Thursday, July 09, 2020

Updating the HF Indicators

I posted this over on Seeking Alpha.

Not much good seems to be happening, and I am concerned about the low pace of construction and a likely end to the short-term impetus provided by the auto manufacturing restart. That seems to be petering out.

More tomorrow (probably).

Not much good seems to be happening, and I am concerned about the low pace of construction and a likely end to the short-term impetus provided by the auto manufacturing restart. That seems to be petering out.

More tomorrow (probably).

Saturday, July 04, 2020

Happy Fourth of July!!!

I know it's a rough year, but in the history of our country there have been many.

Think of Hong Kong's sad fate, and take the time to be thankful for everything you do have rather than worry about everything you don't have or might not have in the future.

There's a reason why we celebrate Independence Day. The founding of our country is only one chapter in humanity's struggle to establish a decent and humane culture founded on respect for human rights, but it is a great and wonderful chapter in a book filled with many sad ones. Every time we party on this day, we are saying something about how human beings ought to live.

Think of Hong Kong's sad fate, and take the time to be thankful for everything you do have rather than worry about everything you don't have or might not have in the future.

There's a reason why we celebrate Independence Day. The founding of our country is only one chapter in humanity's struggle to establish a decent and humane culture founded on respect for human rights, but it is a great and wonderful chapter in a book filled with many sad ones. Every time we party on this day, we are saying something about how human beings ought to live.

Thursday, July 02, 2020

June Employment Report Quick Take

In most respects, no surprises, but an uncommon amount of certainty!

Household and Enterprise Surveys agree for once. It is a miracle.

+4.9 million Household,

+4.8 million Establishment.

Consequently we can be quite confident about using the numbers in the establishment survey.

Of course big gains in manufacturing/goods production, with the auto restart. Over May and June we have now regained about half the jobs lost in April. The mining and logging component, mostly oil/gas, is still losing jobs as expected.

Services is more difficult. The two-month gain is only about a third of the jobs lost in April. Retail was a big gainer this month with almost 740K jobs added.

Medical is going to be one wild card. The Healthcare & Social Assistance category had lost about 2.13 million jobs in April. Over May/June the sector has regained about 40% of those jobs, with 475K being added in June.

Most of the medical jobs were lost due to people not being either able to access more routine care or being willing to access routine care. The ability to access the care is sharply improved in most areas, but the willingness may be lagging. This is likely to be a slow recovery sector.

Leisure and Hospitality had dumped nearly 7.6 million jobs in April, and so far has regained nearly 3.5 million jobs, with 2.09 of those this month.

There should be a little more improvement next month in these categories, but it is hard to tell how much. Some states are still in the re-opening stages, albeit a little more slowly on average. The sharp increases in new CV cases and now the increasing wave of hospitalizations has changed things for some populous states. Texas, Florida and California are back-pedaling a bit and plans for scheduled reopening of various establishments in some other states have been paused or rolled back a bit in states not seeing the large uptick.

TX, FL and CA are such a huge share of the national economy that it's a bit daunting; changes there are certainly going to show up in national stats.

The above are surveys based on sampling, although the strong correspondence between two different surveys should raise confidence in the results.

For another take on the matter, here is an update on Withheld Income and Employment Taxes as reported in Daily Treasury Receipts, shown as year-over-year change:

Smaller businesses are the slowest to send in payroll taxes, so recent upticks in small business won't be picked up. We'll see more of that in a few weeks.

Part of the fall off in June in payroll tax receipts is related to school closings; the losses in private employment were much higher.

Regardless, the income effects of the downturn are not totally captured by counting jobs. Shorter hours and wage cuts are leading to lower paychecks for many. From the Household Survey, about 4,700 more workers were unwillingly part-time in the survey week compared to June of 2019.

If you look at the four-week average in the graph above for June 22nd, the actual number was -11.1%. The official unemployment rate for June was 11.1%. Treasury receipts are of course delayed by weeks from workers on payroll in the survey week, but I have previously found that there is a good correspondence between those numbers. I'm not sure if that relationship still holds as well given the massive economic disruption we are seeing.

When workers are laid off, especially at the higher levels, they usually get severance checks and the withheld taxes on those severance checks produce a temporary boost in payroll tax receipts.

With that caveat, the trend I am seeing in the treasury receipts is forecasting a bad summer with a slowing economy. Congress had better extend the temporary employment programs pronto.

Monday, June 29, 2020

Not Dead Yet

Poking my head out of the bunker and looking around. Not too happy about the economic prospects this summer - I wrote up an explanation over here at Seeking Alpha.

Daily Treasury Receipts and fast freight from EIA and rail. Ugly. Just ugly.

Daily Treasury Receipts and fast freight from EIA and rail. Ugly. Just ugly.

Wednesday, January 25, 2017

Those Whom The Gods Wish To Destroy ...

they first make mad. Still true!!!

(Note: this post, and probably several others to follow, are actually about the US dollar and relative currency trends. If you have the patience, at the end it may be worthwhile. Because, when you come down to it, the value of the dollar will be determined by the economy, and right now the economy is determined by politics. Political initiatives are going to determine Real Gross Private Domestic Investment. Which is and has been the problem with this recovery:

The other view - percent change YoY:

The Trump candidacy and presidency will be about trying to fend off the next recession, which pretty much was baked in the US economic cake. )

The amazing thing about Donald Trump's victory is not that it happened - he was a shoo-in, given the failure of the Republican AND Democratic leadership to maintain touch with the voters, a declining economy, and additionally, the Democrats' irresponsibility in nominating a deeply ethically flawed candidate.

Now I can imagine that Democrats don't want to debate out loud whether they could have won this one if they weren't running a crook who had already flouted laws as Secretary of State and appeared to have sold influence as Secretary of State. The natural assumption would be "Yes", but is it true? I don't know the answer. I suspect they wouldn't have, due to the economic issues.

I have been looking for good reporting from a Democratic slant on this election, and this article (from NPR) is about the best. I saw hints in the article that the debate over the bad candidate/bad message question is occurring:

The problem seems to be more that they are wandering in the urban areas, and have forgotten about the vastness of the flyover territory in the US, demonstrated by the 2016 presidential county map:

In 2016, surprisingly, they rejected it - or rather, the voters evaded that problem by electing a Republican candidate who is really an old-fashioned Democrat. The electorate is and has been moderate, and so they put Trump in there to defend their interests. They wanted economic growth and protection for the average citizen against vested interests. They wanted JFK. Trump was as close as they could get.

It seems clear to me that the essential political issue for the Democrats is entirely whether they can recover enough of a geographic base in 2018 to become policy players nationally. I write this because money seems to be very important in Democratic campaigns (it was unimportant in Trump's presidential run - he spent way less and won). But Dems have been playing the demographic-segment for so long that they need a media splash to get people to turn out. And - if Dems aren't able to convince donors that they can deliver, donors are not going to cough up in the same way.

Unless Democrats can shift to a bottom-up policy generation for 2018, they will be losers again - the problem with having such a strong but geographically limited base is that unless the interests of that base are general, your congressional leadership is not going to be helping the party regain ground. It's likely to help the party lose ground. That's why they have to develop a DNC that basically polls locals and asks them what they need and where they want to go.

The above doesn't fit well with special-interest politics centered on groups. The Dems already know that, which is why they are going after women. It did not work in 2016. In 2018, perhaps they can leverage it a bit more.

But for this putative DNC-reboot, trying to build a 2018 base capable of electoral success can't be done in isolation - they have to deal with the other players. In my next post, I'll try to list the major players at the table.

I would appreciate your input!

(Note: this post, and probably several others to follow, are actually about the US dollar and relative currency trends. If you have the patience, at the end it may be worthwhile. Because, when you come down to it, the value of the dollar will be determined by the economy, and right now the economy is determined by politics. Political initiatives are going to determine Real Gross Private Domestic Investment. Which is and has been the problem with this recovery:

The other view - percent change YoY:

The Trump candidacy and presidency will be about trying to fend off the next recession, which pretty much was baked in the US economic cake. )

The amazing thing about Donald Trump's victory is not that it happened - he was a shoo-in, given the failure of the Republican AND Democratic leadership to maintain touch with the voters, a declining economy, and additionally, the Democrats' irresponsibility in nominating a deeply ethically flawed candidate.

Now I can imagine that Democrats don't want to debate out loud whether they could have won this one if they weren't running a crook who had already flouted laws as Secretary of State and appeared to have sold influence as Secretary of State. The natural assumption would be "Yes", but is it true? I don't know the answer. I suspect they wouldn't have, due to the economic issues.

I have been looking for good reporting from a Democratic slant on this election, and this article (from NPR) is about the best. I saw hints in the article that the debate over the bad candidate/bad message question is occurring:

Onyeukwu, like the Democrats in the Mahoning Valley, also thinks the party needs to focus more on the economy. He points out that's how a man named Barack Hussein Obama won Ohio — twice. ...

"Hillary's not the problem," said Samuel, the labor organizer. "The democratic process is the problem. And, making sure people feel included." Samuel said the Democratic Party doesn't seem to understand its audience. And for Onyeukwu, that audience includes many people of color. So he wants a party that also continues to push for more progressive policies on race.I'd recommend reading the article. What more progressive policies on race might be, I don't know. Earlier, the observation that an economic focus is not exclusive of social policy was made:

And yet others insist that economics and race are not mutually exclusive choices, that it is possible to focus on both simultaneously. Figuring out that balance is going to be central to the party's survival, as it currently wanders in the political wilderness.The Dems may be out of political power now, but I think wandering in the wilderness is up to them.

The problem seems to be more that they are wandering in the urban areas, and have forgotten about the vastness of the flyover territory in the US, demonstrated by the 2016 presidential county map:

Overall Trump won approximately 2,600 counties to Clinton’s 500, or about 84% of the geographic United States. However, Clinton won 88 of of the 100 largest counties (including Washington D.C.).Oops. The significance of the geographical distribution is that you might shift a few counties back by concentrating on them, but will you get back the Senate? Can you fight back and win the House? If not, the best the Dems could achieve would be a presidential stymie. Voters have voted for that before!

In 2016, surprisingly, they rejected it - or rather, the voters evaded that problem by electing a Republican candidate who is really an old-fashioned Democrat. The electorate is and has been moderate, and so they put Trump in there to defend their interests. They wanted economic growth and protection for the average citizen against vested interests. They wanted JFK. Trump was as close as they could get.

It seems clear to me that the essential political issue for the Democrats is entirely whether they can recover enough of a geographic base in 2018 to become policy players nationally. I write this because money seems to be very important in Democratic campaigns (it was unimportant in Trump's presidential run - he spent way less and won). But Dems have been playing the demographic-segment for so long that they need a media splash to get people to turn out. And - if Dems aren't able to convince donors that they can deliver, donors are not going to cough up in the same way.

Unless Democrats can shift to a bottom-up policy generation for 2018, they will be losers again - the problem with having such a strong but geographically limited base is that unless the interests of that base are general, your congressional leadership is not going to be helping the party regain ground. It's likely to help the party lose ground. That's why they have to develop a DNC that basically polls locals and asks them what they need and where they want to go.

The above doesn't fit well with special-interest politics centered on groups. The Dems already know that, which is why they are going after women. It did not work in 2016. In 2018, perhaps they can leverage it a bit more.

But for this putative DNC-reboot, trying to build a 2018 base capable of electoral success can't be done in isolation - they have to deal with the other players. In my next post, I'll try to list the major players at the table.

I would appreciate your input!

Saturday, January 21, 2017

The NYT and Ahistoricism

There is this nice editorial in the NY Times today, to celebrate the peaceful passing of power from the Lightbringer to Hitler 2.0, entitled "What President Trump Doesn't Get About America". You can open it in a private window if you don't have access. Ann Althouse has been going to town thwapping the NYT, btw. We have very different angles of attack, so I'd recommend hers as well.

My instinct, looking at the headline, was "This is going to be rich - because clearly the NYT crew have not understood an awful lot about America, which is why Trump's election came as such a shock to them."

It delivered:

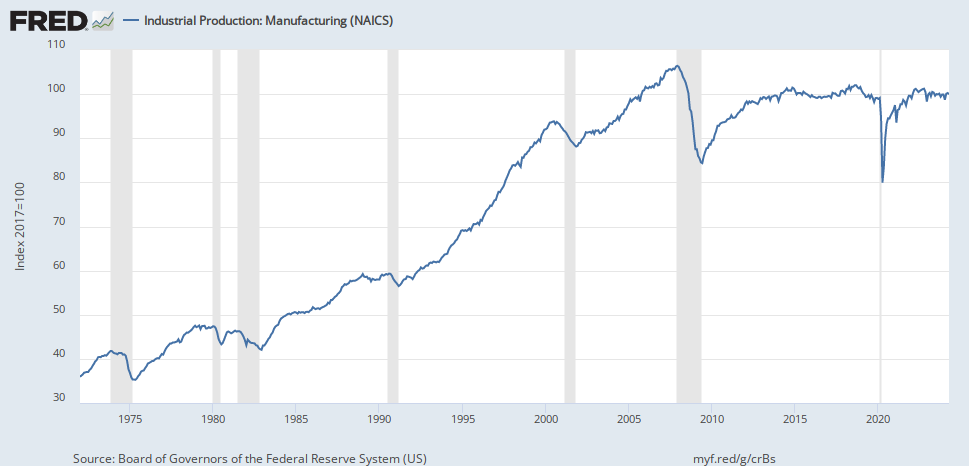

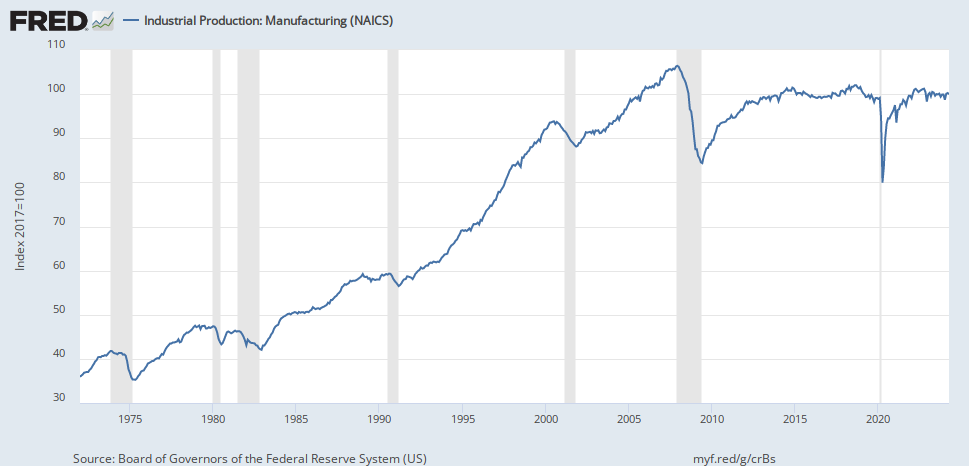

It turns out that industrial production in 2016 was below the level of 2007. It had briefly, oh so briefly, recovered to just above its pre-recession peak, but that was in 2014. In 2015 industrial production began a new decline, and by the time Election Day 2016 had rolled around, the US had been in an industrial recession for well more than a year.

One might hazard that the "Rust Belt" (that's a hint, NYT people - that's a clue!!) might have been particularly receptive to Candidate Trump's discussion of the country's decline due to the facts that

Note that when Obama ran in 2012, industrial production was improving AND HE CAMPAIGNED WITH THAT MESSAGE. He took credit for it and said that this recovery was and would be an American priority. This might explain why racism suddenly reared its ugly head in rejecting a white candidate in areas in which four years prior, a black candidate had succeeded.

More economic resilience graphs (NYT crew has all the words, I just have the facts):

That's the difference between the Reagan recovery and the Obama recovery, and those bitter racist homophobic sexist clingers in the Rust Belt live it.

Cause and Consequence (I'm the Jane Austen of economic bloggers):

That's not because of an aging population - that's the 25-54 employment/population ratio. Yes, welfare dependence has skyrocketed. It had to do so.

Which causes consequences:

Skyrocketing public debt in relation to GDP. The trajectory doesn't look better if you look at federal debt held by the public, but what the heck - I am not being polemical here:

Some might call this carnage.

Some might call the news that the US death rate (age-adjusted) is rising "carnage". Some might even wonder why having more of the population covered under the glorious Obamacare social progress results in:

But don't worry, the NYT is not going to travel that lonesome road by asking a question like that. It's entirely politically incorrect, isn't it? We must be politically correct even if it is killing those bitter clingers in those rural counties.

One suspects that those rural counties felt a tiny surge of hope when President Trump told them in his inaugural address that they would no longer be forgotten. One suspects that a manufacturing resurgence would really help Detroit. But it is politically incorrect to say that out loud, isn't it?

My instinct, looking at the headline, was "This is going to be rich - because clearly the NYT crew have not understood an awful lot about America, which is why Trump's election came as such a shock to them."

It delivered:

The new president offered a tortured rewrite of American history — ignoring the injustices of the past as well as the nation’s economic resilience and social achievements in recent decades.

One longed, as Mr. Trump spoke, for a special kind of simultaneous translation, one that would convert Trumpian myth into concrete fact. It might have noted, when Mr. Trump sounded like a politician from the 1980s in promising to “get our people off welfare and back to work,” that the number of people receiving federal Temporary Assistance for Needy Families benefits fell by more than 70 percent, to 1.2 million, between 1996 and 2016. As Mr. Trump spoke about the disappearance of jobs, it would have noted that the unemployment rate has fallen from 10 percent in 2009, the height of the recession, to less than 5 percent.

Mr. Trump portrayed the nation’s closed factories as having needlessly hemorrhaged jobs to overseas companies. But even as production jobs fell by about five million since 1987, the country’s manufacturing output has increased by more than 86 percent, according to the Bureau of Labor Statistics.

Gee, 1987 was a while ago. How about a little more recently?? Generally voters don't go back to three decades ago when voting now.

It turns out that industrial production in 2016 was below the level of 2007. It had briefly, oh so briefly, recovered to just above its pre-recession peak, but that was in 2014. In 2015 industrial production began a new decline, and by the time Election Day 2016 had rolled around, the US had been in an industrial recession for well more than a year.

One might hazard that the "Rust Belt" (that's a hint, NYT people - that's a clue!!) might have been particularly receptive to Candidate Trump's discussion of the country's decline due to the facts that

A) They were experiencing another industrial recession of the type that preceded the 2007 Late Great Economic Unpleasantness, andHad Madame Secretary The Most Brilliant Person Ever Former First Lady Hillary Rodham Clinton The Most Qualified Candidate Ever to Run for President Most Glorious and Esteemed Glass Ceiling Breaker and Not Even Indicted (to give her her full title) seen fit to run a campaign that noticed this minor detail of American life, perhaps the outcome would have been different. But no, instead the puzzling lack of enthusiasm for the Obama Economy Victory Tour that her campaign was pushing was blamed on racism, sexism, and homophobia. (Nothing causes a bitter clinging to homophobia like not just having the local factory shut down, but then having the plant itself demolished so that the property taxes won't be paid.)

B) The other candidates, including the Oh So Esteemed And Worthy Mrs. Clinton, had all failed to notice this occurrence.

Note that when Obama ran in 2012, industrial production was improving AND HE CAMPAIGNED WITH THAT MESSAGE. He took credit for it and said that this recovery was and would be an American priority. This might explain why racism suddenly reared its ugly head in rejecting a white candidate in areas in which four years prior, a black candidate had succeeded.

More economic resilience graphs (NYT crew has all the words, I just have the facts):

That's the difference between the Reagan recovery and the Obama recovery, and those bitter racist homophobic sexist clingers in the Rust Belt live it.

Cause and Consequence (I'm the Jane Austen of economic bloggers):

That's not because of an aging population - that's the 25-54 employment/population ratio. Yes, welfare dependence has skyrocketed. It had to do so.

Which causes consequences:

Skyrocketing public debt in relation to GDP. The trajectory doesn't look better if you look at federal debt held by the public, but what the heck - I am not being polemical here:

Some might call this carnage.

Some might call the news that the US death rate (age-adjusted) is rising "carnage". Some might even wonder why having more of the population covered under the glorious Obamacare social progress results in:

Most of the retreat in life expectancy came from increases in deaths from heart disease, chronic lower respiratory diseases, unintentional injuries, stroke, Alzheimer's disease, diabetes, kidney disease, and suicide, according to the CDC.A rise in deaths from chronic illness when we supposedly have increased access to healthcare across the population? Wouldn't that mean that the population LOST access to health care? It's almost as if, for no possible reason, the access to rescue medication like the EpiPen and higher-end inhalables like Advair diminished? As if many generic medications now cost 5-10 times what they did five years ago? As if the combination of $6,000 deductibles and a legal monopoly granted to insurance companies somehow reduced access to health care? How could that be, with all the social advances made in our glorious republic?

But don't worry, the NYT is not going to travel that lonesome road by asking a question like that. It's entirely politically incorrect, isn't it? We must be politically correct even if it is killing those bitter clingers in those rural counties.

One suspects that those rural counties felt a tiny surge of hope when President Trump told them in his inaugural address that they would no longer be forgotten. One suspects that a manufacturing resurgence would really help Detroit. But it is politically incorrect to say that out loud, isn't it?

Wednesday, November 09, 2016

Non Nobis Domine

I had decided my time would be better spent in prayer than blogging; my conscience tells me that we were graced in a time of difficult choice.

Not a time for boasting or wrath. I think that Thiel expressed it best:

Peter Thiel, the Facebook director and venture capitalist who struck a contrary chord in this liberal stronghold by backing Donald Trump, congratulated Trump's surprise win of the U.S. presidential election by saying "we're going to need all hands on deck."

"He has an awesomely difficult task, since it is long past time for us to face up to our country's problems," he said in a statement to USA TODAY

Friday, June 03, 2016

I Told You So

Eventually, the music always stops.

The monthly employment report could not be worse, and will rebound next month, but only to very disappointing levels. One of the special factors causing the "shock" factor in this report are probably Texas floods, with manufacturing and transportation delays. But a great deal of it cannot be blamed on special factors. The Verizon strike doesn't have anything to do with it.

There is strong agreement for May between the Household and Establishment surveys. Household is +26,000 jobs; Establishment is +38,000/25,000 private.

According to Household Table A-8, non-ag part-time workers for economic reasons rose by almost 500,000.

All of this really shouldn't shock anybody, but it will be reported and felt as shocking. There were significant downward revisions to prior months in the Establishment survey. The unemployment rate fell to 4.7% because of participation changes, with the month-to-month Not In Labor Force total rising 664,000. Participation rates have been falling for a couple of months. In March it was calculated at 63.0; this month it is 62.6 - lower than May 2015.

What is happening is that services are slowly downturning to follow manufacturing. Manufacturing is not pulling out at all.

Temporary help services was quite negative at -21,000. Generally this doesn't predict strong performance over the next few months.

Rail intermodal has been highly negative for several months. The CMI business to business credit survey (see page 6; look at the graph) shows that services are following manufacturing, with some more to go.

The June rate hike (snicker) is off the table. It always was.

The collapse in the worst-of-the-worst subprime auto issues has a little to do with this, but the basic problem is that the growth impetuses are all slowly fading. Inventory pile-ups have been forecasting this for quite some time.

Nothing I am seeing in any reports changes my assessment. We are in the first stages of a European-style business-led recession. It will be long and slow.

More about drivers whenever I have the time. In the meantime, from a political perspective, it ought to be obvious that the advantage is to the candidate talking about JOBS JOBS JOBS instead of the candidate talking about continuing current policies.

UPDATE: The May service sector reports are out, confirming my comment that the mechanism here is a slowing in services. Markit. ISM.

The monthly employment report could not be worse, and will rebound next month, but only to very disappointing levels. One of the special factors causing the "shock" factor in this report are probably Texas floods, with manufacturing and transportation delays. But a great deal of it cannot be blamed on special factors. The Verizon strike doesn't have anything to do with it.

There is strong agreement for May between the Household and Establishment surveys. Household is +26,000 jobs; Establishment is +38,000/25,000 private.

According to Household Table A-8, non-ag part-time workers for economic reasons rose by almost 500,000.

All of this really shouldn't shock anybody, but it will be reported and felt as shocking. There were significant downward revisions to prior months in the Establishment survey. The unemployment rate fell to 4.7% because of participation changes, with the month-to-month Not In Labor Force total rising 664,000. Participation rates have been falling for a couple of months. In March it was calculated at 63.0; this month it is 62.6 - lower than May 2015.

What is happening is that services are slowly downturning to follow manufacturing. Manufacturing is not pulling out at all.

Temporary help services was quite negative at -21,000. Generally this doesn't predict strong performance over the next few months.

Rail intermodal has been highly negative for several months. The CMI business to business credit survey (see page 6; look at the graph) shows that services are following manufacturing, with some more to go.

The June rate hike (snicker) is off the table. It always was.

The collapse in the worst-of-the-worst subprime auto issues has a little to do with this, but the basic problem is that the growth impetuses are all slowly fading. Inventory pile-ups have been forecasting this for quite some time.

Nothing I am seeing in any reports changes my assessment. We are in the first stages of a European-style business-led recession. It will be long and slow.

More about drivers whenever I have the time. In the meantime, from a political perspective, it ought to be obvious that the advantage is to the candidate talking about JOBS JOBS JOBS instead of the candidate talking about continuing current policies.

UPDATE: The May service sector reports are out, confirming my comment that the mechanism here is a slowing in services. Markit. ISM.

Friday, May 06, 2016

Employment Report, April

This one's a bit of a puzzle. We have the sharp divergence of the Household Survey vs the Establishment Survey. Neither are particularly good: Establishment came in at 160K, whereas Household came in at -316K.

The two-month (Feb to April) Household number is +70K, for an average +35K per month.

Establishment is showing a much better number for those two months at +184K per month. There were downward revisions to the previous two months totaling -19K.

I do think the Household Survey picks up trend shifts (both positive and negative) earlier than the Establishment Survey. Adjusting for the higher error ratio in the Household gives an unreconcilable -50K per month, so I would hazard that in the future the Establishment Survey will be revised down. The Employment/Population ratio dropped from 59.9 to 59.7 in Household.

Looking at Table A-8, it appears to me that some of the big Household Survey swing is actually due to weather- and calendar-induced SA perturbations. So I do not foresee a sudden drop-off in employment in the near future, although I think employment weakness will slowly become more obvious by July.

I am not surprised by the weakness, because FUTA has been forecasting it.

I still believe that the US entered recession in March. I still believe, however, that the US economy has been Europeanized to the extent that this one will have a European-style trajectory - very slow and long.

April rail figures for intermodal freight were notably poor:

The air is slowly leaking out of this expansion, and I really don't see what will redress it. There is time, but barring sudden fiscal stimulus, the weakness will continue to very slowly drag down the economy.

Looking at grocery stores, it appears to me that a price correction is underway. I expect the inflation rate to begin dropping sharply. This may help on the consumer side.

Both auto and housing sales are showing clear signs of weakening trends over the last few months. These trends have not yet impaired production, but when they do later in the year (or whenever managements begin to cut spending), we will see more traditional recession signs.

This is still a business-led downturn, and those do not have a sudden effect on employment. Inventories are too high, still. This is not going to rebalance on its own.

The dollar is weakening in response to recent data, but global growth trends are not very strong, and it will be hard for US manufacturing to pick up on export orders even with a weaker dollar.

Addendum & Note:

The theory that the strong employment of the last few years is enough to keep us from a consumer participation in a weak business cycle is rather stupid. If one looks at the longer term, this has been a stunningly poor expansion in terms of jobs:

The population has grown but full-time jobs are only a few million more than they were before the previous recession. There is literally not enough in the system to support housing values and rents; there is a limit to what credit can accomplish.

People are running up their credit cards again, but this has a natural end:

The two-month (Feb to April) Household number is +70K, for an average +35K per month.

Establishment is showing a much better number for those two months at +184K per month. There were downward revisions to the previous two months totaling -19K.

I do think the Household Survey picks up trend shifts (both positive and negative) earlier than the Establishment Survey. Adjusting for the higher error ratio in the Household gives an unreconcilable -50K per month, so I would hazard that in the future the Establishment Survey will be revised down. The Employment/Population ratio dropped from 59.9 to 59.7 in Household.

Looking at Table A-8, it appears to me that some of the big Household Survey swing is actually due to weather- and calendar-induced SA perturbations. So I do not foresee a sudden drop-off in employment in the near future, although I think employment weakness will slowly become more obvious by July.

I am not surprised by the weakness, because FUTA has been forecasting it.

I still believe that the US entered recession in March. I still believe, however, that the US economy has been Europeanized to the extent that this one will have a European-style trajectory - very slow and long.

April rail figures for intermodal freight were notably poor:

The air is slowly leaking out of this expansion, and I really don't see what will redress it. There is time, but barring sudden fiscal stimulus, the weakness will continue to very slowly drag down the economy.

Looking at grocery stores, it appears to me that a price correction is underway. I expect the inflation rate to begin dropping sharply. This may help on the consumer side.

Both auto and housing sales are showing clear signs of weakening trends over the last few months. These trends have not yet impaired production, but when they do later in the year (or whenever managements begin to cut spending), we will see more traditional recession signs.

This is still a business-led downturn, and those do not have a sudden effect on employment. Inventories are too high, still. This is not going to rebalance on its own.

The dollar is weakening in response to recent data, but global growth trends are not very strong, and it will be hard for US manufacturing to pick up on export orders even with a weaker dollar.

Addendum & Note:

The theory that the strong employment of the last few years is enough to keep us from a consumer participation in a weak business cycle is rather stupid. If one looks at the longer term, this has been a stunningly poor expansion in terms of jobs:

The population has grown but full-time jobs are only a few million more than they were before the previous recession. There is literally not enough in the system to support housing values and rents; there is a limit to what credit can accomplish.

People are running up their credit cards again, but this has a natural end:

Friday, April 15, 2016

We Are Not In The Mood For This.

So I am reading about "residual seasonality" affecting first quarter growth. I guess the "weather" excuse became too risible? The comic economic commentary index, which always soars in the beginning of US recessions, is rising rapidly.

Many Who Know claim that first quarter growth will not reflect the real health of our economy. Which is very vibrant and thrilling. Or something like that.

The NY Fed is going to get in the GDP forecasting game. But unlike Atlanta, they are going to modelize it, rather than depending on that irritating data. It's a model on top of data. Since they have already been publishing GDP models on Liberty Street, I don't understand what is so different?

But anyway, here is the link to the new " FRBNY Nowcast". As of this morning, 0.8 Q1 & 1.2 Q2.

Note for non-US persons reading this blog:

1) All US GDP numbers are always annualized.

2) No Fed bank ever forecasts recessions. It's an unwritten rule. Thus this is as close to a recession forecast as you are ever going to see from a Fed source.

3) The basic US annualized quarterly GDP error range is slightly more than one percent.

Admittedly, March was crappy:

The crappiness hardly began in March. Really, folks. So retail joined in the party, a bit. That in a March that included Easter? Hah, it will be revised up. There will be sales in the last week. But still, this is not a growing economy.

Of course, there is always April:

But now it is not just carloads joining the pity party. Intermodal has joined in.

April is the cruelest month? One suspects not, because of this:

That was February. Inventory to sales ratios can't keep rising forever (although they do contribute to GDP). Since March retail sales weren't very good, one can presume that we have additional adjustments ahead.

Since rail is lower, it ain't over. The trucking gauge has been running way better than rail, but look at the petroleum report. Four-week product supplied for distillate fuel oil is down 7% YoY. At this time of year, that's mostly trucking.

NFIB - ah, yes, the small business report. In March's version, the "R" word appeared in a dispirited manner:

It should be noted (you may read the report on the website) that small business hiring appears past peak,

small business openings look to be stalled or past peak,

and, you know, there's perhaps not much more there:

If you read the link to the pdf of the report and go through the earnings/sales/sales expectations, particularly the last on the bottom of page 9, you'll see that vibrant hiring is unlikely. Price cutting in small firms often precedes a recession:

You may imagine how thrilled they are with the campaign for a $15 hour minimum wage. When the law forces you to pay your workers more than you are earning, hiring preferences ratchet down.

April is the next "large" survey. I expect it to be slightly better. I think this is just going to ooze along, but not upwards. Ooze tends to follow gravity's pull.

Missing a recession bar, but you get the idea from looking at this long term Industrial Production graph:

Note: In case you weren't getting it, Industrial Capacity Utilization (missing a recession bar):

Many Who Know claim that first quarter growth will not reflect the real health of our economy. Which is very vibrant and thrilling. Or something like that.

The NY Fed is going to get in the GDP forecasting game. But unlike Atlanta, they are going to modelize it, rather than depending on that irritating data. It's a model on top of data. Since they have already been publishing GDP models on Liberty Street, I don't understand what is so different?

But anyway, here is the link to the new " FRBNY Nowcast". As of this morning, 0.8 Q1 & 1.2 Q2.

Note for non-US persons reading this blog:

1) All US GDP numbers are always annualized.

2) No Fed bank ever forecasts recessions. It's an unwritten rule. Thus this is as close to a recession forecast as you are ever going to see from a Fed source.

3) The basic US annualized quarterly GDP error range is slightly more than one percent.

Admittedly, March was crappy:

The crappiness hardly began in March. Really, folks. So retail joined in the party, a bit. That in a March that included Easter? Hah, it will be revised up. There will be sales in the last week. But still, this is not a growing economy.

Of course, there is always April:

But now it is not just carloads joining the pity party. Intermodal has joined in.

April is the cruelest month? One suspects not, because of this:

That was February. Inventory to sales ratios can't keep rising forever (although they do contribute to GDP). Since March retail sales weren't very good, one can presume that we have additional adjustments ahead.

Since rail is lower, it ain't over. The trucking gauge has been running way better than rail, but look at the petroleum report. Four-week product supplied for distillate fuel oil is down 7% YoY. At this time of year, that's mostly trucking.

NFIB - ah, yes, the small business report. In March's version, the "R" word appeared in a dispirited manner:

For a broader perspective, the Index has turned decidedly “south” over the last 15 months falling from a reading of 100 in December 2014 to 92.8. A “chartist” looking at the data historically might conclude that the Index has clearly hit a top and is flashing a recession signal. The April survey will decide whether or not the alarm should be rung. This month’s change was not statistically significant, just not in a positive direction.This is what he's talking about:

It should be noted (you may read the report on the website) that small business hiring appears past peak,

small business openings look to be stalled or past peak,

and, you know, there's perhaps not much more there:

If you read the link to the pdf of the report and go through the earnings/sales/sales expectations, particularly the last on the bottom of page 9, you'll see that vibrant hiring is unlikely. Price cutting in small firms often precedes a recession:

You may imagine how thrilled they are with the campaign for a $15 hour minimum wage. When the law forces you to pay your workers more than you are earning, hiring preferences ratchet down.

April is the next "large" survey. I expect it to be slightly better. I think this is just going to ooze along, but not upwards. Ooze tends to follow gravity's pull.

Missing a recession bar, but you get the idea from looking at this long term Industrial Production graph:

Note: In case you weren't getting it, Industrial Capacity Utilization (missing a recession bar):

MaxedOutMama

MaxedOutMama