, which may be overstating the case. But those figures seem to show that retailers outran themselves in stocking and will be pulling back in ordering unless retail sales are very strong the rest of the year. This, however, probably is more of a problem for China, Taiwan and India than for US manufacturers.

I'm working on a long post, but I'll update with some more figures in the afternoon on this interim post.

Regardless, jobs growth will mostly depend on the small businesses, and there uncertainties really are weighing. You can see a video that is some sort of clip from Fox News posted on the NFIB website. The reality is that states are auditing and raising taxes, and the healthcare bill really will impose a lot of extra costs on smaller businesses. And who needs it? Right now businesses are still staggering forward trying to get their feet under them. Note that in the video the VAT comes up. All these regulations, most especially the 1099 for all vendors deal, are a nightmare and a real additional cost for businesses. They are overburdened and uncertain, but sure that they are going to face much higher compliance costs.

I have started a compilation for SuperDoc, but I am very afraid that when I finally do broach the subject he will just give up and close the doors of his practice. One thing for sure, this is not going to lower medical costs!

Update: Retail chain stores sales for June were not great, and imply that the retail sales report for June will be less than brilliant:

Further Update:

Consumer credit is out. This is for May. April was revised to -7.3% annualized. May initial is -4.5%. In those two months revolving (generally CC) debt dropped 11.8% and 10.5% respectively.

And this is hardly a surprise, because credit card rates are still averaging at 14%, and 24 month personal loans at 11%. Nor, given the economy and widespread defaults, can that come down very much. Of course it is a mix - some "gold" customers are getting much better rates, and other customers are getting hosed. New car loans at six and a quarter. Non-revolving, which is disproportionately car loans (no real estate in this report) balance has dropped to about 2007. We generally do need autos more than CC bling.

In those same two months, other deposits (from H.8) grew 3.2% and 9.4% annualized. We don't have the final for June, but through the June 23rd week other deposits were up at a healthy pace (about 50 billion seasonally adjusted).

It looks decent to me. People just aren't going to borrow blindly at these rates, nor should they, nor is it all that feasible for most consumers to borrow very cheaply due to the risks in the economy.

For what it's worth, the seasonally adjusted revolving credit balance is about down to 2005 levels.

PS: And if you think banks can do much better on most of these rates, you'd better look at delinquencies and chargeoffs. A 10% charge-off rate on credit cards doesn't leave much room to drop rates no matter HOW low your cost of funds is, and an 11.29% delinquency rate on residential mortgages means that FHA and Fannie are going to cost the taxpayers a WHOLE lot of money. It's not nearly so much fun to holler about greedy bankers when it turns out that the taxpayers are the "greedy" bankers.

PPS: Something about the consumer credit report brings out the dementia in analysts and/or reporters. Take this Bloomberg article:

Consumers who have no money coming in are more than willing to run up their credit cards to buy groceries and keep the lights on - most of them won't be paying it back. But consumers who do have money coming in, but are getting 1% at best on their money in the bank, aren't going to be paying 10% to borrow. They'll wait a few months and pay cash, and this is by far the best financial return they can get - by NOT borrowing. The old "leveraging your way to wealth" meme is pretty well busted.

So we have a situation where the desperate impecunious will borrow, but the financially solvent and provident won't unless in extreme emergency, and then they are going to buckle down and pay it back as quickly as they can. They'll borrow for car loans, but not the casual stuff. This does make it hard for banks to improve their overall loan portfolios, but consumers should be looking after their own interests and not worrying about bank profitability.

And then, there are still some people who would like to refinance their homes but need to bring a little money to the table to do so. For many of them, it's a wise idea to save and refinance at current rates (taxpayer subsidized rates, but hey).

Still, the economic news this week has to add up better than last week's, because hey, it really couldn't have gotten any worse. Retail sales are still decent.

Seasonal adjustments play a pretty big role during June for claims. The next real blip I expect will come at the end of August and into September. That is the point at which school systems open back up. I think we are going to see some impact from state and local budget cuts, i.e. employees who won't be coming back to work. Those won't be reported as initial claims, but a lot of employees get temporary unemployment benefits during the summer, and this year some will unfortunately be still be drawing benefits during the fall. Therefore I am expecting at least some blip in continued claims and insured unemployment rates if the cuts are as big as claimed. I'm not sure they are!

Consumer credit is supposed to be published this afternoon. That will be interesting.

I have a severe case of double economic vision. Many of the most reliable indicators I watch vigilantly seem to signal that we have a much stronger base and that we can carry through the rest of this year in moderate growth mode. These indicators include freight, deposits at banks, and commercial paper:

Look at the nonfinancial growth. That is a recovery indicator.

For the most part, industries seem to have been cautious and therefore should continue some expansion even if the pace drops off.

I have seen one blip that indicates an overrun, and that is apparently in retail stocking.

I am judging by the rail intermodal figures, which may be overstating the case. But those figures seem to show that retailers outran themselves in stocking and will be pulling back in ordering unless retail sales are very strong the rest of the year. This, however, probably is more of a problem for China, Taiwan and India than for US manufacturers.

I'm working on a long post, but I'll update with some more figures in the afternoon on this interim post.

Regardless, jobs growth will mostly depend on the small businesses, and there uncertainties really are weighing. You can see a video that is some sort of clip from Fox News posted on the NFIB website. The reality is that states are auditing and raising taxes, and the healthcare bill really will impose a lot of extra costs on smaller businesses. And who needs it? Right now businesses are still staggering forward trying to get their feet under them. Note that in the video the VAT comes up. All these regulations, most especially the 1099 for all vendors deal, are a nightmare and a real additional cost for businesses. They are overburdened and uncertain, but sure that they are going to face much higher compliance costs.

I have started a compilation for SuperDoc, but I am very afraid that when I finally do broach the subject he will just give up and close the doors of his practice. One thing for sure, this is not going to lower medical costs!

Update: Retail chain stores sales for June were not great, and imply that the retail sales report for June will be less than brilliant:

Chain-store sales were soft in June pointing to a second straight decline for the Commerce Department's ex-auto ex-gas category. Light traffic is a common theme in today's reports along with continued consumer caution. Sales trends are nearly even with May which remember was a disappointing month. Even if ex-auto ex-gas sales manage to match May's total, they will be well below April which more and more looks to have been a peak for the retail sector.Still, it's a heck of a lot better than the insane crash days.

Further Update:

Consumer credit is out. This is for May. April was revised to -7.3% annualized. May initial is -4.5%. In those two months revolving (generally CC) debt dropped 11.8% and 10.5% respectively.

And this is hardly a surprise, because credit card rates are still averaging at 14%, and 24 month personal loans at 11%. Nor, given the economy and widespread defaults, can that come down very much. Of course it is a mix - some "gold" customers are getting much better rates, and other customers are getting hosed. New car loans at six and a quarter. Non-revolving, which is disproportionately car loans (no real estate in this report) balance has dropped to about 2007. We generally do need autos more than CC bling.

In those same two months, other deposits (from H.8) grew 3.2% and 9.4% annualized. We don't have the final for June, but through the June 23rd week other deposits were up at a healthy pace (about 50 billion seasonally adjusted).

It looks decent to me. People just aren't going to borrow blindly at these rates, nor should they, nor is it all that feasible for most consumers to borrow very cheaply due to the risks in the economy.

For what it's worth, the seasonally adjusted revolving credit balance is about down to 2005 levels.

PS: And if you think banks can do much better on most of these rates, you'd better look at delinquencies and chargeoffs. A 10% charge-off rate on credit cards doesn't leave much room to drop rates no matter HOW low your cost of funds is, and an 11.29% delinquency rate on residential mortgages means that FHA and Fannie are going to cost the taxpayers a WHOLE lot of money. It's not nearly so much fun to holler about greedy bankers when it turns out that the taxpayers are the "greedy" bankers.

PPS: Something about the consumer credit report brings out the dementia in analysts and/or reporters. Take this Bloomberg article:

Consumer borrowing in the U.S. dropped in May more than forecast, a sign Americans are less willing to take on debt without an improvement in the labor market.Oh, could we put down the bong and try to focus our eyes on reality for a change? The numbers in the article are good, but this wacky interpretation perturbs me.

...

“Consumers are loathe to take out additional credit as the tight labor market is making it hard to get a job or maybe even keep one,” Chris Rupkey, chief financial economist at Bank of Tokyo-Mitsubishi UFJ Ltd. in New York, said before the report.

Consumers who have no money coming in are more than willing to run up their credit cards to buy groceries and keep the lights on - most of them won't be paying it back. But consumers who do have money coming in, but are getting 1% at best on their money in the bank, aren't going to be paying 10% to borrow. They'll wait a few months and pay cash, and this is by far the best financial return they can get - by NOT borrowing. The old "leveraging your way to wealth" meme is pretty well busted.

So we have a situation where the desperate impecunious will borrow, but the financially solvent and provident won't unless in extreme emergency, and then they are going to buckle down and pay it back as quickly as they can. They'll borrow for car loans, but not the casual stuff. This does make it hard for banks to improve their overall loan portfolios, but consumers should be looking after their own interests and not worrying about bank profitability.

And then, there are still some people who would like to refinance their homes but need to bring a little money to the table to do so. For many of them, it's a wise idea to save and refinance at current rates (taxpayer subsidized rates, but hey).

Wednesday, July 07, 2010

There Is No Doubt That Policy Uncertainty Is An Employment Drag

I am not sure what we can do to fix that with the current combination of Congress and Executive. A somewhat wacked-out ideology is driving a lot of decisions.

Two examples:

The first is the housing tax credit. The bottom line on the housing tax credit is that it pulled forward a lot of sales, but doesn't seem to have generated much in the way of sales that wouldn't have happened. The vicious reality is that mortgage delinquencies are now climbing once more, and quite a few new defaults will arise from the tax credit loans. Why on earth anyone would think that advancing a downpayment would work differently when done by a governmental act than by a private entity? But still we did it.

The worst of it is that mortgage interest rates are now so low that many of those who used the housing tax credit to buy would have been far better off if they had waited, so some of those buyers have been turned from good loans to bad loans by nothing more than market interference. Unfortunately, there will be further hangover as FHA insurance rates have to go higher, thus preventing new buyers from getting the real benefit of the low rates. In short, the long term effect of the housing tax credit will be to suppress overall demand over years.

Current policy makers seem stuck on the idea that if the government does a thing that is highly destructive when a private entity does it, the activity will somehow become economically functional due to the government interference. That defines "Stuck on Stupid".

The second example entails the recent attempt to interfere with medical insurance rates out of political purposes. Recently I discussed this in an oddly-named post. I am not going to revisit that post, which has primary resources and some discussion of the issues and figures, but the reality is that Massachusetts was completely wrong. As predicted, the risk-based capital levels of several of the (non-profit) companies involved have dropped so low that they are now under state supervision:

This sort of thing is causing many businesses to operate with great caution and possibly to defer investments where feasible. In some respects, any economic projections from this point on must deal with the issues of government. When the government takes over economic niches, it becomes an economic player. And when the government is a stupid economic player, the only option for other players is to short.

So don't expect stock prices to soar until the market perceives that something has changed about the government.

Money and pricing is a giant informational system that tells participants in the system how to plan for future production. When any entity (government or private) lies or subverts the informational exchange, uncertainty rises about true pricing. This may produce unexpected losses, or when the subversion is obvious it adds an uncertainty component to pricing. An uncertainty tax on pricing is a tax on future production and will show up in GDP as a negative. I am now tossing around various ideas about how to assess the impact of that certainty, but I doubt there are any good ways.

Two examples:

The first is the housing tax credit. The bottom line on the housing tax credit is that it pulled forward a lot of sales, but doesn't seem to have generated much in the way of sales that wouldn't have happened. The vicious reality is that mortgage delinquencies are now climbing once more, and quite a few new defaults will arise from the tax credit loans. Why on earth anyone would think that advancing a downpayment would work differently when done by a governmental act than by a private entity? But still we did it.

The worst of it is that mortgage interest rates are now so low that many of those who used the housing tax credit to buy would have been far better off if they had waited, so some of those buyers have been turned from good loans to bad loans by nothing more than market interference. Unfortunately, there will be further hangover as FHA insurance rates have to go higher, thus preventing new buyers from getting the real benefit of the low rates. In short, the long term effect of the housing tax credit will be to suppress overall demand over years.

Current policy makers seem stuck on the idea that if the government does a thing that is highly destructive when a private entity does it, the activity will somehow become economically functional due to the government interference. That defines "Stuck on Stupid".

The second example entails the recent attempt to interfere with medical insurance rates out of political purposes. Recently I discussed this in an oddly-named post. I am not going to revisit that post, which has primary resources and some discussion of the issues and figures, but the reality is that Massachusetts was completely wrong. As predicted, the risk-based capital levels of several of the (non-profit) companies involved have dropped so low that they are now under state supervision:

In the first good news in months, a state appeals board has reversed some of the price controls on the insurance industry that Gov. Deval Patrick imposed earlier this year. Late last month, the panel ruled that the action had no legal basis and ignored "economic realties."What happened is that the companies pulled from their reserves dropping their risk-based capital ratios (RBC) enough to trigger control levels. See the prior post for more info. This put handed the initiative to the state insurance regulators, who now must deal with the problem. Needless to say, there is only one solution - raise premiums.

...

In an April message to his staff, Robert Dynan, a career insurance commissioner responsible for ensuring the solvency of state carriers, wrote that his superiors "implemented artificial price caps on HMO rates. The rates, by design, have no actuarial support. This action was taken against my objections and without including me in the conversation."

Mr. Dynan added that "The current course . . . has the potential for catastrophic consequences including irreversible damage to our non-profit health care system" and that "there most likely will be a train wreck (or perhaps several train wrecks)."

Sure enough, the five major state insurers have so far collectively lost $116 million due to the rate cap. Three of them are now under administrative oversight because of concerns about their financial viability.

This sort of thing is causing many businesses to operate with great caution and possibly to defer investments where feasible. In some respects, any economic projections from this point on must deal with the issues of government. When the government takes over economic niches, it becomes an economic player. And when the government is a stupid economic player, the only option for other players is to short.

So don't expect stock prices to soar until the market perceives that something has changed about the government.

Money and pricing is a giant informational system that tells participants in the system how to plan for future production. When any entity (government or private) lies or subverts the informational exchange, uncertainty rises about true pricing. This may produce unexpected losses, or when the subversion is obvious it adds an uncertainty component to pricing. An uncertainty tax on pricing is a tax on future production and will show up in GDP as a negative. I am now tossing around various ideas about how to assess the impact of that certainty, but I doubt there are any good ways.

Monday, July 05, 2010

The End Of Sexpectation, At Least

With the word "depression" reverberating everywhere, I find myself willing to begin to invest for the first time in a long while.

The problem with economics is that it is a mix of very real and inescapable factors along with group psychology, and then politics comes in. But as I look at oil prices, I feel that we have at least reached a situation in which the markets are being shifted toward fundamentals and less of the bling. I do not like to buy in bling environments.

From EIA:

The high unemployment rate is one factor involved, but so is fleet replacement.

I view money and pricing as an informational network. If that network functions well, the participants gain the maximum ability to make efficient decisions, and economic productivity is boosted.

I am very busy and still thinking, but there are positive factors as well as negative factors.

Consumer Metrics also shows an uptick in the 91 day indexes, and it isn't hard to figure out where that is coming from. Gas prices have dropped enough to push a little, and the first $250 checks for seniors hitting the doughnut hole are adding in a little purchasing power.

Anyway, I'm still cranking away at it - but I'm guessing CF is going to be getting a few more jets.

The problem with economics is that it is a mix of very real and inescapable factors along with group psychology, and then politics comes in. But as I look at oil prices, I feel that we have at least reached a situation in which the markets are being shifted toward fundamentals and less of the bling. I do not like to buy in bling environments.

From EIA:

The high unemployment rate is one factor involved, but so is fleet replacement.

I view money and pricing as an informational network. If that network functions well, the participants gain the maximum ability to make efficient decisions, and economic productivity is boosted.

I am very busy and still thinking, but there are positive factors as well as negative factors.

Consumer Metrics also shows an uptick in the 91 day indexes, and it isn't hard to figure out where that is coming from. Gas prices have dropped enough to push a little, and the first $250 checks for seniors hitting the doughnut hole are adding in a little purchasing power.

Anyway, I'm still cranking away at it - but I'm guessing CF is going to be getting a few more jets.

Sunday, July 04, 2010

Happy Fourth

Despite all the problems, it still is and will remain a great country as long as we can keep our destiny in our own hands and remember that we have the opportunity and the responsibility. At least we have the chance. In this life, a chance is the best you can get, but one doesn't make much of one's chances if one doesn't recognize them.

I've always felt so lucky to be born here. The Chief feels so lucky to have been able to become a citizen. When I think of what my grandparents were born into, and what the Chief was born into, my heart and mind are filled with gratitude for my good fortune. I did not deserve it, but I can live a life that makes the most of the chances I have had.

That's why Independence Day is so important. It reminds us that all they wanted back then was the chance to do it right, and to correct the mistakes of the past. And all our history has shown that given the chance, human beings can break away from the mistakes of the past and build a better future.

I've always felt so lucky to be born here. The Chief feels so lucky to have been able to become a citizen. When I think of what my grandparents were born into, and what the Chief was born into, my heart and mind are filled with gratitude for my good fortune. I did not deserve it, but I can live a life that makes the most of the chances I have had.

That's why Independence Day is so important. It reminds us that all they wanted back then was the chance to do it right, and to correct the mistakes of the past. And all our history has shown that given the chance, human beings can break away from the mistakes of the past and build a better future.

Friday, July 02, 2010

Nearer My God To Thee

Oh, no. I thought the employment report would be bad, but not this bad. I mean, the headline number looks great, but you head for diapers when you look at the household survey:

There is some good stuff in here - those who are working are less likely to be working part-time due to slack work or the inability to find full-time work.

The establishment survey reports average weekly hours down .1 (33.2>33.1). All of that is in goods-producing; service industries are stable.

There is a severe temptation to just cuddle up to the establishment survey, because the numbers there look so much better - only a loss of 125,000 jobs, of which all were in government (mostly Census), and private industries gained 83K (-8K goods on 22K construction loss, +91K services). But the reality is that the household survey is generally far more accurate in these conditions in the first month.

And then, one must deal with the last month's higher initial claims. The household survey and initial claims sync very well. Also, one cannot really explain this away as a wave of retirements, because Table A-16 shows that U-5 did not decrease. U-6 edged down, but that is because more employed people are working full-time. The only difference between U-5 and U-6 is that U-6 counts involuntary part-time workers as well as discouraged, etc. U-5 is still at 11%, and last June it was at 10.8%.

This is a totally sickening employment report. The NSA birth-death adjustment for the establishment survey for June is 147K. Scroll down to see the tables.

I have to rethink my second-half forecast now.

Update: And this just puts the icing on the cake. Manufacturers' shipments, inventories and orders full report for May. Bottom line: New orders dropped 1.4%, shipments dropped 1.3%, durable goods inventories rose 0.9%. When you look at the inventories page, you see that value of inventories only really dropped for non-durable, and when you go through that category, it's petroleum.

So this is the end of the inventory cycle. From here, it's sales. And if people are out of the workforce because they have lost hope of finding a job, final sales aren't going to be roaring ahead. Graph published so obligingly by Census: