Tuesday, August 10, 2010

Uh-Oh, Three Month Decline After April

Update 8/12: The first horseman of the second apocalypse has been sighted. Last week's initial claims were revised up to 482,000, and this week's advance initial claims is reported as 484,000. We have never made a more stupid mistake than in not extending some form of unemployment benefits for those who have recently lost their jobs in high-unemployment areas. (The unemployment extension is still just for those who lost their jobs a while ago.) I realize that initial unemployment claims are confusing to many, but the bottom line here is that this week's non-seasonally adjusted initial claims are 420,997, and last year's claims for the comparable period were 482,590. At that time we were still losing jobs pretty rapidly. If continued, claims at this pace are entirely consistent with a new contraction. If I had the time, I would update the 1980/1981 graph for you - we seem to be moving toward 1981. This week's four-week moving average is 473,500. I do not know of anything in the works that should distort initial claims this much. End update.

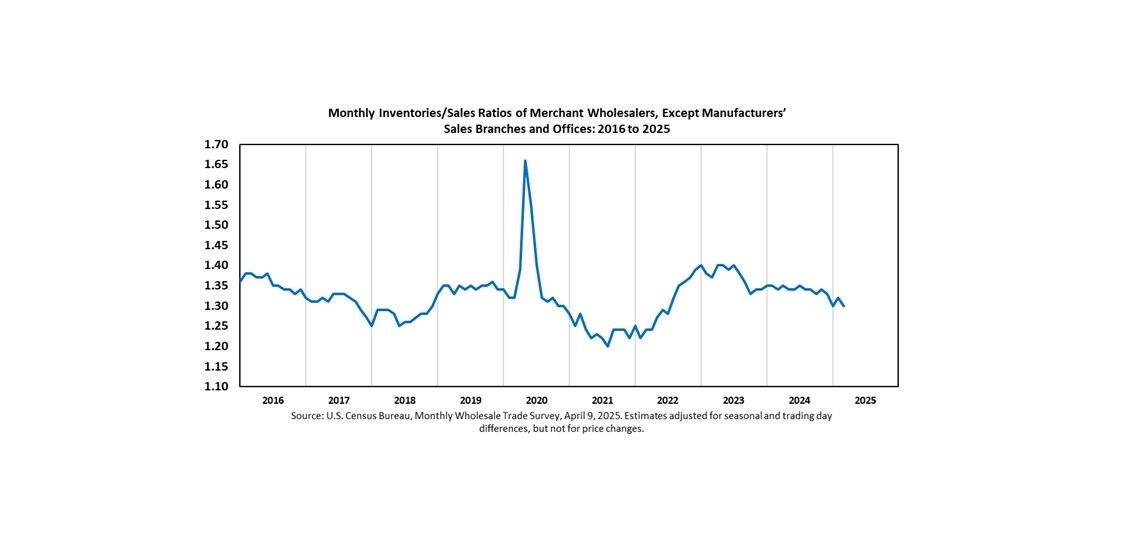

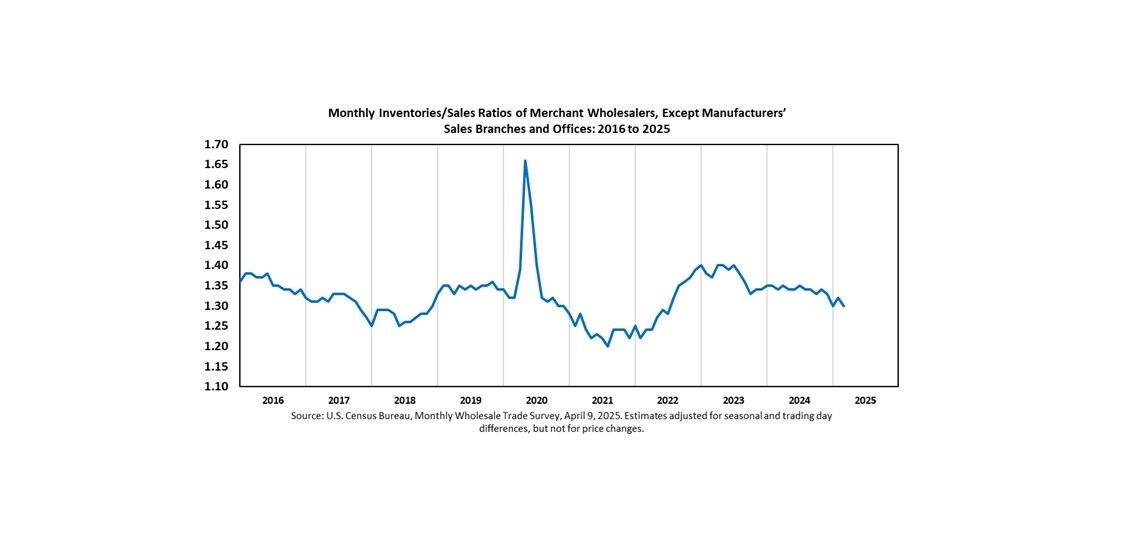

Wholesale Sales/Inventory ratios show signs of trouble:

This only goes through June, but the inventories rose 0.5 > 0.1 for the last two months, and sales dropped -0.5 > -0.7 for the last two months. In May durable sales rose 0.5 and in June they dropped -.02. And that doesn't seem so bad, except nondurable sales dropped -1.4 > -1.1 for May and June. So final demand is declining and orders will keep following.

NACM (National Association of Credit Managers, covers business-to-business credit) was released last week. The manufacturing index looked bad, although services rose a bit. But this index has shown an increasing pattern of month-to-month declines for three months. Take a look at their July report, and don't neglect the commentary.

Note that there is a stunning correlation across a wide variety of reports showing that April WAS the peak for the near-term. The only question now is how far down we will go? As of August, we are still in an improving economy, although the real pace of improvement has fallen hard, and price indexes (as measured by M_O_M) for consumer goods show that free cash in consumers' hands is due to be swallowed up more and more by the basics.

NFIB's July Small Business survey was pretty negative. Current factors are okay, but expectations are dropping rapidly. The small business outlook has fallen from 8 in May to -15 in July.

Why am I so sure that we are still growing? Well, if you look at NACM you see that credit sales are still in the pretty positive range, and the Fed's Commercial Paper (look at blue line for non-financials) is somewhat encouraging as well:

I say "somewhat" encouraging because look what it did in 2007. I prefer to see a slow steady increase rather than the pop up of recent months. You can argue this either way, because for many companies, the commercial paper market is delivering by far the lowest financing costs. So if companies are covering short-range financing needs on this market, and will get the money back to cover by profit on sales of products for which they are ramping up production (look at Chicago PMI), then everything's A-okay.

BUT, if companies find themselves squeezed by slightly lower sales and a slow-down in orders and then there is enough agita over this to raise commercial paper rates, then the weaker borrowers on this market might find themselves hit by something of a rate shock with revenues trending slower, base costs of production rising, and rates rising. So I will be watching this with some attention, because fundamental costs of production are going up as are crude product costs, but the sales trend looks iffy.

If you look at Commercial Paper Outstandings for Nonfinancial domestic, seasonally adjusted, you'll see that we may be nearing problem territory. And if you want to look at volume stats for AA Nonfinancial, you'll see that we are ballooning up at the short end (1-4 days), although in August so far we at least moved some to 10-20. So they are going for the low, low, low rates. A2/P2 Nonfinancial issues and volumes are dropping overall, although what there is out there is stuck in the 1-4 day.

The other side of the coin is H.8 Assets and Liabilities of Commercial Banks. Other deposits, which is basically your spendable cash for smaller businesses and consumers, is still rising but at a lower pace - 5.3% for June. So far for July the pace is picking up as it seems to be for large time deposits (Jumbos). The huge draw-down in large time deposits evaporated last month, so indeed that was mostly driven by the tax credit for housing. When the tax credit evaporated, so did that draw-down. And there should also have been a draw down in other deposits, so we will have to wait for a month or two to see what's really flying. One of the things I am wondering about is that when there was probably a partial shift from large time deposits to other deposits; I strongly suspect that in many cases parents pulled money out of CDs to give to kids for a hefty home downpayment.

Anyway, clearly the downturn risks are rising quite rapidly. I see no possibility that the economy can sustain growth in 2011 if all the Bush tax cuts expire, and the probability is very high that any significant tax increase could tip it back.

Q2 GDP should be revised down.

Wholesale Sales/Inventory ratios show signs of trouble:

This only goes through June, but the inventories rose 0.5 > 0.1 for the last two months, and sales dropped -0.5 > -0.7 for the last two months. In May durable sales rose 0.5 and in June they dropped -.02. And that doesn't seem so bad, except nondurable sales dropped -1.4 > -1.1 for May and June. So final demand is declining and orders will keep following.

NACM (National Association of Credit Managers, covers business-to-business credit) was released last week. The manufacturing index looked bad, although services rose a bit. But this index has shown an increasing pattern of month-to-month declines for three months. Take a look at their July report, and don't neglect the commentary.

Note that there is a stunning correlation across a wide variety of reports showing that April WAS the peak for the near-term. The only question now is how far down we will go? As of August, we are still in an improving economy, although the real pace of improvement has fallen hard, and price indexes (as measured by M_O_M) for consumer goods show that free cash in consumers' hands is due to be swallowed up more and more by the basics.

NFIB's July Small Business survey was pretty negative. Current factors are okay, but expectations are dropping rapidly. The small business outlook has fallen from 8 in May to -15 in July.

Why am I so sure that we are still growing? Well, if you look at NACM you see that credit sales are still in the pretty positive range, and the Fed's Commercial Paper (look at blue line for non-financials) is somewhat encouraging as well:

I say "somewhat" encouraging because look what it did in 2007. I prefer to see a slow steady increase rather than the pop up of recent months. You can argue this either way, because for many companies, the commercial paper market is delivering by far the lowest financing costs. So if companies are covering short-range financing needs on this market, and will get the money back to cover by profit on sales of products for which they are ramping up production (look at Chicago PMI), then everything's A-okay.

BUT, if companies find themselves squeezed by slightly lower sales and a slow-down in orders and then there is enough agita over this to raise commercial paper rates, then the weaker borrowers on this market might find themselves hit by something of a rate shock with revenues trending slower, base costs of production rising, and rates rising. So I will be watching this with some attention, because fundamental costs of production are going up as are crude product costs, but the sales trend looks iffy.

If you look at Commercial Paper Outstandings for Nonfinancial domestic, seasonally adjusted, you'll see that we may be nearing problem territory. And if you want to look at volume stats for AA Nonfinancial, you'll see that we are ballooning up at the short end (1-4 days), although in August so far we at least moved some to 10-20. So they are going for the low, low, low rates. A2/P2 Nonfinancial issues and volumes are dropping overall, although what there is out there is stuck in the 1-4 day.

The other side of the coin is H.8 Assets and Liabilities of Commercial Banks. Other deposits, which is basically your spendable cash for smaller businesses and consumers, is still rising but at a lower pace - 5.3% for June. So far for July the pace is picking up as it seems to be for large time deposits (Jumbos). The huge draw-down in large time deposits evaporated last month, so indeed that was mostly driven by the tax credit for housing. When the tax credit evaporated, so did that draw-down. And there should also have been a draw down in other deposits, so we will have to wait for a month or two to see what's really flying. One of the things I am wondering about is that when there was probably a partial shift from large time deposits to other deposits; I strongly suspect that in many cases parents pulled money out of CDs to give to kids for a hefty home downpayment.

Anyway, clearly the downturn risks are rising quite rapidly. I see no possibility that the economy can sustain growth in 2011 if all the Bush tax cuts expire, and the probability is very high that any significant tax increase could tip it back.

Q2 GDP should be revised down.

Comments:

<< Home

The stimulus boost ran out. Instead of trying to

protect asset prices, they should have tried to protect

jobs. Oh well, back to the drawing board.

Sporkfed

protect asset prices, they should have tried to protect

jobs. Oh well, back to the drawing board.

Sporkfed

Spork - in the form of the Fed buying T-bills.

Ah, well....

One of the problems is that there isn't that much real demand for money.

Clearly, the Fed has its doubts.

This week's T-bill coverage took a noticeable decline.

Ah, well....

One of the problems is that there isn't that much real demand for money.

Clearly, the Fed has its doubts.

This week's T-bill coverage took a noticeable decline.

M_O_M, do you mean not much demand for money, or not much demand for credit? Savings rate seems to be going up pretty steadily, although I have to admit that MZM has actually declined of late (!!!). Not sure how to interpret that. Still, I would expect a continued increase in the demand for savings instruments and conservative investments.

MoM,

Is it possible that "other deposits" are rising as a function of falling money market fund assets? Also, consumers are pulling money out of equity mutual funds as well.

Is it possible that "other deposits" are rising as a function of falling money market fund assets? Also, consumers are pulling money out of equity mutual funds as well.

Neil - demand for assets that will generate cash flow for you is quite a different thing than demand for money. I do mean low demand for money, aka low credit demand.

Realistically, only people who truly have to borrow money are now borrowing it, and that includes most companies. From a consumer viewpoint, it is quite rational to pay down most loans given the very low return on money due to artificially low interest rates.

Realistically, a great many people would get the best return for their money by paying down debt.

The hope, of course, is that lower debt payments will gradually put more money back into consumers' hands thence to be spent, and that companies will increase production and investment because the cost of doing so (borrowing money) is quite low.

But the reality is a little different.

Realistically, only people who truly have to borrow money are now borrowing it, and that includes most companies. From a consumer viewpoint, it is quite rational to pay down most loans given the very low return on money due to artificially low interest rates.

Realistically, a great many people would get the best return for their money by paying down debt.

The hope, of course, is that lower debt payments will gradually put more money back into consumers' hands thence to be spent, and that companies will increase production and investment because the cost of doing so (borrowing money) is quite low.

But the reality is a little different.

David - I suspect so. We'll know in a couple of months when we have the chance to see the progression of deposits sans the housing tax credit distortion, which showed up in most types of accounts with large balances.

Based on pricing in stores and inflation measures, we should expect the prices of necessities to slowly rise for the most part. My burning and unanswered question is about profit margins. I bet most companies are going to reduce production to maintain margins.

Given that the pace of growth in Asia is still generally good, although probably set to decline over the next year, I think we are going to see a slow rise in costs in the US no matter what. I am betting this will generate more consumer caution.

I don't have a good feel yet for the role of delayed consumption in generating pent-up demand vs the increased caution.

I also think that most households 55 and older are very worried about retirements and certainly spooked by the talk of further cuts in Social Security, so I expect those households to generate less demand than has been characteristic of recent decades.

Based on pricing in stores and inflation measures, we should expect the prices of necessities to slowly rise for the most part. My burning and unanswered question is about profit margins. I bet most companies are going to reduce production to maintain margins.

Given that the pace of growth in Asia is still generally good, although probably set to decline over the next year, I think we are going to see a slow rise in costs in the US no matter what. I am betting this will generate more consumer caution.

I don't have a good feel yet for the role of delayed consumption in generating pent-up demand vs the increased caution.

I also think that most households 55 and older are very worried about retirements and certainly spooked by the talk of further cuts in Social Security, so I expect those households to generate less demand than has been characteristic of recent decades.

Note - David, I am still assuming that the remarkably large swings in large time deposits can be attributed to housing purchases due to the timing, but at this point I believe it is a safe assumption.

I think the information you cite shows that your conclusions in your July 19 post about the short-run prospects for the unemployed still hold: " I don't see much hope for big impetus on the horizon. The best we can hope for is a slow climb out of the abyss, and the ability to juice it is just about gone. "

The sad thing is that the term “ abyss “ probably is a very accurate description of the growth US income and employment over the long term, because of two very disturbing overhangs that are affecting the plans of every corporation in the US regarding future expansion of their businesses : the imposition of the Obama healthcare bill, and the $1 trillion plus deficits which are actually low end, by the book estimates of the CBO. In fact, the LONG TERM hopes for the unemployed may even be worse than they are for the short term, because these 2 overhangs will reduce the wages of even those who have jobs.

The long term outlook for the employed is even worse than we are experiencing now, because the healthcare bill and the deficit will inevitably lead to a dramatic reduction of profit in the economy and reduced rates of business expansion and innovation. Since these 2 overhangs are now hard-wired into the economy, it is reasonable to say that the rate of growth in the natural rate of output of the economy will slow dramatically, and permanentl I think the information you cite shows that your conclusions in your July 19 post about the short-run prospects for the unemployed still hold: " I don't see much hope for big impetus on the horizon. The best we can hope for is a slow climb out of the abyss, and the ability to juice it is just about gone. "

The sad thing is that the term “ abyss “ probably is a very accurate description of the growth and level of US income and employment over the long term, because of two very disturbing overhangs that are affecting the plans of every corporation in the US regarding future expansion of their businesses : the imposition of the Obama healthcare bill, and the $1 trillion plus deficits which are actually low end, by the book estimates of the CBO. In fact, the LONG TERM hopes for the unemployed may even be worse than they are for the short term, because these 2 overhangs will reduce the wages of even those who have jobs.

The long term outlook for the employed is even worse than we are experiencing now, because the healthcare bill and the deficit will inevitably lead to a dramatic reduction of profit in the economy and reduced rates of business expansion and innovation. Since these 2 overhangs are now hard-wired into the economy, it is reasonable to say that the rate of growth in the natural rate of output of the economy will slow dramatically, and permanently. Because effects which reduce output concurrently reduce demand for labor, the decline in the growth of the natural rate of output will simultaneously produce a ( permanently ) higher natural rate of unemployment in the economy, and a lower median wage.

Although the occasional business may find ways as time goes on to create partial work-arounds, or game the new environment to their advantage, the macro effect in the broad economy will be to sharply reduce the rate of growth of output below what it would be in the overhang’s absence. The stagflation of the ‘70’s was an analogous situation, but this will be worse because the overall comparative advantage of the US economy over its competitors has been substantially reduced by 30 years of bad public policy.

( continued below )

The sad thing is that the term “ abyss “ probably is a very accurate description of the growth US income and employment over the long term, because of two very disturbing overhangs that are affecting the plans of every corporation in the US regarding future expansion of their businesses : the imposition of the Obama healthcare bill, and the $1 trillion plus deficits which are actually low end, by the book estimates of the CBO. In fact, the LONG TERM hopes for the unemployed may even be worse than they are for the short term, because these 2 overhangs will reduce the wages of even those who have jobs.

The long term outlook for the employed is even worse than we are experiencing now, because the healthcare bill and the deficit will inevitably lead to a dramatic reduction of profit in the economy and reduced rates of business expansion and innovation. Since these 2 overhangs are now hard-wired into the economy, it is reasonable to say that the rate of growth in the natural rate of output of the economy will slow dramatically, and permanentl I think the information you cite shows that your conclusions in your July 19 post about the short-run prospects for the unemployed still hold: " I don't see much hope for big impetus on the horizon. The best we can hope for is a slow climb out of the abyss, and the ability to juice it is just about gone. "

The sad thing is that the term “ abyss “ probably is a very accurate description of the growth and level of US income and employment over the long term, because of two very disturbing overhangs that are affecting the plans of every corporation in the US regarding future expansion of their businesses : the imposition of the Obama healthcare bill, and the $1 trillion plus deficits which are actually low end, by the book estimates of the CBO. In fact, the LONG TERM hopes for the unemployed may even be worse than they are for the short term, because these 2 overhangs will reduce the wages of even those who have jobs.

The long term outlook for the employed is even worse than we are experiencing now, because the healthcare bill and the deficit will inevitably lead to a dramatic reduction of profit in the economy and reduced rates of business expansion and innovation. Since these 2 overhangs are now hard-wired into the economy, it is reasonable to say that the rate of growth in the natural rate of output of the economy will slow dramatically, and permanently. Because effects which reduce output concurrently reduce demand for labor, the decline in the growth of the natural rate of output will simultaneously produce a ( permanently ) higher natural rate of unemployment in the economy, and a lower median wage.

Although the occasional business may find ways as time goes on to create partial work-arounds, or game the new environment to their advantage, the macro effect in the broad economy will be to sharply reduce the rate of growth of output below what it would be in the overhang’s absence. The stagflation of the ‘70’s was an analogous situation, but this will be worse because the overall comparative advantage of the US economy over its competitors has been substantially reduced by 30 years of bad public policy.

( continued below )

The way Obama health bill will decrease demand for labor much below what it would be in the bill’s absence is its requirement in huge increases in health costs for US corporations, which costs can be increased at any time in the future by the unelected bureaucracies created in that bill. On top of the mandated cost increases will be the overhead required to hire hundreds of thousands of new Federal employees to administer the system, so that the delivery $1 of healthcare may well cost $2 due to the added overhead. These higher costs will permanently reduce the profitability of US corporations, and make many of them unprofitable. Without profits, corporations can not secure the bank lending necessary for expanding their business into new areas, and building the plant and buying the equipment necessary to support that expansion in the market. Without expansion, there will be no growth in labor demand.

The coming increase in healthcare costs will have another damaging effect on unemployment by reducing US technological innovation. Companies struggling to maintain profitability find research and development budgets tempting places to pare spending. With the large, and growing costs from the Obama healthcare bill, this tendency towards parimony will only grow over time. The alternate source of funds for R & D, bank lending, will of course be limited by lower profitability, as in the case of lending for building new plant. Underwriting standards for lending to businesses are fundamentally the same regardless of the stated uses of the funds.

The second event that will hurt US employment will be increases in US corporate taxes, which will be large, and ever-growing.

Corporate taxes in the US will definitely rise strongly because Obama and Congress will be unable to borrow from the Chinese and, as Democrats, willl refuse to use the option of addressing the $1 trillion plus budget deficits by cutting the budget, because that would run counter to their party’s strategy of increasing dependency on government. With spending cuts off the table, the only option for closing the gap, in their view, is by increasing the taxes on US citizens and the taxes on US corporate profits by a minimum of $1 trillion per year.. How large will be the increases in these taxes for the average person, and average corporation? One estimate shows that doubling taxes would still leave the US with unsustainable deficits of $400 billion per year.

Although it will cause great hardship for families to pay these vastly increased taxes, the tax increases on corporate profits will have even worse effects on the unemployed (not to mention retiree’s pensions ). Less after tax profit will ultimately mean US firms subject to US taxes will lose out in the competition for investment capital, creating a decreased need for hiring, and a lower median wage.

The combined impact of the healthcare bill and higher taxes will strengthen the trend of selling into the US market from production bases in countries other than than the US.

( continued below )

The coming increase in healthcare costs will have another damaging effect on unemployment by reducing US technological innovation. Companies struggling to maintain profitability find research and development budgets tempting places to pare spending. With the large, and growing costs from the Obama healthcare bill, this tendency towards parimony will only grow over time. The alternate source of funds for R & D, bank lending, will of course be limited by lower profitability, as in the case of lending for building new plant. Underwriting standards for lending to businesses are fundamentally the same regardless of the stated uses of the funds.

The second event that will hurt US employment will be increases in US corporate taxes, which will be large, and ever-growing.

Corporate taxes in the US will definitely rise strongly because Obama and Congress will be unable to borrow from the Chinese and, as Democrats, willl refuse to use the option of addressing the $1 trillion plus budget deficits by cutting the budget, because that would run counter to their party’s strategy of increasing dependency on government. With spending cuts off the table, the only option for closing the gap, in their view, is by increasing the taxes on US citizens and the taxes on US corporate profits by a minimum of $1 trillion per year.. How large will be the increases in these taxes for the average person, and average corporation? One estimate shows that doubling taxes would still leave the US with unsustainable deficits of $400 billion per year.

Although it will cause great hardship for families to pay these vastly increased taxes, the tax increases on corporate profits will have even worse effects on the unemployed (not to mention retiree’s pensions ). Less after tax profit will ultimately mean US firms subject to US taxes will lose out in the competition for investment capital, creating a decreased need for hiring, and a lower median wage.

The combined impact of the healthcare bill and higher taxes will strengthen the trend of selling into the US market from production bases in countries other than than the US.

( continued below )

The way Obama health bill will decrease demand for labor much below what it would be in the bill’s absence is its requirement in huge increases in health costs for US corporations, which costs can be increased at any time in the future by the unelected bureaucracies created in that bill. On top of the mandated cost increases will be the overhead required to hire hundreds of thousands of new Federal employees to administer the system, so that the delivery $1 of healthcare may well cost $2 due to the added overhead. These higher costs will permanently reduce the profitability of US corporations, and make many of them unprofitable. Without profits, corporations can not secure the bank lending necessary for expanding their business into new areas, and building the plant and buying the equipment necessary to support that expansion in the market. Without expansion, there will be no growth in labor demand.

The coming increase in healthcare costs will have another damaging effect on unemployment by reducing US technological innovation. Companies struggling to maintain profitability find research and development budgets tempting places to pare spending. With the large, and growing costs from the Obama healthcare bill, this tendency towards parimony will only grow over time. The alternate source of funds for R & D, bank lending, will of course be limited by lower profitability, as in the case of lending for building new plant. Underwriting standards for lending to businesses are fundamentally the same regardless of the stated uses of the funds.

The second event that will hurt US employment will be increases in US corporate taxes, which will be large, and ever-growing.

Corporate taxes in the US will definitely rise strongly because Obama and Congress will be unable to borrow from the Chinese and, as Democrats, willl refuse to use the option of addressing the $1 trillion plus budget deficits by cutting the budget, because that would run counter to their party’s strategy of increasing dependency on government. With spending cuts off the table, the only option for closing the gap, in their view, is by increasing the taxes on US citizens and the taxes on US corporate profits by a minimum of $1 trillion per year.. How large will be the increases in these taxes for the average person, and average corporation? One estimate shows that doubling taxes would still leave the US with unsustainable deficits of $400 billion per year.

Although it will cause great hardship for families to pay these vastly increased taxes, the tax increases on corporate profits will have even worse effects on the unemployed (not to mention retiree’s pensions ). Less after tax profit will ultimately mean US firms subject to US taxes will lose out in the competition for investment capital, creating a decreased need for hiring, and a lower median wage.

The combined impact of the healthcare bill and higher taxes will strengthen the trend of selling into the US market from production bases in countries other than than the US.

( continued below )

The coming increase in healthcare costs will have another damaging effect on unemployment by reducing US technological innovation. Companies struggling to maintain profitability find research and development budgets tempting places to pare spending. With the large, and growing costs from the Obama healthcare bill, this tendency towards parimony will only grow over time. The alternate source of funds for R & D, bank lending, will of course be limited by lower profitability, as in the case of lending for building new plant. Underwriting standards for lending to businesses are fundamentally the same regardless of the stated uses of the funds.

The second event that will hurt US employment will be increases in US corporate taxes, which will be large, and ever-growing.

Corporate taxes in the US will definitely rise strongly because Obama and Congress will be unable to borrow from the Chinese and, as Democrats, willl refuse to use the option of addressing the $1 trillion plus budget deficits by cutting the budget, because that would run counter to their party’s strategy of increasing dependency on government. With spending cuts off the table, the only option for closing the gap, in their view, is by increasing the taxes on US citizens and the taxes on US corporate profits by a minimum of $1 trillion per year.. How large will be the increases in these taxes for the average person, and average corporation? One estimate shows that doubling taxes would still leave the US with unsustainable deficits of $400 billion per year.

Although it will cause great hardship for families to pay these vastly increased taxes, the tax increases on corporate profits will have even worse effects on the unemployed (not to mention retiree’s pensions ). Less after tax profit will ultimately mean US firms subject to US taxes will lose out in the competition for investment capital, creating a decreased need for hiring, and a lower median wage.

The combined impact of the healthcare bill and higher taxes will strengthen the trend of selling into the US market from production bases in countries other than than the US.

( continued below )

The way the Obama health bill will decrease demand for labor much below what it would be in the bill’s absence is its requirement in huge increases in health costs for US corporations, which costs can be increased at any time in the future by the unelected bureaucracies created in that bill. On top of the mandated cost increases will be the overhead required to hire hundreds of thousands of new Federal employees to administer the system, so that the delivery $1 of healthcare may well cost $2 due to the added overhead. These higher costs will permanently reduce the profitability of US corporations, and make many of them unprofitable. Without profits, corporations can not secure the bank lending necessary for expanding their business into new areas, and building the plant and buying the equipment necessary to support that expansion in the market. Without expansion, there will be no growth in labor demand.

The coming increase in healthcare costs will have another damaging effect on unemployment by reducing US technological innovation. Companies struggling to maintain profitability find research and development budgets tempting places to pare spending. With the large, and growing costs from the Obama healthcare bill, this tendency towards parimony will only grow over time. The alternate source of funds for R & D, bank lending, will of course be limited by lower profitability, as in the case of lending for building new plant. Underwriting standards for lending to businesses are fundamentally the same regardless of the stated uses of the funds.

The second event that will hurt US employment will be increases in US corporate taxes, which will be large, and ever-growing.

Corporate taxes in the US will definitely rise strongly because Obama and Congress will be unable to borrow from the Chinese and, as Democrats, willl refuse to use the option of addressing the $1 trillion plus budget deficits by cutting the budget, because that would run counter to their party’s strategy of increasing dependency on government. With spending cuts off the table, the only option for closing the gap, in their view, is by increasing the taxes on US citizens and the taxes on US corporate profits by a minimum of $1 trillion per year.. How large will be the increases in these taxes for the average person, and average corporation? One estimate shows that doubling taxes would still leave the US with unsustainable deficits of $400 billion per year.

Although it will cause great hardship for families to pay these vastly increased taxes, the tax increases on corporate profits will have even worse effects on the unemployed (not to mention retiree’s pensions ). Less after tax profit will ultimately mean US firms subject to US taxes will lose out in the competition for investment capital, creating a decreased need for hiring, and a lower median wage.

The combined impact of the healthcare bill and higher taxes will strengthen the trend of selling into the US market from production bases in countries other than than the US.

( continued )

The coming increase in healthcare costs will have another damaging effect on unemployment by reducing US technological innovation. Companies struggling to maintain profitability find research and development budgets tempting places to pare spending. With the large, and growing costs from the Obama healthcare bill, this tendency towards parimony will only grow over time. The alternate source of funds for R & D, bank lending, will of course be limited by lower profitability, as in the case of lending for building new plant. Underwriting standards for lending to businesses are fundamentally the same regardless of the stated uses of the funds.

The second event that will hurt US employment will be increases in US corporate taxes, which will be large, and ever-growing.

Corporate taxes in the US will definitely rise strongly because Obama and Congress will be unable to borrow from the Chinese and, as Democrats, willl refuse to use the option of addressing the $1 trillion plus budget deficits by cutting the budget, because that would run counter to their party’s strategy of increasing dependency on government. With spending cuts off the table, the only option for closing the gap, in their view, is by increasing the taxes on US citizens and the taxes on US corporate profits by a minimum of $1 trillion per year.. How large will be the increases in these taxes for the average person, and average corporation? One estimate shows that doubling taxes would still leave the US with unsustainable deficits of $400 billion per year.

Although it will cause great hardship for families to pay these vastly increased taxes, the tax increases on corporate profits will have even worse effects on the unemployed (not to mention retiree’s pensions ). Less after tax profit will ultimately mean US firms subject to US taxes will lose out in the competition for investment capital, creating a decreased need for hiring, and a lower median wage.

The combined impact of the healthcare bill and higher taxes will strengthen the trend of selling into the US market from production bases in countries other than than the US.

( continued )

The way the Obama health bill will decrease demand for labor much below what it would be in the bill’s absence is its requirement in huge increases in health costs for US corporations, which costs can be increased at any time in the future by the unelected bureaucracies created in that bill. On top of the mandated cost increases will be the overhead required to hire hundreds of thousands of new Federal employees to administer the system, so that the delivery $1 of healthcare may well cost $2 due to the added overhead. These higher costs will permanently reduce the profitability of US corporations, and make many of them unprofitable. Without profits, corporations can not secure the bank lending necessary for expanding their business into new areas, and building the plant and buying the equipment necessary to support that expansion in the market. Without expansion, there will be no growth in labor demand.

The coming increase in healthcare costs will have another damaging effect on unemployment by reducing US technological innovation. Companies struggling to maintain profitability find research and development budgets tempting places to pare spending. With the large, and growing costs from the Obama healthcare bill, this tendency towards parimony will only grow over time. The alternate source of funds for R & D, bank lending, will of course be limited by lower profitability, as in the case of lending for building new plant. Underwriting standards for lending to businesses are fundamentally the same regardless of the stated uses of the funds.

The second event that will hurt US employment will be increases in US corporate taxes, which will be large, and ever-growing.

Corporate taxes in the US will definitely rise strongly because Obama and Congress will be unable to borrow from the Chinese and, as Democrats, willl refuse to use the option of addressing the $1 trillion plus budget deficits by cutting the budget, because that would run counter to their party’s strategy of increasing dependency on government. With spending cuts off the table, the only option for closing the gap, in their view, is by increasing the taxes on US citizens and the taxes on US corporate profits by a minimum of $1 trillion per year.. How large will be the increases in these taxes for the average person, and average corporation? One estimate shows that doubling taxes would still leave the US with unsustainable deficits of $400 billion per year.

Although it will cause great hardship for families to pay these vastly increased taxes, the tax increases on corporate profits will have even worse effects on the unemployed (not to mention retiree’s pensions ). Less after tax profit will ultimately mean US firms subject to US taxes will lose out in the competition for investment capital, creating a decreased need for hiring, and a lower median wage.

The combined impact of the healthcare bill and higher taxes will strengthen the trend of selling into the US market from production bases in countries other than than the US.

( continued )

The coming increase in healthcare costs will have another damaging effect on unemployment by reducing US technological innovation. Companies struggling to maintain profitability find research and development budgets tempting places to pare spending. With the large, and growing costs from the Obama healthcare bill, this tendency towards parimony will only grow over time. The alternate source of funds for R & D, bank lending, will of course be limited by lower profitability, as in the case of lending for building new plant. Underwriting standards for lending to businesses are fundamentally the same regardless of the stated uses of the funds.

The second event that will hurt US employment will be increases in US corporate taxes, which will be large, and ever-growing.

Corporate taxes in the US will definitely rise strongly because Obama and Congress will be unable to borrow from the Chinese and, as Democrats, willl refuse to use the option of addressing the $1 trillion plus budget deficits by cutting the budget, because that would run counter to their party’s strategy of increasing dependency on government. With spending cuts off the table, the only option for closing the gap, in their view, is by increasing the taxes on US citizens and the taxes on US corporate profits by a minimum of $1 trillion per year.. How large will be the increases in these taxes for the average person, and average corporation? One estimate shows that doubling taxes would still leave the US with unsustainable deficits of $400 billion per year.

Although it will cause great hardship for families to pay these vastly increased taxes, the tax increases on corporate profits will have even worse effects on the unemployed (not to mention retiree’s pensions ). Less after tax profit will ultimately mean US firms subject to US taxes will lose out in the competition for investment capital, creating a decreased need for hiring, and a lower median wage.

The combined impact of the healthcare bill and higher taxes will strengthen the trend of selling into the US market from production bases in countries other than than the US.

( continued )

The way the Obama health bill will decrease demand for labor much below what it would be in the bill’s absence is its requirement in huge increases in health costs for US corporations, which costs can be increased at any time in the future by the unelected bureaucracies created in that bill. On top of the mandated cost increases will be the overhead required to hire hundreds of thousands of new Federal employees to administer the system, so that the delivery $1 of healthcare may well cost $2 due to the added overhead. These higher costs will permanently reduce the profitability of US corporations, and make many of them unprofitable. Without profits, corporations can not secure the bank lending necessary for expanding their business into new areas, and building the plant and buying the equipment necessary to support that expansion in the market. Without expansion, there will be no growth in labor demand.

The coming increase in healthcare costs will have another damaging effect on unemployment by reducing US technological innovation. Companies struggling to maintain profitability find research and development budgets tempting places to pare spending. With the large, and growing costs from the Obama healthcare bill, this tendency towards parimony will only grow over time. The alternate source of funds for R & D, bank lending, will of course be limited by lower profitability, as in the case of lending for building new plant. Underwriting standards for lending to businesses are fundamentally the same regardless of the stated uses of the funds.

The second event that will hurt US employment will be increases in US corporate taxes, which will be large, and ever-growing.

Corporate taxes in the US will definitely rise strongly because Obama and Congress will be unable to borrow from the Chinese and, as Democrats, willl refuse to use the option of addressing the $1 trillion plus budget deficits by cutting the budget, because that would run counter to their party’s strategy of increasing dependency on government. With spending cuts off the table, the only option for closing the gap, in their view, is by increasing the taxes on US citizens and the taxes on US corporate profits by a minimum of $1 trillion per year.. How large will be the increases in these taxes for the average person, and average corporation? One estimate shows that doubling taxes would still leave the US with unsustainable deficits of $400 billion per year.

Although it will cause great hardship for families to pay these vastly increased taxes, the tax increases on corporate profits will have even worse effects on the unemployed (not to mention retiree’s pensions ). Less after tax profit will ultimately mean US firms subject to US taxes will lose out in the competition for investment capital, creating a decreased need for hiring, and a lower median wage.

The combined impact of the healthcare bill and higher taxes will strengthen the trend of selling into the US market from production bases in countries other than than the US.

( continued )

The coming increase in healthcare costs will have another damaging effect on unemployment by reducing US technological innovation. Companies struggling to maintain profitability find research and development budgets tempting places to pare spending. With the large, and growing costs from the Obama healthcare bill, this tendency towards parimony will only grow over time. The alternate source of funds for R & D, bank lending, will of course be limited by lower profitability, as in the case of lending for building new plant. Underwriting standards for lending to businesses are fundamentally the same regardless of the stated uses of the funds.

The second event that will hurt US employment will be increases in US corporate taxes, which will be large, and ever-growing.

Corporate taxes in the US will definitely rise strongly because Obama and Congress will be unable to borrow from the Chinese and, as Democrats, willl refuse to use the option of addressing the $1 trillion plus budget deficits by cutting the budget, because that would run counter to their party’s strategy of increasing dependency on government. With spending cuts off the table, the only option for closing the gap, in their view, is by increasing the taxes on US citizens and the taxes on US corporate profits by a minimum of $1 trillion per year.. How large will be the increases in these taxes for the average person, and average corporation? One estimate shows that doubling taxes would still leave the US with unsustainable deficits of $400 billion per year.

Although it will cause great hardship for families to pay these vastly increased taxes, the tax increases on corporate profits will have even worse effects on the unemployed (not to mention retiree’s pensions ). Less after tax profit will ultimately mean US firms subject to US taxes will lose out in the competition for investment capital, creating a decreased need for hiring, and a lower median wage.

The combined impact of the healthcare bill and higher taxes will strengthen the trend of selling into the US market from production bases in countries other than than the US.

( continued )

M O M -

I apologize for messing up your comments secton. Please feel free to delete all, and I will repost.

I apologize for messing up your comments secton. Please feel free to delete all, and I will repost.

M_O_M,

Whither the demand for dollars (as savings instruments) is the key question now! We've come to it, finally--the Fed announced QE2 and the dollar rose while gold and equities fell, hard. The market claims there's not a helicopter big enough to stop deflation, and they're going to play chicken with the Fed to settle the question.

Now we find out the answer to two questions: a) Can the Fed really stop deflation? b) Can they stop inflation without creating hyperinflation?

At these rates I'll happily borrow dollars all day long, if I can guarantee they'll earn me the interest payments plus a large margin of safety. Too bad those opportunities are few and far between. That's not going to change.

The answer to question b) depends on confidence in the dollar as a store of value, and the availability of useful alternatives. Thus, my concern for demand for dollars as savings instruments.

Post a Comment

Whither the demand for dollars (as savings instruments) is the key question now! We've come to it, finally--the Fed announced QE2 and the dollar rose while gold and equities fell, hard. The market claims there's not a helicopter big enough to stop deflation, and they're going to play chicken with the Fed to settle the question.

Now we find out the answer to two questions: a) Can the Fed really stop deflation? b) Can they stop inflation without creating hyperinflation?

At these rates I'll happily borrow dollars all day long, if I can guarantee they'll earn me the interest payments plus a large margin of safety. Too bad those opportunities are few and far between. That's not going to change.

The answer to question b) depends on confidence in the dollar as a store of value, and the availability of useful alternatives. Thus, my concern for demand for dollars as savings instruments.

<< Home

MaxedOutMama

MaxedOutMama