Friday, August 31, 2012

Regarding the Whole RNC Thing

Almost any other personal reaction I might have had was overwhelmed by the extreme surprise I felt over the push by the Dem spinsters to label Romney as "extreme". Whatever he is, he is not extreme. It's almost as if they pulled out the playbook they'd prepared for Huckabee if he had won the nomination and tried to execute it.

Romney was a two-term governor of Massachusetts, and the state is not exactly hard-core conservative. But to read through the Dem talking points earlier this week, one would have thought that Romney spent two MA terms presiding over the regular monthly public burnings on the Boston Commons of birth-control-using women, lesbians, divorced couples, and witches, of course.

Anyway, this phase of electioneering has marked a new insulting low for women delivered at the hands of the feminists, and I'm sulking quietly about it. Oh, for the halcyon days when the woman's movement was all about proclaiming that women are NOT their vaginas. It seems a very, very long time ago. Now it seems that not only do all true women march around screaming about their vaginas if not wearing large replicas of them, but that voting your vagina is the ONLY way to vote.

How far we've regressed!

Romney was a two-term governor of Massachusetts, and the state is not exactly hard-core conservative. But to read through the Dem talking points earlier this week, one would have thought that Romney spent two MA terms presiding over the regular monthly public burnings on the Boston Commons of birth-control-using women, lesbians, divorced couples, and witches, of course.

Anyway, this phase of electioneering has marked a new insulting low for women delivered at the hands of the feminists, and I'm sulking quietly about it. Oh, for the halcyon days when the woman's movement was all about proclaiming that women are NOT their vaginas. It seems a very, very long time ago. Now it seems that not only do all true women march around screaming about their vaginas if not wearing large replicas of them, but that voting your vagina is the ONLY way to vote.

How far we've regressed!

Chicago PMI et al

Mixed. At 53.0, the headline index isn't bad (although of course it is sharply off last years mean/median of 62.8/62.1). Order backlogs at a seasonally adjusted 41.7 don't provide much hope for the next couple of months. Inventories came down to an SA 41.7. Last month order backlogs had resurged to a 52.8, so maybe they will again. Prices paid came up to 57.0.

The order backlogs number is worrisome. It's the lowest of the year. Right now, this looks slowing but not moribund.

Japan's Markit PMI for August was released showing a further decline from 47.9 in July to 47.7 in August. Since July industrial production came in -1.2%, this is not a good sign. Costs are declining fast. Basically Japan is in deflation.

Canada reports Q2 GDP at 1.8%, which was a bit better than anticipated, but still not very good. Q1 was revised from 1.9% to 1.8%, so now it's a steady state. However there is plenty of stuff on hand, so I'm guessing that the Bank of Canada is going to be considering cutting interest rates later this year. They are still worried about household debt up there in the great frozen North. It's being reported that exports are the problem, but there are some internal slowing factors as well. If you exclude growth in inventories, the picture was a lot worse - really no growth in the quarter.

Well, Carney had been talking about raising, and he isn't going to raise. Next meeting he'll sit, then they'll slap some bankers around to make sure it won't cause too many problems, and then they'll cut. Business investment was very strong, but the housing sector is going to be weak for a while.

South Korea's industrial production fell 1.6% after having fallen 0.6% in June. Asia is impacted by China (Thailand taking YoY drops, Singapore had a bad July, Malaysia slowed up in June), which is impacted by European weakness and generalized global sagginess. Indonesia's still hanging in. India's industrial production has been weakening and sometimes contracting.

We're all holding hands, strolling down the scenic walk to Recession Lake. They say sometimes groups of passionate but despairing economists jump off Easy Money Leap, and on moonlight nights you can hear their voices wailing across the waters. I hear Krugman is working on an epic economic verse romance about it.

Bernanke refused to throw Mr. Market a meaty bone, so now everyone just has to sulk over a long weekend, but why not buy anyway? We all know the Fed is probably going to do it sooner or later. The problem for the commodity traders is that they may do it after the bottom drops out of prices.

I have read all the Fedspeak and some of the Fedhead speeches, and I think the real policy is that the Fed will buy whatever bonds it has to buy in order to keep long bond yields from rising much, but that the real limitation is that they are desperately afraid of flattening the yield curve. And the problem is that buying long bonds will indeed raise the near-term inflation rate and thus most often short yields, and the rather huge volume stuck in these short yield auctions nowadays indicates that yields could rise suddenly. Buying short terms is a risky biz for that type of program.

Spain still don' wanna. Mr. Market knows what to do about that!

The order backlogs number is worrisome. It's the lowest of the year. Right now, this looks slowing but not moribund.

Japan's Markit PMI for August was released showing a further decline from 47.9 in July to 47.7 in August. Since July industrial production came in -1.2%, this is not a good sign. Costs are declining fast. Basically Japan is in deflation.

Canada reports Q2 GDP at 1.8%, which was a bit better than anticipated, but still not very good. Q1 was revised from 1.9% to 1.8%, so now it's a steady state. However there is plenty of stuff on hand, so I'm guessing that the Bank of Canada is going to be considering cutting interest rates later this year. They are still worried about household debt up there in the great frozen North. It's being reported that exports are the problem, but there are some internal slowing factors as well. If you exclude growth in inventories, the picture was a lot worse - really no growth in the quarter.

Well, Carney had been talking about raising, and he isn't going to raise. Next meeting he'll sit, then they'll slap some bankers around to make sure it won't cause too many problems, and then they'll cut. Business investment was very strong, but the housing sector is going to be weak for a while.

South Korea's industrial production fell 1.6% after having fallen 0.6% in June. Asia is impacted by China (Thailand taking YoY drops, Singapore had a bad July, Malaysia slowed up in June), which is impacted by European weakness and generalized global sagginess. Indonesia's still hanging in. India's industrial production has been weakening and sometimes contracting.

We're all holding hands, strolling down the scenic walk to Recession Lake. They say sometimes groups of passionate but despairing economists jump off Easy Money Leap, and on moonlight nights you can hear their voices wailing across the waters. I hear Krugman is working on an epic economic verse romance about it.

Bernanke refused to throw Mr. Market a meaty bone, so now everyone just has to sulk over a long weekend, but why not buy anyway? We all know the Fed is probably going to do it sooner or later. The problem for the commodity traders is that they may do it after the bottom drops out of prices.

I have read all the Fedspeak and some of the Fedhead speeches, and I think the real policy is that the Fed will buy whatever bonds it has to buy in order to keep long bond yields from rising much, but that the real limitation is that they are desperately afraid of flattening the yield curve. And the problem is that buying long bonds will indeed raise the near-term inflation rate and thus most often short yields, and the rather huge volume stuck in these short yield auctions nowadays indicates that yields could rise suddenly. Buying short terms is a risky biz for that type of program.

Spain still don' wanna. Mr. Market knows what to do about that!

Thursday, August 30, 2012

How Do You Say "Huh" in Spanish?

Is this not a touch off?

Spain will delay deciding whether to seek a sovereign bailout until the aid conditions are clear, Prime Minister Mariano Rajoy said following a meeting with French President Francois Hollande.But Draghi had said that ECB help would be contingent on Spain and Italy going through the two funds (ESM coming up in September), and therefore contingent on the countries accepting those terms.It really sounds like Rajoy is still trying to evade that necessity - he wants ECB to launch a new bond-buying program separately, which is not what was announced.

The two chiefs, who held talks in Madrid today, pressed the European Central Bank to implement decisions from a June summit to reduce borrowing costs in Spain and Italy as euro-area policy makers struggle to enact an emergency plan.

Thursday Grabbag

I'll just update this one with any interesting tidbits.

The first thing that catches my eye is Poland's lagging growth. Poland got hurt in 2008, but it may go into outright recession next year. This is a very large slowdown, relatively speaking. A 1% drop in GDP YoY over the course of one quarter is too large for comfort, and it raises questions. Poland has relatively high unemployment already.

July Personal Income, US: Positive, but PCE did not meet expectations, and June's income and DPI were revised down from 0.5 and 0.4 to 0.3, respectively. Thus this month's 0.3 gain looks less than thrilling. Real PCE was -0.1 in June and +0.4 in July, so that is a big improvement. We'll see.

Initial claims: Last week's initially reported 372K was revised up to 374K, and this week's headline is 374K. Last week I did not twitch because the four-week moving average was still in the 365-369K range, which is where I had expected it to be when the summer figures steadied up. However this week the four-week moving average climbs to 370,250K, so this bears watching.

Covered employment of 127,495,952 is good. What is not good is that this takes us back to covered employment levels of June of 2001! That is how bad this sucks, folks. Eleven years, no growth in jobs. The height of covered employment in the last cycle was in December of 2008 at 133,902,387. Still more than 6 million behind. This is such a dispiriting statistic, but it is a terribly valid one, although it would look far worse population adjusted. Covered employment is a distinctly lagging indicator, but two cycles of lag?

Oh, well, might as well. See, this is why I sometimes don't blog for a bit. These things can be really depressing. Here's the population-adjusted graph:

This has every thing to do with why American household incomes are declining. It was on a slow downward slope before the Slump began, but it does not recover and in fact it gets worse when it shouldn't. n

Covered employment is a slightly different indicator than standard employment. It includes actual jobs where unemployment insurance is deducted - thus it is a better measure of the real economy than official employment figures. It also has very little error, because it is derived from actual reports from state employment departments rather than sample surveys.

Eurozone retail PMI for August, which really only covers Germany, France and Italy, came in very poorly.

I don't know what to make of the four-week slump in distillate sales - now at -6.2% YoY. Last year at the same time it was up 5.5% YoY. I'm tempted to blame 2% on low purchases of heating oil, but regardless it kind of looks like the economic Titanic/iceberg thang. Should this continue we can just send Obama a condolence card and a hearty recommendation for another Nobel prize (for consolation) in October.

The bottom line is that the season of Bring has failed big-time this year, thus Bling ain't gonna be good.

S&P downgrades Illinois. Some kerfuffle about pension obligations? Who'd a thunk? Negative outlook

KC Survey is on the bright side. Inventory is increasing, but shipments rose also so this is a pretty stable result, if not brilliant. The average workweek, seasonally adjusted, dropped (-5) and new export orders dropped (-6), but that is kind of a given, isn't it? International data has been most discouraging. The biggest problem here is stable sales prices and rising prices for materials (+26). Expectations are for increasing output pricing, which is understandable.

The first thing that catches my eye is Poland's lagging growth. Poland got hurt in 2008, but it may go into outright recession next year. This is a very large slowdown, relatively speaking. A 1% drop in GDP YoY over the course of one quarter is too large for comfort, and it raises questions. Poland has relatively high unemployment already.

July Personal Income, US: Positive, but PCE did not meet expectations, and June's income and DPI were revised down from 0.5 and 0.4 to 0.3, respectively. Thus this month's 0.3 gain looks less than thrilling. Real PCE was -0.1 in June and +0.4 in July, so that is a big improvement. We'll see.

Initial claims: Last week's initially reported 372K was revised up to 374K, and this week's headline is 374K. Last week I did not twitch because the four-week moving average was still in the 365-369K range, which is where I had expected it to be when the summer figures steadied up. However this week the four-week moving average climbs to 370,250K, so this bears watching.

Covered employment of 127,495,952 is good. What is not good is that this takes us back to covered employment levels of June of 2001! That is how bad this sucks, folks. Eleven years, no growth in jobs. The height of covered employment in the last cycle was in December of 2008 at 133,902,387. Still more than 6 million behind. This is such a dispiriting statistic, but it is a terribly valid one, although it would look far worse population adjusted. Covered employment is a distinctly lagging indicator, but two cycles of lag?

Oh, well, might as well. See, this is why I sometimes don't blog for a bit. These things can be really depressing. Here's the population-adjusted graph:

This has every thing to do with why American household incomes are declining. It was on a slow downward slope before the Slump began, but it does not recover and in fact it gets worse when it shouldn't. n

Covered employment is a slightly different indicator than standard employment. It includes actual jobs where unemployment insurance is deducted - thus it is a better measure of the real economy than official employment figures. It also has very little error, because it is derived from actual reports from state employment departments rather than sample surveys.

Eurozone retail PMI for August, which really only covers Germany, France and Italy, came in very poorly.

I don't know what to make of the four-week slump in distillate sales - now at -6.2% YoY. Last year at the same time it was up 5.5% YoY. I'm tempted to blame 2% on low purchases of heating oil, but regardless it kind of looks like the economic Titanic/iceberg thang. Should this continue we can just send Obama a condolence card and a hearty recommendation for another Nobel prize (for consolation) in October.

The bottom line is that the season of Bring has failed big-time this year, thus Bling ain't gonna be good.

S&P downgrades Illinois. Some kerfuffle about pension obligations? Who'd a thunk? Negative outlook

KC Survey is on the bright side. Inventory is increasing, but shipments rose also so this is a pretty stable result, if not brilliant. The average workweek, seasonally adjusted, dropped (-5) and new export orders dropped (-6), but that is kind of a given, isn't it? International data has been most discouraging. The biggest problem here is stable sales prices and rising prices for materials (+26). Expectations are for increasing output pricing, which is understandable.

Tuesday, August 28, 2012

A Dysphoric Summer's End

Consumer confidence turned in an "unexpected" 5 point drop to 60.6 from an initial July number of 65.9. Consumers expected inflation to be at 5.9%, which may account for much of their bad mood.

Dallas Fed survey was surprisingly negative. Unfilled orders contracted (-9.2), shipments contracted slightly (-2.3), but inventories rose (materials +8.9, finished +6.7). This survey didn't bother me last month because inventories shrank, but now it looks quite pessimistic. Hours worked went marginally negative. Prices received dropped 1.6 - prices paid for raw materials increased 10.9. What a beautiful picture!

Richmond is bad also. Richmond is now bleeding through into jobs and the workweek (-11) is not encouraging either. New orders at -20 and backlogs at -25 reiterate last month's weakness. Finished goods inventories +18; raw materials inventories +24. Can't look for a turnaround next month, can we? This despite a capacity utilization drop of 16 in July and another 9 in August.

If the Fed is going to act in September, wouldn't reports like this force its hand? What exactly is improving? We can hope that Kansas and Chicago PMI look okay, but that still would leave the midwest hanging out there hauling the whole wagon with a lot of dispirited consumers in the wagon.

On the other hand, launching another QE should shoot commodities prices up, and it is hard to see that really helping the situation.

For context on consumer confidence, I recommend this excellent post with graphs by Doug Short and Steven Hansen. at Econintersect. In particular, read to the bottom and look at the NFIB correlation series in recent history.

PS: One reason for my own dysphoria is that last year we had a very big cash build in other deposits, which supported the season of Bling. This year, no:

Monday, August 27, 2012

The Great EconoMechanics Debate

The latest installment is a Dallas Fed working paper by William R. White, who comes out of BIS (Bank of International Settlements).

This paper discusses the awkward question of the limits of monetary policy. I assume that there are such limits - for example, ask yourself the mental question about what would happen if the Fed decided to buy up essentially all of the long term Treasuries outstanding?

Researchers at the Bank for International Settlements have suggested that a much broader spectrum of credit driven “imbalances10”, financial as well as real, could potentially lead to boom‐bust processes that might threaten both price stability and financial stability11. This BIS way of thinking about economic and financial crises, treating them as systemic breakdowns that could be triggered anywhere in an overstretched system, also has much in common with insights provided by interdisciplinary work on complex adaptive systems. This work indicates that such systems, built up as a result of cumulative processes, can have highly unpredictable dynamics and can demonstrate significant non linearities12. The insights of George Soros, reflecting decades of active market participation, are of a similar nature.As a testimony to this complexity, it has been suggested that the threat to price stability could also manifest itself in various ways. Leijonhufvud (2012) contends that the end results of such credit driven processes could be either hyperinflation or deflation14, with the outcome being essentially indeterminate prior to its realization. Indeed, Reinhart and Rogoff (2009) and Bernholz (2006) indicate that there are ample historical precedents for both possible outcomes.15

Of course deflation is not the intent, but a long shove in one direction tends to do odd things to financial systems. I guess I should disclose my own bias here. Among my basic precepts:

A) The same inputs into a modern economic system can have different results depending on the initial state and population effects. Demographics isn't Alles, but it's an awful lot!

B) Any "shove" away from equilibrium, continued for a long time frame, will eventually have destabilizing effects.

C) An imbalanced system will collapse, but the direction of the future collapse is not always predictable. What is predictable is that the imbalance in the system will make the system more prone to collapses as a result of external effects.

D) Any economics that ignores the workings of the banking system is BS economics, no matter how many Nobel prize winners believe in the BS.

E) Any economics that ignores the input of energy prices is BS economics, no matter how many Miseans believe in the BS.

The questions the paper tries to answer are:

In current circumstances, two questions must be addressed. First, will ultra easy monetary conditions be effectively transmitted to the real economy? Second, assuming the answer to the first question is yes, will private sector spending respond in such a way as to stimulate the real economy and reduce unemployment? It is suggested in this paper that the answer to both questions is no.

Heresy! But is it true? I would suggest that it is at least partly true on two grounds.

The first is that if you have aging populations, retirement security becomes a sought-after good. If you have aging populations who are being subjected to a prolonged discussion on the need to cut future retirement benefits, the population in question will necessarily respond by placing a higher importance on saving and a lower importance on current spending. Thus money spent now by governments, which logically does have a stimulating effect, will be seen as taking away from future consumption and will increase the desire to save.

The second ground is that there is in principle a lower bound to the credit stimulating effects of low interest rates, and that is because the risk of loss is an important component of actual interest rates - i.e. the time cost of money - and the risk of loss due to changes in rates over time is also an important component of actual interest rates. The lower current costs of money fall, the more the risk component becomes magnified in credit-granting decisions, which tends to suppress credit. The current tightened standards for mortgages are just an example of that process.

By creating government-backed pools of mortgages (Fannie, FHA) and selling bonds on the open market which compete with other government-guaranteed securities, one can somewhat offset the risk of loss due to rate risk. But there is no way to offset the relative growth of the risk of loss - the risk that the money won't be repaid. Because there is no way to offset it, either you ignore it and accrue more future government deficits, or you charge more to cover the risk of loss - which is why FHA premiums have gone up so much.

As soon as the relative importance of non-repayment of money rises, then the premium for risk rises, and the incentive for individual and corporate borrowers to save rises. So you create negative feedbacks, which is one reason why companies and individuals now want to save more.

Jackson Hole And Meaty Statistics

Well, Ben is due to speak this week at Jackson Hole. He will promise much, presumably with low levels of detail. While Mr. Market contemplates the oracle, the rest of us can contemplate some statistics about US meat consumption, and what they might say about the ability of the Fed to stimulate Main Street.

First, we go to St. Louis for the NBER macrohistory commodity series, and total historical meat consumption in the US. The graph ends during the WWII period, but it takes us nicely through the 20's recession period and the GD which ensued.

What's so notable about this series is that despite a growing population, meat consumption was flat from the second 1920s recession through about 1940. This should have been a warning at the time - wages weren't rising and before the financial crash, indicators of the Main Street economy were showing signs of recession. But at the time everyone was staring at Wall Street in a fervor, so no one paid attention.

Now, courtesy of the professionally censorious folks at NPR, who are tired of the masses messing up their pristine world (although the masses are allowed to clean their houses, cook their food, fix their cars and mow their lawns), an earnest plea not to eat meat, containing a nice historical graph of total meat consumption in the US.

Wow! All of sudden we masses have begun to really pay attention to NPR! That, or we just can't afford it....

This is all the more astounding because the US has hugely expanded our food stamp program, and between 1 in 6 and 1 in 7 Americans are receiving SNAP. Obviously this raises food spending by consumers. Also this stat does not account for shifting from higher-priced meats to lower-priced meats, which is the normal consumer reaction to financial strains. When you see this type of fall over such a few years, it means that some consumers can't afford to buy meat at all. Remember, the US population is still growing.

The change in US consumption habits is far more notable than it was during the GD. It's remarkable - it indicates a fall in US living standards that is just huge in historical terms. Most of it is probably comprehended in basics such as the ability to heat/cool living space, maintain the same type of diet, pay for medicines, etc.

It's hard to see how inserting money at high levels changes dynamics such as these. Electricity and gas utilities are another type of measure that show what's happening to consumers:

PS: Mark is assisting us in interpretation with his meaty trend graph:

Dare I suggest that this might be related to some of Mark's other graphs, such as this one and this one?

Friday, August 24, 2012

Durable Goods Looks Okay To Me

There's a very negative headline up at Bloomberg, but to me this report for July looks like more of the same. There has been a gradual decline of forward momentum, which is what you would expect under the global circumstances.

This report is consistent with a slowing of manufacturing growth, but not with any real downturn. Machinery orders did drop hard for the second month, but that's expected. Communications equipment is actually growing still - it's been through the cycle already and is now into a new cycle.

The problem with this report is that the shipment/new orders ratios YTD have shifted to the point at which normally we would expect a slowdown going forward, but there certainly is no real change this month. I think the financial press is just getting on the negative bandwagon - everyone on WS wants Ben to throw money; everyone on Main Street wants Ben not to throw money.

I really like this site for used-car price trends.

Thursday, August 23, 2012

We B Stimulatin'

Unfortunately I do not know the Mandarin phrase for this:

Bank of China Ltd., the nation’s third-largest lender by assets, posted the slowest quarterly profit growth in three years as loan demand weakened and lower interest rates squeezed margins....The bank bolstered first-half earnings by setting aside fewer provisions for bad debt, as the first cut in benchmark interest rates since 2008 eroded profitability of lending operations....Soured debts at the nation’s 3,800 banks increased for a third straight quarter to 456.4 billion yuan by June, the China Banking Regulatory Commission said last week.

There is an ancient and very moving Chinese banking spiritual that goes something like:

Roll those loans and capitalize the interest lalalla. You May Have Seen This

University of Colorado Boulder analysis projects a big win for Romney. This analysis has proved accurate in the past. It is chiefly based on economics.

As to why this should be so, see this Bloomberg article discussing what has happened to real household incomes during the recovery.

Median household income fell 4.8 percent on an inflation- adjusted basis since the recession ended in June 2009, more than the 2.6 percent drop during the 18-month contraction, the research firm’s Gordon Green and John Coder wrote in a report today.Household income is 7.2 percent below the December 2007 level, the former Census Bureau economic statisticians wrote. “Almost every group is worse off than it was three years ago, and some groups had very large declines in income,” Green, who previously directed work on the Census Bureau’s income and poverty statistics program, said in a phone interview today. “We’re in an unprecedented period of economic stagnation.”

There's a reason why the Wisconsin special election worked out as it did. The University of Colorado analysis is predicting a Romney landslide with over 300 electoral votes. I found myself hoping they are wrong about the magnitude, because it would inflict real pain on some of those who are very personally identified with Obama's candidacy.

But ultimately, "It's the economy, stupid!" A lot of people will vote for Obama just because, but not nearly enough.

The statistics in the Bloomberg article are important, because to some extent the effect has been masked by tax changes, which are due to expire.

Wednesday, August 22, 2012

FLASH Chinese PMI

Well, this does not really come as a surprise, but HSBC Chinese PMI drops to 47.8, and the output index dropped three points to 47.9. Note - this is the preliminary for August. The only thing expanding are stocks of finished goods, which can hardly be a good indicator for September, eh?

If you look at the employment, it has now escaped the lower bound of its oscillation and is headed down. New export business likewise.

PS: I keep reading all the stuff about an upturn, but it's beginning to remind me of the Chinese production of "Waiting for Godot". I had to read that thing in college. It was incredibly boring.

When you have a demand problem, monetary easing doesn't do much. If they are going to spend money, they need to put in subsidies for car purchases and stuff like that. Maybe cut taxes. Until inventories stop accumulating, the situation isn't going to get better.

If you look at the employment, it has now escaped the lower bound of its oscillation and is headed down. New export business likewise.

PS: I keep reading all the stuff about an upturn, but it's beginning to remind me of the Chinese production of "Waiting for Godot". I had to read that thing in college. It was incredibly boring.

When you have a demand problem, monetary easing doesn't do much. If they are going to spend money, they need to put in subsidies for car purchases and stuff like that. Maybe cut taxes. Until inventories stop accumulating, the situation isn't going to get better.

One last link: This is NOT an economic stimulus. Economically, in the short term it's a contractionary influence if they really try to execute.

Tuesday, August 21, 2012

Ah, Yes, The Legends Meet The Reality

The second half rebound in China is off to a good start for Japan:

I suppose we could say this may be possibly related:

India has a plan, though:

Japan's trade deficit in July was 517.4 billion yen, considerably above the estimated. I think everyone expected European exports to be low, but a 12% drop to China falls into the "very dead mackerel in face" category.Exports fell 8.1 percent from a year earlier, compared with an estimated 2.9 percent decline. Imports rose 2.1 percent. ...Shipments to the European Union fell 25 percent in July from a year earlier, the biggest decline since October 2009, while those to China slipped 12 percent, the ministry said

I suppose we could say this may be possibly related:

Corporate earnings in China are disappointing. Singapore's July wasn't that great either. When the banks are saying one thing and the companies are saying another, I'd bet on the companies. Shipping lines seem to be hurting very badly, between the increased cost of fuel and overcapacity.“The Chinese economy is only at the beginning of a harsh winter,” Zhang Hongxia, chairman of China’s largest cotton- textile maker, said in an interview in Hong Kong on Aug. 20. “China now is facing a situation where everything from coal to steel inventories are piling up.”

India has a plan, though:

Half of the short-term borrowings of the state-owned utilities, which generate or buy and distribute electricity, will be transferred to the books of the regional governments, according to a power ministry draft proposal obtained by Bloomberg News. The rest will be rescheduled by the banks and allowed a three-year moratorium on principal repayments.Cash losses at utilities widened 15 times over three years to 288 billion rupees ($5.2 billion) in the year ended March 2010, prompting them to seek short-term loans even as dues to power producers and coal miners rose. The difference between the average cost of supplying electricity and the average tariff has almost doubled in the 11 years to March 2010, according to the draft, leading banks to refuse loans.

I'm sure being unable to collect on the old loans is really going to want to make banks give them new loans, eh? At some point, if you don't pay for the energy you use, you stop getting the energy. Odd how that happens.

If they are not willing to raise prices so that the utilities can pay their costs, I"m failing to see how this helps much. It starts to make negative nominal yields for Bunds look somewhat attractive!

It turns out that one major cause of the power failures was utilities drawing more than their allocated because they didn't want to have to buy more expensive power - or rather, they couldn't afford to buy it.

But an elevated vision is trumping this dirty, crass, ignoble reality. Read this florid editorial on the blackout and climate change:

However, the multi-dimensionality of climate impacts makes it vital that India adopts an approach that is interdisciplinary in its character, breaks traditional ministerial boundaries, and learns rapidly from the effects of warming that are ongoing and our successes and failures in dealing with them.Experts are still learning about sub-regional impacts of climate change, but we know for sure that reducing emissions is urgent as is reducing vulnerability. We suggest the following processes: first, through a collaborative and systematic method, identify development decisions in different sectors that could lock in structures, technological systems and institutions leading to high emissions pathways, which as it turns out are also generally inequitable, and find plausible alternatives. Second, incorporate increasing climate resilience into decision-making. Climate resilience generally refers to the capacity to respond effectively to climate change.

Or you could write off the bad loans so the whole cycle could start again. If you will go back and read the first article again, you'll note that power production by independent producers is dropping, due to the fact that the utilities can't pay for it:

We have a global epidemic of ignoring reality and blaming it on something else. We live in Fantasy Island, and it's not just a Western disease.NTPC Ltd. (NTPC), the country’s biggest power producer, was forced to cut generation by 13 billion kilowatt hours, or 6 percent of total production in the year ended March 31, as state government utilities reduced purchases, Chairman Arup Roy Choudhury said on Aug. 7. The company may have to cut output by almost as much this fiscal year.

Monday, August 20, 2012

Renewables, The Joy

I have had to spend over $500 to even out the power supply at SuperDoc's. Renewables blew the grid voltage. I put a monitor on it and just watched the incoming voltage flicker. It's so bad now that it is going to blow out his AC unit if he's not careful. The thing has begun tripping and going offline due to the fluctuations.

Germany is now coping with the same thing, and so far industries are largely coping by taking over their own generation, which will inevitably increase the use of fossil fuels.

The move to gas in Germany did not occur, because of high costs and inability to recover the investment due to the priority of wind/solar in purchases. So Germany is burning more coal instead.

In the US CO2 emissions are steadily dropping. We might want to think all of this over before following in Germany's path. NG is now cheap and it emits less CO2 than coal. If you believe that CO2 is harmful to the environment, the fact that US CO2 emissions are back to early 1990s levels (when we were in a recession) is highly significant and positive.

The extreme variability of wind makes it a very useless combo with any fossil-fuel combos. If you are compensating with hydro, you can do it without too much problem, but that isn't possible in most places. It's also a very bad mix with nuclear power.

As soon as you push the grid to the failure point for industrial operations, companies that stay will have to go to their own generation, and that pushes up fossil fuel usage.

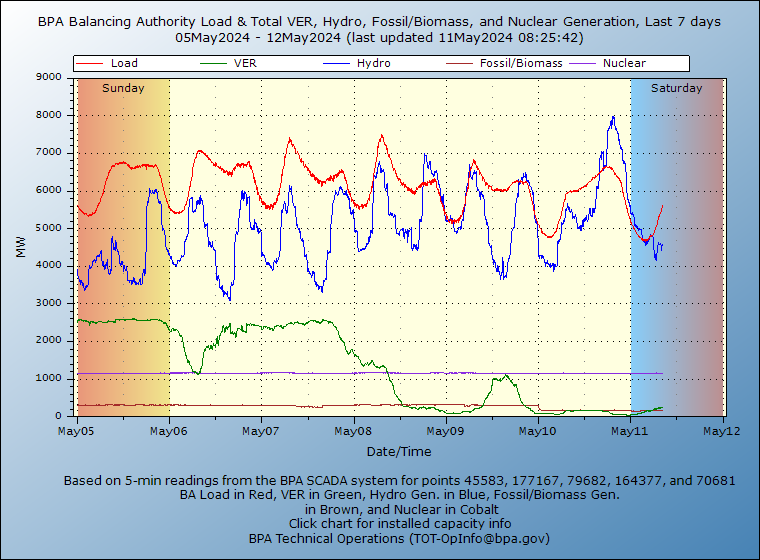

To understand just how much of a climate disaster on-grid wind power is, see the BPA wind page.

I made you guys a graph from the data. This is January of this year. Note the fascinating erraticism of the orange wind curve. The best part of it is that it is fractal - if you look at a shorter time frame (they publish five minute samples) the curve remains as loopy.

This is their current seven day rolling chart:

Everybody Needs To Run Out And Buy Something

I'm serious. CFNAI. July was revised down.

You can't have CFNAI this low combined with stagnant or declining real retail sales without ensuing sorrow:

I added in the gas/diesel prices. I can see why retail sales are stagnating, but still....

It's Mark's fault. He should be out there spending his money and he doesn't. Some cheeping whining BS about wanting to have money when he's 75. He should throw himself into the spending fray.

It does raise questions about what the Fed can accomplish. Arguably, they normally make the consumer spending side worse with their interventions, which is why you see the oddity of gas and diesel prices rising in the beginning of a recession. If lower interest rates spark a consumer credit expansion, then they can overcome the tailwinds, but we're not really slated for that.

I have some more graphs, but they are depressing. I need to scrub stuff to be able to deal with this. I'll be back when I have run out of bleach. I bought one of those big containers this weekend, so don't hold your breath. Also two mops (the kinds that have the spray nozzle built in) and a range of other cleaning supplies.

Based on the M_O_M scrub-dex, this is going to be ugly. I also bought shoes and anything else I could think of, but frankly, I just don't have that much to throw into the pot. I haven't put 20K on the car I bought less than two years ago.

I'm seeing light staffing and light stocking in retail, and grocery stores look like it is keeling over.

The problem is that entry-level salaries aren't going anywhere, and many are declining. And costs are rising. The bottom line is that we just haven't been able to accumulate the money this year for the expansive surge that we saw last year:

Last year we collectively stuck a whole lot of dough in our checking accounts from June through the end of August, and it fueled holiday spending. This year we haven't been able to do that., and rising gas and basic food costs ensure that we're not going to be able to make it up by squeezing the daily dollar.

We have been struggling with our CCs, but even that is worse relatively than it was last year:

One of the issues is services, especially insurance. Low returns are driving up insurance costs for understandable reasons, but it's another draw on the budget. Thursday, August 16, 2012

Blah, Blah, Blah

Sentiment is pretty good on WS, but Main Street still seems to be lagging. Rail traffic shows the consumer slowdown pretty clearly. It's August, but container (usually foreign shipments) traffic is only up 4.6% YoY and 5.7% YTD. As of July 12th it was up 7.3%. June 14th was 6.1%. August is usually a huge port traffic month with holiday selling season goods rolling into those ports, destined for transport to stores and warehouses. It's going to be subdued this year.

I suppose consumers could suddenly start buying, and all this could turn around. It's relatively unlikely for 65th percentile and down in view of the higher food and gas prices. People who budget are going to be feeling the squeeze.

Philly Fed Survey is out, and there was nothing encouraging in it. The sustained downturn has naturally led to increasing cuts in employees and average workweek. Unfilled orders dropped 16.2 this month in comparison to last month's 9.5 drop. Shipments dropped 11.3 compared to the prior month's drop of 8.6. It is too soon to say that this is close to turning around. But it is only one manufacturing survey. Prices paid rose 11.2 compared to the prior month's +3.2. That indicates that conservatism is likely to continue.

A lot of chatter about decreasing foreign investment in China. Not a surprise. Consumer prices took a tiny uptick in July in China, but the trend change was very steep at + 0.7, basically on food. As to FDI, this release might hold some clues:

New residential construction is out. Permits are rising, starts fell a tad, and completions are up 7.4% YTD and 5.4% YoY. Under construction is up 17% YoY. The real contribution is in the activity, so peg it at 10%? However housing construction is at such a low rate by historic terms that it doesn't offer us that much hope:

Another way to look at this is that in a growing economy, this helps. But it is not enough, relatively, to keep us out of a contraction.

Initial claims remain right in line. School systems are beginning to start up, and that will help to get more money flowing through the economy. Insured unemployment continuing claims are not mounting, which is a big asset.

Wednesday, August 15, 2012

Empire State Survey goes negative

Well, this is not exactly optimistic:

The August Empire State Manufacturing Survey indicates that conditions for New York manufacturers deteriorated over the month. The general business conditions index slipped below zero for the first time since October 2011, falling thirteen points to -5.9. At -5.5, the new orders index was below zero for a second consecutive month, and the shipments index fell six points to 4.1. The prices paid index climbed nine points to 16.5, pointing to a pickup in the pace of increase in input prices, while the prices received index hovered just above zero for a third consecutive month.

Survey questions also noted negative revisions to future plans:

In a series of supplementary questions, manufacturers were asked about modifications to 2012 hiring and capital spending—both year-to-date changes and revisions planned for the rest of the year. Substantially more firms (roughly twice as many) made downward than upward revisions in their plans for the second half of the year. As for actual spending year-to-date, modest downward adjustments were made, on balance. When asked about negative influences on 2012 hiring and capital spending plans, a majority of respondents cited increased uncertainty about business prospects.

Staples reports same store sales in North America down 2%. It's hard to know how much of this is shifting of sales to the big discounters like Walmart. Still, it is in no sense an economic positive:

Sales fell 5.5 percent to $5.50 billion in the second quarter ended on July 28, well below the analysts' average estimate of $5.72 billion. International sales dropped 18 percent to $1.1 billion, hurt by weakness in Europe, which is reeling from an economic crisis, and lackluster demand in Australia.

It's better than Office Depot, though. This is where the bad NFIB reports start to hurt the general economy.

Amid all the chatter over CPI (because everyone's waiting for the moneycopters), no one seems to be commenting on the fall in price increases for new cars and used cars. Here's the full html release. On the month, new car prices fell 0.3%. Used cars and trucks are still rising a bit at +0.3%. This takes the 12 month gain to 0.8% for new vehicles and 1.1% for used vehicles. On an SA basis, that's -0.1 and -0.5 respectively.

I'm thinking that the joy of subprime car loans is about to expire. The financing boom at auto dealers has been supported by good overall loan stats. Subprime auto loans have been supported by high resale values, which greatly cut the cost of those loans. I think that the used car market is equalizing now. This shouldn't be that much of an impact this year. I think.

Import cargo volume at the nation's major retail container ports is expected to increase 6.3% in August compared with the same month last year,

Tuesday, August 14, 2012

Do We Laugh Or Do We Cry?

Item 1: The NOAA (National Weather Service) is buying significant quantities of hollow-point ammo. So did the DHS (Homeland Security):

A solicitation which appears on the FedBizOpps website asks for 16,000 rounds of .40 S&W jacketed hollow point (JHP) bullets, noted for their strength, to be delivered to locations in Ellsworth, Maine, and New Bedford, Mass. A further 6,000 rounds of S&W JHP will be sent to Wall, New Jersey, with another 24,000 rounds of the same bullets heading to the weather station in St. Petersburg, Florida. ...UPDATE: The Washington Post now reports, via a statement from NOAA spokesman Scott Smullen, that the original solicitation contained a “clerical error” and that the “solicitation for ammunition and targets for the NOAA Fisheries Office of Law Enforcement mistakenly identified NOAA’s National Weather Service as the requesting office.”

Personally, none of this makes me happy. I recommend reading the article and thinking a bit. This stuff is really happening, and it should make everyone's eyes roll.

However, one possible explanation:

A 17-foot-7-inch Burmese python found in the Florida Everglades set a state record for both its size and the 87 eggs the snake was carrying, according to an official at the national park.

Preparing for boapocalypse! That or they intend to shoot climate change deniers, er, alligators? I am responding to a question up at Small Dead Animals.

Tuesday's News

Here is where things get kind of interesting. First July retail. The monthly number is great, but the quarterly trend is still down. If you go to Table 2 on the right, you'll now see a rolling three month comparison with the prior three months. And that's the story. Retail is slumping quietly.

Overall retail is still one of the brighter sides of this story:

This gives current retail data on a YoY basis. The red line is price-adjusted, the blue line is not. So the red line goes through June and the blue line through July. The depth of the trend change is evident when you look at it this way.

On the whole, retail is still one of the economic positives, because it hasn't yet fallen to the OMG we're in a recession levels. On the other hand, if you look at the 2000 sequence, it is not inconsistent with a mild recession either. But this graph is not too painful to contemplate, so I put it up first.

NFIB. The headline shows near stagnation after June's unhappy tumble. The real story for small businesses is this:

Earnings changes fell back into standard recession levels. July is one of the big samples, so I regard this as confirmed. This is why the economy is slack. The commentary on this month's report is interesting:

If it weren’t for population growth, Gross Domestic Product growth would be about zero. More people eat burgers, get haircuts, drive a vehicle, etc. So, 1 percent population growth will support something like a 1 percent growth in spending. And that’s our basic support level. Absent that (as in Japan and Eastern Europe where it’s near zero), growth would be under 1 percent. And the NFIB indicators point to a continuation of just that kind of growth.

... . Overall, it is clear that the “economic growth stars” are not in alignment and that we can expect very sluggish growth for the balance of the year, ever grateful for population growth which will help insure that we don’t experience the dreaded recession. If consumers and business owners were presented with a plan to resolve our calamitous debt/spending cycle that they could believe in, they would spend more. Until then, no risky bets will be placed.

I have to agree with that last statement. People are in "survive" mode. The big increases in basic costs (often rent), definitely food and fuel, combined with slack incomes, are making the majority of the people cautious. Also the continued seesaw of stimulus-forced increases in basic costs makes the average household worry. People have to plan ahead for expenditures. They can't simply go blithely from month to month. Most people in the US have moderate incomes. Their financial stability (or instability) is based on budgeting.

The worst indicators for the economy are some of the most basic, like inventory/sales ratios:

The only thing you can say about that is "yuck". The retail sales levels we saw in July are not enough to clear this trend, so China suffers. The report is here. If you look at the non-adjusted YoY's, you see that worst is felt at the wholesale level, then at retail, and last at manufacturing. That means there is more to come this quarter as slowness rolls through the system.

We cannot truly believe that with the Baby Boomers retiring we can afford to keep payroll taxes where they are. We know we must change things. We just don't know how things will change, and at this point uncertainty is a growing economic drag.

Lastly, PPI shows the future stressors in the system. Producer prices are going up, not down, and headline inflation has reached a transitory low which is doomed to evaporate. Food prices, in particular, are rising. Food prices have a large impact on consumer buying behavior, and the combination of higher food prices (esp. for lower income households) and higher gas prices don't set us up well for the rest of the year.

Current trends in commodities and higher auction sizes are beginning to show up in Treasuries. The four week showed a significant jump in yield. But that is logical - as money can shift to other plays, there is no need to accept a really low four week yield.

Tomorrow we get Empire State Manufacturing plus industrial production.

Internationally, one really sees the impact of all of this. From India, where consumer food prices are still up 10% over a year ago, with July exports falling 14% from a year ago, with future investments compromised by the situation, to the Philippines, where just about everything is going wrong, the global economy is tightening up.

Currency deflation (China is trying to adjust down, India's is still sliding) will help these economies somewhat but raise the bar for other countries struggling to push exports.

The Euro-area economy is down 0.4% from a year earlier. The slow slide into contraction is beginning to take hold. The Czech experience pretty much shows the basic trend for the region:

I think this recession will be relatively mild, but it seems awfully determined. The cure to this one can only be price drops. The idea that central banks across the world can throw enough in the pot to change the curve is irrational.

I think this recession will be relatively mild, but it seems awfully determined. The cure to this one can only be price drops. The idea that central banks across the world can throw enough in the pot to change the curve is irrational.

In general, the economies of the Americas are doing better than the economies of Europe. But still, consumption/investment in too many of those economies is being supported by unsustainable levels of borrowing in one form or another. In the US, it is government borrowing. In Canada, it is household debt and declining disposable incomes. I look at Brazilian news, and see consumer loan defaults rising and Mantega demanding that banks lend more and average interest rates on lending above 30% for consumer lending, and above 20% for business lending, and I cringe.

Mexico's economy is doing well, but inflation may become a factor later this year and credit expansion is a big part of it.

Sunday, August 12, 2012

About Ryan's Candidacy

When the Trustees released their report this year, they advanced the OASDI fund exhaustion date to 2033. Once it is exhausted, under current law benefits would be cut. They also projected DI exhaustion in 2016.

The exhaustion date for SS assumes that funds will once more be shifted from SS to DI so that currently disabled individuals will continue to receive benefits.

Any way you look at it, the Social Security issue is on the table now. Since the trust funds are mythical entities, failure to redress at least some of our huge budget deficit problem will mean that the US will run out of borrowing power far earlier than 2033 and be forced to cut these payments. My best guess is that this will happen by 2024. Our deficit is rising too rapidly to let us continue on this path.

However, if you want to ignore that, 2033 is just 21 years away. If you are 55, your full retirement age is 67. By the time you are 77 you can expect to lose a hunk of your Social Security check.

Any realistic attempt to forefend disaster and maintain at least the core of these benefit programs has to rely on expanding growth, which is contingent upon cheap energy, and cutting overall spending, which is contingent upon cutting social spending.

If you or a family member are currently on Disability, you can expect to lose a portion of it within the next decade.

Thus, the Democratic rhetoric on this issue is completely idiotic. Failure to deal with our situation will only shortchange retirees. They are already in a pickle, and throwing them to the wolves is not a realistic option. Thus we must start working now to figure out a way to cover the basics.

A Democratic party that doesn't take this situation seriously is not the Democratic party of the past. The name may be the same, but the party is not.

How Inevitable

Grilli is claiming that Italy is going to reduce its debt-to-GDP ratio by 20% over 5 years. Once this recession is over, that is:

Grill[i] said that when the government gets back to work after a brief summer recess, a debt reduction plan will be introduced that is composed mainly of state real estate sales, spending cuts and prudent budget management. "When this recession is over, (the debt reduction plan) would permit a lowering in the debt-to-GDP ratio of 20 percentage points in five years," he said.

But he's also admitting that Italy will miss its nominal deficit target this year. Italy has been in recession for a year, and the result has been to shrink the overall economy by over 2%. Confindustria predicts the 2012 contraction to be over 2%. Actually 2.4%, but at this stage who is quibbling? The government is projecting about 1% less, which is remarkable, because GDP has already contracted this year by more than the projected decrease. In other words, the government is projecting rising GDP in the second half.

By the end of the year, then, we can expect Italy's debt-to-GDP ratio to be over 125%.

Tax revenues are falling short of projections. Raise the property tax, and VAT receipts fall. Who'd 'a thunk? Heck, tax revenues this year are falling short of the prior year's tax revenues, and the tax revenues of the year before that, and the year before that, and:

Value-added tax receipts have declined since Monti’s predecessor, Silvio Berlusconi, raised the rate by 1 percentage point in September as the economy was slipping into recession, government data released June 5 showed. The amount collected fell in the 12 months ended April 30 to the lowest since 2006.

There's this thing called a "Laffer curve". It exists. So economists are now calling for spending cuts.

Pretty obviously, spending cuts are not going to be sustainable over the long term. The two population slices in their 20s are outnumbered by the two population brackets in their 60s. More workers must exit the workforce than can enter. It's really quite extraordinary that Italy has achieved such a high unemployment rate with these demographics.

Pretty obviously, spending cuts are not going to be sustainable over the long term. The two population slices in their 20s are outnumbered by the two population brackets in their 60s. More workers must exit the workforce than can enter. It's really quite extraordinary that Italy has achieved such a high unemployment rate with these demographics.

I don't want to kick a country when it's down, but short of seizing the Vatican and selling everything in it, there is not much that Italy can do about its situation - other than exit the Euro. It is in a worse position to do that than it was a year ago, which is why the Finance Minister is going around telling bald-faced lies.

Spain is in a relatively good position to exit the Euro. Devaluation would bring a lot of money into the country. Italy has mucked up its banks with the ECB money, so now they are in a rough situation. They will try to run this out, but they are in the end game now.

Saturday, August 11, 2012

Oh, So Romney Wants the Campaign To Be About Something?

That was my reaction to the news of Ryan as Veep.

Update: Iowahawk sums it up:

Paul Ryan represent[s] Obama's most horrifying nightmare: math.

Funniest commenter reaction over at IMAO:

That would make a great bumper sticker, wouldn't it? "Paul Ryan - Not assassination insurance."I will give Romney props for more physical bravery than I thought he had, unlike Biden, Paul Ryan is definitely not assassination insurance.

DU is workin' hard to get the hate out. So far:

The "Apocalypse Now" thread. Sample:

And my fave.43. From what I have seen posted here about Romney and RyanIf some how they come to power, there will be no future for the United States. It will end with the tiny whimper of some poor sap, being sucked down into the bowls of the earth, as the rest of the world, tries to stop the evil from spreading, and Romney, Ryan and rich friends will be happily dining off the ashes.

Friday, August 10, 2012

Right On Schedule

Chinese exports for July were released, and this has led to a tad of oily skepticism. China was targeting a 10% gain for exports this year. In July, all outbound shipments were just 1% above last year, which of course was completely unexpected and all that. Everyone was completely amazed.

Shipments to Europe fell 16%, and shipments to the US were just above flat on a YoY basis.

Of course, following the same logic, we read that this just makes stimulus more certain. However, no one can adequately explain how Chinese stimulus would fix buying power in the US and in Europe, so let's just say that the Chinese are going to have to focus on internal demand for the nonce.

Speaking of demand, the Chinese government announced that it would raise gas and oil prices internally as a result of the recent increase in costs for oil. This should prove very stimulative, I'm sure.

India has gotten itself into a terrible situation, because it is forcing sales of fuel below cost, but it has forgotten to pay the compensation to the companies handed this bowl of rice. The banking focus begins to shift to bad loans, etc. A poorish monsoon isn't helping at all. The latest estimate is close to 20% down, which will have a major impact.

One of the problems with Indian infrastructure is that when you control the final price of commodities like fuel, people don't want to build power plants and such like infrastructure, and banks don't want to lend on them, because they are not sure the payments will roll through.

The likely explanation for the big negative Chinese figure on exports is that work was slack, so orders were filled and shipped more quickly. Therefore averaging June/July would give you a more representative number on exports. However that number is low enough to cause deep concern.

US 30 year auction was crappy. The rubber bands are all pulled tight, and now the snap-backs begin, and each time one of them breaks or snaps back, the pressure on all the rest of them increases.

Note that you can see the impact of lower shipments in rail container figures, which are beginning to come off their annual pace.

Note that you can see the impact of lower shipments in rail container figures, which are beginning to come off their annual pace.

MaxedOutMama

MaxedOutMama