Friday, June 26, 2015

Got Up Early To Watch Shanghai

That's quite some bloodbath, but there's surely more to come. I don't know what people were expecting, really. Who buys the dips on negative earnings?

Regarding the US, the puzzling thing is that all indications are that housing is just fine. First-time buyers are coming in due to mortgage changes (FHA & agreements to restrain pushbacks) and high rents, which, combined with household formation changes, should place a pretty solid floor under the markets this year.

Yet, even with the indications on housing and continued strength in motor vehicles, June's data was mixed to poor. It seems as if the manufacturing arm might be stabilizing a bit from some indicators, but if Markit's Services PMI is any decent indicator, the June overall trends are not that great, with Flash PMI coming sharply lower than anticipated. This, btw, was indicated by May NACM CMI, which forecast an uptick in manufacturing and a downtick in services.

Rail sticks at a declining trend, moving inexorably it appears to a significant YoY negative 1%. Intermodal has been slowing a bit recently.

ATA trucking shows a sharper shift than rail, with May being up monthly, but the YoY trend now falling, apparently trying to converge with rail.

Durable Goods advance just was not reassuring at all. Five months into the year, YTD shipments are up 2.8% and YTD new orders are down 2.2%, and this does not indicate any life in the sector. Further, while motor vehicles are still the stand-out, they may be topping. You always have to wait for three total months to make that determination, esp. around model year shifts.

The odd placement of Memorial Day can affect multiple lines of data for May, so one can't get too excited right now. In particular, durable goods for June might look much, much better.

Still, we have softness and not a ton of net momentum build moving into the third quarter.

Housing, however, is excellent, which leads me to puzzle over trucking. Perhaps it will look stronger by August.

As things now stand, the US economy is not falling through the rails with gathering negative correlations. It is hard to see how it could with housing showing such strength. Further, crude production in the US is still increasing, albeit quite slowly, and fuel supply indicators confirm that the US economy is NOT declining. However if motor vehicle sales and production top out, the picture may change.

If I have time I will write some more this weekend, because an interesting situation is developing here.

Regarding the US, the puzzling thing is that all indications are that housing is just fine. First-time buyers are coming in due to mortgage changes (FHA & agreements to restrain pushbacks) and high rents, which, combined with household formation changes, should place a pretty solid floor under the markets this year.

Yet, even with the indications on housing and continued strength in motor vehicles, June's data was mixed to poor. It seems as if the manufacturing arm might be stabilizing a bit from some indicators, but if Markit's Services PMI is any decent indicator, the June overall trends are not that great, with Flash PMI coming sharply lower than anticipated. This, btw, was indicated by May NACM CMI, which forecast an uptick in manufacturing and a downtick in services.

Rail sticks at a declining trend, moving inexorably it appears to a significant YoY negative 1%. Intermodal has been slowing a bit recently.

ATA trucking shows a sharper shift than rail, with May being up monthly, but the YoY trend now falling, apparently trying to converge with rail.

Durable Goods advance just was not reassuring at all. Five months into the year, YTD shipments are up 2.8% and YTD new orders are down 2.2%, and this does not indicate any life in the sector. Further, while motor vehicles are still the stand-out, they may be topping. You always have to wait for three total months to make that determination, esp. around model year shifts.

The odd placement of Memorial Day can affect multiple lines of data for May, so one can't get too excited right now. In particular, durable goods for June might look much, much better.

Still, we have softness and not a ton of net momentum build moving into the third quarter.

Housing, however, is excellent, which leads me to puzzle over trucking. Perhaps it will look stronger by August.

As things now stand, the US economy is not falling through the rails with gathering negative correlations. It is hard to see how it could with housing showing such strength. Further, crude production in the US is still increasing, albeit quite slowly, and fuel supply indicators confirm that the US economy is NOT declining. However if motor vehicle sales and production top out, the picture may change.

If I have time I will write some more this weekend, because an interesting situation is developing here.

Tuesday, June 09, 2015

Life On The Low End CONFIRMED

Update: Note that I wrote all of the below BEFORE the JOLTS survey was released. Yes, it's real.

NFIB published its Small Business Report this morning, and it is decidedly non-recessionary and decidedly pro-inflation. Look at the actual report, pages 12 and 13. Look at the split between compensation and prices, and compensation and plans.

There is life on the low end, but it is constrained not by lack of credit, but by lack of spending power and the accumulated forces built up over many years. What businesses can afford and have expected to pay for labor often will not acquire skilled or even competent labor, and thus the business owners are in a bit of a fix. They have to raise compensation, and they have to raise prices to do it, and they are muddling through.

Nonetheless, they are making money - earnings are finally back to growth levels and finally back to expansion levels.

So we see an economy in the stages of adaptation to constraints, that IS adapting. Larger publicly traded firms are all trying to cut costs to maximize reported profits on constrained sales, while not dropping list pricing. So a lot of the growth is moving to the lower end.

The sample for this month's report is a small one. In July we get the next big sample. I always look at the number of respondents for an additional clue, because in bad economic times they go up. There is no sign of bad economic times.

The "muddle-through" zone has been a feature of steady growth during many episodes of US economic history, but it also sets up the stage for a wage-price spiral.

Inventories have drawn down, and that means that later in the year sales will pick up and new orders will pick up. Capital investment is low (showing up in larger company surveys as well).

Short-term borrowing costs were 4.8%.

If I were the Fed, I would start to raise rates in June. They must raise slowly, and they need to shock the system so that price adjustments can continue smoothly. Forget the effing stock market. Let it pee its pants and get over it. The traders have been warned.

This is a stunningly powerful inflationary engine that the Fed has created, and if they don't start to raise rates soon, they are going to be forced to pull a Volcker all too soon. If they let inflation really start humming, it is going to knock us into a recession in these circs. This economy is growing and is set up for continued growth, but it needs time to reshuffle pricing, which just can't happen overnight.

Note that BEFORE I read this report I thought that an inflationary cycle was starting, and after having read this report, I am certain.

NFIB published its Small Business Report this morning, and it is decidedly non-recessionary and decidedly pro-inflation. Look at the actual report, pages 12 and 13. Look at the split between compensation and prices, and compensation and plans.

There is life on the low end, but it is constrained not by lack of credit, but by lack of spending power and the accumulated forces built up over many years. What businesses can afford and have expected to pay for labor often will not acquire skilled or even competent labor, and thus the business owners are in a bit of a fix. They have to raise compensation, and they have to raise prices to do it, and they are muddling through.

Nonetheless, they are making money - earnings are finally back to growth levels and finally back to expansion levels.

So we see an economy in the stages of adaptation to constraints, that IS adapting. Larger publicly traded firms are all trying to cut costs to maximize reported profits on constrained sales, while not dropping list pricing. So a lot of the growth is moving to the lower end.

The sample for this month's report is a small one. In July we get the next big sample. I always look at the number of respondents for an additional clue, because in bad economic times they go up. There is no sign of bad economic times.

The "muddle-through" zone has been a feature of steady growth during many episodes of US economic history, but it also sets up the stage for a wage-price spiral.

Inventories have drawn down, and that means that later in the year sales will pick up and new orders will pick up. Capital investment is low (showing up in larger company surveys as well).

Short-term borrowing costs were 4.8%.

If I were the Fed, I would start to raise rates in June. They must raise slowly, and they need to shock the system so that price adjustments can continue smoothly. Forget the effing stock market. Let it pee its pants and get over it. The traders have been warned.

This is a stunningly powerful inflationary engine that the Fed has created, and if they don't start to raise rates soon, they are going to be forced to pull a Volcker all too soon. If they let inflation really start humming, it is going to knock us into a recession in these circs. This economy is growing and is set up for continued growth, but it needs time to reshuffle pricing, which just can't happen overnight.

Note that BEFORE I read this report I thought that an inflationary cycle was starting, and after having read this report, I am certain.

Monday, June 08, 2015

Behind Those Self-Employment Numbers

Freight is now flashing a warning. May was a bad month for rail, which is always the immediate index:

AAR now has a graph widget on their site, updated weekly. I encourage anyone who's interested to play with it - you can sort bycomponents. Because of the early Memorial Day holiday, the YoY won't be directly comparable until we pass that down spike you see in the graph for previous years. Those downward spikes are Memorial Day, July 4th, Labor Day, Thanksgiving, and the Christmas/New Year holidays.

The bottom line is that you are comparing the last week to the next week in the graph, but it is evident that May traffic was substantially weaker YoY even with that adjustment.

ATA's truck tonnage index lags a month, but through April it looks worse than rail:

This does not necessarily imply that 2nd quarter GDP will be negative - after all, we are comparing YoY, and last year in March the economy picked up very strongly. But it does imply that if the government publishes a strong Q2 GDP number on the first pass, you should laugh and ignore it. Services trails manufacturing, and services can expand while manufacturing contracts a bit, although eventually they tend to correlate.

As of April, manufacturing was in contraction, with YoY shipments down solidly and New Orders down. Motor vehicles were still strong, which should not surprise anyone who has watched auto sales this year.

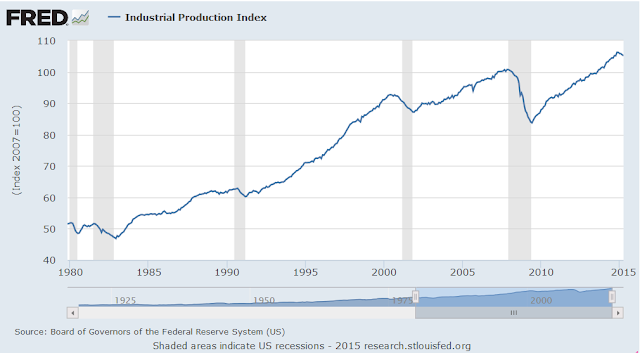

As you would expect, Industrial Production through April was showing contraction:

I have a hard time believing that it did very well in May after looking at rail.

Construction spending through April was fine and moving upwards. You don't get recession with motor vehicles holding AND construction spending increasing. However, in my experience construction can easily lag the start of recession - it is not a good forward indicator, and neither is employment. But here it is:

Services are harder to assess. A lot of the data is imputed; it tends to be substantially revised some months down the line. Growth on the bottom side, such as was clearly seen in the employment report from last week, may not show up very well. Because of this, most tend to inductively figure service trends from retail, because generally consumer spending on services will follow retail:

AAR now has a graph widget on their site, updated weekly. I encourage anyone who's interested to play with it - you can sort bycomponents. Because of the early Memorial Day holiday, the YoY won't be directly comparable until we pass that down spike you see in the graph for previous years. Those downward spikes are Memorial Day, July 4th, Labor Day, Thanksgiving, and the Christmas/New Year holidays.

The bottom line is that you are comparing the last week to the next week in the graph, but it is evident that May traffic was substantially weaker YoY even with that adjustment.

ATA's truck tonnage index lags a month, but through April it looks worse than rail:

This does not necessarily imply that 2nd quarter GDP will be negative - after all, we are comparing YoY, and last year in March the economy picked up very strongly. But it does imply that if the government publishes a strong Q2 GDP number on the first pass, you should laugh and ignore it. Services trails manufacturing, and services can expand while manufacturing contracts a bit, although eventually they tend to correlate.

As of April, manufacturing was in contraction, with YoY shipments down solidly and New Orders down. Motor vehicles were still strong, which should not surprise anyone who has watched auto sales this year.

As you would expect, Industrial Production through April was showing contraction:

I have a hard time believing that it did very well in May after looking at rail.

Construction spending through April was fine and moving upwards. You don't get recession with motor vehicles holding AND construction spending increasing. However, in my experience construction can easily lag the start of recession - it is not a good forward indicator, and neither is employment. But here it is:

Services are harder to assess. A lot of the data is imputed; it tends to be substantially revised some months down the line. Growth on the bottom side, such as was clearly seen in the employment report from last week, may not show up very well. Because of this, most tend to inductively figure service trends from retail, because generally consumer spending on services will follow retail:

In my experience, freight and retail do work together to forecast recessions at least six months in advance. The distinctive feature is that real retail will flatten for some months, and freight will start falling. Together, you get at least six months of warning.

Just looking at freight and retail, I would say that we are in the early stages of recession formation, with some chance to get out of it before the whirlpool develops. At this time fiscal stimulus would be indicated if this administration were a little less oblivious. A tax cut or a rebate would be enough to carry us through.

We are not going to get that, and I don't know whether we can edge out of this or not. Recessions form when the economy can no longer adapt. I am not sure whether we can adapt out of it.

Last year I thought we had a very high probability of being in recession by this spring, because consumer incomes had fallen too much. Then when oil fell, I thought that would be enough to keep us afloat.

Either of my theories is still credible right now. I don't know what will happen. It takes time for lower costs to hit in the form of more discretionary income in retail.

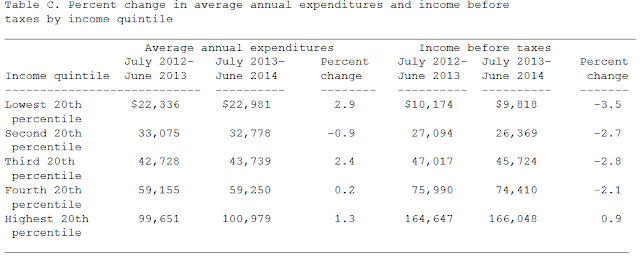

What's causing this is more than a bad winter and the oil slowdown. What's causing this are prior developments in household incomes and expenses, as CES has shown:

Take a good long look at that table. A really good look!!! The third and fourth quintile are saving quintiles. They earn more than they spend. They do not intend to move into their retirement and live in a paper box. So they respond by dropping discretionary spending when their financial position has consistently worsened over a year to try to keep stable. Further, high basic costs for needs goods does not inspire them to save LESS. It inspires them to save MORE.

In particular, the behavior of the middle quintile usually predicts US recessions. It is all very well to read asinine articles all over the financial world about the cheaper gas windfall and the odd behavior of the consumers in not spending it, but get real, you fools.

The average US household may be saving $700 dollars a year on gas, but in the prior year the average middle income household lost $1,300 in income and spent $1,000 more on expenses, and so, from their perspective, built up a deficit that would take three years of that $700 windfall to redress. The fourth quintile, which spends more on discretionary and can more easily save, responded to the drop in income by not increasing spending, i.e., cutting real spending. This wasn't an option for households that spend more on basics. They are in a deep hole.

Then there is the impact of ACA/PPACA/Obamacare. Most consumers are paying more for actual healthcare than they were before, and many financially stable households find themselves forced to allocate significantly more for deductibles. It is very hard to assess the force of this, but it will change consumer behavior and cause higher rates of saving. The reason it is hard to calculate is that your deductible only matters when you have to use a decent amount of healthcare services, and many consumers don't in any particular year. But as this wears on, companies will ratchet up employee cost-sharing to come under the ACA guidelines, and each year more and more households will get the bill and change behavior as a result.

By "change behavior", I mean stuff like this:

These are YoY changes (NSA) for two categories of industrial production that are sensitive to financial strictures on small businesses and households - nondurable consumer goods and electric and gas. When YoY moves down it generally means tightness, usually redressed by downward price changes. They are both choppy series, affected by weather and other factors. If you add the two of them together, the signal becomes a little clearer, because consumers, and to some degree, small businesse, compensate for forced utility spending by cutting spending on nondurables:

Not particularly strong.

Closeup and add real retail sales:

Not a recession yet, but getting close. Usually pricing fixes this without a recession - if the situation continues for too long prices and margins are cut and we edge out of it. Especially on the medical, we have built a structural situation in which adaptation is hard, the price signal is muted, and economic responsiveness is likewise limited.

It certainly looks like there is time for this to fix itself.

Friday, June 05, 2015

Ah, Thar She Blows

You know, even Canada blew out employment in May.

As for the US - the Household and the Establishment agree at 272/280K.

The life, meat, and fascination of this report comes from Table A-8, which breaks down employment by categories. And there, my friends, we see a situation that makes a whole lot of sense. The life in this economy and the big gains are coming from self-employed. Over the last few months we have seen an SA drop in private industry, and a very large gain in self-employed:

It does not leave the IMF much of a leg to stand on with the plea/command to not raise rates until 2016.

I am very busy, but more about this when I get a chance.

CONTINUED:

Okay, so far we have Gordon and Teri as thread winners: Teri: But first let's make the minimum wage $15 an hour! Because those folks deserve a living wage!

Gordon: I am seeing anecdotal evidence of Obamacare's impact almost daily in the retail world.

Companies that supply labor for store remodels and resets will not let workers work more than three days a week.

...

The assistant manager told me she cannot keep anyone good, because she can't let them work over 29 hours a week. There's no point in training them, as it will be wasted as they will bail out for something full-time elsewhere as soon as they can.

Yes, if you are going to impose payroll costs higher than the return on the labor, you are going to generate a lot of self-employed. It may be illegal for a person to work for a wage of $12 an hour, but there's nothing to prevent that person in many cases from agreeing to do that labor as an independent for a price that is equivalent to $9 an hour. It may be illegal for companies to employ persons for 30-35 hours a week without paying a fine if they don't pay for insurance, but there is nothing to prevent them from contracting with individuals by the job, at which point the possible fines do not enter the equation.

There is also evidence of construction picking up, and construction generates large numbers of self-employed. Always.

And then we have Charles: Since Obamacare, my company is looking at contractors first and employees as a last resort. Employees (aka skeleton crew) are now considered stakeholders, the pay may not be commensurate but the job security is there...

Yes, and the tightening financial margins shown in the NACM CMI show up as a reluctance of companies to hire for the longer term.

So we have a shift in growth:

This is the total employment level - the self-employed, and one can see that since February, the YoY has been dropping.

As for construction, I'll let your alert minds decide how much of a factor it is, versus regulatory overreach:

The funniest part about this is what it portends politically. Statistically, these independents turn into political Independents, who frown upon too much government meddling.

If the government creates a situation in which a person who wants to work full time has to go into business, that government should be prepared to pay the price in voting patterns.

As for the US - the Household and the Establishment agree at 272/280K.

The life, meat, and fascination of this report comes from Table A-8, which breaks down employment by categories. And there, my friends, we see a situation that makes a whole lot of sense. The life in this economy and the big gains are coming from self-employed. Over the last few months we have seen an SA drop in private industry, and a very large gain in self-employed:

It does not leave the IMF much of a leg to stand on with the plea/command to not raise rates until 2016.

I am very busy, but more about this when I get a chance.

CONTINUED:

Okay, so far we have Gordon and Teri as thread winners: Teri: But first let's make the minimum wage $15 an hour! Because those folks deserve a living wage!

Gordon: I am seeing anecdotal evidence of Obamacare's impact almost daily in the retail world.

Companies that supply labor for store remodels and resets will not let workers work more than three days a week.

...

The assistant manager told me she cannot keep anyone good, because she can't let them work over 29 hours a week. There's no point in training them, as it will be wasted as they will bail out for something full-time elsewhere as soon as they can.

Yes, if you are going to impose payroll costs higher than the return on the labor, you are going to generate a lot of self-employed. It may be illegal for a person to work for a wage of $12 an hour, but there's nothing to prevent that person in many cases from agreeing to do that labor as an independent for a price that is equivalent to $9 an hour. It may be illegal for companies to employ persons for 30-35 hours a week without paying a fine if they don't pay for insurance, but there is nothing to prevent them from contracting with individuals by the job, at which point the possible fines do not enter the equation.

There is also evidence of construction picking up, and construction generates large numbers of self-employed. Always.

And then we have Charles: Since Obamacare, my company is looking at contractors first and employees as a last resort. Employees (aka skeleton crew) are now considered stakeholders, the pay may not be commensurate but the job security is there...

Yes, and the tightening financial margins shown in the NACM CMI show up as a reluctance of companies to hire for the longer term.

So we have a shift in growth:

This is the total employment level - the self-employed, and one can see that since February, the YoY has been dropping.

As for construction, I'll let your alert minds decide how much of a factor it is, versus regulatory overreach:

The funniest part about this is what it portends politically. Statistically, these independents turn into political Independents, who frown upon too much government meddling.

If the government creates a situation in which a person who wants to work full time has to go into business, that government should be prepared to pay the price in voting patterns.

MaxedOutMama

MaxedOutMama