Friday, September 28, 2012

History, Rhyming

This is a really fascinating article which you may not bother to read. It is linked on Drudge. It's about Golden Dawn (a nativist party in Greece) and the growing partnership between the party and the police, plus the party's emergence as a social welfare network. Only for the "right" people, of course.

I have been reading about Golden Dawn for some time. See this from early summer. Note how quickly support is growing.

Wikipedia has a pretty good backgrounder if you've never heard of Golden Dawn.

I have been reading about Golden Dawn for some time. See this from early summer. Note how quickly support is growing.

Wikipedia has a pretty good backgrounder if you've never heard of Golden Dawn.

The Problem Is Incomes

Update: There seems to be some shock about the Chicago PMI number, but why? If you look at the details this is just a continuation of trend. It's catching up with the headline number because of the rolling averaging and seasonal adjustments, but surely nobody thought this was going higher? The order backlog trend has been quite negative since May (only above the 50 line ONCE). It was going to catch up with us. It did. If this is unexpected, so is hunger and thirst. What is notable in this report is that although employment is still expanding, there was a sharp downshift that is going to show up in employment reports over the next couple of months.

End update.

It's not just our problem, either.

BEA's personal income and outlays report for August is out. July's nominal personal income increase was revised down to 0.1, and August is reported as 0.1. However, in inflation adjusted dollars, July's increase is still 0.1 but August converts to a -0.3. Nominal PCE is 0.4 for July and 0.5 for August, but in inflation-adjusted dollars it is 0.4 for July and 0.1 for August, and that's with back-to-school spending!

Consumer spending isn't going to carry us through (article), because all too many consumers don't have money to spend! Jacking up the amount they must spend for basics is hardly going to help the situation. The Fed's actions are sustaining commodity prices and equities to an extent, but I hardly see how it will increase jobs. You need an increase in real spending to increase jobs.

Eurozone inflation took an "unexpected" jump in September to 2.7%, dashing hopes that ECB would lower rates.

China is limiting its stimulus actions due to fears over house prices. Read the article. They are desperately trying to avoid a crash landing. Who can really criticize them? Who wants to be Spain or Ireland? Still, this means they are doomed to walk it down. Chinese companies are having a funding problem because they have a revenue/profit problem:

Anyway, the weakness in the US economy shows in more restrained intermodal gains in rail and various shipping indicators. This is of course awful news for China, and also for Japan, which is clearly in a recession. Manufacturing PMI is just hanging in contraction.

But aren't we all just slowly walking it down? It's a quiet, inexorable sag. The European recession just grew with a determined, stolid stoicism that now defies any possible attempt to redress.

End update.

It's not just our problem, either.

BEA's personal income and outlays report for August is out. July's nominal personal income increase was revised down to 0.1, and August is reported as 0.1. However, in inflation adjusted dollars, July's increase is still 0.1 but August converts to a -0.3. Nominal PCE is 0.4 for July and 0.5 for August, but in inflation-adjusted dollars it is 0.4 for July and 0.1 for August, and that's with back-to-school spending!

Consumer spending isn't going to carry us through (article), because all too many consumers don't have money to spend! Jacking up the amount they must spend for basics is hardly going to help the situation. The Fed's actions are sustaining commodity prices and equities to an extent, but I hardly see how it will increase jobs. You need an increase in real spending to increase jobs.

Eurozone inflation took an "unexpected" jump in September to 2.7%, dashing hopes that ECB would lower rates.

China is limiting its stimulus actions due to fears over house prices. Read the article. They are desperately trying to avoid a crash landing. Who can really criticize them? Who wants to be Spain or Ireland? Still, this means they are doomed to walk it down. Chinese companies are having a funding problem because they have a revenue/profit problem:

Anyway, the weakness in the US economy shows in more restrained intermodal gains in rail and various shipping indicators. This is of course awful news for China, and also for Japan, which is clearly in a recession. Manufacturing PMI is just hanging in contraction.

But aren't we all just slowly walking it down? It's a quiet, inexorable sag. The European recession just grew with a determined, stolid stoicism that now defies any possible attempt to redress.

Thursday, September 27, 2012

Another Donnerstag

Well, let's start with the good. Initial claims this week headline at a more optimistic 359K. Last week revised up to 385K. Current moving average 374K. That moving average just doesn't want to change. But at least it is below 400K, huh?

And then the kicks in the 'nads, which I kinda knew were coming, but were worse than I expected.

A) Eurozone retail stuck in contraction in September. Whole darn thing is just sliding slowly down the cliff. Austria manufacturing (one of the last expansion holdouts) took another tumble this month. The trajectory here is not good - the entire region is just converging negatively.

B) Durables (advance). This is for August.The big weakness is in planes, but a drop of 13.2% in durable orders is shockingly bad. Ex-transportation new orders decreased 1.6%. Shipments dropped 3%; ex-transportation shipments dropped 0.9%. I wouldn't recommend reading this thing - the string of minus signs burns out your eyeballs. About the only good thing I could find in here was non-defense capital goods ex-aircraft. Shipments declined 0.9%, but new orders rose 1.1%. However even that is not good, because on a YoY basis orders in that category have declined from 61,719 to 58,606.

If you are such a masochist as to try to read this entire report, you will find no comfort in the second page where we get to inventories and unfilled orders. Inventories rising, unfilled orders dropping, the beatings will continue until morale improves.

C) GDP. Q2 was revised downward to 1.3%. Unexpectedly. If you look at tables 11 and 12, you'll see that domestic industry profits are dropping, and that's one reason why we have such nasty forward indicators. There's not much joy in this report - private inventories are probably rising now, which will help Q3, but doesn't provide much hope for the future. Domestic income gains are slowing rapidly.

And then we have to deal with the tax cut expirations next year. This is a formidable wall. Externally things keep slowing and we have internal brakes set as well.

China, btw, turned in another big fall in industrial profits. Noda said Japan ain't backing down.

Pending home sales dropped. ATA trucking tonnage index for August dropped SA 0.9%. Read link.

Kansas weakened:

And then the kicks in the 'nads, which I kinda knew were coming, but were worse than I expected.

A) Eurozone retail stuck in contraction in September. Whole darn thing is just sliding slowly down the cliff. Austria manufacturing (one of the last expansion holdouts) took another tumble this month. The trajectory here is not good - the entire region is just converging negatively.

B) Durables (advance). This is for August.The big weakness is in planes, but a drop of 13.2% in durable orders is shockingly bad. Ex-transportation new orders decreased 1.6%. Shipments dropped 3%; ex-transportation shipments dropped 0.9%. I wouldn't recommend reading this thing - the string of minus signs burns out your eyeballs. About the only good thing I could find in here was non-defense capital goods ex-aircraft. Shipments declined 0.9%, but new orders rose 1.1%. However even that is not good, because on a YoY basis orders in that category have declined from 61,719 to 58,606.

If you are such a masochist as to try to read this entire report, you will find no comfort in the second page where we get to inventories and unfilled orders. Inventories rising, unfilled orders dropping, the beatings will continue until morale improves.

C) GDP. Q2 was revised downward to 1.3%. Unexpectedly. If you look at tables 11 and 12, you'll see that domestic industry profits are dropping, and that's one reason why we have such nasty forward indicators. There's not much joy in this report - private inventories are probably rising now, which will help Q3, but doesn't provide much hope for the future. Domestic income gains are slowing rapidly.

And then we have to deal with the tax cut expirations next year. This is a formidable wall. Externally things keep slowing and we have internal brakes set as well.

China, btw, turned in another big fall in industrial profits. Noda said Japan ain't backing down.

Pending home sales dropped. ATA trucking tonnage index for August dropped SA 0.9%. Read link.

Kansas weakened:

The month-over-month composite index was 2 in September, down from 8 in August and 5 in July, and the lowest in nine months (Tables 1 & 2, Chart). The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Manufacturing growth decreased at most durable- and nondurable goods-producing plants, with the exception of metal and transportation products which posted a slight increase. Most other month-over-month indexes also fell in September. The production index dropped from 7 to - 4, and the shipments, new orders, and order backlog indexes also moved into negative territory. The employment index eased from 2 to 1, while the new orders for export index inched higher but remained below zero. Both inventory indexes eased but were still in positive territory.

Tuesday, September 25, 2012

Absolutely Not An Economic Post

Some things are just not worth the cost.

I dispute the supposed evidence in the link. And even if it is true, maybe it's just lack of female nagging that caused the long life spans! That, anyway, is the Chief's way of viewing such nonsense.

The comments at the link are pretty darned good!

If the link is still effed up, try this: http://www.dailymail.co.uk/sciencetech/article-2207981/Scientists-secret-living-life-men-bad-news-Castration-key.html

The html is correct, so I don't know what's up. Maybe Blogger is in fact male, and is experiencing acute discomfort over the content at the link.

I dispute the supposed evidence in the link. And even if it is true, maybe it's just lack of female nagging that caused the long life spans! That, anyway, is the Chief's way of viewing such nonsense.

The comments at the link are pretty darned good!

If the link is still effed up, try this: http://www.dailymail.co.uk/sciencetech/article-2207981/Scientists-secret-living-life-men-bad-news-Castration-key.html

The html is correct, so I don't know what's up. Maybe Blogger is in fact male, and is experiencing acute discomfort over the content at the link.

Monday, September 24, 2012

Dallas Fed

September. Underlying details in Dallas have been stronger than the headline would suggest, but increasing input costs and stagnant-to-dropping finished goods prices are not a good sign.

Ordering info was more positive, but (look at the chart on page two) unfilled orders are still dropping. Finished goods inventories dropped this month after rising last month, which offers hope for the future perhaps. Orders trajectories have now been negative for three months, which is slowly converting the employment index toward stagnation. I have considerable hope that this region will grow through a recession, even if at a quite slow pace.

Ordering info was more positive, but (look at the chart on page two) unfilled orders are still dropping. Finished goods inventories dropped this month after rising last month, which offers hope for the future perhaps. Orders trajectories have now been negative for three months, which is slowly converting the employment index toward stagnation. I have considerable hope that this region will grow through a recession, even if at a quite slow pace.

CFNAI August

Well, we knew it would not be good. Look at the six month progression on CFNAI-MA3 (the moving three month average)

This latest month's figure is below the commonly accepted recession line of -0.70. Graphs and all at link, but you can find no happiness here. Look at the diffusion - it's broad-based.

The most irritating thing about all this is that the Fed's action will probably make things slightly worse, but it might have had a chance to influence matters positively if they had moved into action six months ago. Even then it would have been a long shot, but now it's just coals of fire.

This latest month's figure is below the commonly accepted recession line of -0.70. Graphs and all at link, but you can find no happiness here. Look at the diffusion - it's broad-based.

The most irritating thing about all this is that the Fed's action will probably make things slightly worse, but it might have had a chance to influence matters positively if they had moved into action six months ago. Even then it would have been a long shot, but now it's just coals of fire.

Sunday, September 23, 2012

Fisher And White

These are both really good reading if you want to think about our current course. Richard Fisher's "Sailing" talk is here. Bill White's August paper is here, in a slightly different format than I first read.

I particularly recommend White's paper. I believe that the BIS framework is more accurate than the Fed framework, largely because the Bank of International Settlements has an ingrained habit of looking at the financial system of the globe as a whole.

There is no possible way that the Fed's recent policy shift doesn't create new instability. There is no way to tell what will come of it, but it is highly unlikely that it will actually accomplish the stated goals. It may well turn out to increase aggregate borrowing and reserving costs in the US.

I particularly recommend White's paper. I believe that the BIS framework is more accurate than the Fed framework, largely because the Bank of International Settlements has an ingrained habit of looking at the financial system of the globe as a whole.

There is no possible way that the Fed's recent policy shift doesn't create new instability. There is no way to tell what will come of it, but it is highly unlikely that it will actually accomplish the stated goals. It may well turn out to increase aggregate borrowing and reserving costs in the US.

Friday, September 21, 2012

Freight

Not looking particularly brilliant. Waterways:

Rail - biggest factor here is that YoY autos are slowly sagging. It's like watching a balloon with a leak.

Thursday, September 20, 2012

Latest Fed Guv Comes Up With Brilliant Proposal

Donnerstag!

Well, oil is still pressured downwards. Always start with the bright side.

Initial Claims, US: This week's headline of 382K is exactly the same as last week's headline of 382K, but that was revised upward to 385K. The moving 4-week average therefore comes up to 377,750. Not good news, but continuing claims are not piling up yet.

It's worth noting that recessions don't start with rising layoffs. The initiation is generally marked by a dropoff in new job creation. We seem to be in that mode right now.

PMIs. I don't want to dwell on this unpleasantness, but Euro PMI is quite depressing with a composite output index of 45.9. Germany did better, France did much worse with a kind of shocking composite output index of 44.1. Although Germany did better, the strength (50.6) was in the services sector, and outstanding work for services dropped hard, so Q4 doesn't look that good there either. Employment is trending downwards everywhere now. These are preliminary for September. The takeaway is that the recession in Europe deepened in the third quarter, and unfortunately appears to be getting worse just in time for the fourth quarter - a fact which just cannot make anyone happy.

China: Output index at 47 (manufacturing). Stocks of finished goods still expanding. Slowdown will continue into the next quarter.

US (manufacturing): A modest expansion, but output index is lower, new export orders declined faster, and in this month's report, backlogs of work changed direction to contract at 48.9. So while this is much less unpleasant than the Euro version, it's not what you want to see on your plate. There has been a difference between the contraction/expansion summer levels between ISM and Markit, with Markit being the more positive. Declining industrial production in August may indicate that ISM is the more accurate at the moment. They appear to be converging.

Philly Fed survey up this morning - Empire was a negative surprise this week, so maybe Philly Fed will look better.

PS:

I'm not sure what the heck happened in France. A manufacturing output index of 39.6 is almost incredible. Maybe there were strikes I missed. We certainly can kiss Q4 goodbye in Europe. In the US we are still in slow sag mode.The US economy has mono; the European economy has a whopping case of flu with respiratory complications.

In the meantime, the international peace and amity explosion is very impressive.

Well, Philly Fed is something of a disappointment. The headline looks a lot better, at only -1.9. But shipments fell to -21.2, a big drop. Unfilled orders continued their drop. However inventories are declining, so maybe we are closer to stabilization. After five negative months, we should be getting closer to that point. Employment at -7.3 and the average workweek is still contracting also. One of the special questions was on Q4 production expectations, which was as negative as Q3 production reports. The six month outlook is getting better, but that may not mean much if a negative quarter is expected first. 47/35 (negative) in Q3 vs 45/32 (negative) in Q4 doesn't exactly provide a vista of hope.

Initial Claims, US: This week's headline of 382K is exactly the same as last week's headline of 382K, but that was revised upward to 385K. The moving 4-week average therefore comes up to 377,750. Not good news, but continuing claims are not piling up yet.

It's worth noting that recessions don't start with rising layoffs. The initiation is generally marked by a dropoff in new job creation. We seem to be in that mode right now.

PMIs. I don't want to dwell on this unpleasantness, but Euro PMI is quite depressing with a composite output index of 45.9. Germany did better, France did much worse with a kind of shocking composite output index of 44.1. Although Germany did better, the strength (50.6) was in the services sector, and outstanding work for services dropped hard, so Q4 doesn't look that good there either. Employment is trending downwards everywhere now. These are preliminary for September. The takeaway is that the recession in Europe deepened in the third quarter, and unfortunately appears to be getting worse just in time for the fourth quarter - a fact which just cannot make anyone happy.

China: Output index at 47 (manufacturing). Stocks of finished goods still expanding. Slowdown will continue into the next quarter.

US (manufacturing): A modest expansion, but output index is lower, new export orders declined faster, and in this month's report, backlogs of work changed direction to contract at 48.9. So while this is much less unpleasant than the Euro version, it's not what you want to see on your plate. There has been a difference between the contraction/expansion summer levels between ISM and Markit, with Markit being the more positive. Declining industrial production in August may indicate that ISM is the more accurate at the moment. They appear to be converging.

Philly Fed survey up this morning - Empire was a negative surprise this week, so maybe Philly Fed will look better.

PS:

I'm not sure what the heck happened in France. A manufacturing output index of 39.6 is almost incredible. Maybe there were strikes I missed. We certainly can kiss Q4 goodbye in Europe. In the US we are still in slow sag mode.The US economy has mono; the European economy has a whopping case of flu with respiratory complications.

In the meantime, the international peace and amity explosion is very impressive.

Well, Philly Fed is something of a disappointment. The headline looks a lot better, at only -1.9. But shipments fell to -21.2, a big drop. Unfilled orders continued their drop. However inventories are declining, so maybe we are closer to stabilization. After five negative months, we should be getting closer to that point. Employment at -7.3 and the average workweek is still contracting also. One of the special questions was on Q4 production expectations, which was as negative as Q3 production reports. The six month outlook is getting better, but that may not mean much if a negative quarter is expected first. 47/35 (negative) in Q3 vs 45/32 (negative) in Q4 doesn't exactly provide a vista of hope.

Tuesday, September 18, 2012

The French Are Jealous

The Germans got their embassy attacked. The US and British got attacked. But no one's attacking French embassies, which makes them feel disrespected and left out, so they'll demand their day in the rioting sun.

Of course, if this were to happen all over the world, eventually the Muslims would get tired of wailing about it.

Of course, if this were to happen all over the world, eventually the Muslims would get tired of wailing about it.

Maybe It Is 3 AM

Supposedly there is a convoy of Chinese fishing vessels headed to the disputed islands. Both Japanese and Chinese officials say this. And now this.

There would be widespread and enthusiastic support in the Chinese population for a military confrontation with Japan at this time. I don't believe the Chinese government wants shooting, but it does need to win this one for the popular-approval team.

China has been through its Hjalmar Schacht period, and now faces the reckoning. The reckoning is causing a crisis of confidence in the Chinese public, and subways ain't gonna do it. Support for the Chinese government has been eroded by the impact of the slowly bursting bubble and bridges and railroads that fail less than two years after they are built.

There is also a definite plutocracy which is strongly allied to party families, so the Chinese have evolved their own Junker system.

I am not sure the Japanese will back down.

There would be widespread and enthusiastic support in the Chinese population for a military confrontation with Japan at this time. I don't believe the Chinese government wants shooting, but it does need to win this one for the popular-approval team.

China has been through its Hjalmar Schacht period, and now faces the reckoning. The reckoning is causing a crisis of confidence in the Chinese public, and subways ain't gonna do it. Support for the Chinese government has been eroded by the impact of the slowly bursting bubble and bridges and railroads that fail less than two years after they are built.

There is also a definite plutocracy which is strongly allied to party families, so the Chinese have evolved their own Junker system.

I am not sure the Japanese will back down.

Monday, September 17, 2012

Empire Strikes Back

As my bulldog explicated this morning, "Gruffle". The current conditions index on the Empire State Manufacturing Survey was considerably worse than consensus, and thus "unexpected". General business conditions at -10.41, a sharp degradation from August at -5.85. New orders -14.03, unfilled orders at -14.89. Inventories were stable this month, so one expects the contraction to continue. This has been a recent decliner - Philly Fed reacted earlier this year.

The level is somewhat of a red flag - this is the worst since before the Great Recession ended, suggesting that NY manufacturing has entered at least a Dinky Recession. Prices paid are increasing much faster than prices received, so profits aren't going to bail them out. The average workweek dropped a bit, but employment hasn't felt the impact yet.

The full report is here. If you look at the graph, Empire is now about where it was during the first quarter of 2008 when we were in an early recession. However future expectations remain very positive. We will see, we will see. I can always get a better future expectations reading from the bulldog by holding a pork chop bone in front of her face, but I find the effect doesn't last long.

Singapore was also an unwelcome surprise - August non-oil domestic exports declined 11% on a YoY basis. Tons of detailed info at the link. Total trade is down 7.1% YoY. Exports to the EU27 are down YoY 27%:.

Total trade ain't so hot either:

So no one's picking on NY. We all get our turn in the barrel.

So no one's picking on NY. We all get our turn in the barrel.

The level is somewhat of a red flag - this is the worst since before the Great Recession ended, suggesting that NY manufacturing has entered at least a Dinky Recession. Prices paid are increasing much faster than prices received, so profits aren't going to bail them out. The average workweek dropped a bit, but employment hasn't felt the impact yet.

The full report is here. If you look at the graph, Empire is now about where it was during the first quarter of 2008 when we were in an early recession. However future expectations remain very positive. We will see, we will see. I can always get a better future expectations reading from the bulldog by holding a pork chop bone in front of her face, but I find the effect doesn't last long.

Singapore was also an unwelcome surprise - August non-oil domestic exports declined 11% on a YoY basis. Tons of detailed info at the link. Total trade is down 7.1% YoY. Exports to the EU27 are down YoY 27%:.

Total trade ain't so hot either:

So no one's picking on NY. We all get our turn in the barrel.

So no one's picking on NY. We all get our turn in the barrel. Sunday, September 16, 2012

How Bad Stanford University "Experts" Are

DU starts to work on this claim RE the feasibility of powering the East Coast with a rapture of wind turbines, and thoroughly debunks it:

15. The spacing would be more like 2500 feet (5 to 8 rotor diameters)

So a single rank of turbines would contain 4,000 units. That means about 40 ranks of turbines, with the ranks also separated by 2500 feet.

That results in an offshore "wind farm" 2000 miles long by at least 20 miles deep, with the blade tips reaching over 500 feet in the air. Even if there is that much suitable offshore shelf, I'm quite sure the USAF and NORAD would have something to say about this because of radar interference.

It ain't happening. Large Scale Offshore Wind Power in the United States - an Assessment of Opportunities and Barriers (PDF)Note that this poster and many others commenting strongly support wind power. They also figure out that just the wind turbines would cost 2 trillion dollars, without accounting for grid problems, etc. This is what the professorship has created. In the next revolution, the motto will be:

First, we kill all the professors....

Meantime, Back At The Ranch

The Chinese-Japanese confrontation over the disputed islands continues to heat up. Last week there were multiple incidents, yesterday an attack on the Japanese embassy, and today:

A Chinese official had hinted at a boycott - I don't think the authorities are goosing this one.

A few years ago, in the run-up to the late unfortunate Great Recession, I was writing about unrest in the ME and in China.

The Libyan attack that killed four American diplomatic staffers was clearly organized, but the spontaneous outbreaks probably have more to do with inflation and difficult economic circumstances than anything else.

A Panasonic Corp. (6752) factory and a Toyota Motor Corp. (7203) dealership in China were damaged by fire as anti-Japanese demonstrations spread across the country, prompting Prime Minister Yoshihiko Noda to urge the Chinese government to ensure the safety of its citizens.It's not really surprising that so much tension has erupted. It's worth noting that a group of Hong Kong activists started the conflict originally. In late August, the Japanese ambassador's vehicle was attacked.

A Chinese official had hinted at a boycott - I don't think the authorities are goosing this one.

A few years ago, in the run-up to the late unfortunate Great Recession, I was writing about unrest in the ME and in China.

The Libyan attack that killed four American diplomatic staffers was clearly organized, but the spontaneous outbreaks probably have more to do with inflation and difficult economic circumstances than anything else.

Friday, September 14, 2012

Islam, Islam Ueber Alles, Ueber Alles In Der Welt

German and US embassies in Sudan attacked.

Friday prayers, you know? It sounds like the German embassy got it much worse than the US embassy:

Earlier in the day police fired tear gas to try to scatter some 5,000 demonstrators who had surrounded the German embassy and nearby British mission. But a Reuters witness said policemen stood by when the crowd forced its way into Germany's mission.

Protesters raised an Islamic flag saying in white letters "there is no God but God and Mohammed is his prophet". They smashed windows, cameras and furniture in the German complex and then started a fire, witnesses said.

There is no G_d present but the I-Slam mob. What a nasty bunch of idiots.

Note: The Spiegel article has more info, presumably correct. They are saying it was a targeted attack and that the diplomats had expected it for days because the imams were calling for it.

Clearly we need to give Angela Merkel the Nobel peace prize immediately. On Thursday the Foreign Ministry in Khartoum sent a request to Merkel to ban demonstrations in Germany with Muhammed caricatures.

Friday prayers, you know? It sounds like the German embassy got it much worse than the US embassy:

Earlier in the day police fired tear gas to try to scatter some 5,000 demonstrators who had surrounded the German embassy and nearby British mission. But a Reuters witness said policemen stood by when the crowd forced its way into Germany's mission.

Protesters raised an Islamic flag saying in white letters "there is no God but God and Mohammed is his prophet". They smashed windows, cameras and furniture in the German complex and then started a fire, witnesses said.

There is no G_d present but the I-Slam mob. What a nasty bunch of idiots.

Note: The Spiegel article has more info, presumably correct. They are saying it was a targeted attack and that the diplomats had expected it for days because the imams were calling for it.

Clearly we need to give Angela Merkel the Nobel peace prize immediately. On Thursday the Foreign Ministry in Khartoum sent a request to Merkel to ban demonstrations in Germany with Muhammed caricatures.

Retail & CPI

Retail report here. Two-thirds of the SA increase from July to August was in gas. Spending at grocery stores did not change, which is a trouble sign. The rest seems to be in motor vehicles. Overall, not a good report. There was an increase in bar and restaurants, but non-store retailers were flat MoM, clothing & general merchandise stores were negative, sporting & hobby was flat, and electronics & appliances were negative.

CPI - In June and July all-items CPI was flat. In August it increased 0.6%. Gas was up 9%. The 0.5% gain in bars and restaurants has to be balanced with the 0.3% increase in food away from home prices. Food at home is listed as being up .1% on the month. This is something of an illusion, because basic food commodities are pretty high, but that is being offset somewhat by desperate struggles for the grocery dollar at retailers. I saw bread pricing ads in September, which just can't be a good sign!

Therefore, real retail sales gains are very slim, and we are definitely in the trouble zone. I already knew this, because of my roaming through the aisles looking at price changes. What I see is the classic consumer bust, but that is probably exaggerated by the pressure of back to school spending.

Industrial production: -1.2% in August. Consumer goods -1.2%. Utilities -3.6%:

Business inventories will be out later. I may not get to that until this weekend, because I am pretty busy.

Where we are now in the business cycle is that the consumer-led recession has now moved through to the production side, which then forces slowness in manufacturing, which then induces another round of consumer/business contraction.

If you are wondering what the Fed's actions yesterday will do to help this situation, the answer is that it will make it considerably worse. Then we have to add the US fiscal problems to the mix, so what would naturally be a relatively mild inventory cycle recession is apt to turn into The Blob.

I have, btw, always found that the waterways freight indicator is good, and it's been showing recession all summer.

Since we are well into Stage 2 of this thing, the Fed had no ability anyway to correct it. The Fed would have had to start early in the spring to possibly goose anything, but its current toolbox is empty. Currently the Fed is into homeopathic economic remedies, but unfortunately the illness is real.

So enjoy your apricot pits!

CPI - In June and July all-items CPI was flat. In August it increased 0.6%. Gas was up 9%. The 0.5% gain in bars and restaurants has to be balanced with the 0.3% increase in food away from home prices. Food at home is listed as being up .1% on the month. This is something of an illusion, because basic food commodities are pretty high, but that is being offset somewhat by desperate struggles for the grocery dollar at retailers. I saw bread pricing ads in September, which just can't be a good sign!

Therefore, real retail sales gains are very slim, and we are definitely in the trouble zone. I already knew this, because of my roaming through the aisles looking at price changes. What I see is the classic consumer bust, but that is probably exaggerated by the pressure of back to school spending.

Industrial production: -1.2% in August. Consumer goods -1.2%. Utilities -3.6%:

Manufacturing output decreased 0.7 percent in August, but it remained 3.8 percent above its year-earlier level. The factory operating rate moved down 0.7 percentage point in August to 77.0 percent, a level 1.8 percentage points below its long-run average.

The production index for durable goods decreased 1.1 percent in August. Declines were widespread among the major durable goods industries, with the largest drop coming in motor vehicles and parts. Only primary metals posted an increase. Capacity utilization for durable goods manufacturing was 77.3 percent, a rate 0.2 percentage point above its long-run average.We've maxed out on the auto thang. It's worth reading through the entire industrial production report to get a feel for just how diffused the slowdown is, which, btw, matches very well with the manufacturing diffusion index on the employment report for August.

Business inventories will be out later. I may not get to that until this weekend, because I am pretty busy.

Where we are now in the business cycle is that the consumer-led recession has now moved through to the production side, which then forces slowness in manufacturing, which then induces another round of consumer/business contraction.

If you are wondering what the Fed's actions yesterday will do to help this situation, the answer is that it will make it considerably worse. Then we have to add the US fiscal problems to the mix, so what would naturally be a relatively mild inventory cycle recession is apt to turn into The Blob.

I have, btw, always found that the waterways freight indicator is good, and it's been showing recession all summer.

Since we are well into Stage 2 of this thing, the Fed had no ability anyway to correct it. The Fed would have had to start early in the spring to possibly goose anything, but its current toolbox is empty. Currently the Fed is into homeopathic economic remedies, but unfortunately the illness is real.

So enjoy your apricot pits!

Thursday, September 13, 2012

Which Sums Up My Take

Mark, marking the snark:

I'm sure high prices for oil are just gonna correct this trend, right? Heh.

I'm sure high prices for oil are just gonna correct this trend, right? Heh.

Hmm, Thursday Again

Fed Thursday, which overshadows even burning embassies.

Initial claims - headline is 382K, up from last week's original 365K, revised to 367K. I'm not saying this is invalid, but this is the time of the year when seasonal adjustments increase the headline, and actual claims came in below 300K this week, which is pretty good. Also seasonally adjusted continuing claims are dropping, which is good. The four-week moving average for initial claims is 375K, which is not bad.

Of more economic concern is PPI, which comes in at 1.7% on the month. Hefty. The Fed is probably going to give that a boost today. The MoM change was 5.8% for crude goods and 1.1%. The 12-month finished is now 2%. Last month's ex food and energy was 0.4 and this month's is 0.2, but somehow many producers will have to pass these costs along. The last three months of finished food are 0.5, 0.5 and 0.9 this month. Energy was up 6.4% this month. Just this month. I'm sure any resemblance to any recent unfortunate economic collapse is purely coincidental, huh?

Ah, there's nothing like soaring commodity prices at the beginning of a recession to waft the sweet autumnal smell of burning GDP growth through the econatmosphere. Some might think that easier interest rates have something to do with the usual recession spike for prices. It's more than that, however. Other assets get less plausible. Thursday's child has far to go.

From the PPI release, a demonstration of why job creation is so slack:

Initial claims - headline is 382K, up from last week's original 365K, revised to 367K. I'm not saying this is invalid, but this is the time of the year when seasonal adjustments increase the headline, and actual claims came in below 300K this week, which is pretty good. Also seasonally adjusted continuing claims are dropping, which is good. The four-week moving average for initial claims is 375K, which is not bad.

Of more economic concern is PPI, which comes in at 1.7% on the month. Hefty. The Fed is probably going to give that a boost today. The MoM change was 5.8% for crude goods and 1.1%. The 12-month finished is now 2%. Last month's ex food and energy was 0.4 and this month's is 0.2, but somehow many producers will have to pass these costs along. The last three months of finished food are 0.5, 0.5 and 0.9 this month. Energy was up 6.4% this month. Just this month. I'm sure any resemblance to any recent unfortunate economic collapse is purely coincidental, huh?

Ah, there's nothing like soaring commodity prices at the beginning of a recession to waft the sweet autumnal smell of burning GDP growth through the econatmosphere. Some might think that easier interest rates have something to do with the usual recession spike for prices. It's more than that, however. Other assets get less plausible. Thursday's child has far to go.

From the PPI release, a demonstration of why job creation is so slack:

Trade industries: The Producer Price Index for the net output of total trade industries declined 1.3 percent in August, the largest decrease since a 1.4-percent drop in June 2010. (Trade indexes measure changes in margins received by wholesalers and retailers.) Leading the August decline, margins received by merchant wholesalers of durable goods moved down 1.7 percent. Lower margins received by gasoline stations and department stores also contributed to the decrease in the total trade industries index.Margin compression!

Transportation and warehousing industries: The Producer Price Index for the net output of transportation and warehousing industries moved up 0.4 percent in August following a 0.4- percent decline in July. Over half of this advance can be attributed to a 1.3-percent rise in prices received by the scheduled passenger air transportation industry. Higher prices received by the truck transportation industry group and by the general warehousing and storage industry also were factors in the increase in the transportation and warehousing industries index.

Traditional service industries: The Producer Price Index for the net output of total traditional service industries advanced 0.6 percent in August after no change in the prior month. Leading this rise, prices received by the industry group for hospitals climbed 1.6 percent. Higher prices received by the industry groups for depository credit intermediation and for securities, commodity contracts, and related financial investment services also contributed to the increase in the total traditional service industries index.

Now In Yemen?

Attack reported on US embassy in Sanaa, Yemen. No US casualties, apparently, but the report states that the Ambassador is being evacuated.

The virtual Yemen civil war has seen US involvement at the behest of the Saudis, so this is not that surprising. The south wants to split from the north and the Shia want some sort of autonomy. A powder keg of a country.

The virtual Yemen civil war has seen US involvement at the behest of the Saudis, so this is not that surprising. The south wants to split from the north and the Shia want some sort of autonomy. A powder keg of a country.

Wednesday, September 12, 2012

Now This Is Dedication

The sad part about economic forecasting is that you can almost always ignore sentiment and look at fundamentals. My back is not improving, but to answer the question about whether I believe we are in a recession - YES.

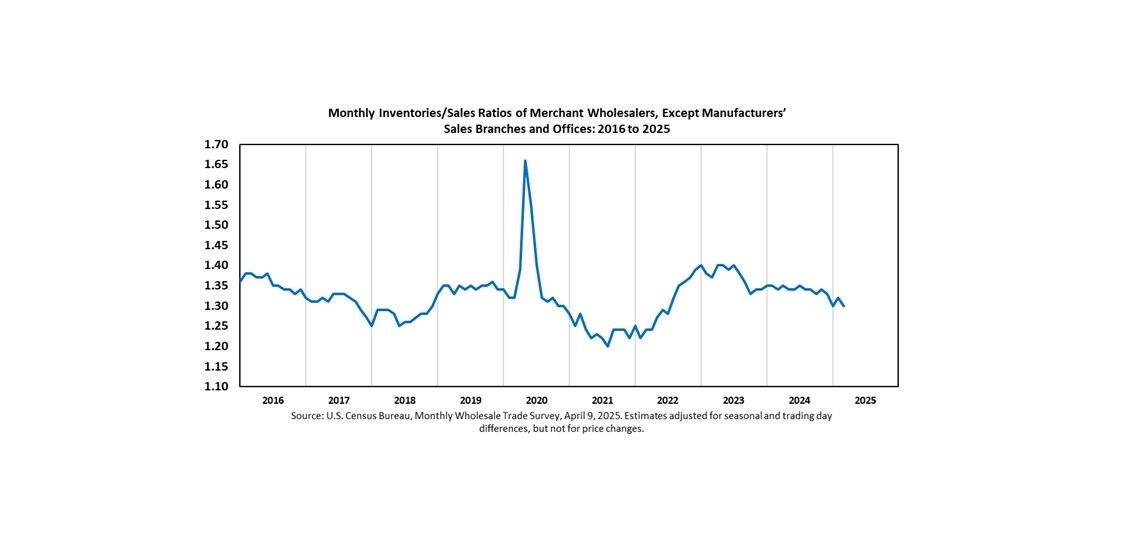

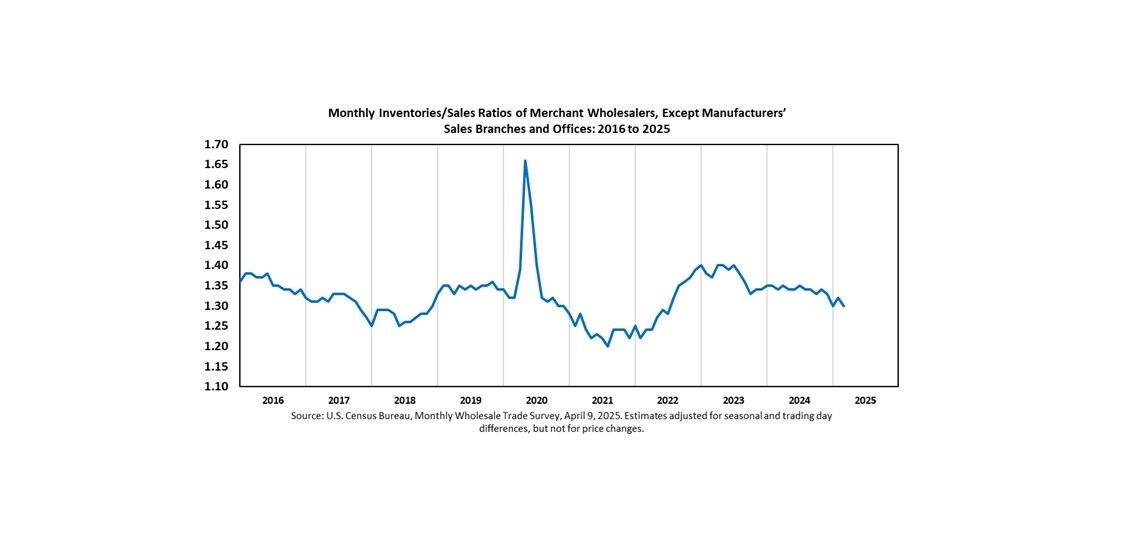

Inventories are moving in the wrong direction:

This is most definitely a troublesome sign.

In the grocery stores, it is evident that customers are acutely sensitive to price changes and are shifting their consumption patterns rapidly as a result.

There just isn't the money in checking accounts to cover all the expected Bling-season expenditures, so a lot of consumers will be ratcheting back:

Last year from just before tax due date to the end of August we got this big build in deposits which fueled Bling spending. This year, we got very little. From 4/13/11 to 8/31/11, other deposits rose from 6,315 to 6,694. This year, from 4/11/12 to 8/29/11, other deposits rose only from 7,159 to 7,214. People are just running out of money this year. This includes business deposits also.

Finally, we are going into this period with high fuel prices and high food prices, which really does not inspire confidence for households or businesses on a tight budget.

We are in a consumer-led very mild recession, but the Fed is going to help us out and keep prices HIGH. It's so kind and stimulative of them. When the problem is money circulation for the 65%, raising prices for the 65% is not the cure!

Bling last year was helped by a drop in gas prices. Bling this year looks pretty slim.

Note: Census' updated 2011 report contains some pretty amazing figures re poverty. Median incomes for both men and women declined 2.5% from the previous year. Household incomes declined less at 1.5%, but that is because people are consolidating households due to inability to pay the rent. Median incomes for both men and women without a disability declined 2.6% over the year. Start on internal page 7. Median household income was 8.1% lower than in 2007.

Inventories are moving in the wrong direction:

This is most definitely a troublesome sign.

In the grocery stores, it is evident that customers are acutely sensitive to price changes and are shifting their consumption patterns rapidly as a result.

There just isn't the money in checking accounts to cover all the expected Bling-season expenditures, so a lot of consumers will be ratcheting back:

Last year from just before tax due date to the end of August we got this big build in deposits which fueled Bling spending. This year, we got very little. From 4/13/11 to 8/31/11, other deposits rose from 6,315 to 6,694. This year, from 4/11/12 to 8/29/11, other deposits rose only from 7,159 to 7,214. People are just running out of money this year. This includes business deposits also.

Finally, we are going into this period with high fuel prices and high food prices, which really does not inspire confidence for households or businesses on a tight budget.

We are in a consumer-led very mild recession, but the Fed is going to help us out and keep prices HIGH. It's so kind and stimulative of them. When the problem is money circulation for the 65%, raising prices for the 65% is not the cure!

Bling last year was helped by a drop in gas prices. Bling this year looks pretty slim.

Note: Census' updated 2011 report contains some pretty amazing figures re poverty. Median incomes for both men and women declined 2.5% from the previous year. Household incomes declined less at 1.5%, but that is because people are consolidating households due to inability to pay the rent. Median incomes for both men and women without a disability declined 2.6% over the year. Start on internal page 7. Median household income was 8.1% lower than in 2007.

Tuesday, September 11, 2012

Back Out

The world is pain. It is impacting blogging.

But because it made me laugh, I thought I'd share this NYT column about medical cannabis and parenting. The part that tickled my funnybone:

But because it made me laugh, I thought I'd share this NYT column about medical cannabis and parenting. The part that tickled my funnybone:

So, in 2010, I resolved to seek medical help. I received a thorough physical examination from my CannaMed doctor, who checked not only my pulse but my blood pressure as well. Examining the results, he concluded that I would benefit enormously from a cannabis-based treatment regimen and recommended that I use a brownie-based form of the drug to avoid the lung irritation associated with other modes of dose administration.

- Wow, that's some thorough physical, isn't it?

- Some of us find that just the brownies do the same thing. How about a double-blind test in which a control group gets just the brownies? I volunteer to be in the control group! At the same time we should run another group that studies walnut-adulterated brownies in comparison to hemp-adulterated brownies. About 20 years should do it. I volunteer to be in that one as well.

- Is there any person who has ever consulted this doctor who wasn't deemed to benefit enormously from a cannabis-based treatment regimen?

- My dog is trying to convince me that a pork-bone based treatment regimen is the cure for all canine ills.

- If pork bones are not available, she claims that walnut-adulterated brownies are a close substitute.

- Under ObamaCare, if I can get my WannaChocDoc to write a prescription for a daily walnut-adulterated brownie treatment regimen along with daily coffee, will my insurer have to pay for it?

Monday, September 10, 2012

Current Situation

North America and China are still world bright spots, but growth in both areas is slackening. Japan revised its Q2 GDP growth estimate to 0.2% on the quarter, 0.7% annualized. On a nominal basis it's a 1% contraction. Q3 is going to be worse given current stats. The situation in Japan is really weird. They've passed a sales tax increase for next year, but the economy is about to fall into another recession (almost certainly now contracting), so they want to add a supplementary spending package. However they are in an internal political fight and the government is due to run out of money this year unless Parliament comes to terms and authorizes more borrowing. Subsidies for vehicles are expiring and the general forecast isn't good.

China issued industrial production for August at an 8.9% YoY growth rate - another drop. Exports rose 2.7% on the year in August, way below target. Imports fell 2.6%, which generally doesn't happen and is a very bad indicator. So China is in a pickle. This makes the Japanese outlook worse, because China is a big export market for China. The strong yen doesn't help, but BoJ hasn't been able to meaningfully intervene.

Asia as a whole is steadily weakening. Singapore's MoM industrial production for July came in at -9.1%, still up 1.9% YoY. Some generalized weakness is emerging there. Korean exports fell again in August at a 6.2% rate after falling 8% in July. So Korea is planning to push. Australia is of course under pressure, and now it is both external and internal. Taiwan continues its exports slide. It is negative YoY.

Still waiting for August Indian data, but July was sharply negative.

There is ongoing Euro-squawkage as Greece's unhappy ruling bedfellows try to negotiate, and as everyone waits for the German High Court to rule on the ESM. But the German court will not block the ESM.

The real issue now is that the ESM won't do anything unless the ECB buys bonds (unlimited!!!), and the ECB is still claiming that it will only buy bonds if the countries involved formally apply and observe the rules imposed. It is not clear that either Spain or Italy will do that. I assume they will be forced to do it, but that the resultant internal strife will force them to do it Greek-style, after which the ECB has promised to terminate the bond-buying program. But the ECB cannot terminate the bond-buying program once it gets well underway, because stopping it would inflict dire losses.

So there is no exit strategy for the ECB - once it accumulates a good amount of those bonds it is committed. I assume the program will be put in place and will quietly continue regardless of what Spain and Italy do with their fiscal programs.

ECB is now accepting - literally! - old shoes and used underwear from Greece's central bank as collateral, so we all know that ECB can pump forever into Italy. Thus, the Germans have already lost their battle. At some point, it will come to an end, but when that happens is unpredictable.

China issued industrial production for August at an 8.9% YoY growth rate - another drop. Exports rose 2.7% on the year in August, way below target. Imports fell 2.6%, which generally doesn't happen and is a very bad indicator. So China is in a pickle. This makes the Japanese outlook worse, because China is a big export market for China. The strong yen doesn't help, but BoJ hasn't been able to meaningfully intervene.

Asia as a whole is steadily weakening. Singapore's MoM industrial production for July came in at -9.1%, still up 1.9% YoY. Some generalized weakness is emerging there. Korean exports fell again in August at a 6.2% rate after falling 8% in July. So Korea is planning to push. Australia is of course under pressure, and now it is both external and internal. Taiwan continues its exports slide. It is negative YoY.

Still waiting for August Indian data, but July was sharply negative.

There is ongoing Euro-squawkage as Greece's unhappy ruling bedfellows try to negotiate, and as everyone waits for the German High Court to rule on the ESM. But the German court will not block the ESM.

The real issue now is that the ESM won't do anything unless the ECB buys bonds (unlimited!!!), and the ECB is still claiming that it will only buy bonds if the countries involved formally apply and observe the rules imposed. It is not clear that either Spain or Italy will do that. I assume they will be forced to do it, but that the resultant internal strife will force them to do it Greek-style, after which the ECB has promised to terminate the bond-buying program. But the ECB cannot terminate the bond-buying program once it gets well underway, because stopping it would inflict dire losses.

So there is no exit strategy for the ECB - once it accumulates a good amount of those bonds it is committed. I assume the program will be put in place and will quietly continue regardless of what Spain and Italy do with their fiscal programs.

ECB is now accepting - literally! - old shoes and used underwear from Greece's central bank as collateral, so we all know that ECB can pump forever into Italy. Thus, the Germans have already lost their battle. At some point, it will come to an end, but when that happens is unpredictable.

Sunday, September 09, 2012

Wow - Not The Greatest Soros Fans

The forum comments for the Spiegel article about Soros' call for Germany to lead or leave are less than favorable to his small request. Most of them make some reference to the fact that he is talking his own book.

If you don't read German, you can use Google translate to get the gist of it.

The German High Court's decision over the ESM funding is due on the 12th, and it doesn't seem like its decision will be greeted with joy. One must remember that the voters can overrule their representatives in the next election!

There is however some enthusiasm for the idea of leaving the Euro, but wouldn't that produce a northern currency and a southern (bankrupt) currency?

If you don't read German, you can use Google translate to get the gist of it.

The German High Court's decision over the ESM funding is due on the 12th, and it doesn't seem like its decision will be greeted with joy. One must remember that the voters can overrule their representatives in the next election!

There is however some enthusiasm for the idea of leaving the Euro, but wouldn't that produce a northern currency and a southern (bankrupt) currency?

Friday, September 07, 2012

Without Ice Cream

There is no way to safely peruse the employment report. But I can't have ice cream, first because there is none, and having gotten up at 2:35 AM to get the Chief to his date with destiny, I am too tired to go out and get any. Nor is any ice cream allowed near the Chief, due to the fact that is one of the factors in having to get up at 2:35 AM for these fun dates with destiny. So I cannot go through this whole thing tonight.

The good news is that the Chief's date with destiny went very well. Unfortunately, the employment report is kind of the inverse of the Chief Metal Heart No-Nag report.

Thanks for the comments on the employment report. It's hard to do justice to the sheer ugliness of this thing with just words, isn't it? The ugliness has such depth that there are always little nuggets of detailed disgustingness hidden in each new segment, or so it seems to my weary eyes.

Stats like this:

Household - June to July jobs loss 314,000.

Household - August 2011 less than five weeks unemployed was 110K LESS than August 2012's number????

Household, selected unemployment indicators - women who maintain households 12.3% in August, which is yes, worse than August 2011, and has risen 2.1% since April.

An awful lot of these indicators have worsened since June.

And what about the lower-level indicators in the Establishment survey? Last year the diffusion index for private industries was 57.3. This month it fell down to 50.2 from 54.3 last month. That is neutral. The manufacturing diffusion index was 50.0 last August - exactly neutral. Remember, we were still suffering some from the Japanese 3/11 disaster. This month it fell to 36.4 from 50.6 last month. Temporary help employment dropped, confirming months of declines in that stat.

The emp/pop ratio is 58.3, right where it was last August. Unfortunately, the ratio has fallen from 58.6 in June to this 58.3 we have right now, so that is not exactly encouraging, is it?

Directional indicators look flat at best with the rolling three-month trend distinctly in the "Yuck" band, and prior months' figures were revised down.

Fiscally, the Household survey presents us with the deeply unpleasant picture of ever-escalating deficits, because over the past year the number of employed people has risen by 2.35 million, whereas the number of those not in the labor force has risen by 2.72 million. We added .58 million this last month. The Establishment survey shows a total non-farm YoY growth of under 2 million.

The good news is that the Chief's date with destiny went very well. Unfortunately, the employment report is kind of the inverse of the Chief Metal Heart No-Nag report.

Thanks for the comments on the employment report. It's hard to do justice to the sheer ugliness of this thing with just words, isn't it? The ugliness has such depth that there are always little nuggets of detailed disgustingness hidden in each new segment, or so it seems to my weary eyes.

Stats like this:

Household - June to July jobs loss 314,000.

Household - August 2011 less than five weeks unemployed was 110K LESS than August 2012's number????

Household, selected unemployment indicators - women who maintain households 12.3% in August, which is yes, worse than August 2011, and has risen 2.1% since April.

An awful lot of these indicators have worsened since June.

And what about the lower-level indicators in the Establishment survey? Last year the diffusion index for private industries was 57.3. This month it fell down to 50.2 from 54.3 last month. That is neutral. The manufacturing diffusion index was 50.0 last August - exactly neutral. Remember, we were still suffering some from the Japanese 3/11 disaster. This month it fell to 36.4 from 50.6 last month. Temporary help employment dropped, confirming months of declines in that stat.

The emp/pop ratio is 58.3, right where it was last August. Unfortunately, the ratio has fallen from 58.6 in June to this 58.3 we have right now, so that is not exactly encouraging, is it?

Directional indicators look flat at best with the rolling three-month trend distinctly in the "Yuck" band, and prior months' figures were revised down.

Fiscally, the Household survey presents us with the deeply unpleasant picture of ever-escalating deficits, because over the past year the number of employed people has risen by 2.35 million, whereas the number of those not in the labor force has risen by 2.72 million. We added .58 million this last month. The Establishment survey shows a total non-farm YoY growth of under 2 million.

Thursday, September 06, 2012

Chief Metal Heart No-Nag

& I are back doing the cardiac thang, so I doubt I'll be posting tomorrow. I have to get up at 3:00 AM to take him in for his next appointment.

Let me know how the employment report turns out!

Let me know how the employment report turns out!

Wednesday, September 05, 2012

Oil

The weekly summary:

(for prior week)

JPM Global PMI:

At 48.1 in August, down slightly from 48.4 in July, the JPMorgan Global Manufacturing PMI™ – a composite index produced by JPMorgan and Markit in association with ISM and IFPSM – remained below the neutral 50.0 mark that separates expansion from contraction for the third consecutive month. The headline index currently stands at its lowest level since June 2009.

Hmm, I wonder why June 2009 sounds so familiar? Was that the end of the recession in the US? Are the good folks at JPM trying to hint at something with this?

ISM data indicated that US manufacturing production contracted for the first time since May 2009.

I just have to tuck this in somewhere, so here it is. Look at this article about car loans and subprime loans in particular. And look at the LTVs!!!

Total products supplied over the last four-week period have averaged 19.2 million barrels per day, down by 2.1 percent compared to the similar period last year. Over the last four weeks, motor gasoline product supplied has averaged about 9.1 million barrels per day, down by 1.0 percent from the same period last year. Distillate fuel product supplied has averaged 3.6 million barrels per day over the last four weeks, down by 6.2 percent from the same period last year. Jet fuel product supplied is 3.8 percent lower over the last four weeks compared to the same four-week period last year.Obviously not much heating oil is being bought. Trucking can't be that hot either. Still, stocks of distillate are very low, so I wonder what is going on? Propane stocks are way, way up. The other part of the release.

JPM Global PMI:

At 48.1 in August, down slightly from 48.4 in July, the JPMorgan Global Manufacturing PMI™ – a composite index produced by JPMorgan and Markit in association with ISM and IFPSM – remained below the neutral 50.0 mark that separates expansion from contraction for the third consecutive month. The headline index currently stands at its lowest level since June 2009.

Hmm, I wonder why June 2009 sounds so familiar? Was that the end of the recession in the US? Are the good folks at JPM trying to hint at something with this?

ISM data indicated that US manufacturing production contracted for the first time since May 2009.

I just have to tuck this in somewhere, so here it is. Look at this article about car loans and subprime loans in particular. And look at the LTVs!!!

Tuesday, September 04, 2012

Thirteen PERCENT

Food stamps in June (SNAP) cost 6.21 billion. Total grocery store spending (which includes a lot of non-food items) in June was 47.552 billion. That means that of all the food bought at grocery stores, at least 13% of it is being bought with food stamps.

Monday, September 03, 2012

Happy Labor Day!

Go drink a beer or grill something. Buy a car. Buy two. Don't read this blog post.

However, for all the non-US-slackers, for whom this is just another Monday:

Oh, great, Swedish manufacturing jumped into the ditch. Something about export orders. Employment contracting and everything.

China's manufacturing PMI (Markit version w/ HSBC) fell to 47.6 from 49.3. No happiness there.

Eurozone 45.1, which is better than July's 44, but still a very sharp contraction. Germany 44.7, but export orders still declining hard. Poland and The Czech Republic are still contracting. In the Euro area, Ireland seems to be the bright spot.

Turkey improved to stable at 50. Russia's at 51. Outstanding work is falling. India's at 52.8, which is pretty good considering everything.

In Asia, Indonesia's up again to 51.6. Maybe that doesn't sound so hot, but compared to the rest of Asia it does. China at 47.6, with sharply falling input costs. Taiwan, 46.1!!! South Korea 47.5, which is close to July's number. Japan 47.7, which is close to July's number.

However, for all the non-US-slackers, for whom this is just another Monday:

Oh, great, Swedish manufacturing jumped into the ditch. Something about export orders. Employment contracting and everything.

China's manufacturing PMI (Markit version w/ HSBC) fell to 47.6 from 49.3. No happiness there.

Eurozone 45.1, which is better than July's 44, but still a very sharp contraction. Germany 44.7, but export orders still declining hard. Poland and The Czech Republic are still contracting. In the Euro area, Ireland seems to be the bright spot.

Turkey improved to stable at 50. Russia's at 51. Outstanding work is falling. India's at 52.8, which is pretty good considering everything.

In Asia, Indonesia's up again to 51.6. Maybe that doesn't sound so hot, but compared to the rest of Asia it does. China at 47.6, with sharply falling input costs. Taiwan, 46.1!!! South Korea 47.5, which is close to July's number. Japan 47.7, which is close to July's number.

Sunday, September 02, 2012

What People Don't Know About Politics

Gallup is not exactly a right-wing organization. Here is their time series of the conservative-moderate-liberal split in the US:

And for those who don't understand the touchy-feely thang about the RNC, reading this Pew survey on political knowledge might be an eye-opener. A large segment of the population is pretty ignorant regarding politics.

And for those who don't understand the touchy-feely thang about the RNC, reading this Pew survey on political knowledge might be an eye-opener. A large segment of the population is pretty ignorant regarding politics.

MaxedOutMama

MaxedOutMama